1/18 Really important report by @dnepo @aneelbhangu out this morning as reported by @ShaunLintern in yesterdays @thesundaytimes

Grateful to have received an early copy for comment &here are some thoughts in a short 🧵

Grateful to have received an early copy for comment &here are some thoughts in a short 🧵

https://twitter.com/ShaunLintern/status/1540966896400482304?s=20&t=SZtNxZ-3BsHIzh9ldSwRjQ

2/18 Firstly this is NOT and never was a "COVID" backlog. As I have repeatedly pointed out the backlog has building over a decade, only worsened by but not caused by COVID.

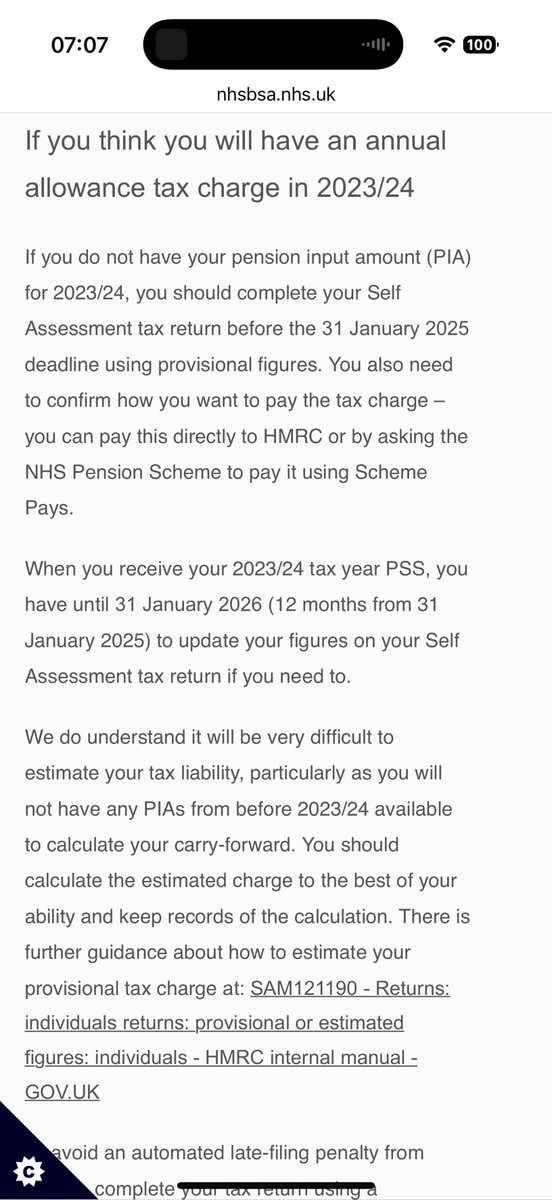

A key part of that has been - as acknowledged by the authors - the interaction with pension taxation

A key part of that has been - as acknowledged by the authors - the interaction with pension taxation

3/18 BUT the problem is not limited to consultants "not taking additional work" - far from it. That particular problem, largely driven by the tapered AA was/is real, but a much bigger threat is reduction in activity (from reduced sessions) and loss of activity by early retirement

4/18 Repeated surveys from Royal Colleges & unions including @TheBMA have shown this - and moreover whereas the withdrawal of additional activity (i.e. waiting list activity) may be temporary, a much bigger threat is reduction of hours or retirement, more often permanent

5/18 It were these actions in 2019, which remain very much live and current today - and most certainly have not been fixed by tweaking the taper thresholds - which remain a potent threat to elective recovery

6/18 So far from being a "covid backlog" it were front pages such as these which left government to need to take emergency action in 2019 (AA compensation scheme) and 2020 (March budget with taper tweak)

7/18 .@thebma were crystal clear with government that the taper changes were not enough to resolve the issues caused by pension taxation. And then in 2021 came the announcement that the lifetime allowance would be frozen (previously increasing annually by inflation).

8/18 LTA was frozen in 2021 - @BMA_Pensions surveyed >8000 consultants & GPs - terrible for retention (72% said LTA freeze⬆️likely retire early; 61% ⬆️ likely work fewer hours). With⬆️inflation, LTA falling REALLY fast - this is going to be a *big* problem @RishiSunak @sajidjavid

9/18 There is very clear evidence of a strong association between the fall (in real terms) of the lifetime allowance - and voluntary early retirement. Whilst some will retire & return this is almost universally on less activity and some will retire for good.

10/18 This is loss of our most experienced clinicians often very much at the peak of their career with so much more to give not only in service but also in training the next generation.

11/18 So coming full circle to the excellent report on waiting times by @dnepo @aneelbhangu - what does the future hold? Well at current levels of activity, could see waiting lists increase to 14.6m by 2030 😔

12/18 As I have repeatedly said since well before the waiting list crisis in 2019 - the key enabler to resolving the waiting list crisis is RETENTION @Jeremy_Hunt.

Training new consultant surgeons (and other critical team members) takes well over a decade.

Training new consultant surgeons (and other critical team members) takes well over a decade.

13/18 Our only hope to turn around the waiting list crisis is to retain the existing workforce - and crucially not only enable them to do additional activity, but also to work as many sessions as they are able / want to, and to work as long as they want.

14/18 Current scheme rules and pension taxation make it extremely unfavorable for those over 59 (or sometime even earlier than this) to carry on working in the NHS

bma.org.uk/doesntpaytostay

bma.org.uk/doesntpaytostay

15/18 We @bma_pensions wish that were not the case, but I am afraid it is. And with soaring inflation (and associated increased AA charges and a rapidly falling lifetime allowance) that position will only deteriorate and it will do so quickly.

16/18 So if government want to turn this around, and I would politely suggest they *really* need to, please urgently speak to us about solutions which *will* work (like late retirement factors, and a tax unregistered scheme like offered to the judges).

17/18 Lets completely uncouple the desire to work as many sessions as one wants, and to retire when you want, from punitive tax charges. Lets make it #paytostay & sort these horrific waiting lists as soon as possible. Lets choose an "optimistic scenario"👇 by turning this around

18/18 It really cannot be done without fixing the elephant in the room - pension taxation. Please RT if you agree and want government to act #taxunregistered #CPIdisconnect #lateretirementfactors #FixTheFinanceAct #arm2022

• • •

Missing some Tweet in this thread? You can try to

force a refresh