Kune Food. A short story.

1. Kune Food was launched in December 2020:

"After three days of coming into Kenya, I asked where I can get great food at a cheap price, and everybody tell me it’s impossible" - Founder Robin Reecht

1. Kune Food was launched in December 2020:

"After three days of coming into Kenya, I asked where I can get great food at a cheap price, and everybody tell me it’s impossible" - Founder Robin Reecht

8. We did attend the high-powered launch btw:

https://twitter.com/MwangoCapital/status/1461651701711134724?s=20&t=7cwbqGDUwDcHAnztaCh2kQ

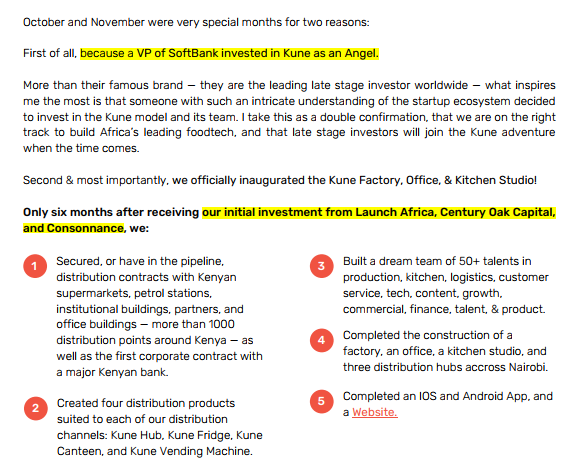

9. December to February 2022 traction:

"Our traction has been tremendous, and above all expectations. In only 3 months since launching, we multiplied our sales by x12, from 3000$ of MRR to 37,000$ of MRR"

+ launched billboards + android and iOS apps:

"Our traction has been tremendous, and above all expectations. In only 3 months since launching, we multiplied our sales by x12, from 3000$ of MRR to 37,000$ of MRR"

+ launched billboards + android and iOS apps:

10. Last we checked they were going to raise $6M for the seed round to expand across Africa:

Seems this did not work out and they have run out and will close shop soon.

Seems this did not work out and they have run out and will close shop soon.

11. They have tried to source for funds or to sell to a strategic buyer and all channels were closed:

"I have exhausted my options. Am just not able anymore to raise money, it’s impossible." - Founder.

"I have exhausted my options. Am just not able anymore to raise money, it’s impossible." - Founder.

12. The founder on LinkedIn:

"Many things could have been done differently, better certainly. The coming months will allow us to reflect on Kune’s failure, and I hope to share about it when the time will be right"

"Many things could have been done differently, better certainly. The coming months will allow us to reflect on Kune’s failure, and I hope to share about it when the time will be right"

Tomorrow evening on #MwangoSpaces, we reflect on the journey of Kune Food [@KuneFood], the lessons we can learn and what it means for the ecosystem.

twitter.com/i/spaces/1vAxR…

twitter.com/i/spaces/1vAxR…

Tomorrow evening on #MwangoSpaces, we reflect on the journey of Kune Food [@KuneFood], the lessons we can learn and what it means for the ecosystem.

twitter.com/i/spaces/1vAxR…

twitter.com/i/spaces/1vAxR…

• • •

Missing some Tweet in this thread? You can try to

force a refresh