True market structure is not viewed as simple relative highs and lows

Narrative in terms of structure is built off of liquidity and imbalances which exist in the market

Narrative in terms of structure is built off of liquidity and imbalances which exist in the market

Before getting into the concepts, you must understand which timeframes you will be working from

Timeframes vary depending on the type of trade looking to be put on, but are all relative to:

Long-term perspective

Intermediate-term perspective

Short-term perspective

Timeframes vary depending on the type of trade looking to be put on, but are all relative to:

Long-term perspective

Intermediate-term perspective

Short-term perspective

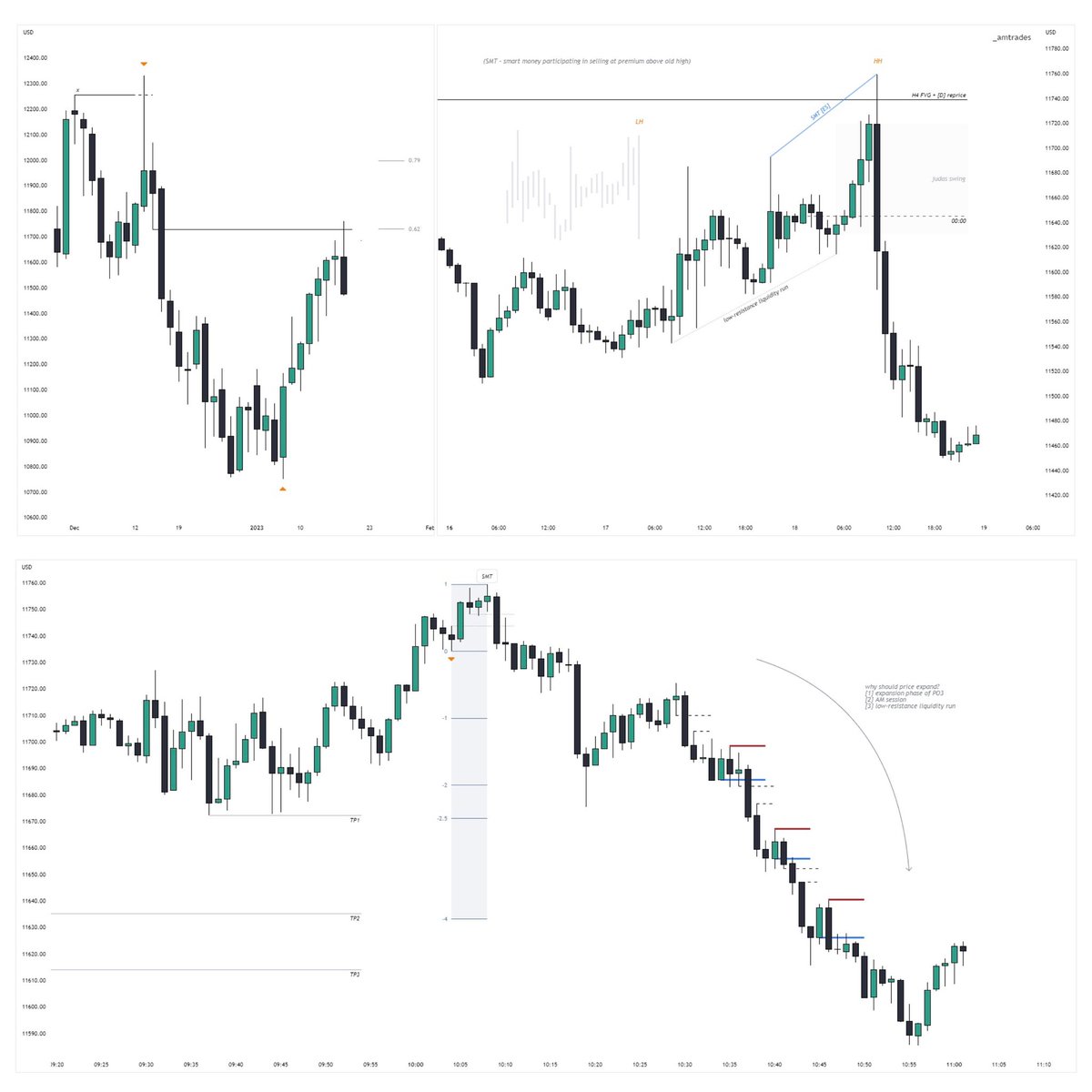

Notice how price becomes more detailed as the time frames are lowered

Each one serves a separate purpose, but hold equal value

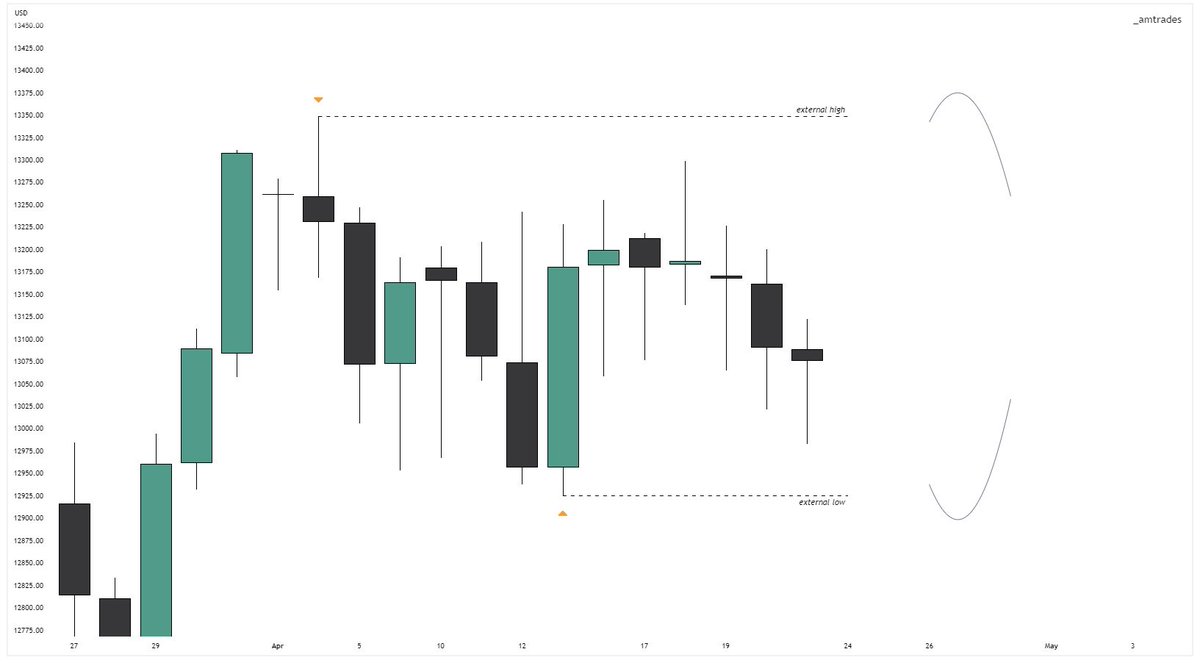

This is the section of price that will be used within the following examples

$ES_F

Each one serves a separate purpose, but hold equal value

This is the section of price that will be used within the following examples

$ES_F

Long-Term | Framework

Long-term swing points will be found on the highest of the three timeframes

Search for major higher timeframe order blocks, fair value gaps, and liquidity levels where price reverses

Directional narrative of a trade is based off the long-term perspective

Long-term swing points will be found on the highest of the three timeframes

Search for major higher timeframe order blocks, fair value gaps, and liquidity levels where price reverses

Directional narrative of a trade is based off the long-term perspective

Long-Term | Example

LTH is created with price forming a swing high off a rejection of a bearish order block

LTL is created with price forming a swing low off a bounce within a fair value gap

LTH is created with price forming a swing high off a rejection of a bearish order block

LTL is created with price forming a swing low off a bounce within a fair value gap

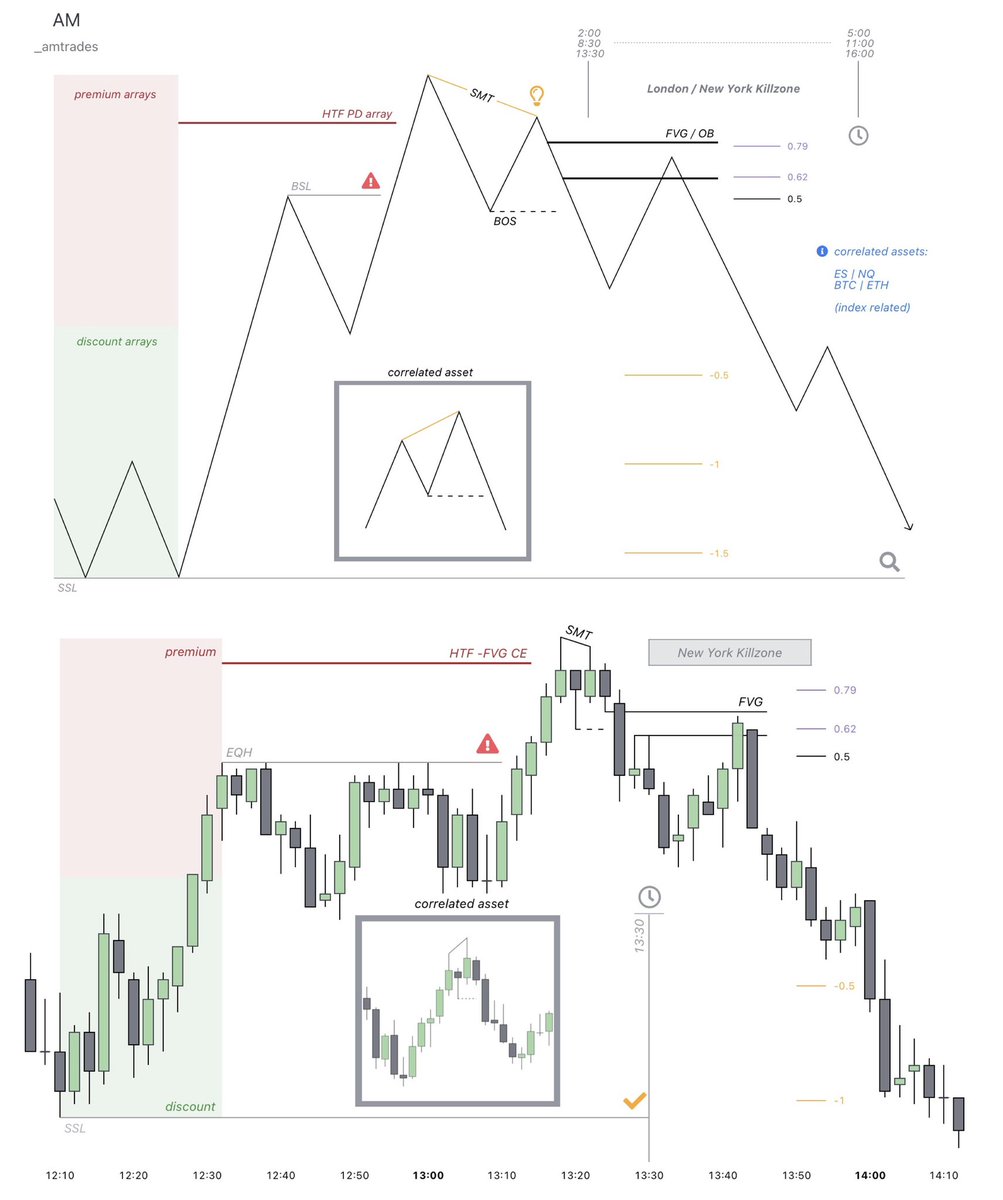

Intermediate-Term | Rebalance

Every time price retraces to rebalance an imbalance (FVG), an intermediate high/low is formed

Trades will be structured around this occurrence as the market is “tipping it’s hand” to you when this happens

Every time price retraces to rebalance an imbalance (FVG), an intermediate high/low is formed

Trades will be structured around this occurrence as the market is “tipping it’s hand” to you when this happens

Intermediate-Term | Classic

Classic ITL: Higher short-term lows to both sides

Classic ITH: Lower short-term highs to both sides

The logic behind this formation gives reason to why rebalanced ITH/ITL are crucial to identify

Classic ITL: Higher short-term lows to both sides

Classic ITH: Lower short-term highs to both sides

The logic behind this formation gives reason to why rebalanced ITH/ITL are crucial to identify

Intermediate-Term | Example

Intermediate-term swing points are determined on the mid level timeframe of the analysis

Note how the ITL are being violated while the ITH has a higher STH to the left (remember the structure of a classic ITH). The market is showing its weakness

Intermediate-term swing points are determined on the mid level timeframe of the analysis

Note how the ITL are being violated while the ITH has a higher STH to the left (remember the structure of a classic ITH). The market is showing its weakness

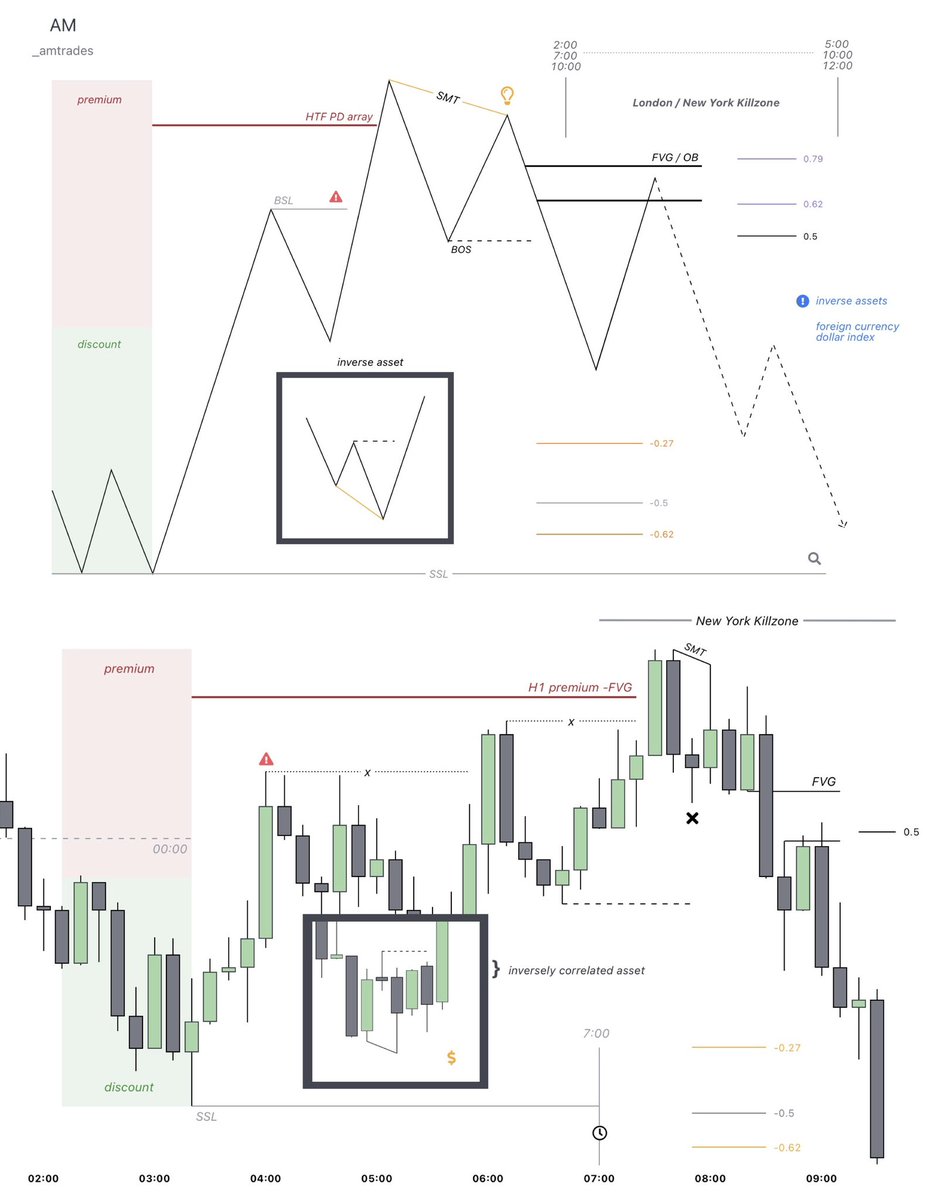

Short-Term | Anticipation

Once the rebalanced intermediate-term price point is established within the correct narrative, it is assumed that the next short-term price swing will fail to violate the ITH/ITL

Once the rebalanced intermediate-term price point is established within the correct narrative, it is assumed that the next short-term price swing will fail to violate the ITH/ITL

Short-Term | Entries

Within the example, we anticipate that the next swing high will fail to violate the rebalanced intermediate-term high

Search for order blocks, imbalances, and/or breakers within a discounted range on the failed retracements to enter a position

Within the example, we anticipate that the next swing high will fail to violate the rebalanced intermediate-term high

Search for order blocks, imbalances, and/or breakers within a discounted range on the failed retracements to enter a position

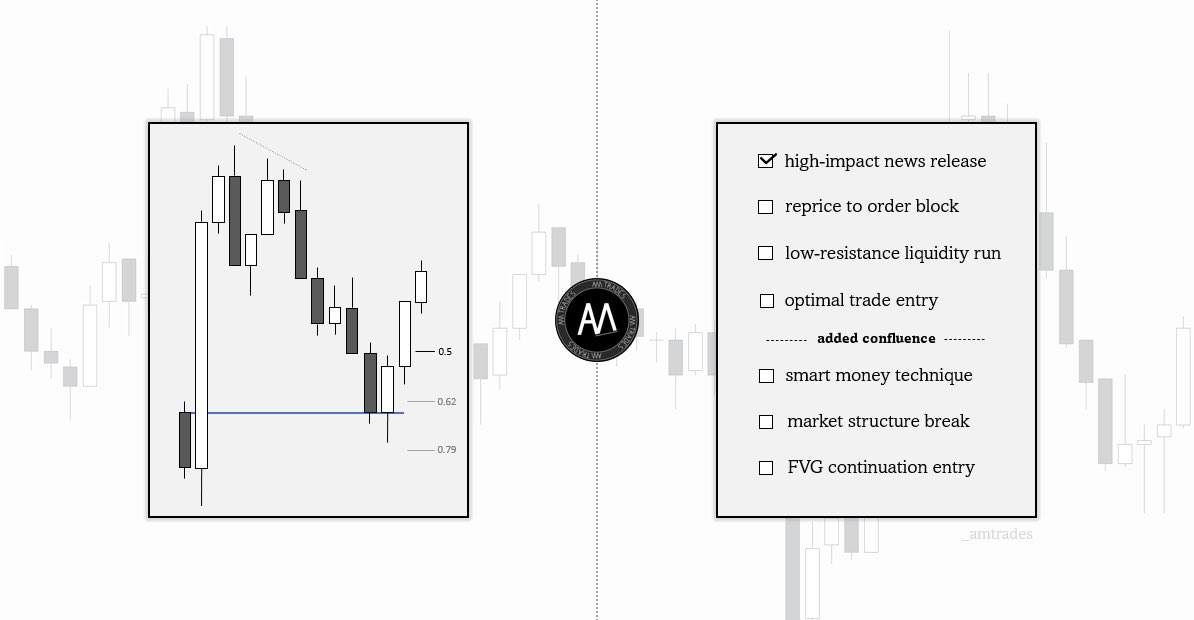

(EXTRA) | Order Block Range - 1

Model which can be used in confluence to classic entries

Each up-close (down-close for bullish) candle on the intermediate-term timeframe on the short-term price swing is viewed as an order block range

This range offers optimal entries

Model which can be used in confluence to classic entries

Each up-close (down-close for bullish) candle on the intermediate-term timeframe on the short-term price swing is viewed as an order block range

This range offers optimal entries

(EXTRA) | Order Block Range - 2

Market offers two optimal entries

Aggressive entry: prior to moving out of the order block range

Conservative entry: after price moves out and retraces back into the order block range

Allows entries in HTF order blocks before they are formed

Market offers two optimal entries

Aggressive entry: prior to moving out of the order block range

Conservative entry: after price moves out and retraces back into the order block range

Allows entries in HTF order blocks before they are formed

Intraday Scalping | Example

Advanced market structure intermediate-term price swings and failed short term retracements are also valid on small timeframe intraday charts for scalping opportunities

Advanced market structure intermediate-term price swings and failed short term retracements are also valid on small timeframe intraday charts for scalping opportunities

Market Structure Shifts

Once the advanced structure is understood, shifts are utilized when searching for entries on the lowest timeframe with short-term perspective

Structure shifts must be energetic and leave behind displacement to ensure that market is looking to reverse

Once the advanced structure is understood, shifts are utilized when searching for entries on the lowest timeframe with short-term perspective

Structure shifts must be energetic and leave behind displacement to ensure that market is looking to reverse

Structure Shift | Example

Note the difference in trend and price action once the structure is shifted in the opposite direction

Note the difference in trend and price action once the structure is shifted in the opposite direction

False Structure Shifts

In order for the market to shift in structure, price must do the following:

Bullish MSS: Break above high which created the most recent lower low with displacement

Bearish MSS: Beak below low which created the most recent higher high with displacement

In order for the market to shift in structure, price must do the following:

Bullish MSS: Break above high which created the most recent lower low with displacement

Bearish MSS: Beak below low which created the most recent higher high with displacement

Remember that structure means nothing without narrative. Lose sight of the draw on price, HTF structure, and resting liquidity and your vulnerable to being faked out

If your unfamiliar with any terms, refer to the thread attached below

If your unfamiliar with any terms, refer to the thread attached below

https://twitter.com/_amtrades/status/1532139297691815937

If you enjoyed this thread and found it helpful, please consider showing some love :)

Follow for more educational #ICT content

Follow for more educational #ICT content

https://twitter.com/_amtrades/status/1539385869672792066

• • •

Missing some Tweet in this thread? You can try to

force a refresh