We looked at every company with promoter buying for the period from April 1st to June 30th (Q1 FY23).

A thread.

Please like and retweet to help more investors

1/n Total 178 names - Part 1 of top 64 here 👇

A thread.

Please like and retweet to help more investors

1/n Total 178 names - Part 1 of top 64 here 👇

2/n

Total 178 names - Part 2 of top 64 buying here 👇

Note: Top promoter selling at the end of the thread

Total 178 names - Part 2 of top 64 buying here 👇

Note: Top promoter selling at the end of the thread

3/n

Sectors that saw the highest level of promoter buying:

1. Cements (mainly) and metals

2. Chemicals and API

3. Auto and auto components

4. Capital Goods

5. Financials

Sectors that saw the highest level of promoter buying:

1. Cements (mainly) and metals

2. Chemicals and API

3. Auto and auto components

4. Capital Goods

5. Financials

4/n

Sector-wise classification

Highest promoter buying seen in Cements (mainly) and Metals:

@jitenkparmar @drvijaymalik

Sector-wise classification

Highest promoter buying seen in Cements (mainly) and Metals:

@jitenkparmar @drvijaymalik

5/n

Companies with good promoter buying in Chemicals, Materials, and API:

@nid_rockz @charts_zone @drprashantmish6 @varadhar1

Companies with good promoter buying in Chemicals, Materials, and API:

@nid_rockz @charts_zone @drprashantmish6 @varadhar1

6/n

Companies with good promoter buying in Consumer Discretionary and Auto components:

@suru27 @soicfinance @Dinesh_Sairam @abhishekcjain

Companies with good promoter buying in Consumer Discretionary and Auto components:

@suru27 @soicfinance @Dinesh_Sairam @abhishekcjain

7/n

Companies with good #insiderbuying in Infra, Industrials, and Capital goods:

@SahilKapoor @connectgurmeet @charanlearning @tycoonmindset05 @SudhirN94847744

Companies with good #insiderbuying in Infra, Industrials, and Capital goods:

@SahilKapoor @connectgurmeet @charanlearning @tycoonmindset05 @SudhirN94847744

8/n

Companies with top promoter buying in Financials sector:

@amey_candor @datta_arvind @nishkumar1977 @MeetshahV @AdityaD_Shah @Falak_Kalyani

Companies with top promoter buying in Financials sector:

@amey_candor @datta_arvind @nishkumar1977 @MeetshahV @AdityaD_Shah @Falak_Kalyani

9/n

Companies with good #insiderbuying in Pharma and healthcare sector:

@AdityaKhemka5 @itsTarH @saketreddy @varinder_bansal @Perpetuity_H2W

Companies with good #insiderbuying in Pharma and healthcare sector:

@AdityaKhemka5 @itsTarH @saketreddy @varinder_bansal @Perpetuity_H2W

10/n

Companies which saw promoter buying in Consumer staples/FMCG sector:

+ Mrs Bectors Food Specialities Ltd (1 cr) and Modi Naturals Ltd (13 cr)

@safiranand @NeilBahal @bharatbetpf @NikhilkvoraVora

Companies which saw promoter buying in Consumer staples/FMCG sector:

+ Mrs Bectors Food Specialities Ltd (1 cr) and Modi Naturals Ltd (13 cr)

@safiranand @NeilBahal @bharatbetpf @NikhilkvoraVora

11/n

Companies with good #insiderbuying in IT/Tech sector:

+ Cigniti Technologies Ltd (7 cr)

@YatinMota @Finstor85 @sidd1307 @DhanValue

Companies with good #insiderbuying in IT/Tech sector:

+ Cigniti Technologies Ltd (7 cr)

@YatinMota @Finstor85 @sidd1307 @DhanValue

12/n

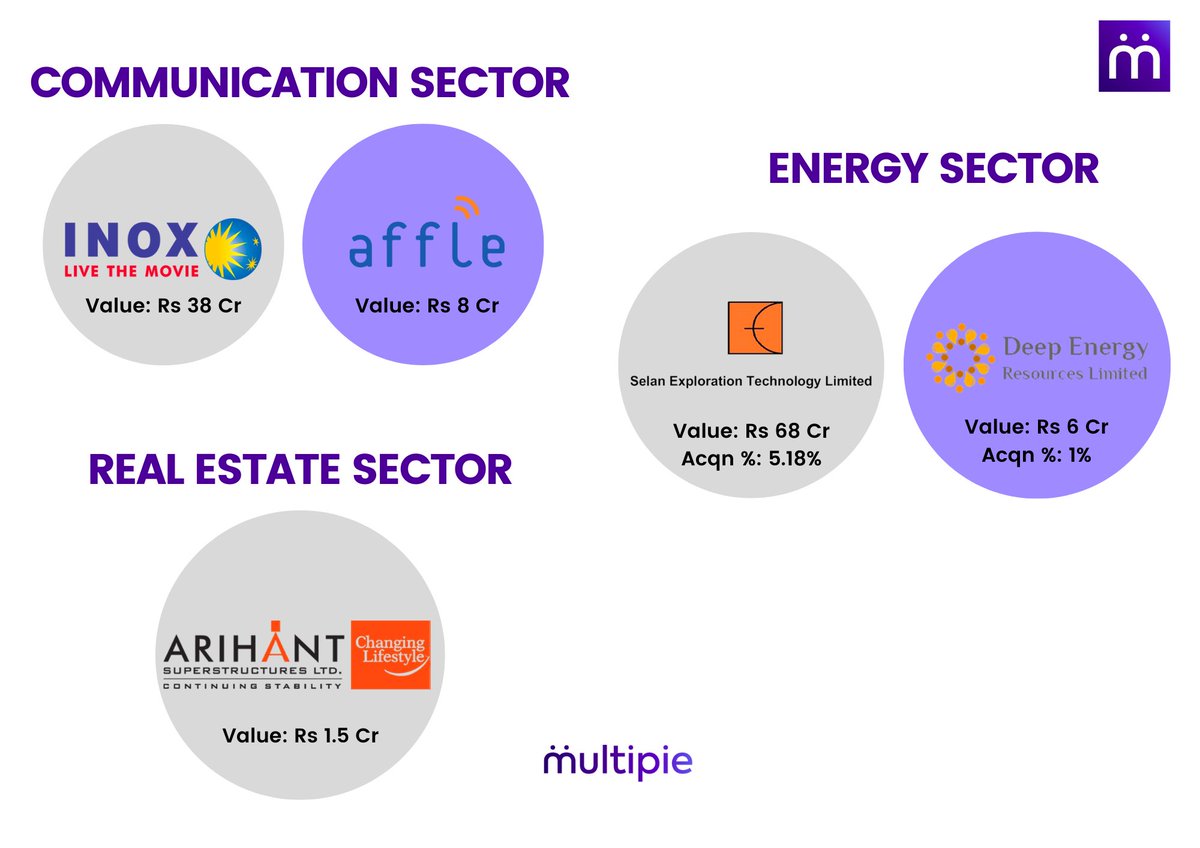

Companies that saw good insider buying in Communication, Oil & Gas, and Real Estate sectors

+ TARC - 2 cr (Anant Raj)

@Coolfundoo @academy_share @TheBullBull

Companies that saw good insider buying in Communication, Oil & Gas, and Real Estate sectors

+ TARC - 2 cr (Anant Raj)

@Coolfundoo @academy_share @TheBullBull

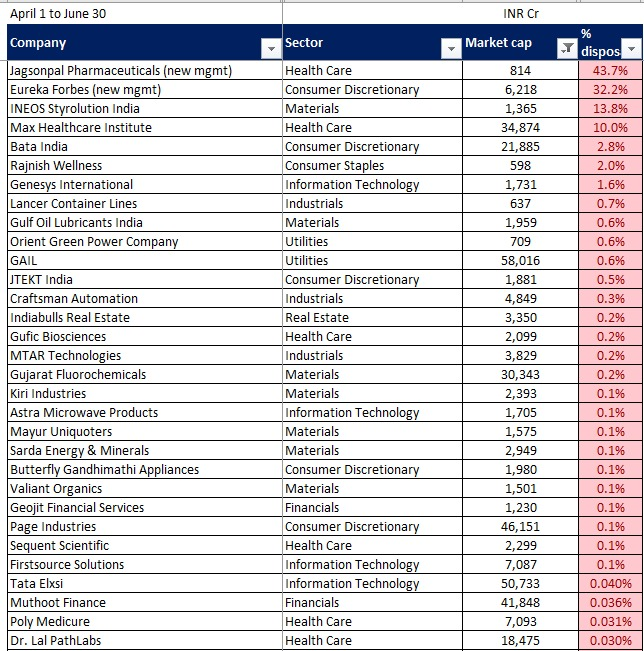

13/n

Key companies with net promoter selling during the quarter👇

@darshanvmehta1 @Tijori1 @LearningEleven

Key companies with net promoter selling during the quarter👇

@darshanvmehta1 @Tijori1 @LearningEleven

@darshanvmehta1 @Tijori1 @LearningEleven 14/n

Comment with the name of any company and we will share full details of promoter activity during the quarter. Follow @MultipieSocial for more such insights.

/End

Link to top of the thread:

Comment with the name of any company and we will share full details of promoter activity during the quarter. Follow @MultipieSocial for more such insights.

/End

Link to top of the thread:

https://twitter.com/MultipieSocial/status/1546789326935101440

Note:

1. We have only considered market purchase/ sale, buyback (promoter not participating) and Rights issue. Actual promoter change might differ somewhat.

2. This is only a starting point of analysis and not for direct buy/ decisions.

1. We have only considered market purchase/ sale, buyback (promoter not participating) and Rights issue. Actual promoter change might differ somewhat.

2. This is only a starting point of analysis and not for direct buy/ decisions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh