1/26 V Important 🧵 on this weeks debate in the House of Commons tabled by @DrDanPoulter

Highlights & my analysis. Pls read to end & share/RT👇. Vital we resolve this to fix *retention* & backlog

Part 1/2 - Dr Poulter (Pt 2/2 Minister response soon)

Highlights & my analysis. Pls read to end & share/RT👇. Vital we resolve this to fix *retention* & backlog

Part 1/2 - Dr Poulter (Pt 2/2 Minister response soon)

2/26 Really important points from @Dr_PhilippaW

1️⃣ vital issue needing 4 nation solutions @BMACymru @BMAScotland @BMA_NI

2️⃣AA is the wrong tax for the wrong group of people & its destroying the NHS

1️⃣ vital issue needing 4 nation solutions @BMACymru @BMAScotland @BMA_NI

2️⃣AA is the wrong tax for the wrong group of people & its destroying the NHS

3/26 A further intervention from Northern Ireland's @JimShannonMP again pointing out the 4 nation problem and large rise in retirements in the NHS since April (my prediction - unless this fixed very urgently, retirements will increase +++ in 22/23)

4/26 Similarly Dame @NiaGriffithMP again pointing out that Wales too affected by the same retention issue. And @DrDanPoulter pointing out this isnt the same issue as previously discussed due to the unique position in the current tax year due to inflation

5/26 Crucial point from @DrDanPoulter on the "just use scheme pays" argument used by government

1️⃣ Eye Wateringly expensive currently as inflation+2.4% so >>10%

1️⃣ Eye Wateringly expensive currently as inflation+2.4% so >>10%

6/26 2️⃣ Unfair 22/23 as being billed thousands of pounds in tax for "pseudogrowth" in their pensions which never materializes

So whats the impact on the NHS

- Waiting lists continue to rise 6.48m waiting for treatment 📈 (and rising)

So whats the impact on the NHS

- Waiting lists continue to rise 6.48m waiting for treatment 📈 (and rising)

7/26 - care backlog for general practice, with 401,115 patients waiting for treatment

8/26 So on staffing...

-England needs additional 46,300 full-time doctors OECD EU average

- Over 100,000 posts in secondary care are vacant, >8,000 medical

- The NHS needs to keep the staff it has simply to keep the current level of service running.

-England needs additional 46,300 full-time doctors OECD EU average

- Over 100,000 posts in secondary care are vacant, >8,000 medical

- The NHS needs to keep the staff it has simply to keep the current level of service running.

9/26 - Pension tax > financially unviable stay in the NHS or work the number of hours they would like to.

- By tackling the NHS pension crisis through amending the Finance Act 2004 & introducing a tax unregistered scheme for those senior NHS workers

- By tackling the NHS pension crisis through amending the Finance Act 2004 & introducing a tax unregistered scheme for those senior NHS workers

10/26 Without those changes to the pension rules, more staff will leave and the care backlog together with waiting times are likely to continue to rise.

11/26 Next Jonathan Edwards points out a similar issue with judges was solved with a tax unregistered scheme which "critically, breaks the link between working more hours and the additional tax bill, as well as ensuring that the right amount of tax is paid.". Poulter agrees

12/26 Now to LTA. Government froze the LTA in 2021. Back then inflation was 0.4%, with 2% long term prediction. A survey of 8000 Gps/con. 72% said LTA freeze⬆️likely retire early; 61% ⬆️ likely work fewer hours.

That would surely be worse now as LTA rapidly falls with inflation

That would surely be worse now as LTA rapidly falls with inflation

13/26 Next @AmyCallaghanSNP intervenes - >100 of her constituents contacted her re this issue. "This really significant issue needs to be noticed & action needs to be taken, but not like the action that was taken with the taper, which did not affect enough doctors. "

14/26 OK pay attention now. This is the technical bit - but essential nonetheless.

- AA "completely unsuited" to defined-benefit schemes such as that in the NHS

- should be scrapped in defined-benefit schemes. That view has been supported by Treasury advisers & @OTS_UK

- AA "completely unsuited" to defined-benefit schemes such as that in the NHS

- should be scrapped in defined-benefit schemes. That view has been supported by Treasury advisers & @OTS_UK

15/26 Next Dr. Poulter turns to the 3 reasons inflation is crucifying retention

(1) Doesn’t pay to stay

(1) Doesn’t pay to stay

16/26 (1) - Doesn’t pay to stay - my thoughts

17/26 (2) - CPI disconnect S235

18/26 (2) - Finance Act S234

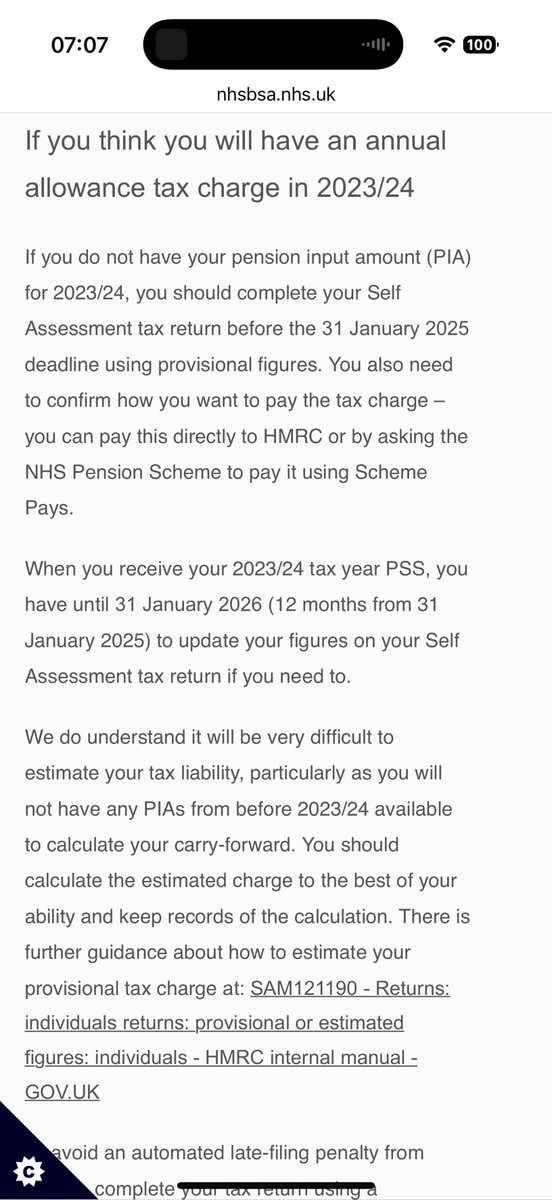

19/26 (2) - Finance Act - My thoughts

20/26 (3) - The lifetime allowance & inflation

23/26 (2) AA Compensation scheme

24/26 (3) #Taxunregistered - fair to taxpayers and doctors. Already delivered to judges.

25/26 AA charges arising from the defects in the Finance Act are *manifestly unfair*. It is clear to any reasonable person that the intention of the Act was to measure growth *above inflation*. It is doing nothing of the sort. Hence @TheBMA asks

26/26 The unintended consequences of rapidly increasing inflation could be dire for the NHS. Please fix this. It needs *urgent* action. @NHSMillion @TheBMA

Please share widely / watch the debate☝️ / RT

Please share widely / watch the debate☝️ / RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh