Developing countries can offset inflation by decentralising and lowering the barrier to financial instruments like gov. debt securities and tax-free savings.

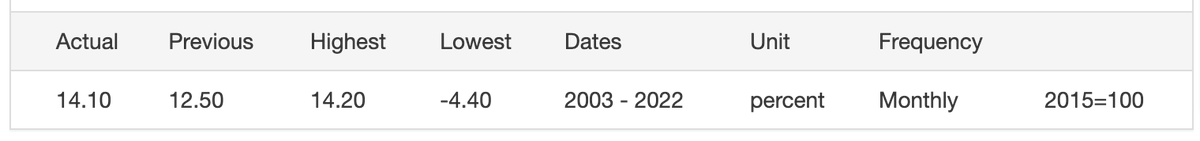

The inflation rate in Kosova 🇽🇰 in June was 14.10% - highly probable that currently, this is higher than +14.20%...

🧵

The inflation rate in Kosova 🇽🇰 in June was 14.10% - highly probable that currently, this is higher than +14.20%...

🧵

which would make it the highest inflation rate in the country's history (*since pre-independence 2003), this inflation rate is calculating a CPI where food & bev. is weighted at ~40%.

tradingeconomics.com/kosovo/inflati…

This means the burden on the people living in the country...

tradingeconomics.com/kosovo/inflati…

This means the burden on the people living in the country...

is getting heavier to shoulder. The average salary in the country has dropped -4.1% from 2018 and with youth unemployment rate at 48.6%.

tradingeconomics.com/kosovo/wages

The truth of course is not so clear-cut in informal economies like Kosova. It's hard to really pinpoint...

tradingeconomics.com/kosovo/wages

The truth of course is not so clear-cut in informal economies like Kosova. It's hard to really pinpoint...

the reality on the ground. Informal economies by nature have an underreported "wealth iceberg". Usually, this comes from an (arguably rational) mistrust of authorities (culturally from unstable or occupied parts of the world)...

en.wikipedia.org/wiki/Informal_…

en.wikipedia.org/wiki/Informal_…

...who have abused their taxes or simply have been shunned from the formal economy (jobs, loans etc).

Unfortunately, the copy-paste nature of governmental and banking policies + infrastructure of developing countries from more developed countries means that the reality...

Unfortunately, the copy-paste nature of governmental and banking policies + infrastructure of developing countries from more developed countries means that the reality...

on-the-ground is much worse when inflation is high in developing countries. There is no fallback mechanism to offset increasing CPI (ISA's, short-term inv. or liquid debt instr.).

Due to the "copy-paste" nature of legacy banking systems means...

Due to the "copy-paste" nature of legacy banking systems means...

the barriers to entry for financial instr. that could help offset inflation exclude a large part of the pop.

No wonder we see an increase in sentiment in crypto in such countries and at such times, like Cypress after the financial crisis of 2008...

cnbc.com/id/100597242

No wonder we see an increase in sentiment in crypto in such countries and at such times, like Cypress after the financial crisis of 2008...

cnbc.com/id/100597242

One solution should be Gov.-backed sovereign debt securities issued directly (#bankless) to investors (people)

- increased participation (lower entry barriers)

- reduced funding costs + time

- immutable and decentralised (not left to politics)

- independent + transparent

- increased participation (lower entry barriers)

- reduced funding costs + time

- immutable and decentralised (not left to politics)

- independent + transparent

This can be achieved through blockchain. If crypto policy is backed by a healthy tax policy then gov. could create a win-win situation with its citizens = Tax-free (incentivised) savings accounts (with degree) based on gov. crypto gilts.

ft.com/content/50a28a…

ft.com/content/50a28a…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh