With all the chatter about the latest statist overeach in the EU regarding bitcoin and 'unhosted wallets' I figured I would share some slides from my talk at @GunsnBitcoin 2022 in Miami

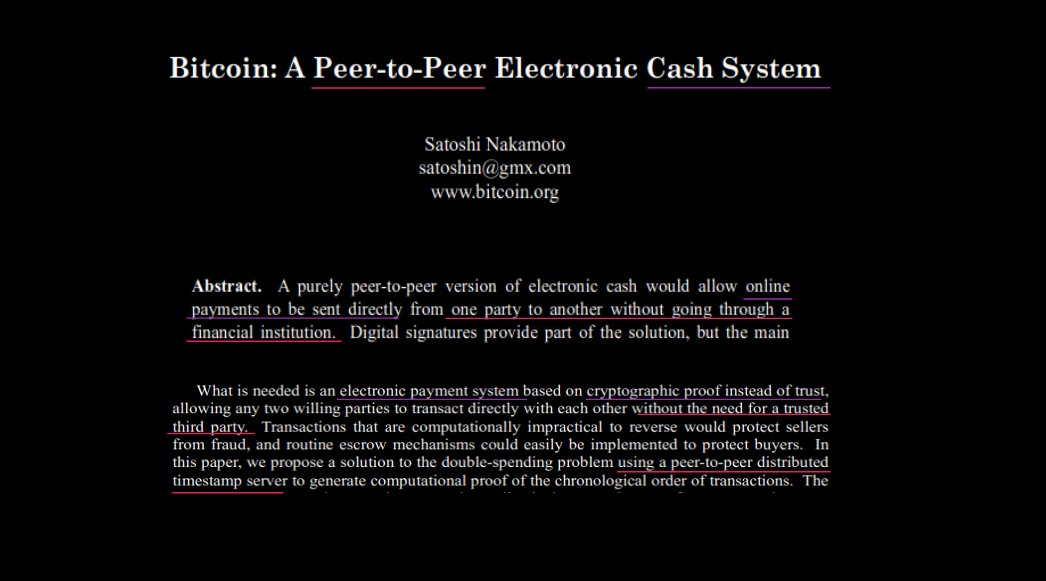

Let's start with Satoshi's white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System

Let's start with Satoshi's white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System

The clue is in the title.

Take note of the following key words:

- Peer-to-Peer

- Electronic Cash.

We'll come back to that, but first to understand what Satoshi invented we need to understand physical (non digital) cash

Take note of the following key words:

- Peer-to-Peer

- Electronic Cash.

We'll come back to that, but first to understand what Satoshi invented we need to understand physical (non digital) cash

Aristotle explored what makes good money in his Nicomachean Ethics. No doubt many of you have seen this before, usually when someone is trying to convince you to buy gold. But it just so happens that even physical fiat dollars tick these boxes too.

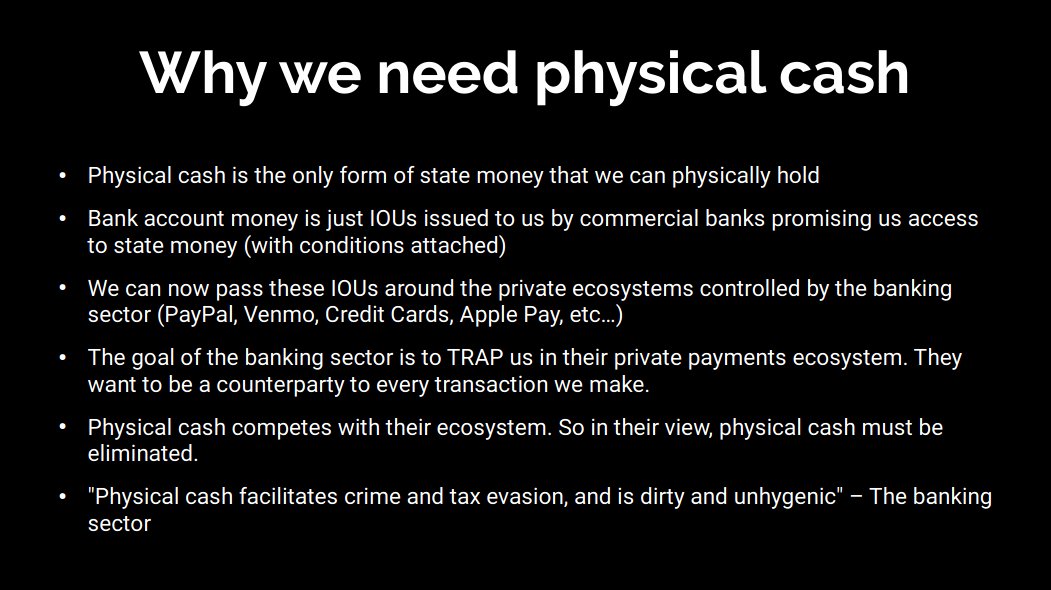

We're increasingly in a world where we are taught to be suspicious of cash, that those who choose to deal primarily with physical cash are shady at best or criminals at worst.

This gas lighting is a recent innovation. The old expression 'Cash is king' exists for a reason.

This gas lighting is a recent innovation. The old expression 'Cash is king' exists for a reason.

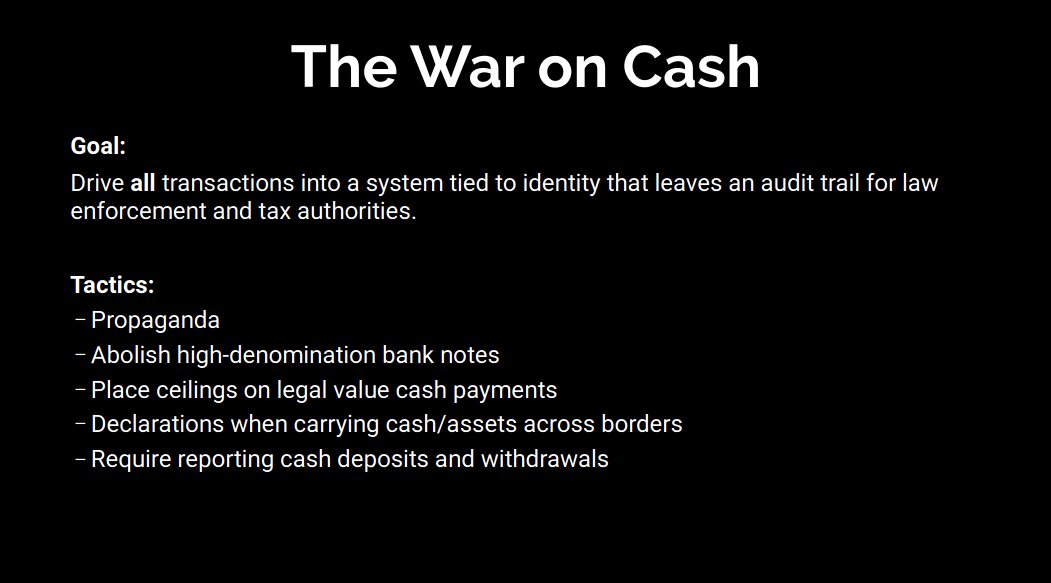

This ties into what is referred to as "The War on Cash"

Make no mistake, this is a war, and the victory condition is a state where *all* transactions are tied to an identity that leaves an audit trail for law enforcement and tax authorities.

Make no mistake, this is a war, and the victory condition is a state where *all* transactions are tied to an identity that leaves an audit trail for law enforcement and tax authorities.

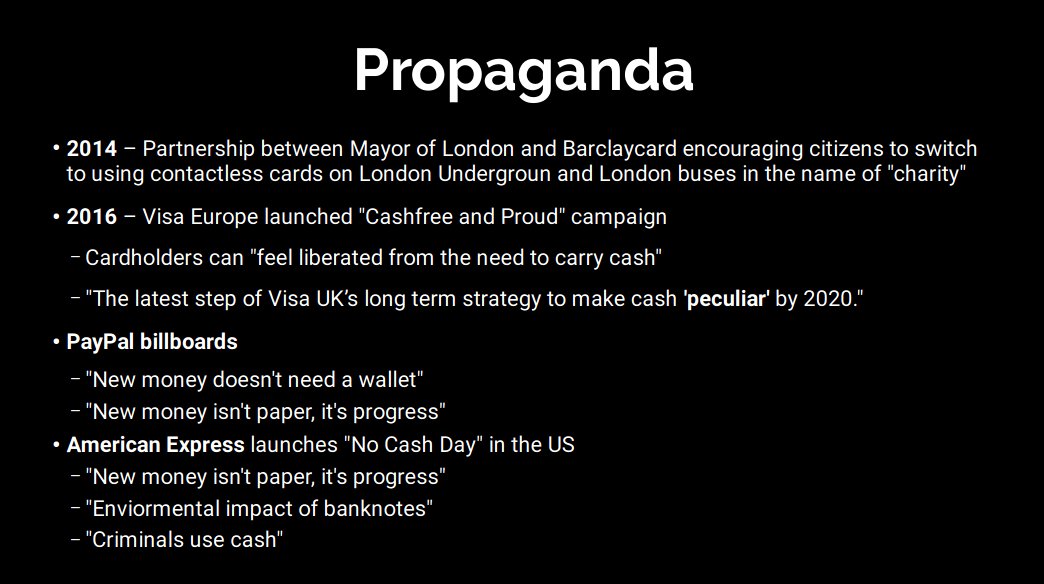

Like all wars, propaganda plays a huge part. Thanks to industry involvement and collaboration, physical cash is seen as dirty, illicit, and strange

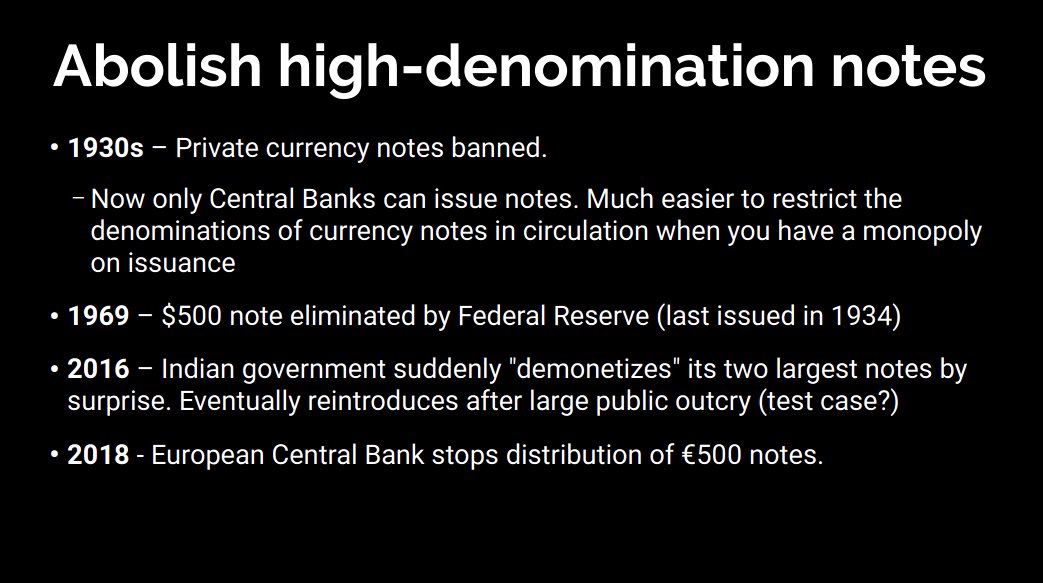

Another effective tool in this war is the absolute legislative and policy control our adversary commands.

In the US private money was banned in the 1930s, with the power to control supply and denominations of notes under total state control.

Control the money control the people

In the US private money was banned in the 1930s, with the power to control supply and denominations of notes under total state control.

Control the money control the people

Adding to the legislative weapons of this war is the legal ceiling on cash payments. In Greece it is illegal to transact more than €500 in cash

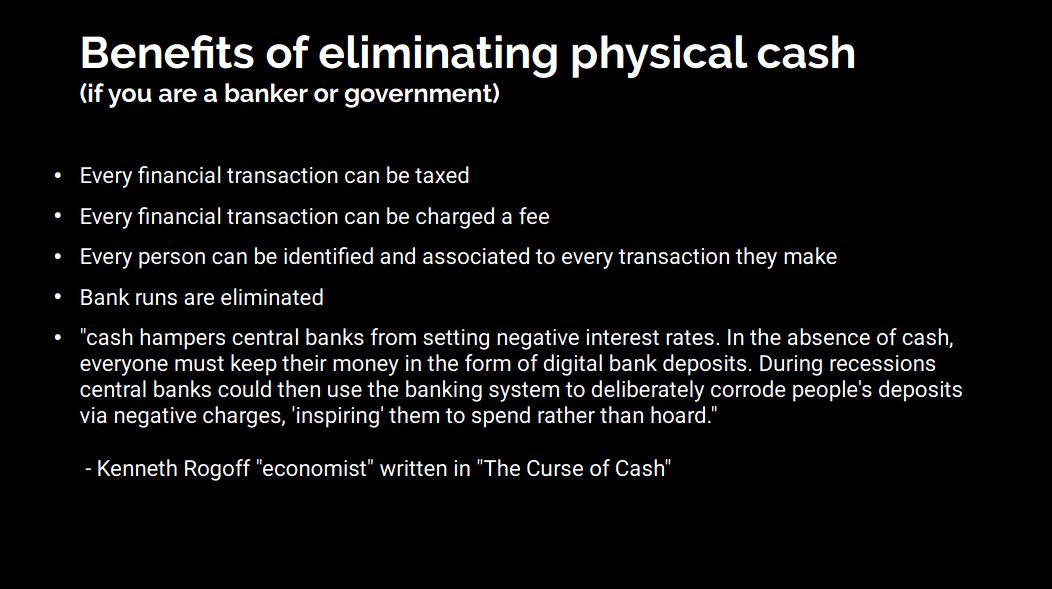

Make no mistake, the war on cash is a real thing. The benefits of a cash free society are too great (from the perspective of central bankers and the state)

And make no mistake, the war on cash is a WAR ON YOU

With that let's jump back to Satoshi's white paper...

With that let's jump back to Satoshi's white paper...

In the second post of this thread I highlighted two key words in the white paper title.

- Peer-to-Peer

- Electronic Cash

But actually I think it is misleading...

In fact, the emphasis shouldn't be 'Electronic Cash' but actually 'Cash System'

- Peer-to-Peer

- Electronic Cash

But actually I think it is misleading...

In fact, the emphasis shouldn't be 'Electronic Cash' but actually 'Cash System'

Bitcoin isn't money. Bitcoin isn't cash.

Bitcoin is an entire system, a system for creating the conditions of physical cash, electronically.

Bitcoin is an entire system, a system for creating the conditions of physical cash, electronically.

Fundamentally Bitcoin (Satoshi's Cash System) is software.

Unfortunately from the very early days Bitcoin has been painted as "a better money" but this is flawed and why Bitcoin is being actively attacked in the war on cash, tied up in 'Anti Money Laundering' regulations

Unfortunately from the very early days Bitcoin has been painted as "a better money" but this is flawed and why Bitcoin is being actively attacked in the war on cash, tied up in 'Anti Money Laundering' regulations

Satoshi's Cash System was successful. The system created the conditions for an electronic analog to physical cash. For the first time ever, data could be cash.

And even more brilliantly, data is analogous to speech, and speech always wants to be free.

And even more brilliantly, data is analogous to speech, and speech always wants to be free.

Let us return back to the flawed concept of equating Bitcoin to money.

By framing Bitcoin in this way is to let the enemy choose the battlefield. If Bitcoin is money you eventually accept it must be regulated and controlled as all money is (yes even gold)

By framing Bitcoin in this way is to let the enemy choose the battlefield. If Bitcoin is money you eventually accept it must be regulated and controlled as all money is (yes even gold)

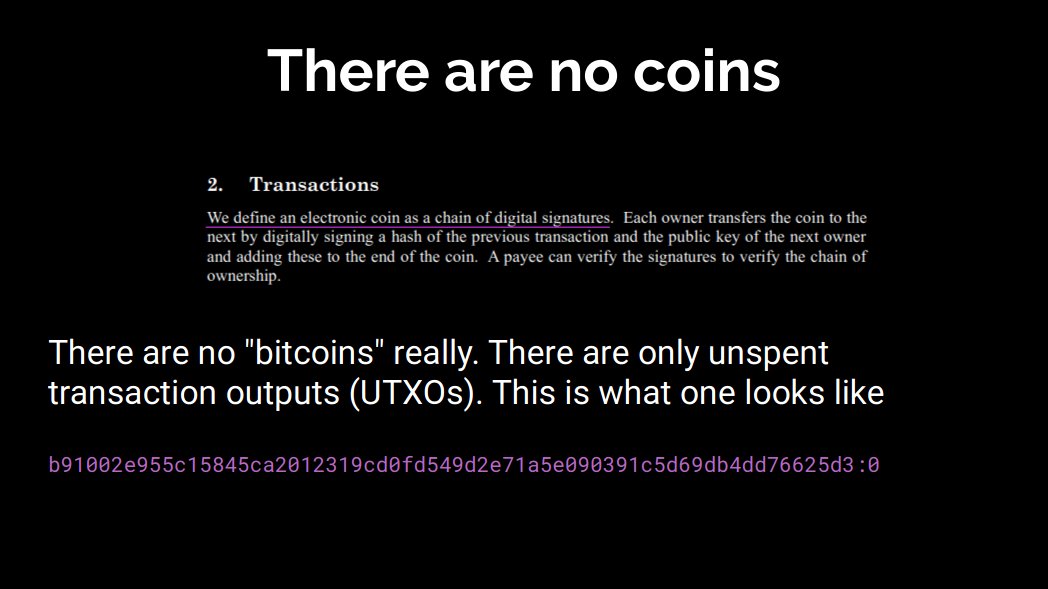

There are no 'coins', no 'notes', no 'currency units'.

There is only a chain of digital signatures.

Text. Data. Speech.

There is only a chain of digital signatures.

Text. Data. Speech.

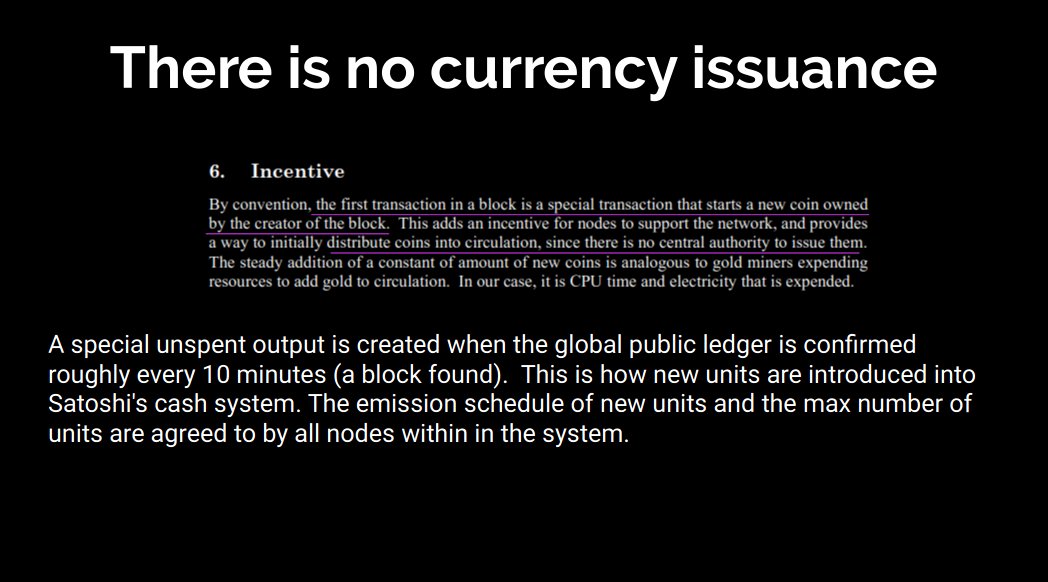

There is no issuance of currency. When a new block is found a new special digital signature is created. The signature announced publicly to anyone who will listen

Text. Data. Speech.

Text. Data. Speech.

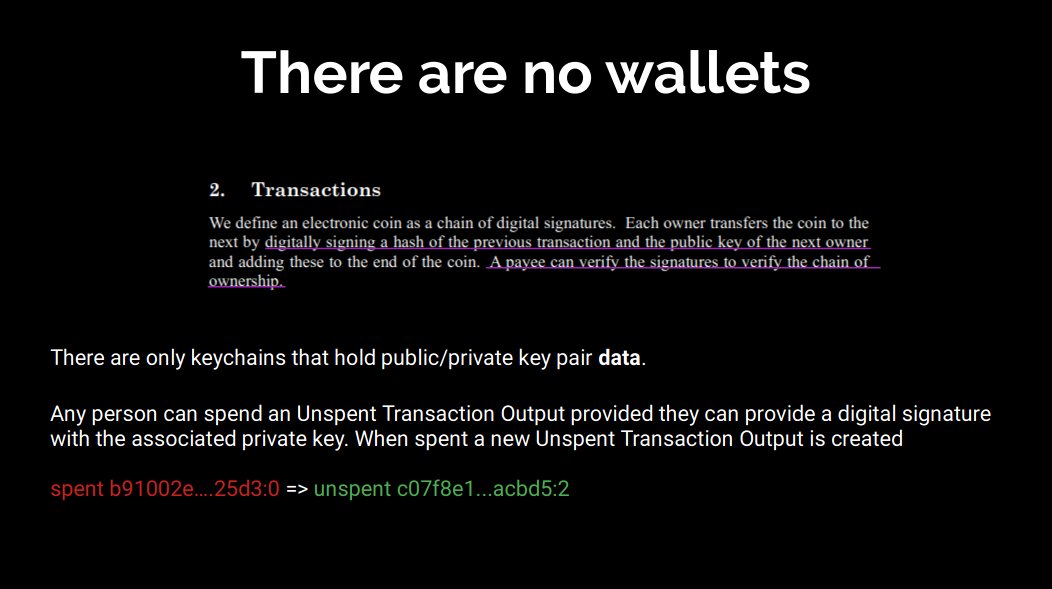

And yes, we are guilty of this metaphor, but there are no wallets.

There are only keychains that hold public/private key pair data

Text. Data. Speech.

There are only keychains that hold public/private key pair data

Text. Data. Speech.

To wrap things up let's look at Satoshi's Cash System in the context of the War on Cash

- Bitcoin represents a *serious* threat to the war on cash

- Without firm control the central banker vision of a cashless society can be severely undermined with Bitcoin

- Bitcoin represents a *serious* threat to the war on cash

- Without firm control the central banker vision of a cashless society can be severely undermined with Bitcoin

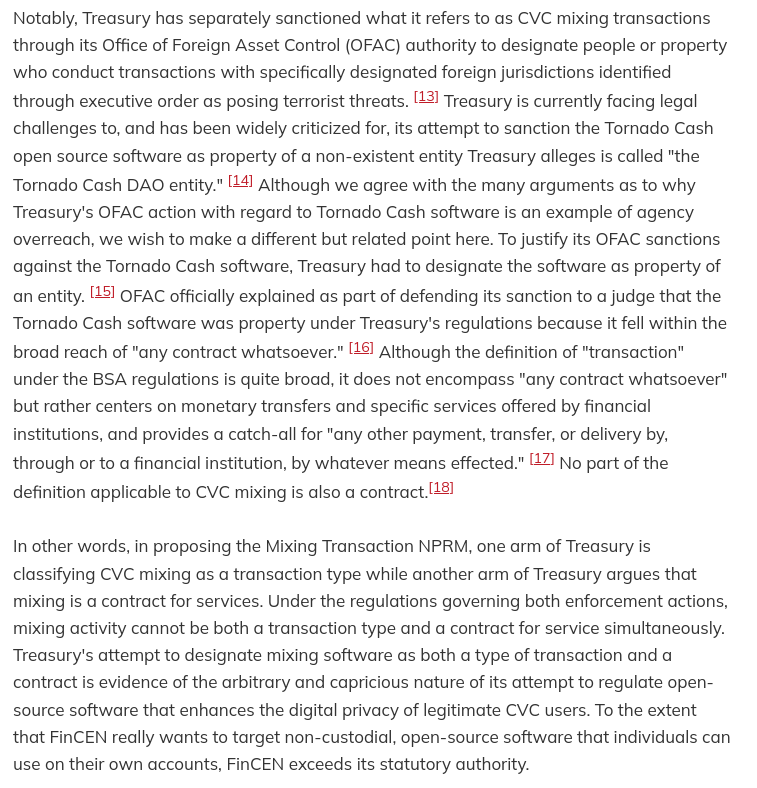

With that in mind regulatory capture is the best bet for neutering and controlling the fall out of a cash system they cannot outright shut down or effectively ban.

KYC is among the most effective tools they have to not only wrangle the cash system but to completely capture it.

More users of the cash system that are identified plays right into their strategic vision of a cashless society where all transactions are tied to an entity.

More users of the cash system that are identified plays right into their strategic vision of a cashless society where all transactions are tied to an entity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh