Green #Hydrogen Task Force:

Action plan by hydrogen industry, supported by @RockyMtnInst: 👇

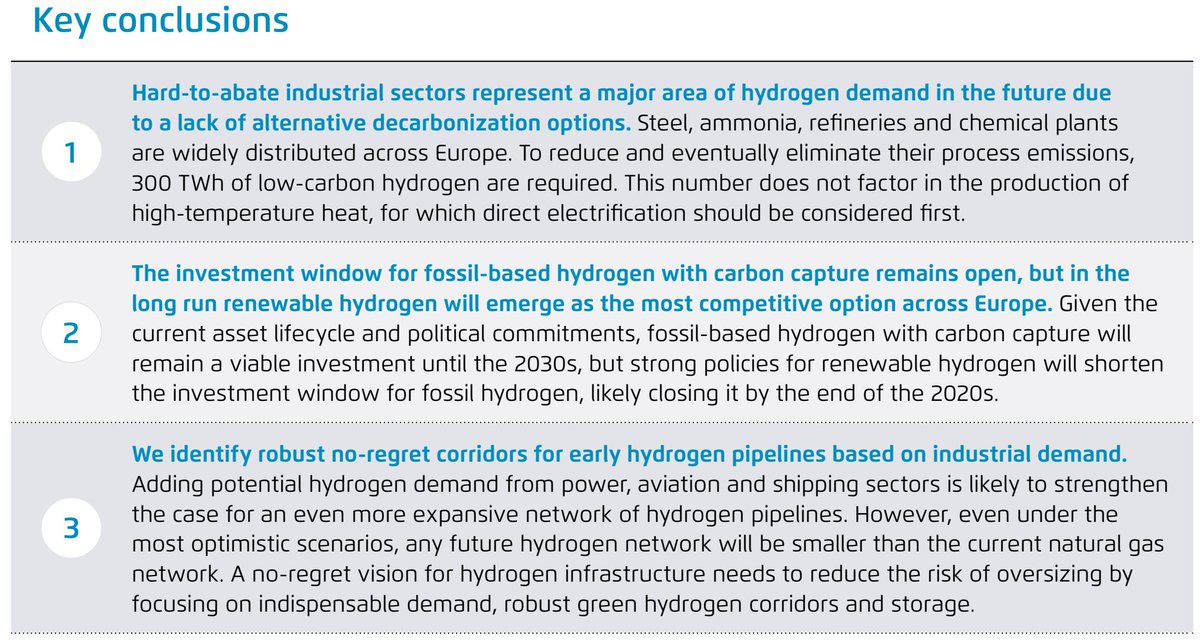

- Imported green H2 could be cheaper than domestically produced grey or blue H2 through to 2030

- need of €20 to €30 billion near-term market and first-mover support by 2030

1/9

Action plan by hydrogen industry, supported by @RockyMtnInst: 👇

- Imported green H2 could be cheaper than domestically produced grey or blue H2 through to 2030

- need of €20 to €30 billion near-term market and first-mover support by 2030

1/9

While green H2 is currently competitive with grey and blue H2 produced with natural gas (see Exhibit 4 above), green H2 fuel is still more expensive in direct competition with fuels like natural gas, crude oil, and coal, which it will displace across several sectors.

2/9

2/9

"The EU ETS price is projected to rise from €80/tonne (2022 average) up to €140/tonne by 2030. Pricing trends that will determine market risk level for green hydrogen are depicted in Exhibit 5."

3/9

3/9

"Rapid scale-up would benefit from current high energy prices, but still, approximately €10 billion would be needed to offset market risk against direct competing fuels — like natural gas, crude oil, and coal — and land 15 Mtpa (500 TWh) of green H2 imports in DE by 2030"

4/9

4/9

"Collective first-mover risk – i.e., the required level of investment to keep all existing production capacity competitive with falling market prices – could build up as suppliers invest in the scale of assets required to deliver targeted levels" of green H2 to DE by 2030.

5/9

5/9

"Ultimately, first-mover risk will be eliminated as the green hydrogen market matures. Exhibit 11 illustrates in further detail how maximum first-mover risk for each new class of assets will evolve until first-mover risk is mitigated for the 2030 asset class" 6/9

"Investing €20 billion to €30 billion between now and

2030 on economic support to offset market risk (€10 billion to €20 billion) and first-mover risk (€8 billion to €10 billion) would unlock up to 10x more capital expenditure for industrial development" 7/9

2030 on economic support to offset market risk (€10 billion to €20 billion) and first-mover risk (€8 billion to €10 billion) would unlock up to 10x more capital expenditure for industrial development" 7/9

@maobelaunde @ThatManZaf @paulmuennich @Fabar021 @emirc1907 @janke_leandro @Carolin45531148 @Isadora_atAgora @PhilDHauser @KWitecka @_camillaoliv @JuliaChMetz

@CitizenSane1 @andreasgraf

@gnievchenko @PhilippLitz @finmuc_schmidt

@PhHauser @Ben_Pfluger

@EnergyRuud

8/9

@CitizenSane1 @andreasgraf

@gnievchenko @PhilippLitz @finmuc_schmidt

@PhHauser @Ben_Pfluger

@EnergyRuud

8/9

@kirstenwestpha1 @YanaZabanova @anunezjimenez @EBiancoIT @JMGlachant @nworbmot @andiwagner @FalkoUeckerdt @ChristianOnRE

@hansDambeck

@UrsMaier

@J_Wettengel @Siemens_Energy @thyssenkrupp @FortescueFuture @EON_SE_en @covestro @SchaefflerDE

9/9

@hansDambeck

@UrsMaier

@J_Wettengel @Siemens_Energy @thyssenkrupp @FortescueFuture @EON_SE_en @covestro @SchaefflerDE

9/9

Finally - the link to the paper:

ffi.com.au/wp-content/upl…

ffi.com.au/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh