NEW: Our latest story is about one of the most powerful people you’ve probably never heard of.

He’s emerged as a Koch-style funder on the right, pouring $100M+ into politics, and backing a host of 2020 election deniers.

And he’s mysteriously good at avoiding taxes.

He’s emerged as a Koch-style funder on the right, pouring $100M+ into politics, and backing a host of 2020 election deniers.

And he’s mysteriously good at avoiding taxes.

As the @propublica crew looked through tax data of America’s ultrarich, we noticed Jeff Yass, a finance deca-billionaire and major TikTok investor.

Many on Wall Street are good at avoiding taxes. But Yass is in a league of his own.

propublica.org/article/jeff-y…

Many on Wall Street are good at avoiding taxes. But Yass is in a league of his own.

propublica.org/article/jeff-y…

While his peers such as Ken Griffin of @Citadel and @CliffordAsness of AQR, typically pay tax rates in the 30%+, range, Yass has averaged 19%.

That saved him more than $1 billion in taxes in just six years.

That saved him more than $1 billion in taxes in just six years.

His firm, Susquehanna International Group, is a major player in markets, buying and selling with retail traders on @RobinhoodApp, E*Trade, and elsewhere.

So how does Yass keep his taxes so low?

So how does Yass keep his taxes so low?

With uncanny consistency, Yass has managed to take in virtually all of his income taxed at the special low rate reserved for longer-term investments.

Take a look:

Take a look:

Deepening the mystery, Yass’ firm, Susquehanna, specializes in ultra-short-term high-volume trading that is typically taxed at rates around 40%.

But Yass has managed to make only the type of income taxed at the lower rate of around 20% reserved for longer-term investments.

But Yass has managed to make only the type of income taxed at the lower rate of around 20% reserved for longer-term investments.

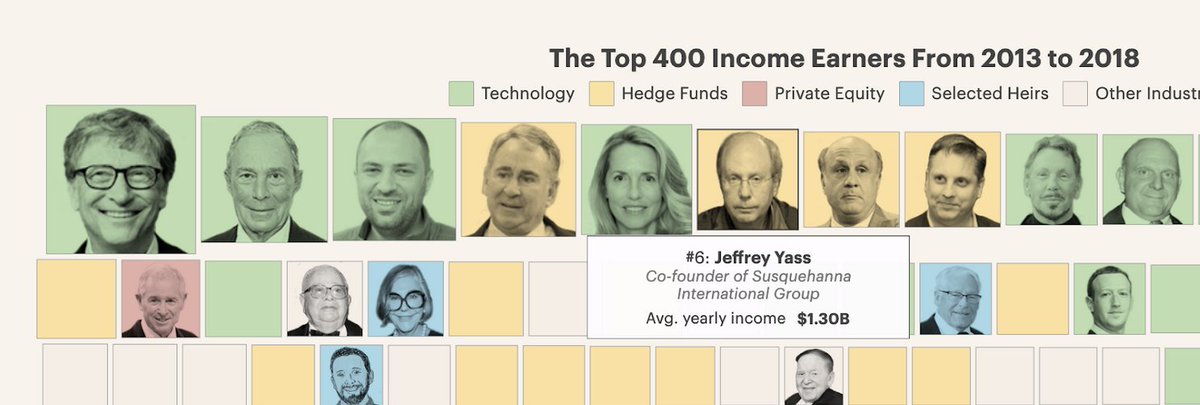

And he does it at scale. In a recent period, Yass had the sixth-highest annual income of anyone in the entire United States, making more than $1 billion per year, only surpassed by folks like Bill Gates & Michael Bloomberg:

projects.propublica.org/americas-highe…

projects.propublica.org/americas-highe…

Yass developed an obsession with taxes, former colleagues say, and Susquehanna embraced numerous strategies to slash its tax bill.

As one former trader put it: “They hate fucking taxes.”

As one former trader put it: “They hate fucking taxes.”

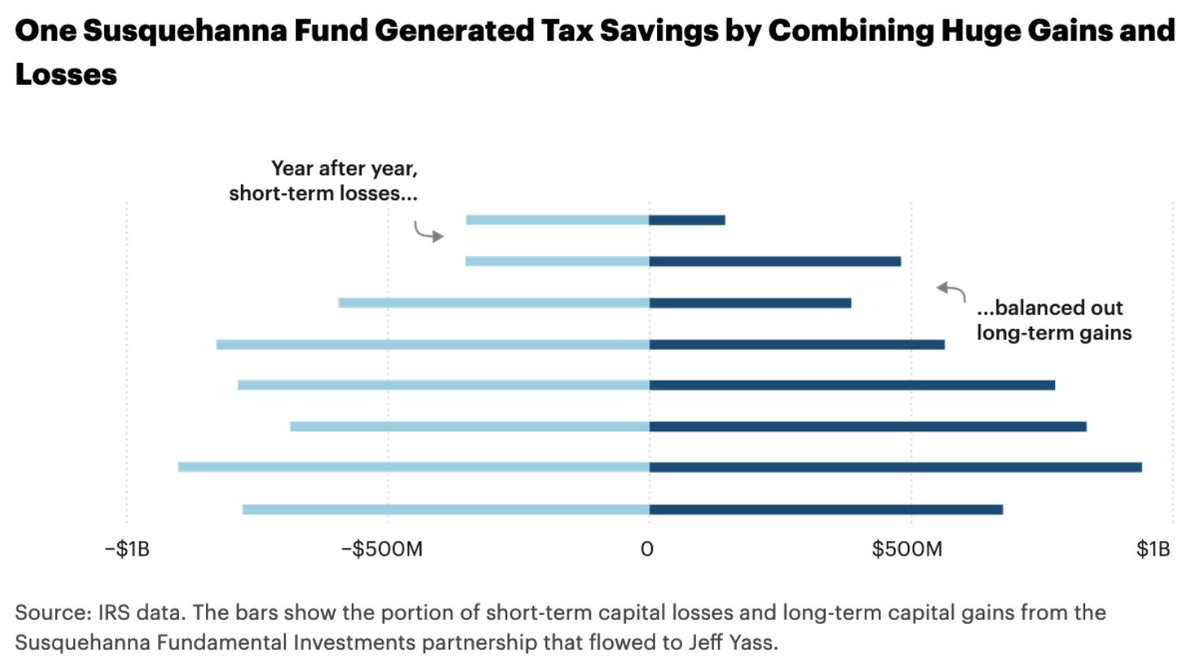

We found that the engine of Yass’ tax avoidance machine is a fund called Susquehanna Fundamental Investments.

It uses trading strategies that consistently produce massive long-term gains and short-term losses, a combination that doesn’t make profits but does slash taxes.

It uses trading strategies that consistently produce massive long-term gains and short-term losses, a combination that doesn’t make profits but does slash taxes.

Yass has repeatedly drawn IRS audits and has often gone to court to fight the government. In 2019 he and two partners were hit with a total of $121 million in back taxes.

Susquehanna has maintained in court filings that it complied with the law.

Susquehanna has maintained in court filings that it complied with the law.

Why should you care about Yass? He’s pouring his fortune into politics – to cut taxes, privatize schools, and back candidates trying to ban abortion and others who deny the 2020 election results.

Here’s an ad he funded on “critical race theory”:

Here’s an ad he funded on “critical race theory”:

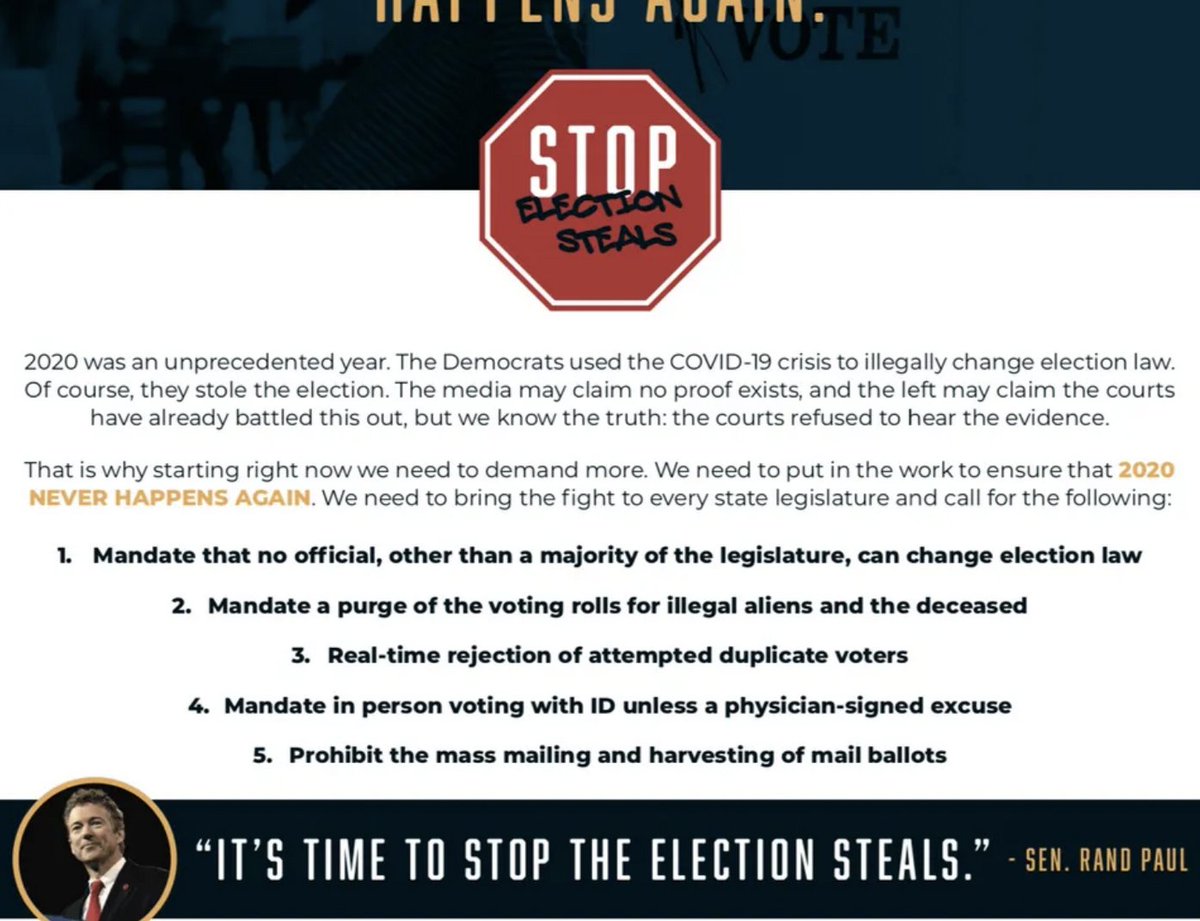

Yass is the single biggest donor to Rand Paul’s “Protect Freedom PAC,” giving more than $12 million. The group’s website says of Democrats: “Of course, they stole the election.”

Susquehanna, Yass and firm co-founders Arthur Dantchik and Joel Greenberg declined to comment.

Here’s the full story, from me, @eisingerj, @paulkiel, @jeffernsthausen, & Doris Burke. Charts and visuals by @lenagroeger and @lrsnwlkr.

propublica.org/article/jeff-y…

Here’s the full story, from me, @eisingerj, @paulkiel, @jeffernsthausen, & Doris Burke. Charts and visuals by @lenagroeger and @lrsnwlkr.

propublica.org/article/jeff-y…

• • •

Missing some Tweet in this thread? You can try to

force a refresh