1/ As a fuel, natural gas has many compelling attributes. It burns cleanly and efficiently. It produces electricity and useful heat with less CO2 emissions and far fewer toxic byproducts than coal or oil. It is also abundant and ubiquitous.

2/ Natural gas does have a few unfortunate drawbacks. It is a fossil fuel and a gas at standard temperature and pressure. The latter makes shipping overseas a complex task that results in a particularly interesting global market.

3/ The ability to safely handle and transport gases at extremely high pressures is perhaps the most underrated technological advancement in the history of humankind. The current boom in natural gas use was enabled by a series of breakthroughs in pipeline and vessel construction.

4/ Transporting natural gas by land from where it is found to where it is useful requires the use of pipelines. The United States has an impressive array of natural gas pipelines that spread across most of the country like a spider’s web. We should build even more.

5/ Because of the intense need for infrastructure investment to unlock its utility, the natural gas market is highly regionalized and surprisingly heterogeneous. Substantial and durable price differences are common between geographies and even within countries.

6/ Building pipelines across oceans isn’t practical, and the only way to make natural gas a global commodity is to put it on boats. The development and commercialization of liquefied natural gas (LNG) technology is a staggering achievement of engineering.

7/ To accomplish the task of shipping natural gas, it must be chilled to extremely cold temperatures at LNG export facilities, thereby transforming the gas to its liquid state. Once liquified, natural gas is loaded onto enormous, highly specialized LNG carrier ships.

8/ By the end of 2020, there were 642 LNG carriers floating around the oceans. Ships like this represent the global flex supply of natural gas, selling their cargo to the highest bidders, often in real-time. They are, in effect, floating arbitrageurs.

9/ Once an incoming carrier arrives at an LNG import facility, the reverse process is carried out. The liquid is regasified, pressurized, and sent via pipeline to end-users. Installations such as this consume billions to build and years to complete.

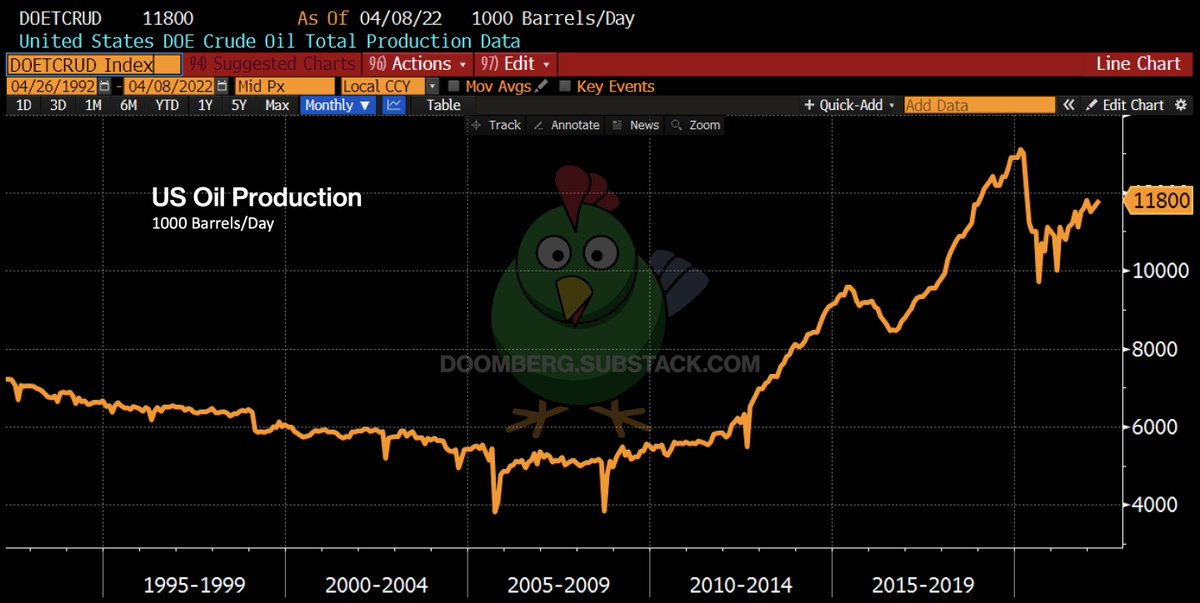

10/ For decades, the US was a net importer of natural gas, predominately from Canada via pipeline. The word “net” is important here because the US also did its fair share of exporting, primarily to Mexico. All of this changed with the advent of fracking.

11/ The shale revolution transformed the US into a global energy superpower. The US is once again the largest producer of oil and gas on the planet and has become one of the three largest LNG exporters, alongside Qatar and Australia.

12/ With more supply than it knew what to do with, the US saw the price of its natural gas sink to historically low levels relative to the price of oil. With gas trapped in the US, producers could not take advantage of higher prices in the international market.

13/ The US gas industry responded by accelerating the build-out of LNG export facilities to close the arbitrage (and, frankly, to enable more production of shale oil – its byproduct, natural gas, had to go somewhere).

14/ Historically, Japan is the leading importer of LNG, but China is not far behind. Together, they account for roughly half of all LNG imports in normal years. Of course, because of the energy crisis in Europe, the current situation is anything but normal.

15/ How much gas did Europe buy from Russia prior to the invasion of Ukraine? In round numbers, approximately 15 billion cubic feet per day (bcf). This compares to total global LNG export capacity of approximately 50 bcf, of which the US accounts for 12 bcf.

16/ To wean Europe off Russian gas thus requires 30% of the entire global LNG export market. Given the price elasticity of demand for natural gas, and that other importing countries won’t exactly forgo their own needs, the nature of the challenge facing Europe becomes clear.

17/ At the time of this writing, natural gas is trading for $6 per MM BTU in the US, $50 (!!) in Europe, and $40 in Asia. Arbitrage spreads like these are truly historic. As a reference, $50 natural gas is roughly the equivalent of $300 per barrel oil.

18/ The situation for Europe was made more dire by an explosion that occurred at the Freeport LNG export terminal in Texas. That incident – the cause of which remains under investigation – knocked off 20% of the US export capacity, largely earmarked for Europe.

19/ Since that explosion, the price of natural gas in the US has collapsed by 35% and has more than doubled in Europe. The Freeport LNG explosion was devastating to Europe’s economic and geopolitical situation.

20/ Separately, Reuters reported yesterday that the US EPA may pressure Cheniere to retrofit its LNG export terminals in Texas and Louisiana with enhanced pollution controls. This could knock out half of the entire LNG export capacity in the US for several months.

21/ If the EPA follows through with this action, expect the price of natural gas in the US to crater and prices in Europe/Asia to soar to unthinkable heights. The President will soon have to choose between our allies and his domestic supporters in the environmental movement.

22/ Natural gas is not just used as a fuel. It is also a critical input into the production of many important commodity chemicals, including ammonia, which is used to make fertilizer. Shortages of natural gas in Europe are presenting policymakers with difficult choices.

23/ As summer progresses and the winter of 2022-2023 approaches, Europe’s approach to the natural gas crisis is reaching a critical point. In a few days, the Nord Stream 1 pipeline will be closed for “maintenance.” Will Putin authorize its reopening? What if he doesn’t?

24/ In our view, the European natural gas situation is the gravest economic crisis facing the world today. In the next few weeks, something has to give. Economic devastation to Europe’s manufacturing capacity seems almost certain. A true humanitarian crisis is possible. <fin>

• • •

Missing some Tweet in this thread? You can try to

force a refresh