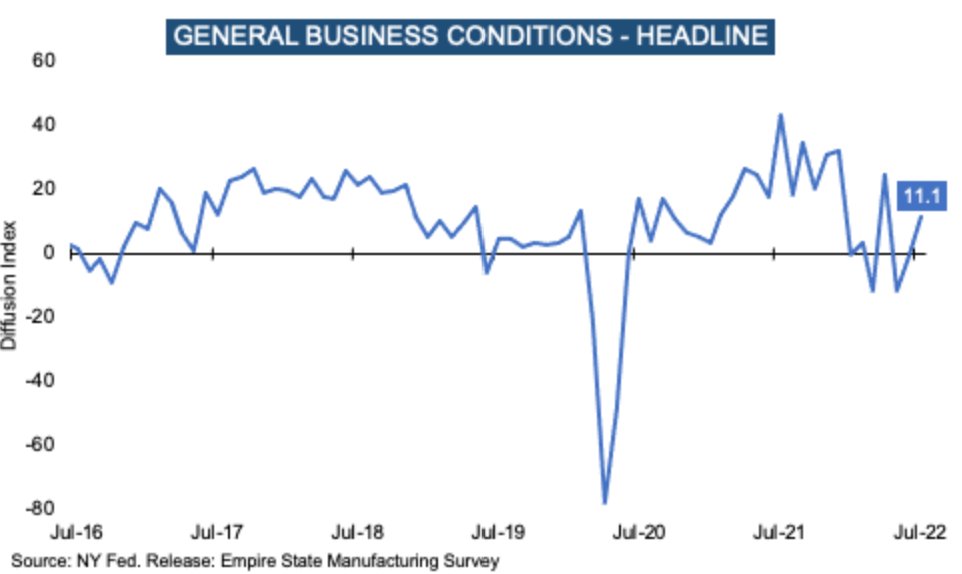

1- #Connectingthedots Today the NY Fed survey came out, which surveys local manufacturing businesses. The headline number, which is based on *current* view, looks benign. So "all is good"?

2- That's the lazy view - there is plenty more detail! Businesses are also asked about their views 6 months from now, and that outlook is dire:

New Orders on a mult-year low indicate very weak business going forward:

New Orders on a mult-year low indicate very weak business going forward:

3- Prices paid drop visibly. This has historically been a lead indicator for CPI. It corroborates my view that inflation will likely come down markedly soon

4- And expectations for a shortened employee workweek imply layoffs, rather than further wage increases

5- Another set of forward-looking datapoints that suggests a fast weakening economy and lower inflation, and why I continue to be positive on bonds, particularly the long end #TLT #ZROZ

• • •

Missing some Tweet in this thread? You can try to

force a refresh