A hacker stole $100 million from the bridge connecting Ethereum and @harmonyprotocol a few hours ago.

Let's explore how the #harmony bridge works and what allowed this to happen 1/9

Let's explore how the #harmony bridge works and what allowed this to happen 1/9

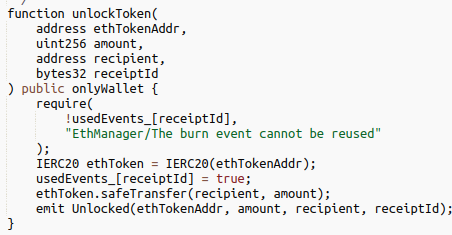

The bridge is relatively simple - users lock tokens on the Ethereum side and a multisig mints tokens on Harmony.

When going the opposite way users burn tokens on Harmony and a multisig requiring 2 signatures unlocks tokens on Ethereum 2/9

When going the opposite way users burn tokens on Harmony and a multisig requiring 2 signatures unlocks tokens on Ethereum 2/9

Every time an unlock happens on Ethereum the bridge smart contract emits an event that includes the transaction id of the associated burn transaction on the Harmony blockchain.

Let's follow a normal Harmony to Ethereum unlock 3/9

Let's follow a normal Harmony to Ethereum unlock 3/9

This was one of the last transactions before the bridge was paused: etherscan.io/tx/0x723a1dde9…

If we look at the emitted events we see that it's associated with the following Harmony transaction: explorer.harmony.one/tx/0x7cd65d048…

Everything looks fine. 4/9

If we look at the emitted events we see that it's associated with the following Harmony transaction: explorer.harmony.one/tx/0x7cd65d048…

Everything looks fine. 4/9

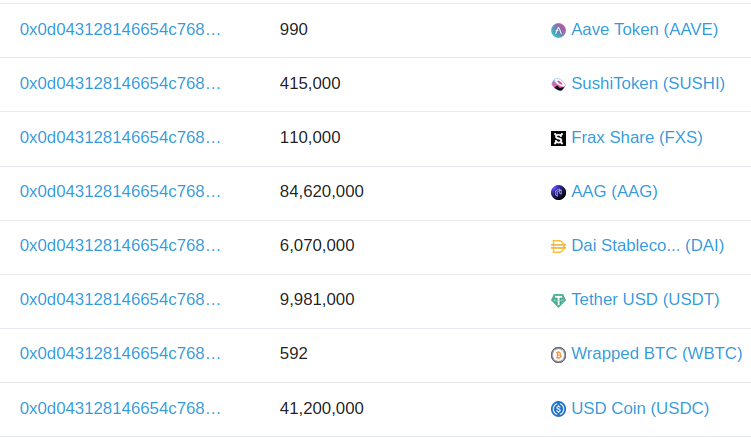

Now let's look at one of the transactions used to drain the bridge. $10 million USDT is unlocked on Ethereum: etherscan.io/tx/0x6487952d4…

The unlock is associated with the following transaction on Harmony: 0xD48D952695EDE26C0AC11A6028AB1BE6059E9D104B55208931A84E99EF5479B6

The unlock is associated with the following transaction on Harmony: 0xD48D952695EDE26C0AC11A6028AB1BE6059E9D104B55208931A84E99EF5479B6

However, no such transaction exists on Harmony. I looked for it in the block explorer, I also tried calling hmyv2_getTransactionReceipt from several Harmony RPC nodes but they all return null.

This is the case for all transactions initiated by the hacker. 6/9

This is the case for all transactions initiated by the hacker. 6/9

What does that mean?

If the attacker managed to unlock tokens on Ethereum without burning tokens on Harmony that most likely means that this is another Ronin-style hack. 7/9

If the attacker managed to unlock tokens on Ethereum without burning tokens on Harmony that most likely means that this is another Ronin-style hack. 7/9

The hacker probably managed to get access to the 2 private keys that are part of the multisig which can calls unlock() on the Ethereum side.

@_apedev wrote a thread a few months ago asking Harmony how these EOA are secured:

@_apedev wrote a thread a few months ago asking Harmony how these EOA are secured:

https://twitter.com/_apedev/status/1510007663832223751

This also explains why the Harmony team added more signers to the multisig after the hack.

Securing bridges is hard.

I hope this will serve as a reminder that even if your smart contracts are secure your off-chain code & opsec must be on point as well. 9/9

Securing bridges is hard.

I hope this will serve as a reminder that even if your smart contracts are secure your off-chain code & opsec must be on point as well. 9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh