🔋THREAD🔌

The inconvenient truth about climate change is that solving it will involve digging, blasting & leaching more minerals from the skin of this planet than ever before.

No one much likes to talk abt this.

But talk about it we must.

⛏👇

The inconvenient truth about climate change is that solving it will involve digging, blasting & leaching more minerals from the skin of this planet than ever before.

No one much likes to talk abt this.

But talk about it we must.

⛏👇

Why? Because tackling climate change is a multi-decade (poss centuries-long) effort.

Hushing up the trade-offs & costs may feel right today, esp if it helps galvanise change.

But it'll only fuel a bigger backlash in decades to come. Because eliminating fossil fuels is a HARD SLOG

Hushing up the trade-offs & costs may feel right today, esp if it helps galvanise change.

But it'll only fuel a bigger backlash in decades to come. Because eliminating fossil fuels is a HARD SLOG

It will involve building a LOT more infrastructure: wind turbines and solar panels, high voltage cabling and energy storage.

In crazy quantities.

Because a) these power sources are less energy-dense than fossil fuels and b) the logic of net zero is to electrify EVERYTHING.

In crazy quantities.

Because a) these power sources are less energy-dense than fossil fuels and b) the logic of net zero is to electrify EVERYTHING.

And there is simply no way of building all this stuff without digging a LOT of minerals out of the ground.

To see what this means in practice, consider a wind turbine. Many materials in there: steel in the tower structure, fibreglass & carbon fibre, rare earth metals up top...

To see what this means in practice, consider a wind turbine. Many materials in there: steel in the tower structure, fibreglass & carbon fibre, rare earth metals up top...

But also, you need crazy amounts of copper.

Imagine a moderately big turbine, capable of turning out about one megawatt of power (so actually smaller than the mega one in the pic).

You need about three tonnes of copper in the generator and another tonne in the transformer...

Imagine a moderately big turbine, capable of turning out about one megawatt of power (so actually smaller than the mega one in the pic).

You need about three tonnes of copper in the generator and another tonne in the transformer...

Then you need about half a tonne of copper in the cables carrying the power down the tower.

Then you need to get that power back onshore, which involves long shielded collector cables which have enormous copper wiring. Look at this cross section of one of them!

Then you need to get that power back onshore, which involves long shielded collector cables which have enormous copper wiring. Look at this cross section of one of them!

There's more: copper at the substation where the power arrives; copper in the distribution cables connecting it to the grid... Tot it all up and according to @WoodMackenzie you're talking about roughly 15 tonnes of copper per megawatt generated.

And we need LOADS of these!

And we need LOADS of these!

Extrapolate this across the world, and perhaps you're starting to see why copper is, to quote Goldman Sachs, the "new oil". They reckon we could see a four-fold or even nine-fold increase in demand from green energy in the coming decades.

We don't think about this all that much because copper is, as far as most of us are concerned, invisible. Yet it's already a massive part of our lives, since without copper there is no electricity. But suddenly, now we're electrifying EVERYTHING, we need much, much more.

The good news with copper is that we are pretty experienced at getting it out of the ground. The bad news is that a) we've already got most of the easy stuff and b) the rate of new mine discoveries has petered out in recent years. So there's a looming shortfall.

The other bad news is that copper extraction is a dirty business. Even when done as "cleanly" as possible it still involves displacing crazy amounts of rock, leaching them with acid, expending lots of energy, and dumping the waste in enormous tailings dams. It's often dirtier.

Copper is not evenly distributed. I just visited Chile, which has the world's biggest reserves (& the world's biggest copper company, state-owned Codelco).

Yet there the new government, led by new socialist President @gabrielboric is pondering new environmental controls on mining

Yet there the new government, led by new socialist President @gabrielboric is pondering new environmental controls on mining

They just shut down a copper smelter in Ventanas because it had caused so much pollution that the local area had been designated a "sacrifice zone". There are other such zones around the country. It's a big issue in Chile. mining-journal.com/copper-news/ne…

Over the past year a convention of people from around the country has been rewriting Chile's constitution. It's a v big moment: first rewrite since Pinochet. For a while they mulled banning some forms of mining altogether. The final draft is less radical but still proposes limits

https://twitter.com/juanbatfran/status/1542030698567331840

So even as the rest of world looks to Chile for the crucial material upon which its net zero ambitions depend, Chile is thinking long and hard about restrictions: more environmental rules, bans on mining near glaciers. And this is doubly significant given it's not just copper...

For alongside the copper, Chile also has the world's biggest reserves of lithium - the material at the heart of rechargeable batteries. Lithium ion batteries are so named because the power inside them is stored/discharged thanks to lithium ions moving between cathode and anode

When people talk abt critical materials in batteries they often reference cobalt. Understandable given much of it comes from the DRC. But you don't actually NEED cobalt in batteries. Lithium on the other hand is essential - EVERY battery chemistry needs it (plus copper!)

So where does the lithium come from? In Chile's case from under the Salar de Atacama. This place 👇An enormous salt flat which looks extraordinary. But even more extraordinary is what lies beneath that salt - a great underground reservoir of brine, concentrated salt solution

https://twitter.com/EdConwaySky/status/1542564811002765314

This is a v different kind of mining to copper. No digging/blasting: brine is pumped up & evaporated over a year, removing non-lithium salts and leaving a liquid which is then refined at this place on the edge of the desert. The SQM refinery. Biggest lithium plant on the planet.

Problem is: this is one of the driest places on the planet. Locals say lithium miners are taking their water. SQM et al have convincing arguments that they don't. But even so, this is an incredibly sensitive environment. Some, eg @criordor, say local ecosystems are being harmed.

The undersecretary for mining from the new Boric government says he is concerned about this - and about pollution from copper mines. He also wants to create a state lithium firm a la Codelco. Tho interestingly he told me there are no plans to force nationalise private companies

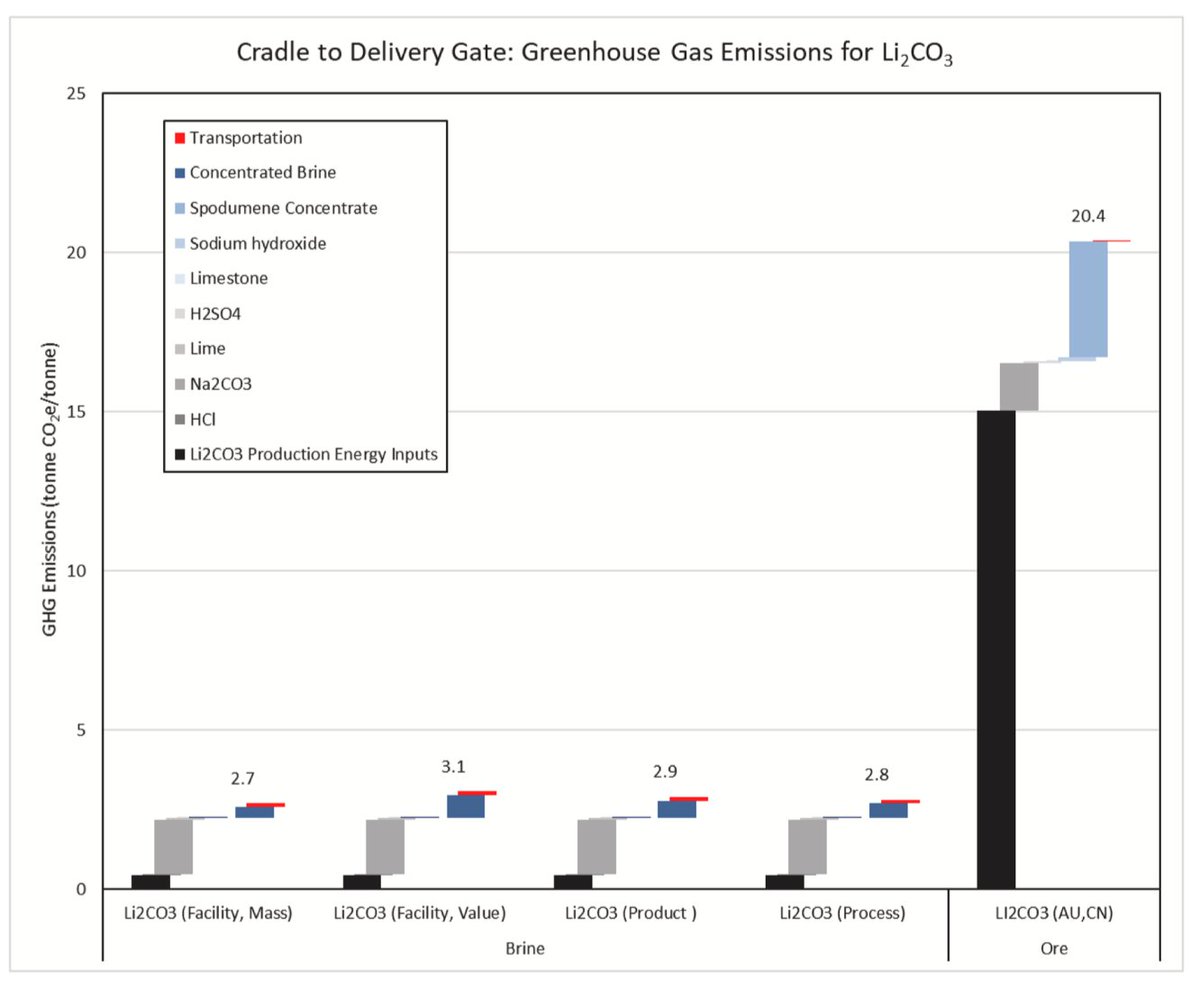

The problem is that while there are clearly impacts from this type of brine mining, the other type of lithium mining - getting it from spodumene in Australia - involves considerably more water use and carbon emissions. It's more like conventional, dirty mining. Look:

So it's not just that there are compromises involved with replacing fossil fuels with renewable alternatives. There's a big spectrum in the cleanliness and nature of compromises of one type of lithium vs another.

Yet, again, few people want to discuss this!

Yet, again, few people want to discuss this!

Anyway, this is a v long-winded way of saying: please watch my film abt this.

I've left pretty much all the detail from the film out of this thread because I'd much prefer you watch it, cos a) we've been working on this for a while & b) I promise you'll enjoy it.

Wee preview:

I've left pretty much all the detail from the film out of this thread because I'd much prefer you watch it, cos a) we've been working on this for a while & b) I promise you'll enjoy it.

Wee preview:

🍿Full film here🍿

Shot by Richie Mockler (his first piece since coming back from Ukraine so esp grateful in every respect to have him along). Produced by @aoifeyourell. Pls share if you enjoy

Shot by Richie Mockler (his first piece since coming back from Ukraine so esp grateful in every respect to have him along). Produced by @aoifeyourell. Pls share if you enjoy

Final thing: I was also in Chile researching my forthcoming book, MATERIAL WORLD.

📖 It'll touch on all this stuff - & go into more detail.

🪨Fascinating nuggets aplenty.

If u enjoy this kind of thing, do check it out.

Erm, when I've finished it.🫣

Out next year all being well...

📖 It'll touch on all this stuff - & go into more detail.

🪨Fascinating nuggets aplenty.

If u enjoy this kind of thing, do check it out.

Erm, when I've finished it.🫣

Out next year all being well...

The link to the video seems to have disappeared so here’s an updated link.

Do give it a watch if you find any of the above 👆interesting.

🍿THE RACE FOR CRITICAL MATERIALS🍿

A short film about SCALE:

Do give it a watch if you find any of the above 👆interesting.

🍿THE RACE FOR CRITICAL MATERIALS🍿

A short film about SCALE:

Big news from Chile today: voters have rejected the new convention which proposed a raft of big changes, inc a national health system and new constraints on mining. Big blow to @gabrielboric.

More on why Chile matters so much to all of us in thread ☝️ theguardian.com/world/2022/sep…

More on why Chile matters so much to all of us in thread ☝️ theguardian.com/world/2022/sep…

• • •

Missing some Tweet in this thread? You can try to

force a refresh