Pleased to share a new NBER working paper on the dealer balance sheet constraints and Treasury yield curve.

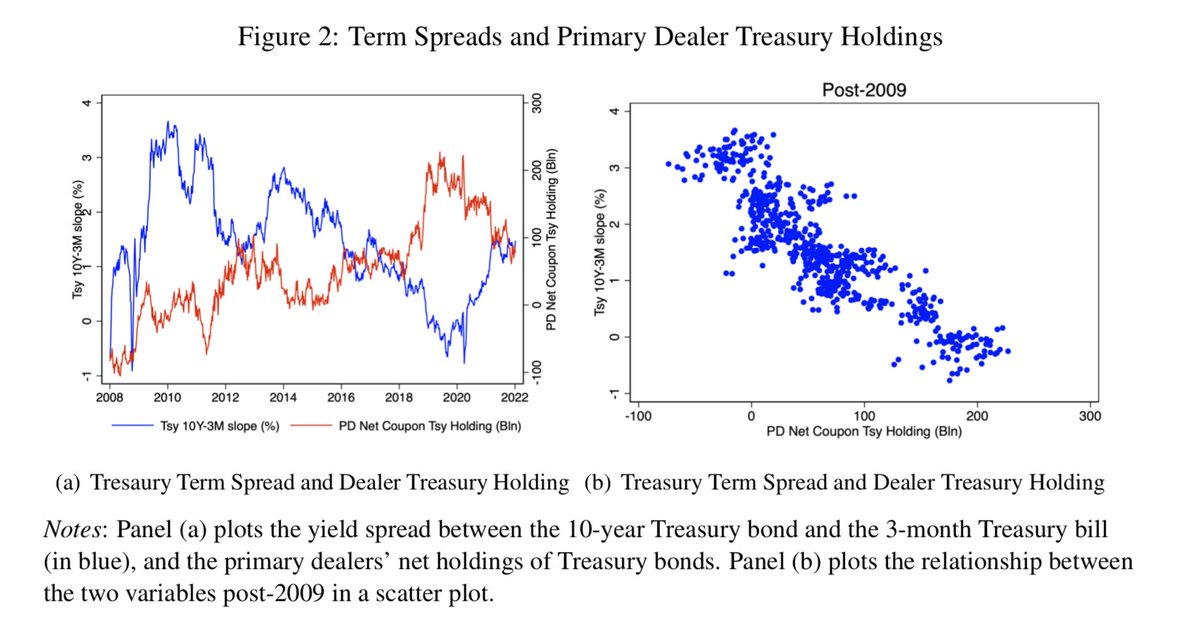

We always start with striking charts.

(1) Primary dealers switched from being net short to net long in Treasury bonds post-GFC;

(2) The primary dealers' position in Treasury bonds is strongly correlated with the swap-Treasury spread and CIP deviations post-GFC.

(1) Primary dealers switched from being net short to net long in Treasury bonds post-GFC;

(2) The primary dealers' position in Treasury bonds is strongly correlated with the swap-Treasury spread and CIP deviations post-GFC.

(3) The primary dealers' position is also negatively correlated with the slope of the Treasury yield curve post-GFC.

We build a consistent framework featuring constrained dealers, levered investors funded by dealer balance sheets, and return-seeking real money investors to explain these new facts. Whether the dealers are net long or short in Treasury bonds matters significantly for yields.

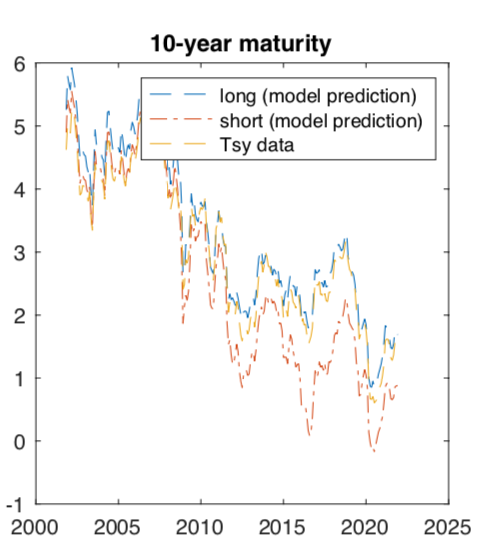

Using CIP deviations as the proxy for dealers' balance sheet costs, our term structure model shows that the Treasury yield curve switched from the dealer-net-short to the dealer-net-long curve, consistent with the change in the dealers' position.

Finally, we use our framework to discuss the implications of several monetary and regulatory policies for the Treasury market, including QE/QT, central bank swap lines, and SLR exemption. Ungated full paper: dropbox.com/s/uahb5za9xjnt…

• • •

Missing some Tweet in this thread? You can try to

force a refresh