1/32 An important🧵 summing up some new worrying information & terrifying predictions, & how to reverse these concerning trends -gvmnt needs to finally take head out of the sand regarding pensions taxation (& and how *you* can help). Pls read to end & share/RT.

2/32 So contrary to the Conservative manifesto pledge of 6,000 more

family doctors by 2024, @thetimes reported yesterday now 27,627 fully qualified full-time GPs in England, down from >28,000 this time last year & almost 2,000 fewer than in 2015.

thetimes.co.uk/article/doctor….

family doctors by 2024, @thetimes reported yesterday now 27,627 fully qualified full-time GPs in England, down from >28,000 this time last year & almost 2,000 fewer than in 2015.

thetimes.co.uk/article/doctor….

3/32 But what the Times article fails to do is dive into the reasons WHY GP numbers are dropping (probably because they are too focussed on obsessing on drop in %age of face to face appointments). But very clear fewer GPs on ground delivering highest activity EVER.

4/32 Clearly numbers of GPs depends on numbers going in (increasing +) vs numbers going out (increasing +++ faster) which is one of the reasons that RETENTION should be front & centre of strategies to increase doctor numbers & reducing waiting lists.

5/32 Obviously the reasons for people leaving are complex & there is not single factor (i.e. burnout, workload, media bashing to name a few) but there is no doubt that pension taxation is also a key driver to both session reduction & early retirement.

6/32 So what is the evidence for this?

Lets look at two drivers and whats happening to them. Lifetime allowance (LTA) and Annual Allowance (AA).

Lets look at two drivers and whats happening to them. Lifetime allowance (LTA) and Annual Allowance (AA).

7/32 We have known for a while that proportions of doctors taking early retirement (before NPA of 60) has been increasing over a decade. In fact its more than tripled in that time for GPs and is now around 60% of retirements (red line)

8/32 Look at the correlation with the fall in the real terms value of the LTA. Back in 2008, corrected for inflation, you could have an NHS pension over £95k and be under LTA (very few did!), but that has decreased massively to 50% of that level, but flattened since 2016-21.

9/32 But here is the worrying bit. Government froze the LTA in

2021. Back then inflation was 0.4%, with 2% long term prediction. A survey of 8000 Gps/con. 72% said LTA freeze⬆️likely retire early; 61% ⬆️ likely work fewer hours.

2021. Back then inflation was 0.4%, with 2% long term prediction. A survey of 8000 Gps/con. 72% said LTA freeze⬆️likely retire early; 61% ⬆️ likely work fewer hours.

https://twitter.com/goldstone_tony/status/1365947865625944064?s=20&t=pFH6Iob3KbMAdm2ATBeo2g

10/32 So deeply worrying policy with inflation at 1-2% - but now inflation is 9.1% & @bankofengland say will exceed 11%. That means- by failing to increase with CPI as it did, LTA will decrease in real terms by 11% (over £100k). What will happen to early retirements??👇

11/32 So what about Annual Allowance? I wont cover this again in detail - suffice to say 22/23 is going to be a *terrible* year, especially for GPs but for consultants too.

https://twitter.com/goldstone_tony/status/1530483691960541191?s=20&t=8401Lgzf1bKupHW1ZPmtPQ

12/32 Important to dismiss the government spin that the AA reflects the "generosity of the scheme". Thats nonsense - almost all the AA charges this year is due to a flaw in the finance act which means its not correctly measuring growth above inflation👇

https://twitter.com/goldstone_tony/status/1530483767013523458?s=20&t=e9jnSRZWSKfeOlDz-mxHDQ

13/32 So we've talked about the situation up to now, but what does the future hold. Last week I did a thread on bleak projections for waiting lists, which could exceed 14.6m by 2030. But on Thursday there was widespread media coverage of a @HealthFdn report 👇

14/32 But lets take a bit of a deep dive into that report. Their key finding is their "pessimistic" scenario predicted that up to 1/4 of GP posts could be vacant by 2030 👇

Thats a very worrying statistic, but how realistic is it @NikkiKF @BMA_GP

Thats a very worrying statistic, but how realistic is it @NikkiKF @BMA_GP

15/32 This shortfall was based on these assumptions. Though @HealthFdn did acknowledge the rates of retirement between early retirement ns NPA, they failed to mention the elephant in the room & one of the key drivers of this - pension taxation.

16/32 The assumptions are that optimistically VER will increase by 1% from now 2030, 5% in the pessimistic scenarios.

You read that right - the *pessimistic* scenario is that VER rates increase by only 5% to 2030

You read that right - the *pessimistic* scenario is that VER rates increase by only 5% to 2030

17/32 I would suggest 5% increase in VER may be SIGNIFICANT underestimate. With LTA dropping by 11% this yr (see correlation graphs abv) & AA bills being "off the scale" this year - w/o govmnt intervention, wouldnt be at all suprised to see those VER rates in next 1-2 years.

18/32 So what can you do about it? There have been some green shoots over the past 3 weeks in government (both side of the political fence) that the penny may be starting to drop. For example (1) @wesstreeting (shadow health)

https://twitter.com/goldstone_tony/status/1539264973641326592?s=20&t=GE2ibnFjnypHrFjaTilZtA

19/32 (2) @sajidjavid gives central support for recycling ♻️ ("make it clear that it is something that we, at the centre, are happy with"), & some superb questioning by GP/MP @drlukeevans

https://twitter.com/goldstone_tony/status/1538128900051591169?s=20&t=8401Lgzf1bKupHW1ZPmtPQ

20/32 (3) Some excellent questions about pension taxation from multiple MPs (less sure about some of the answers!) incl. Dr. Dan Poulter (cons) & @FeryalClark (labour shdow health) asking the Minister about rising CPI inflation & impact on AA/LTA

https://twitter.com/goldstone_tony/status/1541352725203623937?s=20&t=NbMeu5K8VNz7jV0wgCKFzQ

21/32 So how can you help? We've already had over 1000 docs contact their MP asking them to attend a roundtable event at Westminster hosted by Dr. Dan Poulter MP & @bma_pensions

22/32 If you havent already *please* contact *your* MP👇, email preferable (see twt 7) so you can explain circumstances & why they *must* fix this pension tax car crash. Please take a couple of minutes and do it now!

https://twitter.com/goldstone_tony/status/1542100700989120513?s=20&t=GE2ibnFjnypHrFjaTilZtA

23/32 I'm afraid the meeting is for MPs only (& @bma_pensions officer team) but please read the brief so you can see what we are discussing & the solutions we are putting forward.

24/32 When you write, you might get responses such as 👇 as some MPs have been brainwashed that the only problem was the taper, and tweaking it 2020 removed the problem from 96-98% of doctors. It *really* didn't so write back asking them to actually read the brief!

25/32 In various threads I have put my (& @BMA_Pensions) thoughts on solutions. I wish it could be distilled into 1 or even two simple asks, but I'm afraid I dont believe it can. Instead I think there are urgent actions & more medium/long term aims.

26/32 Here are solutions @thebma are urgently asking that we think could turn this round (but action is needed *right now*)

27/32 1️⃣ ALTER THE FINANCE ACT, VERY URGENTLY

The finance act doesnt work & isnt fair.There will be dreadful unintended consequences of not fixing this & thanks again @AISMANewsline for highlighting this & to @hmtreasury @DHSCgovuk to listening to @bma_pensions views on this

The finance act doesnt work & isnt fair.There will be dreadful unintended consequences of not fixing this & thanks again @AISMANewsline for highlighting this & to @hmtreasury @DHSCgovuk to listening to @bma_pensions views on this

28/32 2️⃣ Another part of the finance act re "negative PIAs", and its interaction with scheme regulations needs fixing immediately as well. Neither can wait to avoid terrible consequences. They *both* *must* be fixed

29/32 3️⃣ An AA compensation scheme - carbon copy of 19/20 scheme

Another emergency mitigation could be a carbon copy of 19/20 scheme. To be effective it would need announcing *really* quickly (but in all 4 nations)

Another emergency mitigation could be a carbon copy of 19/20 scheme. To be effective it would need announcing *really* quickly (but in all 4 nations)

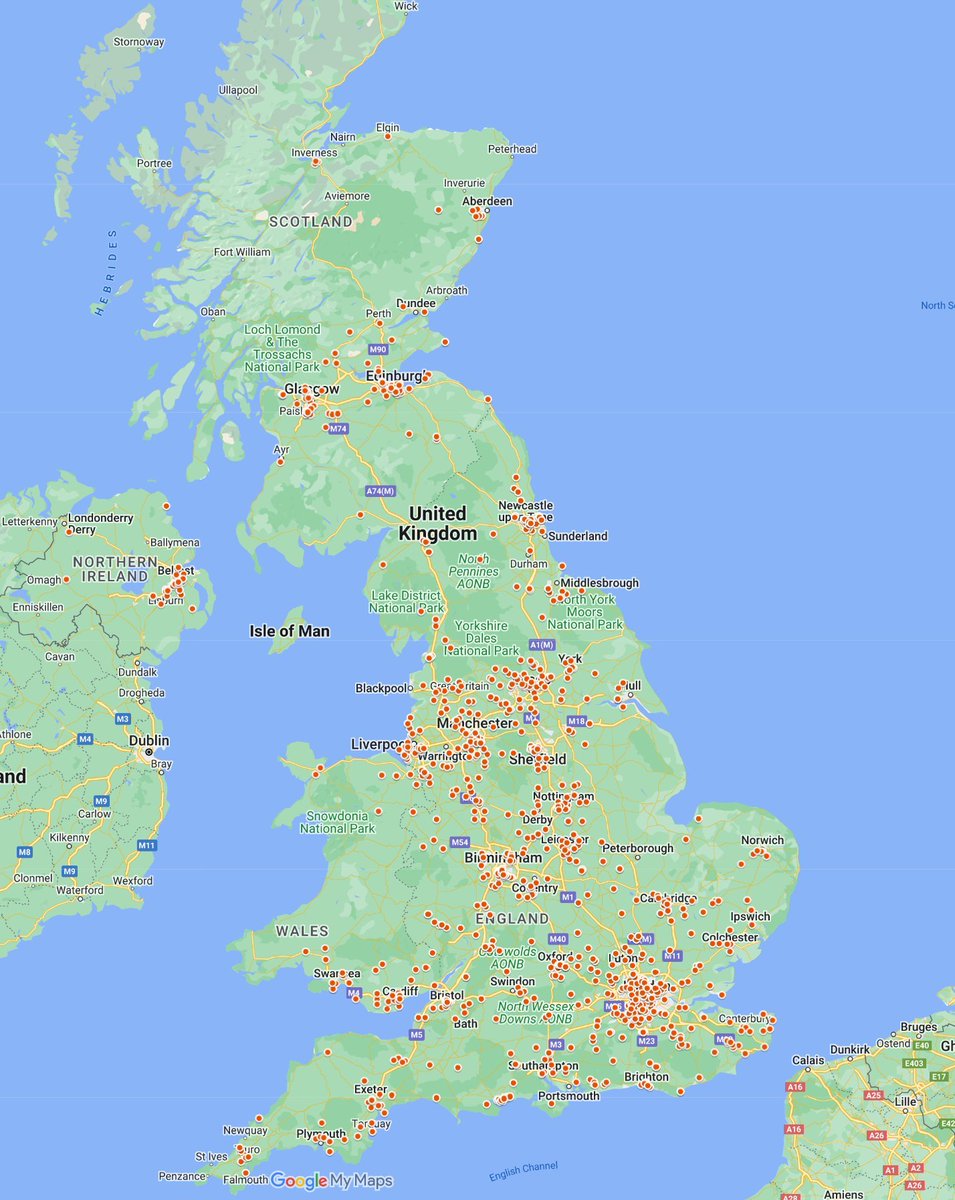

30/32 4️⃣ Full mandated recycling, centrally, in all 4 nations

As mentioned @sajidjavid recycling ♻️ is something "centre are happy with" & "where that is happening, it is certainly helping". So lets end the postcode lottery, and mandate full 20.6% - empl NI, in all 4 nations.

As mentioned @sajidjavid recycling ♻️ is something "centre are happy with" & "where that is happening, it is certainly helping". So lets end the postcode lottery, and mandate full 20.6% - empl NI, in all 4 nations.

31/32 5️⃣ Lastly & perhaps MOST importantly, government must understand its not do 1-4 & the problem goes away. Far from it. The mistake gov. made before- thinking a problem was fixed, & then not listening when it didn't work. Need #taxunregistered

32/32 With record waiting lists, the only way to make a dent in the short and medium terms is to improve RETENTION - these solutions would make a SERIOUS difference to that @Jeremy_Hunt @sajidjavid @RishiSunak @CommonsHealth @NHSMillion

Pls share / RT

Pls share / RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh