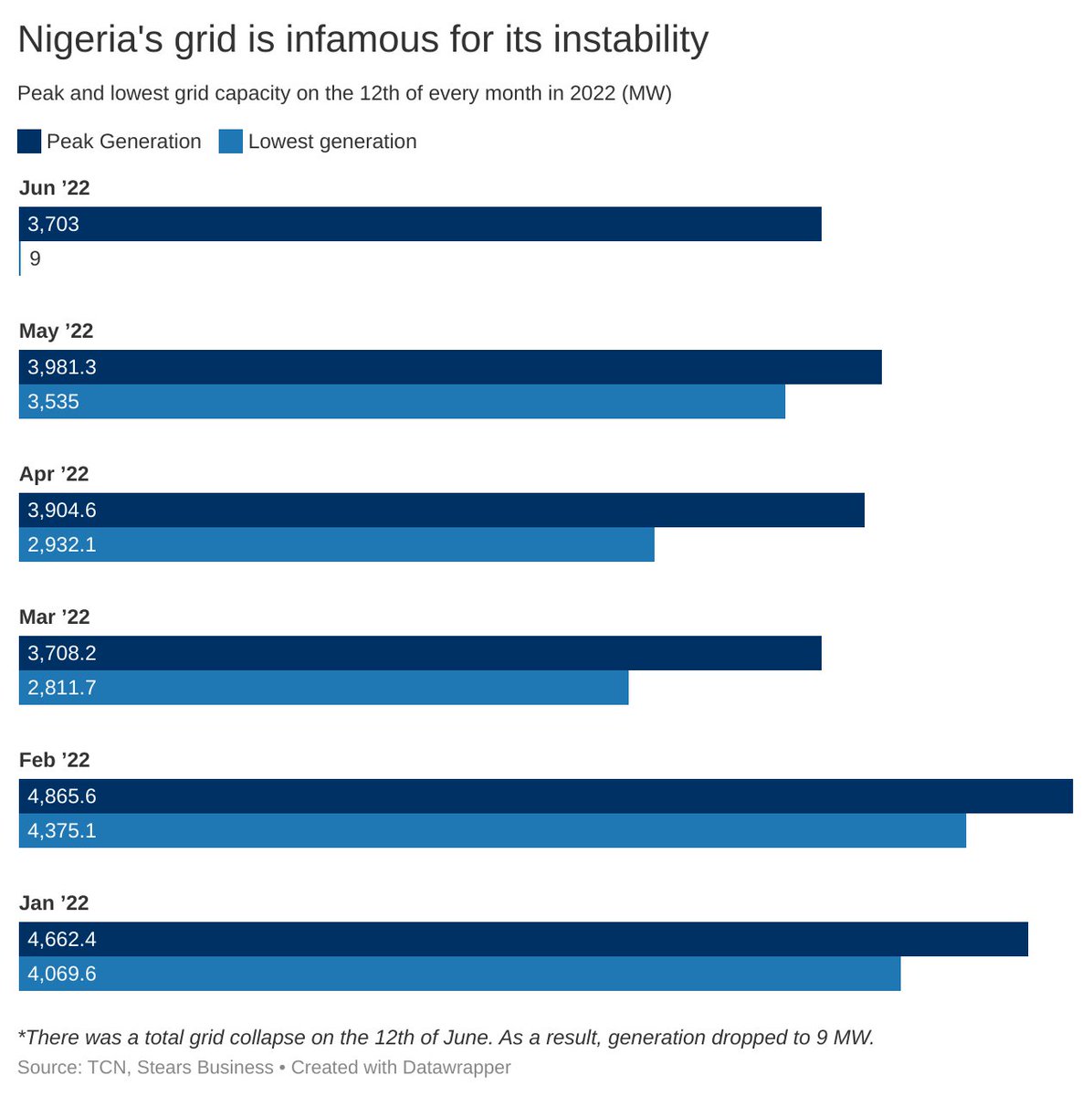

Four days ago, Nigeria’s electricity grid collapsed again.

This meant that the available energy dropped to 9 MW which is barely enough to power a large estate like VGC.

Yes, that bad.

If you are tired of wondering why the grid continues to collapse, keep reading. ⚡

1/13

This meant that the available energy dropped to 9 MW which is barely enough to power a large estate like VGC.

Yes, that bad.

If you are tired of wondering why the grid continues to collapse, keep reading. ⚡

1/13

The major cause of grid collapse is grid instability.

This happens when electricity demand does not equal electricity supply.

2/13

This happens when electricity demand does not equal electricity supply.

2/13

Electricity is a commodity like any other and the tariff is the price.

The generation companies produce electricity from gas, the TCN transmits it and the distribution companies make sure it gets to our homes and offices.

3/13

The generation companies produce electricity from gas, the TCN transmits it and the distribution companies make sure it gets to our homes and offices.

3/13

But electricity can’t be stored.

If you have power in your office right now, it’s because a generation company miles away is producing that electricity in real-time.

4/13

If you have power in your office right now, it’s because a generation company miles away is producing that electricity in real-time.

4/13

To understand why the grid keeps collapsing, let’s replace electricity with oranges in this transaction, because remember electricity is a commodity.

5/13

5/13

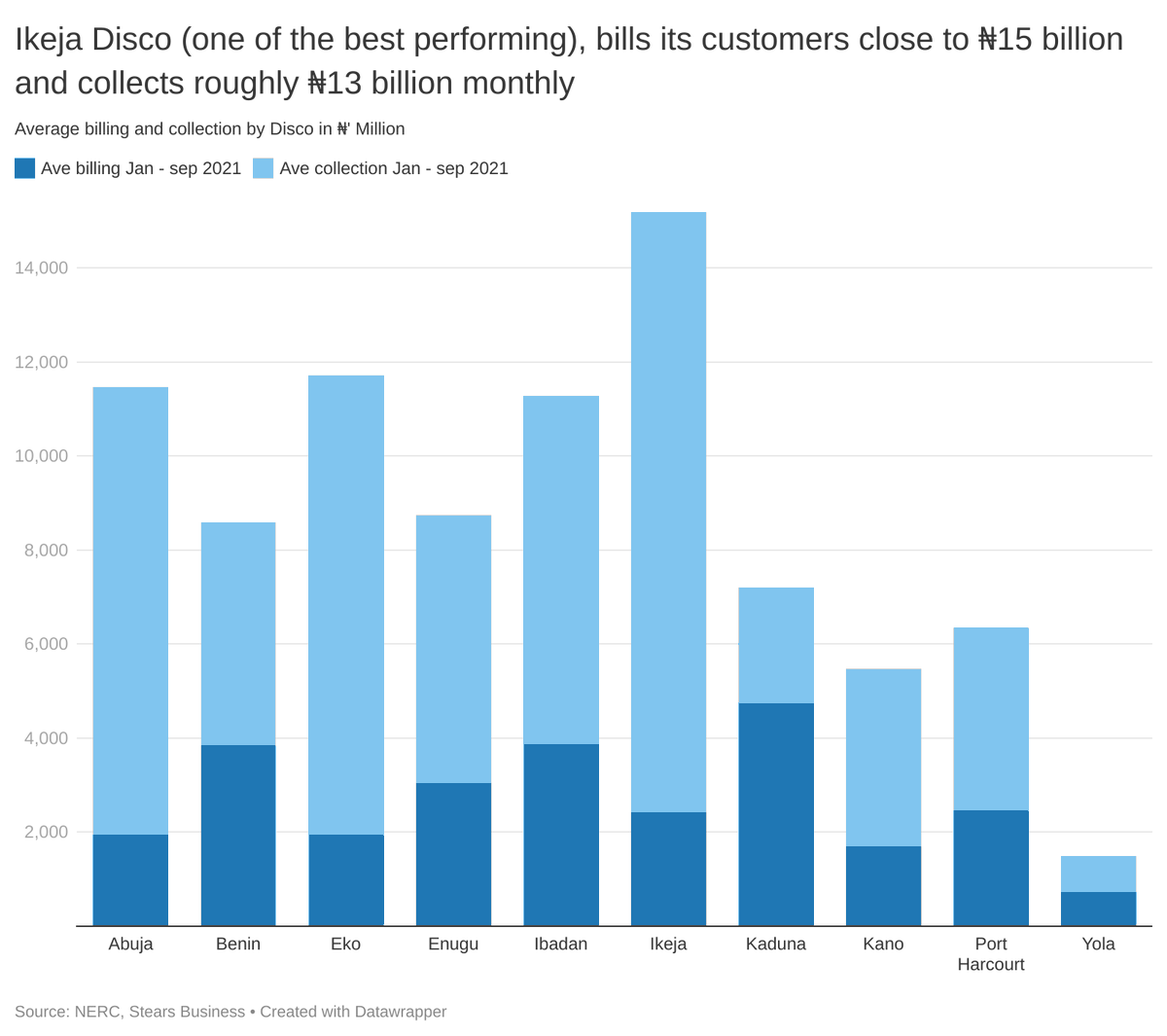

Generation companies produce and send out 10 oranges through TCN to the discos who sell that to their customers.

However, at the end of the month, customers end up paying for only five oranges.

6/13

However, at the end of the month, customers end up paying for only five oranges.

6/13

But the discos must pay the gencos and the TCN for producing and transmitting 10 oranges.

The gencos must also pay their gas suppliers for supplying enough gas for 10 oranges.

7/13

The gencos must also pay their gas suppliers for supplying enough gas for 10 oranges.

7/13

Furthermore, the gencos, TCN and discos must pay their staff and have enough left over to improve their infrastructure.

Without the money for 10 oranges, none of this is possible.

8/13

Without the money for 10 oranges, none of this is possible.

8/13

Since customers will only pay for five oranges, the discos ensure that customers only get five oranges even though they can supply 10.

But this is electricity, and it’s tricky to keep demand stable.

9/13

But this is electricity, and it’s tricky to keep demand stable.

9/13

This affects the supply side as gencos can’t meet up with gas payments.

10/13

10/13

These issues in the power sector are quite deep.

But, it’s worth remembering that the key to solving the challenges is to fix the commercial issues and improve revenue along the value chain.

11/13

But, it’s worth remembering that the key to solving the challenges is to fix the commercial issues and improve revenue along the value chain.

11/13

For instance, consumers need to pay for electricity but they also need to be billed accurately.

This will aid institutions like TCN, whose job is to keep demand and supply stable.

12/13

This will aid institutions like TCN, whose job is to keep demand and supply stable.

12/13

To further understand why discos don’t receive the full price of electricity supply and other commercial challenges plaguing Nigeria’s electricity sector read #StearsPremiumToday’s breakdown.

13/13

stearsng.com/premium/articl…

13/13

stearsng.com/premium/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh