If you don't have time for investing, buy ETFs.

If you do have some time for investing - Try individual stocks!

But are you not sure how and where to start?

Don't worry, I got you covered 💪

It will cost you some time, but I promise you, it's fun!

Let's start 👇

/THREAD

If you do have some time for investing - Try individual stocks!

But are you not sure how and where to start?

Don't worry, I got you covered 💪

It will cost you some time, but I promise you, it's fun!

Let's start 👇

/THREAD

1. Find stocks

I really like Peter Lynch's book One Up on Wall Street.

He recommends keeping your eyes open to the world around you and only invest in stocks you understand.

This is not difficult, just give it a try.

Example: Thule. - Ever seen one of those roof boxes? 👇

I really like Peter Lynch's book One Up on Wall Street.

He recommends keeping your eyes open to the world around you and only invest in stocks you understand.

This is not difficult, just give it a try.

Example: Thule. - Ever seen one of those roof boxes? 👇

Thule is based in Sweden.

They are dominating the roof box and bike racks market. Just visit any camping in Europe and you'll see what I mean.

Recently they also announced to enter the car seat and dog transport market.

What's more? See below 👇

h/t @dekleinekapita1

They are dominating the roof box and bike racks market. Just visit any camping in Europe and you'll see what I mean.

Recently they also announced to enter the car seat and dog transport market.

What's more? See below 👇

h/t @dekleinekapita1

@dekleinekapita1 However, sometimes we're just lacking inspiration.

In that case, a stock screener might come in handy.

But it's tricky. Watch out to not exclude great stocks by using the wrong metrics (i.e. P/E).

How to screen for stocks? Check my article below 👇

europeandgi.com/how-to/dividen…

In that case, a stock screener might come in handy.

But it's tricky. Watch out to not exclude great stocks by using the wrong metrics (i.e. P/E).

How to screen for stocks? Check my article below 👇

europeandgi.com/how-to/dividen…

@dekleinekapita1 As you will see, my screener consists of the following metrics:

👉 Dividend Yield > 2.75%

👉 Payout Ratio < 70%

👉 5 Yr Compounded Annual Growth Rate > 6%

This makes it fairly simple and keeps the focus on our DGI strategy.

So far so good, right? So let's move on!

👉 Dividend Yield > 2.75%

👉 Payout Ratio < 70%

👉 5 Yr Compounded Annual Growth Rate > 6%

This makes it fairly simple and keeps the focus on our DGI strategy.

So far so good, right? So let's move on!

@dekleinekapita1 2. Do your own Research

This is where many people hook off because it feels too complex.

But don't worry, everyone can read and that's a great quality to get started.

As an example, I ALWAYS read the first ~30 pages of the annual report.

-next-

This is where many people hook off because it feels too complex.

But don't worry, everyone can read and that's a great quality to get started.

As an example, I ALWAYS read the first ~30 pages of the annual report.

-next-

@dekleinekapita1 It typically contains:

👉 CEO letter to shareholders

👉 Business performance review

👉 Most important risk factors

Just these 3 items give you an edge compared to the average wall street professional. Most of them don't read this stuff!

Still happy with the company?

👉 CEO letter to shareholders

👉 Business performance review

👉 Most important risk factors

Just these 3 items give you an edge compared to the average wall street professional. Most of them don't read this stuff!

Still happy with the company?

@dekleinekapita1 Then now is the time to do a bit of due diligence into the numbers.

A great business with great products doesn't necessarily make it a great stock.

However, if you don't feel comfortable with this yet, then read the below book first 👇

amzn.to/3v0ux6n

-next-

A great business with great products doesn't necessarily make it a great stock.

However, if you don't feel comfortable with this yet, then read the below book first 👇

amzn.to/3v0ux6n

-next-

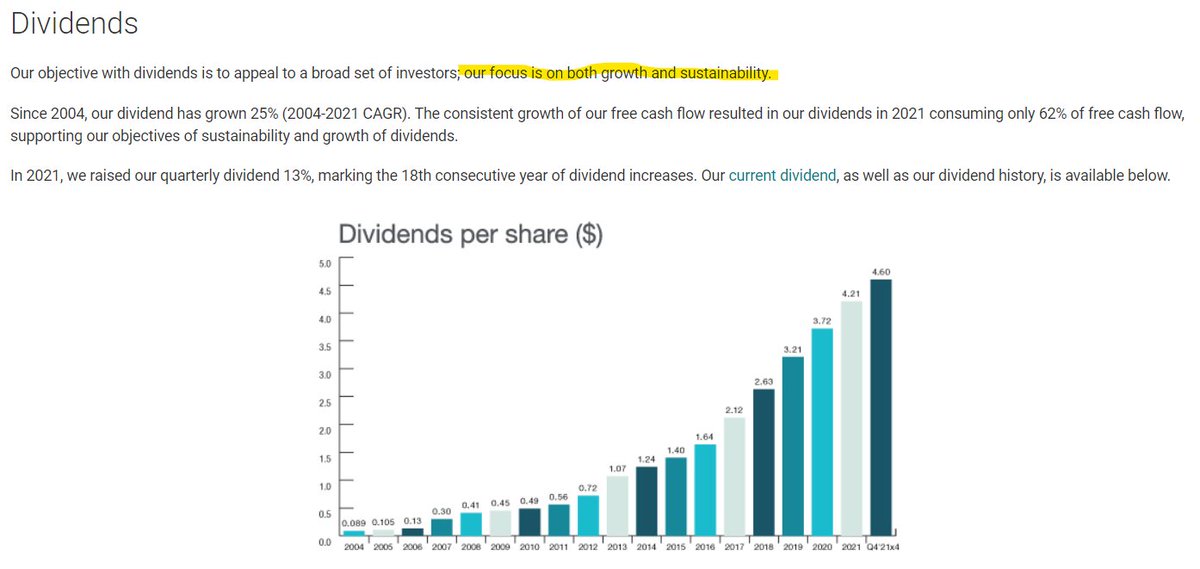

@dekleinekapita1 So what do I look for?

First of all, I'm a dividend growth investor.

Hence, most of my research is to get a feeling about the stock's dividend safety.

To analyze this, I always start with checking their company's dividend policy.

Example: $TXN 👇

First of all, I'm a dividend growth investor.

Hence, most of my research is to get a feeling about the stock's dividend safety.

To analyze this, I always start with checking their company's dividend policy.

Example: $TXN 👇

@dekleinekapita1 Secondly, I look at all three financial statements.

A. Income Statement:

👉 is it growing revenue organically? > 2%?

👉 is it having a high margin compared to its competitors?

👉 are its earnings steady and growing? > 6%?

👉 is it diluting shareholders?

-next-

A. Income Statement:

👉 is it growing revenue organically? > 2%?

👉 is it having a high margin compared to its competitors?

👉 are its earnings steady and growing? > 6%?

👉 is it diluting shareholders?

-next-

@dekleinekapita1 B. Balance Sheet:

👉 How does debt compare to equity? < 60%?

👉 Is debt growing faster than equity?

👉 Are there lots of intangible assets, i.e. Goodwill?

👉 Enough cash & Equivalents?

👉 Anything else that looks awkward?

-next-

👉 How does debt compare to equity? < 60%?

👉 Is debt growing faster than equity?

👉 Are there lots of intangible assets, i.e. Goodwill?

👉 Enough cash & Equivalents?

👉 Anything else that looks awkward?

-next-

@dekleinekapita1 C. Cash Flow Statement:

This is my favorite one, hard to cheat!

👉 Is Free Cash Flow stable and growing (Ops Cash flow - CAPEX)

👉 Is the company investing in the future? CAPEX / FCF = ~30%?

👉 Dividends + Share Buybacks =< Free Cash Flow?

👉 Working Capital OK?

-next-

This is my favorite one, hard to cheat!

👉 Is Free Cash Flow stable and growing (Ops Cash flow - CAPEX)

👉 Is the company investing in the future? CAPEX / FCF = ~30%?

👉 Dividends + Share Buybacks =< Free Cash Flow?

👉 Working Capital OK?

-next-

@dekleinekapita1 Phew, that sounds like a lot, right?

Well, those 3 statements don't need to take more than 15 minutes.

Unless you'll find some awkward figures. If that's the case, go to the NOTES.

The notes are a true GOLD MINE and almost always answer your questions.

-next-

Well, those 3 statements don't need to take more than 15 minutes.

Unless you'll find some awkward figures. If that's the case, go to the NOTES.

The notes are a true GOLD MINE and almost always answer your questions.

-next-

@dekleinekapita1 But until this point, it doesn't tell me entirely yet whether the dividend is SAFE.

Hence, I often look for these metrics:

👉 Credit rating > BBB

👉 Interest Coverage > 5

👉 Dividend cut during a recession?

👉 Payout Ratios < 70%?

If it looks good, we're talking 💪

-next-

Hence, I often look for these metrics:

👉 Credit rating > BBB

👉 Interest Coverage > 5

👉 Dividend cut during a recession?

👉 Payout Ratios < 70%?

If it looks good, we're talking 💪

-next-

@dekleinekapita1 3. Determine your price.

By the time you're here, you can start valuing the company. In the end, we don't want to overpay for it!

However, many people consider this art.

And it is!

That's why many of us apply a margin of safety.

If you're wrong, it shouldn't hurt too much!

By the time you're here, you can start valuing the company. In the end, we don't want to overpay for it!

However, many people consider this art.

And it is!

That's why many of us apply a margin of safety.

If you're wrong, it shouldn't hurt too much!

@dekleinekapita1 Having said that, a margin of safety can be created in many ways.

But in the end, it's all about lowering your assumptions.

As an example:

👉 deduct -10% from fair value price

👉 use conservative multiples, i.e. 15 for P/E or P/FCF

-next-

But in the end, it's all about lowering your assumptions.

As an example:

👉 deduct -10% from fair value price

👉 use conservative multiples, i.e. 15 for P/E or P/FCF

-next-

@dekleinekapita1 So how do we get to a price then?

A simple way of doing this is to use one of the following metrics as a litmus test:

👉 Price / Earnings < 20

👉 Price / Free Cash Flow < 20

👉 Price / Forward Earnings < 20

👉 PEG ratio < 2

-next-

A simple way of doing this is to use one of the following metrics as a litmus test:

👉 Price / Earnings < 20

👉 Price / Free Cash Flow < 20

👉 Price / Forward Earnings < 20

👉 PEG ratio < 2

-next-

@dekleinekapita1 But this doesn't give you the price yet.

Luckily, this can easily be done based on the metrics above.

Just multiply the current earnings (i.e. EPS or FCF) by the multiple you think it deserves.

-next-

Luckily, this can easily be done based on the metrics above.

Just multiply the current earnings (i.e. EPS or FCF) by the multiple you think it deserves.

-next-

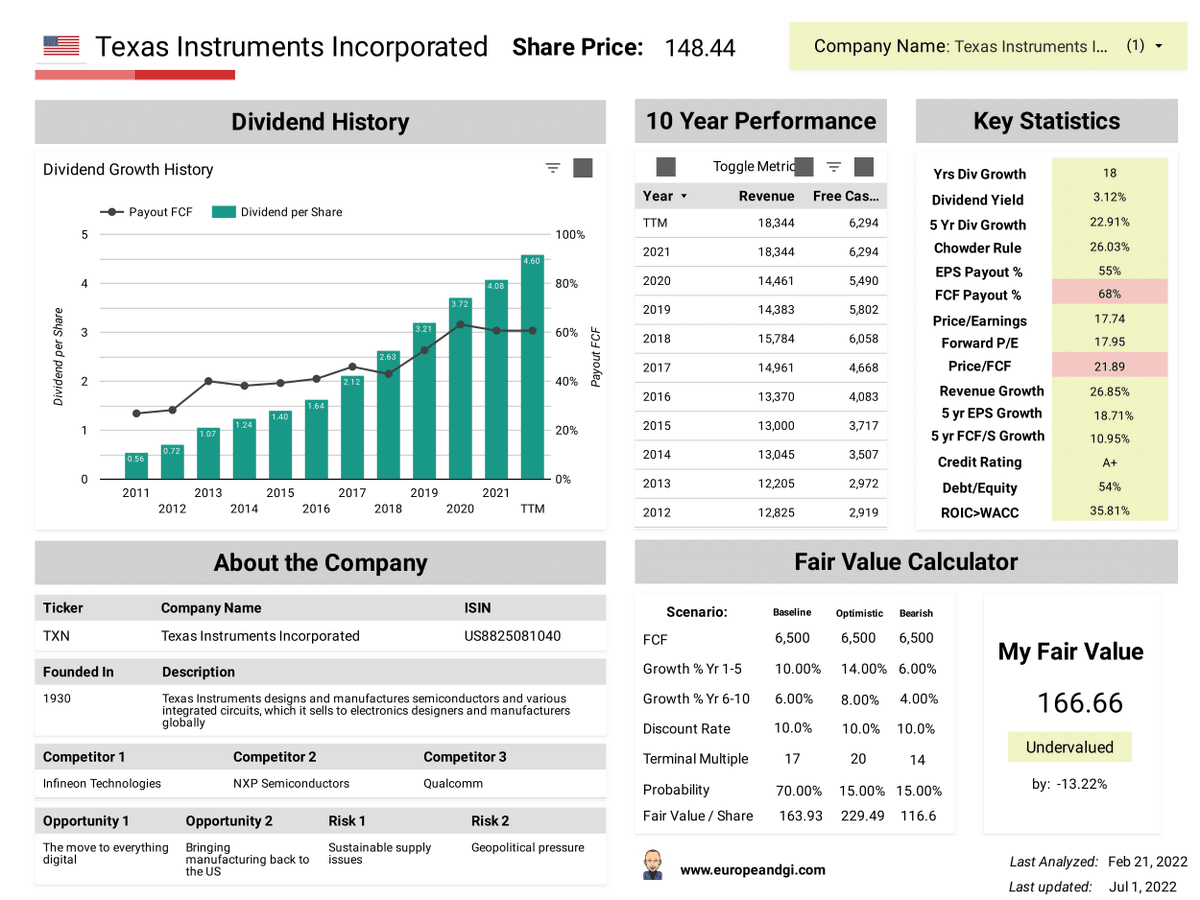

@dekleinekapita1 EXAMPLE: $TXN

Texas Instruments is a high-quality stock and deserves in my opinion a 20 multiple.

👉 EPS = 8.74. x 20 = $174.80

👉 FCF = 6.72. x 20 = $134.40

This gives it an average Fair Value price of $154.60

Fun fact: it's close to my personal calculation 👇

Texas Instruments is a high-quality stock and deserves in my opinion a 20 multiple.

👉 EPS = 8.74. x 20 = $174.80

👉 FCF = 6.72. x 20 = $134.40

This gives it an average Fair Value price of $154.60

Fun fact: it's close to my personal calculation 👇

@dekleinekapita1 Of course, you can go more advanced!

In that case, check my video about how to apply the discounted cash flow model 👇

I truly believe that the value of an investment is based on its expected future cash flows discounted to today.

In that case, check my video about how to apply the discounted cash flow model 👇

I truly believe that the value of an investment is based on its expected future cash flows discounted to today.

@dekleinekapita1 And that's it!

If you follow these simple, yet a bit time-intensive steps, then you're already doing better than most of the people around you.

You will know what you own and you will build conviction during tough times because:

👉 you have done your HOMEWORK 😍

-next-

If you follow these simple, yet a bit time-intensive steps, then you're already doing better than most of the people around you.

You will know what you own and you will build conviction during tough times because:

👉 you have done your HOMEWORK 😍

-next-

@dekleinekapita1 Now let me finish by wishing you all the luck with analyzing your next stock 👌

Let me know how it goes and feel free to drop me, or our amazing #divtwit community, your questions.

We are there to support.

Let me know how it goes and feel free to drop me, or our amazing #divtwit community, your questions.

We are there to support.

@dekleinekapita1 Before you go!

If you enjoyed this thread:

1. Follow me @European_DGI for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @European_DGI for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/European_DGI/status/1546382646841860097

• • •

Missing some Tweet in this thread? You can try to

force a refresh