1/

Get a cup of coffee.

In this thread, I'll walk you through a probabilistic thought experiment.

This will help you appreciate some key investing concepts:

- SURVIVAL is key,

- we need LONG TERM focus,

- the LUCK vs SKILL conundrum, and

- the CERTAINTY vs UPSIDE trade-off.

Get a cup of coffee.

In this thread, I'll walk you through a probabilistic thought experiment.

This will help you appreciate some key investing concepts:

- SURVIVAL is key,

- we need LONG TERM focus,

- the LUCK vs SKILL conundrum, and

- the CERTAINTY vs UPSIDE trade-off.

2/

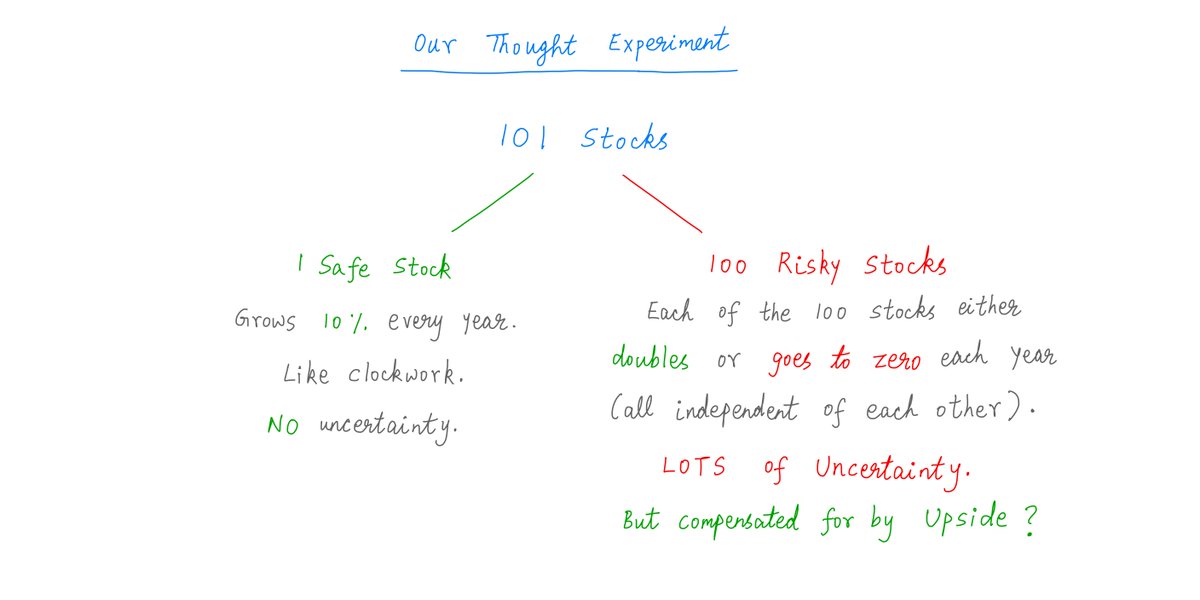

Imagine we have 101 stocks in front of us.

Of these, 1 is "Safe". The other 100 are "Risky".

We know which is which.

The Safe stock grows 10% every year. Like clockwork. There's NO uncertainty around it.

Imagine we have 101 stocks in front of us.

Of these, 1 is "Safe". The other 100 are "Risky".

We know which is which.

The Safe stock grows 10% every year. Like clockwork. There's NO uncertainty around it.

3/

The Risky stocks are more uncertain.

But to compensate, they (seemingly) offer more UPSIDE.

Each Risky stock either *doubles* or *goes to zero* each year. There's a 50/50 chance of either outcome, and it's impossible to predict in advance which Risky stock will do what.

The Risky stocks are more uncertain.

But to compensate, they (seemingly) offer more UPSIDE.

Each Risky stock either *doubles* or *goes to zero* each year. There's a 50/50 chance of either outcome, and it's impossible to predict in advance which Risky stock will do what.

4/

So, if we buy the Safe stock, we're guaranteed a respectable 10% return. Every year.

If we buy one of the Risky stocks, we *could* make 10 times that. We could double our money in just 1 year. But we could also go to zero and lose all of our principal.

That's the trade-off.

So, if we buy the Safe stock, we're guaranteed a respectable 10% return. Every year.

If we buy one of the Risky stocks, we *could* make 10 times that. We could double our money in just 1 year. But we could also go to zero and lose all of our principal.

That's the trade-off.

5/

For simplicity, let's assume that all 100 Risky stocks are "uncorrelated".

That is, one of them doubling (or going to zero) does NOT affect the odds of another doubling (or going to zero).

For simplicity, let's assume that all 100 Risky stocks are "uncorrelated".

That is, one of them doubling (or going to zero) does NOT affect the odds of another doubling (or going to zero).

6/

So, the most likely outcome is:

After 1 year, we'll have ~50 surviving Risky stocks (now worth double what they were a year ago). The other ~50 would have gone to zero.

After 2 years, we'll have ~25 survivors, each worth 4x what they were 2 years ago.

And so on.

So, the most likely outcome is:

After 1 year, we'll have ~50 surviving Risky stocks (now worth double what they were a year ago). The other ~50 would have gone to zero.

After 2 years, we'll have ~25 survivors, each worth 4x what they were 2 years ago.

And so on.

7/

Here's the question:

Suppose, after waiting for a few years, we look up the BEST performing stock out of our 101.

Is this "top performer" more likely to be the Safe stock?

Or is it more likely to be one of the Risky stocks?

Here's the question:

Suppose, after waiting for a few years, we look up the BEST performing stock out of our 101.

Is this "top performer" more likely to be the Safe stock?

Or is it more likely to be one of the Risky stocks?

8/

For example, suppose we wait 1 year and then look up our top performer.

By then, we expect ~50 of our Risky stocks to have perished.

But the other ~50 would have doubled. And these "survivors" will have trounced the Safe stock, which would have only gone up by a measly 10%.

For example, suppose we wait 1 year and then look up our top performer.

By then, we expect ~50 of our Risky stocks to have perished.

But the other ~50 would have doubled. And these "survivors" will have trounced the Safe stock, which would have only gone up by a measly 10%.

9/

So, after 1 year, it's HIGHLY likely that the top performer is a Risky stock.

Unless, by some freak accident, ALL 100 Risky stocks perished in the first year. This is possible, but not very likely. The odds of this are (1/2)^100 ~= one quadrillionth of one in a quadrillion!

So, after 1 year, it's HIGHLY likely that the top performer is a Risky stock.

Unless, by some freak accident, ALL 100 Risky stocks perished in the first year. This is possible, but not very likely. The odds of this are (1/2)^100 ~= one quadrillionth of one in a quadrillion!

10/

But here's the thing:

As we wait longer and longer, more and more Risky stocks will drop like flies.

It's only a matter of time before ALL 100 Risky stocks vanish.

And after that, the "top performer" will be our humble Safe stock -- the sole survivor of all this carnage.

But here's the thing:

As we wait longer and longer, more and more Risky stocks will drop like flies.

It's only a matter of time before ALL 100 Risky stocks vanish.

And after that, the "top performer" will be our humble Safe stock -- the sole survivor of all this carnage.

11/

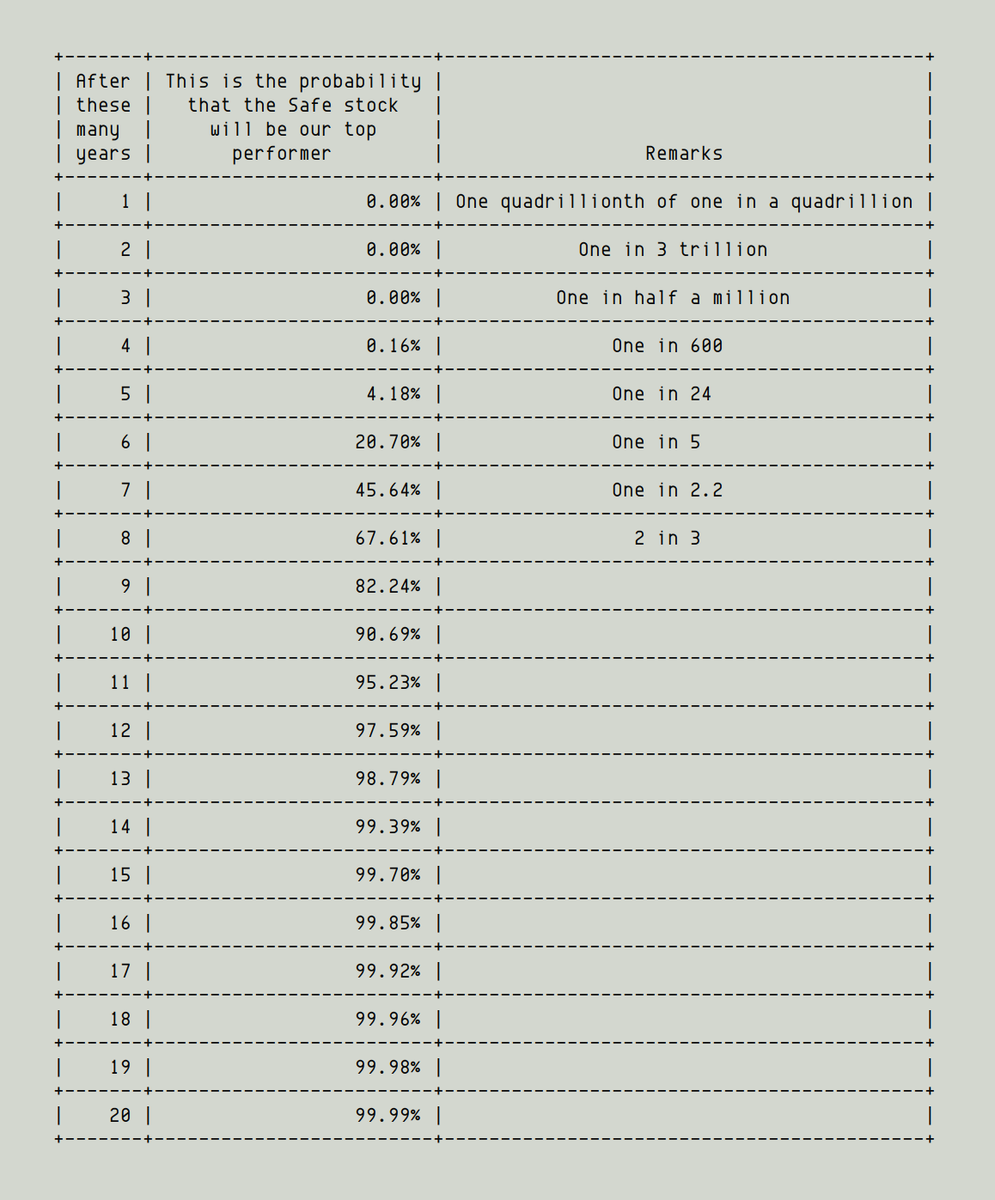

For example, after 8 years, the odds of our Safe stock being the de facto top performer are better than 2 in 3.

After 10 years, the odds are more than 90%.

After 11 years, more than 95%.

After 14 years, more than 99%.

And so on.

For example, after 8 years, the odds of our Safe stock being the de facto top performer are better than 2 in 3.

After 10 years, the odds are more than 90%.

After 11 years, more than 95%.

After 14 years, more than 99%.

And so on.

12/

So, Risky stocks may be exciting. After all, who doesn't want to score a double each year?

But *eventually* -- if there's even a small risk of a total wipe-out that goes un-addressed from year to year -- it WILL happen one day.

That's the math of repeated risk taking.

So, Risky stocks may be exciting. After all, who doesn't want to score a double each year?

But *eventually* -- if there's even a small risk of a total wipe-out that goes un-addressed from year to year -- it WILL happen one day.

That's the math of repeated risk taking.

13/

We can draw several investing lessons from our thought experiment above.

Key Lesson 1. Investing is about SURVIVAL -- first and foremost.

I think individual investors should approach investing as a *satisficing* game. Not a *maximizing* game.

We can draw several investing lessons from our thought experiment above.

Key Lesson 1. Investing is about SURVIVAL -- first and foremost.

I think individual investors should approach investing as a *satisficing* game. Not a *maximizing* game.

14/

That is, our aim should be to get a *decent* rate of return WITHOUT blowing ourselves up -- a "decent" rate being whatever allows us to lead a reasonably comfortable (non-extravagant) life.

We DON'T want the *highest* return -- if that means risking total wipe-out.

That is, our aim should be to get a *decent* rate of return WITHOUT blowing ourselves up -- a "decent" rate being whatever allows us to lead a reasonably comfortable (non-extravagant) life.

We DON'T want the *highest* return -- if that means risking total wipe-out.

15/

For professional money managers, there may be powerful incentives to chase "top performer" status.

We should study these incentives before entrusting our money to such managers.

For professional money managers, there may be powerful incentives to chase "top performer" status.

We should study these incentives before entrusting our money to such managers.

16/

For example, a fund manager who is ranked a "top performer" usually sees BIG inflows into their fund.

These inflows tend to arrive EVEN IF the ranking is based on only a short period of out-performance -- like less than 3 years.

For example, a fund manager who is ranked a "top performer" usually sees BIG inflows into their fund.

These inflows tend to arrive EVEN IF the ranking is based on only a short period of out-performance -- like less than 3 years.

17/

It's like an author getting on the New York Times Bestseller list.

Even if they don't stay on the list very long, they'll still get a lot of publicity that helps sell even more books -- *while* they're on the list, and perhaps even for some time *after* they're kicked off.

It's like an author getting on the New York Times Bestseller list.

Even if they don't stay on the list very long, they'll still get a lot of publicity that helps sell even more books -- *while* they're on the list, and perhaps even for some time *after* they're kicked off.

18/

For a fund manager, such "top performer" status induced inflows often translate to millions of dollars in extra income (via fees).

So, there may be a powerful incentive to get recognized as a "top performer", even if it's only by taking on reckless risk.

For a fund manager, such "top performer" status induced inflows often translate to millions of dollars in extra income (via fees).

So, there may be a powerful incentive to get recognized as a "top performer", even if it's only by taking on reckless risk.

19/

As we saw, even a Risky stock -- bound to go to zero -- can be a "top performer" for a few years.

So, if we pick a fund manager based on recent out-performance, we should be confident that the out-performance is due to superior skill -- and NOT reckless risk taking!

As we saw, even a Risky stock -- bound to go to zero -- can be a "top performer" for a few years.

So, if we pick a fund manager based on recent out-performance, we should be confident that the out-performance is due to superior skill -- and NOT reckless risk taking!

21/

Here's a link to the full episode.

It's about 2 hours of audio, but full of useful insights and nuggets like the one above.

(h/t @AswathDamodaran, @patrick_oshag)

joincolossus.com/episodes/75305…

Here's a link to the full episode.

It's about 2 hours of audio, but full of useful insights and nuggets like the one above.

(h/t @AswathDamodaran, @patrick_oshag)

joincolossus.com/episodes/75305…

22/

Key Lesson 2.

In investing, it's hard to distinguish LUCK from SKILL.

For example, it's hard to tell whether a fund manager's performance is due to genuine prowess, or simply because they got lucky for a few years and they're in fact a ticking time bomb waiting to blow up.

Key Lesson 2.

In investing, it's hard to distinguish LUCK from SKILL.

For example, it's hard to tell whether a fund manager's performance is due to genuine prowess, or simply because they got lucky for a few years and they're in fact a ticking time bomb waiting to blow up.

23/

For more on how to approach such "statistical significance" questions, I recommend reading Buffett's excellent 1984 essay: The Superinvestors of Graham-and-Doddsville.

www8.gsb.columbia.edu/sites/valueinv…

For more on how to approach such "statistical significance" questions, I recommend reading Buffett's excellent 1984 essay: The Superinvestors of Graham-and-Doddsville.

www8.gsb.columbia.edu/sites/valueinv…

24/

Prof. Michael Mauboussin (@mjmauboussin) has also done wonderful work on such questions.

His book, The Success Equation, is full of wisdom on recognizing the role of luck in our investing journeys, and taking decisions under uncertainty.

amazon.com/Success-Equati…

Prof. Michael Mauboussin (@mjmauboussin) has also done wonderful work on such questions.

His book, The Success Equation, is full of wisdom on recognizing the role of luck in our investing journeys, and taking decisions under uncertainty.

amazon.com/Success-Equati…

25/

Some investors can afford much higher levels of risk and uncertainty than others.

Given the opportunities we see, it's up to us to make the right trade-offs between uncertainty, risk, and potential upside.

I hope this thread helped with that. Thanks for reading!

/End

Some investors can afford much higher levels of risk and uncertainty than others.

Given the opportunities we see, it's up to us to make the right trade-offs between uncertainty, risk, and potential upside.

I hope this thread helped with that. Thanks for reading!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh