(1/19) Over in our little corner of De-Fi, big things are happening. As we build more and more tech, blockchain’s killer app is finally becoming clear:

Programmable Money

Read on to learn more about programmable money and why you should be PUMPED for De-Fi and @ethereum.

Programmable Money

Read on to learn more about programmable money and why you should be PUMPED for De-Fi and @ethereum.

(3/19) I remember when @VitalikButerin announced @ethereum to the world. Back then, and for the next ~6 years, my thoughts would drift between “I guess we have internet money now, or whatever” and “scam lol.”

Not anymore.

Not anymore.

(4/19) I’m bullish on @ethereum, De-Fi and crypto. Like really really bullish.

As I look at the real world, I see a world without trust and one that cannot coordinate. The old systems don’t work; we need something new.

We need The World Computer.

As I look at the real world, I see a world without trust and one that cannot coordinate. The old systems don’t work; we need something new.

We need The World Computer.

https://twitter.com/salomoncrypto/status/1522950619224453121

(5/19) Just think of the promise! Coordination without the nation-state, new paradigms of computing, peer-to-peer coordination, stable monetary policy, and on and on.

But as a finance nerd, the thing that gets me real pumped is already starting to appear:

Programmable money.

But as a finance nerd, the thing that gets me real pumped is already starting to appear:

Programmable money.

(6/19) We’ve had bartering forever, then precious/rare metals & gems, next paper bills and now it’s all just accounting and reserve accounts.

Until now, money has been like concrete; building starts from scratch and is bespoke to each individual project.

Until now, money has been like concrete; building starts from scratch and is bespoke to each individual project.

(7/19) Programmable money is something entirely new. If money is concrete, programmable money is like Legos.

Each protocol takes in plastic (value) and produces Lego-bricks (usually tokens). These bricks can be combined with other bricks to create something custom and new.

Each protocol takes in plastic (value) and produces Lego-bricks (usually tokens). These bricks can be combined with other bricks to create something custom and new.

(8/19) Everything in Trad-Fi is single step and based on relationships:

- develop relationship with bank, take a loan

- identify business, negotiate deal, buy business

- maintain operations in order to maintain yield

Time: a lot

Effort: a lot

Permission: a lot

- develop relationship with bank, take a loan

- identify business, negotiate deal, buy business

- maintain operations in order to maintain yield

Time: a lot

Effort: a lot

Permission: a lot

(9/19) Programmable money?

- deposit into @AaveAave, take out a loan

- identify yield farm, deposit, maybe (auto)compound

- withdraw

Time: 15-20 mins?

Effort: Twitter research and ~3 transactions

Permission: wtf is permission?

- deposit into @AaveAave, take out a loan

- identify yield farm, deposit, maybe (auto)compound

- withdraw

Time: 15-20 mins?

Effort: Twitter research and ~3 transactions

Permission: wtf is permission?

(10/19) This isn’t just about permission or usability. Programmable money allows us to combine individual ideas to create solutions and systems we couldn’t even imagine before.

For example…

For example…

(11/19) Over on @arbitrum, @UmamiFinance has cooked up (at least 1) vault that builds a new solution out of money-Legos.

Goal: capture @GMX_IO’s $GLP yield without being exposed to asset prices

Solution: combine $GLP with @TracerDAO short positions to hedge out asset price.

Goal: capture @GMX_IO’s $GLP yield without being exposed to asset prices

Solution: combine $GLP with @TracerDAO short positions to hedge out asset price.

https://twitter.com/salomoncrypto/status/1527339591212335104

(12/19) Purpose: @UmamiFinance has created a vault that provides the return of the top exchange on @arbitrum but without any of the risks or volatility inherent to crypto.

(13/19) Or check out the NFT world!

Goal: create deep, robust floor values for NFT collections

Solution: using @NFTX_, collections can prepare their NFTs for De-Fi. @FloorDAO, an OHM-fork, permanently buys and LPs these NFT.

Goal: create deep, robust floor values for NFT collections

Solution: using @NFTX_, collections can prepare their NFTs for De-Fi. @FloorDAO, an OHM-fork, permanently buys and LPs these NFT.

https://twitter.com/salomoncrypto/status/1537248026003001344

(14/19) Purpose: Collections with liquid floors are healthy collections. We can talk about why, but there’s a specific reason why were doing this…

NFT collections with deep, liquid floors can be liquidated. If they can be liquidated, they can be borrowed against

@JPEGd_69 👀

NFT collections with deep, liquid floors can be liquidated. If they can be liquidated, they can be borrowed against

@JPEGd_69 👀

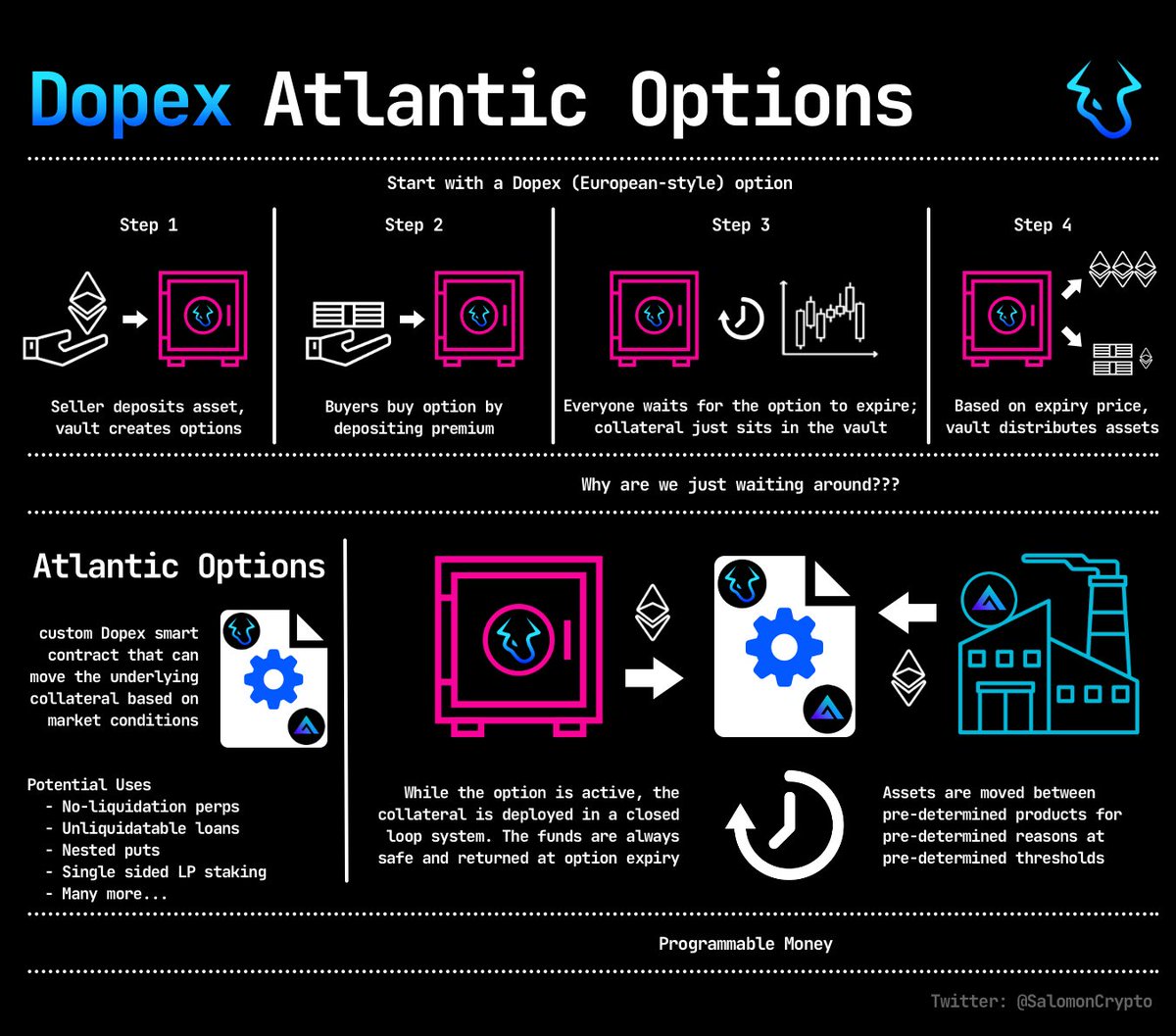

(15/19) I think the coolest example is over at @dopex_io.

Goal: unlock capital efficiency by allowing users/protocols to access the collateral deposited in option vaults

Solution: Atlantic Options

Goal: unlock capital efficiency by allowing users/protocols to access the collateral deposited in option vaults

Solution: Atlantic Options

https://twitter.com/salomoncrypto/status/1535709102080307200

(16/19) Purpose: provide a world of new financial products and opportunities…

- No-liquidation perps and loans

- Automatic hedging

- Single sided LP staking

- Nested puts

- algorithmic opportunistic buying/selling

- whatever you can imagine!!!

- No-liquidation perps and loans

- Automatic hedging

- Single sided LP staking

- Nested puts

- algorithmic opportunistic buying/selling

- whatever you can imagine!!!

(17/19) Programmable money is kind of a confusing and poorly defined idea, but it’s implications are infinite.

The secret sauce is in smart contracts and their ability to understand context and make decisions.

The secret sauce is @ethereum!

The secret sauce is in smart contracts and their ability to understand context and make decisions.

The secret sauce is @ethereum!

(18/19) As you venture out on-chain and into the unknown, keep the concept of programmable money in the back of your head:

- what does this protocol output?

- which protocols accept this output as an input?

- how can I build something greater than the sum of its parts?

- what does this protocol output?

- which protocols accept this output as an input?

- how can I build something greater than the sum of its parts?

(19/19) Together, we will build the financial system of the future… for our grandkids and their grandkids and on and on…

One money-Lego at a time!

One money-Lego at a time!

Like what you read? Help me spread the world by retweeting the thread (linked below).

Follow me for more explainers and as much alpha as I can possibly serve.

Follow me for more explainers and as much alpha as I can possibly serve.

https://twitter.com/salomoncrypto/status/1537445163886252032

• • •

Missing some Tweet in this thread? You can try to

force a refresh