1/44 A really important long read🧵 updating on June @CommonsHealth. Pls read *all* carefully/share/watch clips & share/RT. Some really important updates including very grateful for SOS @sajidjavid showing central support for ♻️

2/44 🧵 on June 2nd @CommonsHealth- important updates following further superb questioning by GP/MP @drlukeevans @Jeremy_Hunt

1️⃣Taper tweak-why it didn’t fix the problem

2️⃣Tax unregistered why it will work (& “flexibility” won’t work)

3️⃣@sajidjavidgives green light to recycling

1️⃣Taper tweak-why it didn’t fix the problem

2️⃣Tax unregistered why it will work (& “flexibility” won’t work)

3️⃣@sajidjavidgives green light to recycling

3/44 Please take time to watch the clips / read the transcripts. Some important info in here, and for what its worth, some analysis from me!

So lets start with

1️⃣Taper tweak-why it didn’t fix the problem

Watch the video and I'll explain my thoughts

So lets start with

1️⃣Taper tweak-why it didn’t fix the problem

Watch the video and I'll explain my thoughts

4/44 So transcript below as well

**The MYTH of higher rate relief in the NHS**

Ok so here is the issue. The “taper” was never the whole problem so tweaking it predictably hasn’t fixed the problem. Let's explain further.

**The MYTH of higher rate relief in the NHS**

Ok so here is the issue. The “taper” was never the whole problem so tweaking it predictably hasn’t fixed the problem. Let's explain further.

5/44 The SOS @sajidjavid said “Whether you worked in private equity or you worked in the NHS, if you were at that income level, you received the benefit of that. In that sense, it was a very expensive change. I think it was the right change.”

Let me explain the problem.

Let me explain the problem.

6/44 The SoS mentions “private equity” and we assume is referring to high earning colleagues in the finance industry. This group of individuals earning over the new higher “threshold income” rate of 200k would attract tax relief of 45% towards pensions contributions.

7/44 That tax relief is expensive. Conversely lower earners for example in that same finance industry who are for example basic rate tax payers would receive only basic rate relief towards their pension contributions.

8/44 Indeed it is @TheBMA understanding that the original intention of the annual allowance (& subsequently the taper) was to limit the amount of tax relief available to very high earners.

9/44 However @TheBMA also believes there is a common *misconception* that high earners in the NHS such as doctors (& senior managers) attract that same higher rate relief as the “private equity” workers referred to by the SoS. However this would be *entirely incorrect*.

10/44 So whereas in the finance sector example the highest earners receive the most relief and the lowest earnest the least relief (providing some justification for a cap on this in the form of AA/taper), this does *not* follow though to public sector workers, most notably…

11/44 …those in the NHS.

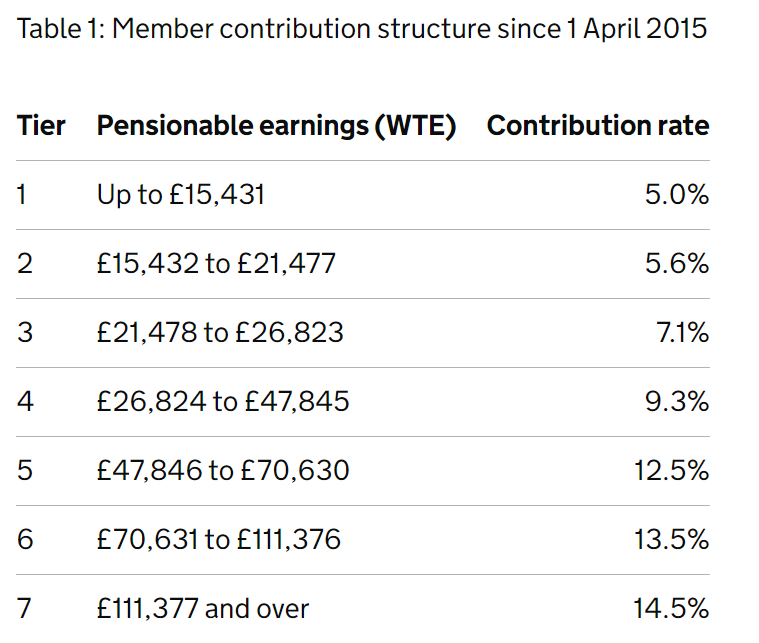

In this latter group there is a very steep “tiered contribution structure” designed to remove *all* the higher rate of relief.

In this latter group there is a very steep “tiered contribution structure” designed to remove *all* the higher rate of relief.

12/44 So for example those who are the highest earners in the NHS earning over around £111k per year contribute 14.5% to their pension whereas the lowest earners in the scheme pay 5% contribution towards each pound of pensionable income purchasing the same pound of pension.

13/44 This very steep “tiering” is higher than in any public sector scheme and *fully removes all higher rate tax relief*, which is one of a number of reasons which makes the annual allowance as a whole (not just the taper) unsuited to defined benefit schemes & the comparison…

14/44 …to “private equity” workers deeply unfair - NHS workers simply do not access that higher rate relief whereas the those in “private equity” (& other sectors) do.

15/44 The 1% club myth

*The myth that only high earners >200k are affected*

OK time to blow another myth out of the water. The problem was never about just high earners who are "tapered".

*The myth that only high earners >200k are affected*

OK time to blow another myth out of the water. The problem was never about just high earners who are "tapered".

16/44 So the oft quoted figures of 96-98% of consultants / GPs not being affected *completely ignore* the crucially important general annual allowance (& lifetime allowance) - both *potent* drivers against retention.

17/44 So for example take the @bmj_latest article from a couple of weeks ago - that example gave an example of a GP with median partner earnings of £115k (so WAY below the £200k taper limit) getting an AA charge of over £32k - not far off HALF their half their post tax income…

18/44 …(mostly because a flaw in the finance act is incorrectly measuring growth above inflation). You can read more about that particular problem here 👇

https://twitter.com/goldstone_tony/status/1530483691960541191?s=20&t=nc9PPMzMntXvQQqMnicrrQ

19/44 But lets take an even more extreme example to show this *isn't* about the "1%" club earning over £200k.

20/44 Let take for example a GP in their 50s, already built up a pension close to the LTA but having wound down to say an income of £50k this year - they could be facing an AA charge (from post tax income) of £20,165. GP- work out your 22/23 charge here - bma.org.uk/pay-and-contra…

21/44 Just scandalous, not least because, as above, all the higher rate relief was in fact *totally removed* by steep tiering above - so a tax designed to claw back that non-existent relief (on fake pseudogrowth above inflation) is SIMPLY NOT FAIR.

22/44 2️⃣Tax unregistered why it will work (& “flexibility” won’t work)

OK time for another excellent question by @drlukeevans - watch the clip please and come back for more analysis

OK time for another excellent question by @drlukeevans - watch the clip please and come back for more analysis

23/44 OK so transcript below. Essentially the question boils down to that we have a crisis (the backlog, which has been building over a decade and very much worse post covid) and solutions have been found elsewhere - i.e. for the judiciary)

24/44 .@drlukeevans asked about the solution given to the judiciary - not going to cover this in detail again other than to say BMA believes this is the long term solution - it removes all the hideous complexity around AA & LTA.

25/44 Doctors can get back to doctoring without fear of blundering into a five figure tax charge. Work as long as they want (if properly designed) without feeling the need to reduce sessions or retire earlier than they might have. Read more here 👇

26/44 But let’s also please again touch on “flexibilities” and outline again - this WONT work. We’ve already consulted on it twice - govmnt had to pull the “50:50” consultation

27/44 A further consultation (gov.uk/government/con…) on wider flexibilities failed too. It introduces more not less “complexity” - that the *last* thing we need right now. It was rejected before and I’m afraid it’s bound to be rejected again.

29/44 3️⃣@sajidjavidgives green light to recycling

OK time for the final excellent question by @drlukeevans - watch the clip please and come back for more analysis

OK time for the final excellent question by @drlukeevans - watch the clip please and come back for more analysis

31/44 And bravo to @sajidjavid for giving such strong support for recycling ♻️ of employer contributions - it's a really important tool to be able to offer some mitigation for doctors & other high earners affected by these punitive taxes & crucial to retention.

32/44 As @sajidjavid says an option is to "give salary in lieu of pension

contributions. Instead of an employer’s pension contribution, they could offer the doctor the *equivalent amount* but in salary. Of course, it is taxed, but the doctor still gets that income."

contributions. Instead of an employer’s pension contribution, they could offer the doctor the *equivalent amount* but in salary. Of course, it is taxed, but the doctor still gets that income."

33/44 .@sajidjavid goes on to "make it clear that it is something that we, at the centre, are happy with.... we want to make sure that they understand that they have these flexibilities, and where that is happening, it is certainly helping."

34/44 I have talked at length before about why I think recycling is so important 👇 I'm not going to cover all that again, but suffice to say I firmly believe it is the right thing to do for these high earners facing these punitive taxes.

https://twitter.com/goldstone_tony/status/1529357095879036934?s=20&t=TjIKS0KANDygZBNnbMLBgA

35/44 But it is not morally right to offer this to all staff- for them staying in the pension scheme is their best option. Given the central support for ♻️ from @sajidjavid, the ask must be for this to now be mandated centrally & remove the postcode lottery @HSJEditor

36/44 So thats it in terms of the excellent @CommonsHealth meetings over the last few weeks and months. My thanks to @Jeremy_Hunt for his excellent chairing, & all the cross party members who have really made retention (& the link to pensions/taxation) such a priority.

37/44 In various threads I have put my (& @BMA_Pensions) thoughts on solutions. I wish it could be distilled into 1 or even two simple asks, but I'm afraid I dont believe it can. Instead I think there are urgent actions & more medium/long term aims.

38/44 Here are solutions @thebma are urgently asking that we think could turn this round (but action is needed *right now*)

39/44 1️⃣ ALTER THE FINANCE ACT, VERY URGENTLY

The finance act doesnt work & isnt fair.There will be dreadful unintended consequences of not fixing this & thanks again @AISMANewsline for highlighting this & to @hmtreasury @DHSCgovuk to listening to @bma_pensions views on this

The finance act doesnt work & isnt fair.There will be dreadful unintended consequences of not fixing this & thanks again @AISMANewsline for highlighting this & to @hmtreasury @DHSCgovuk to listening to @bma_pensions views on this

40/44 2️⃣ Another part of the finance act re "negative PIAs", and its interaction with scheme regulations needs fixing immediately as well. Neither can wait to avoid terrible consequences. They *both* *must* be fixed

41/44 3️⃣ An AA compensation scheme - carbon copy of 19/20 scheme

Another emergency mitigation could be a carbon copy of 19/20 scheme. To be effective it would need announcing *really* quickly (but in all 4 nations)

Another emergency mitigation could be a carbon copy of 19/20 scheme. To be effective it would need announcing *really* quickly (but in all 4 nations)

42/44 4️⃣ Full mandated recycling, centrally, in all 4 nations

As mentioned @sajidjavid recycling ♻️ is something "centre are happy with" & "where that is happening, it is certainly helping". So lets end the postcode lottery, and mandate full 20.6% - empl NI, in all 4 nations.

As mentioned @sajidjavid recycling ♻️ is something "centre are happy with" & "where that is happening, it is certainly helping". So lets end the postcode lottery, and mandate full 20.6% - empl NI, in all 4 nations.

43/44 5️⃣ Lastly & perhaps MOST importantly, government must understand its not do 1-4 & the problem goes away. Far from it. The mistake gov. made before- thinking a problem was fixed, & then not listening when it didn't work. Need #taxunregistered

44/44 With record waiting lists, the only way to make a dent in the short and medium terms is to improve RETENTION - these solutions would make a SERIOUS difference to that @Jeremy_Hunt @sajidjavid @RishiSunak @CommonsHealth @NHSMillion

Pls share / RT

Pls share / RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh