Circular 170 - the key to consistent disclosures

(here’s how to disclose ITC in GSTR-3B)

CBIC has clarified on reporting of the supplies to end-users, composition taxpayers, UIN holders as well as the disclosure of ineligible/blocked input tax credits and reversals thereof.

(here’s how to disclose ITC in GSTR-3B)

CBIC has clarified on reporting of the supplies to end-users, composition taxpayers, UIN holders as well as the disclosure of ineligible/blocked input tax credits and reversals thereof.

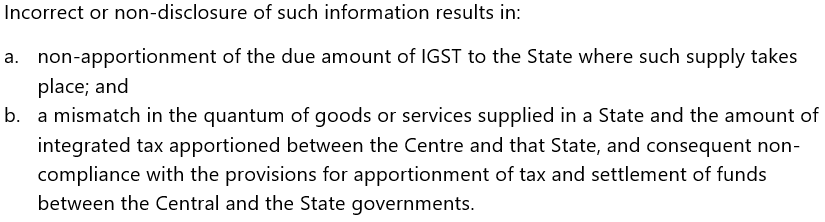

Although the incorrect or non-disclosure of information in table 3.2 does not have direct implications on the revenue collections and neither does it incentivise the taxpayer in any way, it does affect the revenue sharing between the Centre and the States.

The apportionment of IGST collected on inter-state supplies from the source to the destined State takes place based on information reported in table 3.2.

CBIC has suggested the taxpayers to update the customer database and ensure correct disclosure of place of supply for B2C transactions, as well as to give the effect of amendments and receipt/adjustment of advances on such transactions in table 3.2 of GSTR-3B (continued)

so that the tax reaches the consumption State as per the underlying principles of the destination-based taxation system.

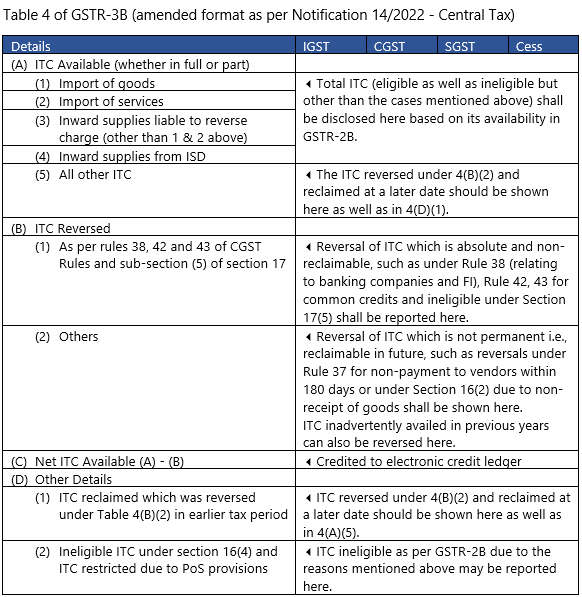

Coming to a more significant aspect of the Circular, CBIC has clarified on the furnishing of the details pertaining to input tax credits in table 4 to bring uniformity in reporting of ineligible and reversal of credits.

Table 4 of GSTR-3B is auto-populated based on GSTR-2B, and includes all ITC other than that unavailable because of the following two reasons:

a.limitation period prescribed under Section 16(4), or

b.the place of supply is located in another State.

a.limitation period prescribed under Section 16(4), or

b.the place of supply is located in another State.

Thus, the reduction of ITC as per GSTR-2B would be required on account of ineligible ITC or reversals to arrive at ‘Net ITC Available’ which gets credited to electronic credit ledger - and hence any reversal of ITC or any ITC which is otherwise ineligible cannot be a part of it.

The finer aspects of the disclosure of availment, reversal, and re-availment as well as the ineligible portion of input tax credits are summarised below:

• • •

Missing some Tweet in this thread? You can try to

force a refresh