A thread on Price action and how to identify stocks showing strong price action.

For me price action is when you answer the What,When,Why,How and Where of price movement of any underlying.

Its a language you use to communicate with the underlying.

Key Parameters thread

1/n

For me price action is when you answer the What,When,Why,How and Where of price movement of any underlying.

Its a language you use to communicate with the underlying.

Key Parameters thread

1/n

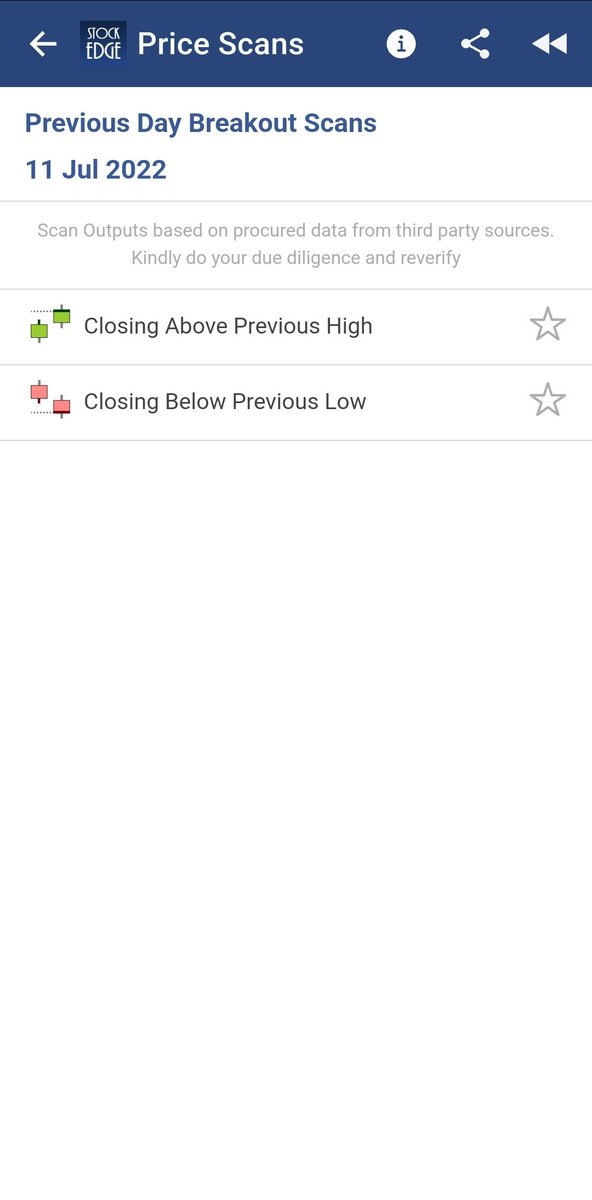

Short term price action is judged when the underlying is crossing precious day high or low. Why last day action is important?Because there are enough short term traders who act at these levels,especially if that day had lots of activities showcased by volume and delivery.

2/n

2/n

Monthly high, low, close are again important as the stocks are typically evaluated on monthly basis for mid term performance. Operator building large positions will react when market breaches these critical levels.

3/n

3/n

Just like monthly, 52 week i.e yearly data is also critical as a symbolic performance of an underlying for long term actions.

4/n

4/n

VWAP literally helps you to judge the behavior of operator. Typically that the price at which operator has build positions. If you combine VWAP with closing, you will be able to judge the probable demand and supply zone of any underlying.

5/n

5/n

Then relative performance of a stock visavis market benchmark. An outperforming stock will show momentum for immediate swing movements and underperforming stock should never be bought. Best tool to implement exit rules.

6/n

6/n

My proprietary RS55 model which measures the outperformance and underperformance over 55 days for normalisation. 55 days is almost 3 month of trading and fibonacci number.

Trained usage of this in my #Learn2Trade series at YouTube.com/vivekbajaj

7/n

Trained usage of this in my #Learn2Trade series at YouTube.com/vivekbajaj

7/n

Finally combining some key paramaters and finding stocks that have high chance of swing action.This will give you a filtered list for trading action.

Create your own #ComboScans by using @mystockedge

Also make sure you subscribe to the premium outputs and become #SelfisSmart

Create your own #ComboScans by using @mystockedge

Also make sure you subscribe to the premium outputs and become #SelfisSmart

• • •

Missing some Tweet in this thread? You can try to

force a refresh