A further update on the #CELshortsqueeze. Only data, no financial advice.

Building on the work done by @ThePrivatier which shows that there are 46m $CEL tokens not locked on Celsius.

(1/x)

Building on the work done by @ThePrivatier which shows that there are 46m $CEL tokens not locked on Celsius.

https://twitter.com/ThePrivatier/status/1544437348678746112?s=20&t=FpuABHNoIePs8CgiB8NRaw

(1/x)

@ThePrivatier Of these 46m $CEL tokens, 16.4m tokens are held in wallets which moved (part of the) $CEL tokens within the last 10 days. So these can be considered most liquid.

2/x

2/x

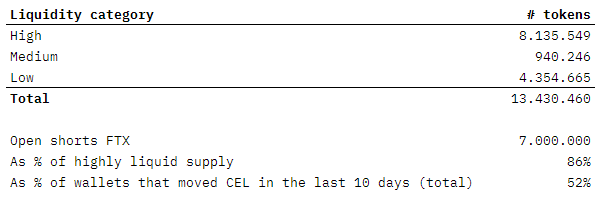

A further deep-dive on the 16.4m $CEL tokens results in the following (see picture).

Part of these tokens are likely lost or belong to Celsius, resulting in a net 13.4m tokens. Based on the wallet info I categorized them into liquidity categories (high, medium, low).

3/x

Part of these tokens are likely lost or belong to Celsius, resulting in a net 13.4m tokens. Based on the wallet info I categorized them into liquidity categories (high, medium, low).

3/x

High: exchanges

Medium: dex

Low: all smaller wallets and one gigachad $CEL squeezer.

Based on the current open shorts on FTX (c. 7m), this shows us that that represents 86% of the very liquid supply and 52% of CEL held in wallets that moved CEL within the last 10 days.

4/x

Medium: dex

Low: all smaller wallets and one gigachad $CEL squeezer.

Based on the current open shorts on FTX (c. 7m), this shows us that that represents 86% of the very liquid supply and 52% of CEL held in wallets that moved CEL within the last 10 days.

4/x

What I don't understand, considering these facts, is that the funding rate is still so low. Do they have a secret stash or OTC deals in place?

5/x

5/x

I do think that they need more bad news shortly to be able to cover their positions. However, the data is not 100% conclusive. IF @CelsiusNetwork is still buying in the open market, for which there are some indications, this becomes even more urgent for shorters in my view.

6/x

6/x

I have no experience in playing short squeezes, so a high likelyhood that I misread the situation. Trying to apply some common sense only.

7/7

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh