A thread on evolution of my Relative Strength theory.

I was an active trader till 2013 before I decided to become a passive trader. I found swing trading (apart from investing) to be the best strategy for me since I was also involved in other business initiatives.

1/n

I was an active trader till 2013 before I decided to become a passive trader. I found swing trading (apart from investing) to be the best strategy for me since I was also involved in other business initiatives.

1/n

I read many market books in 2013-14 and attended many paid training sessions.

And finally adapted Relative Strength model for my journey.

The starting point of RS was simple graph of Price of Nifty by Price of Stock. Objective was to identify strong stock visavis market.

2/n

And finally adapted Relative Strength model for my journey.

The starting point of RS was simple graph of Price of Nifty by Price of Stock. Objective was to identify strong stock visavis market.

2/n

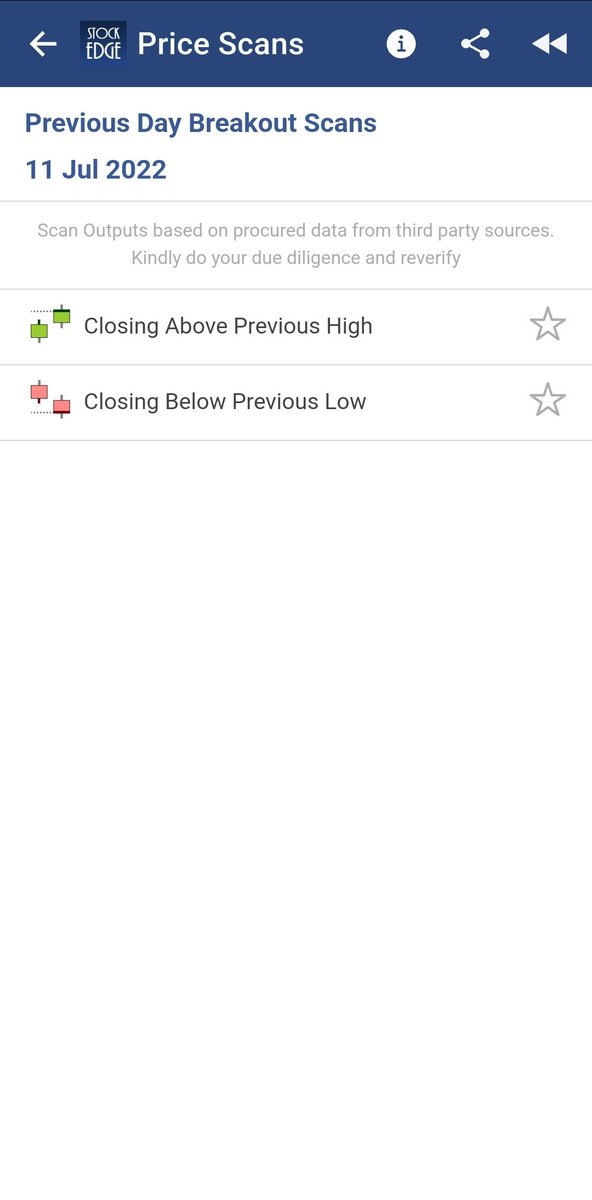

This simple technique worked fantastically till 2016 before I realised that there is need of improvisation.I developed the model further and filtered stocks based on this:

Any stock outperforming market for 1W as well as 3M is strong.We developed the scan in @mystockedge

3/n

Any stock outperforming market for 1W as well as 3M is strong.We developed the scan in @mystockedge

3/n

My model was simple. Find stocks using this scan (post 3), check the outperformance graph (post 2) and trade on breakouts. Similarly short stocks showing weakness as per both 3 and 2 model and trade on breakdown. Short on stock is done using futures and options.

4/n

4/n

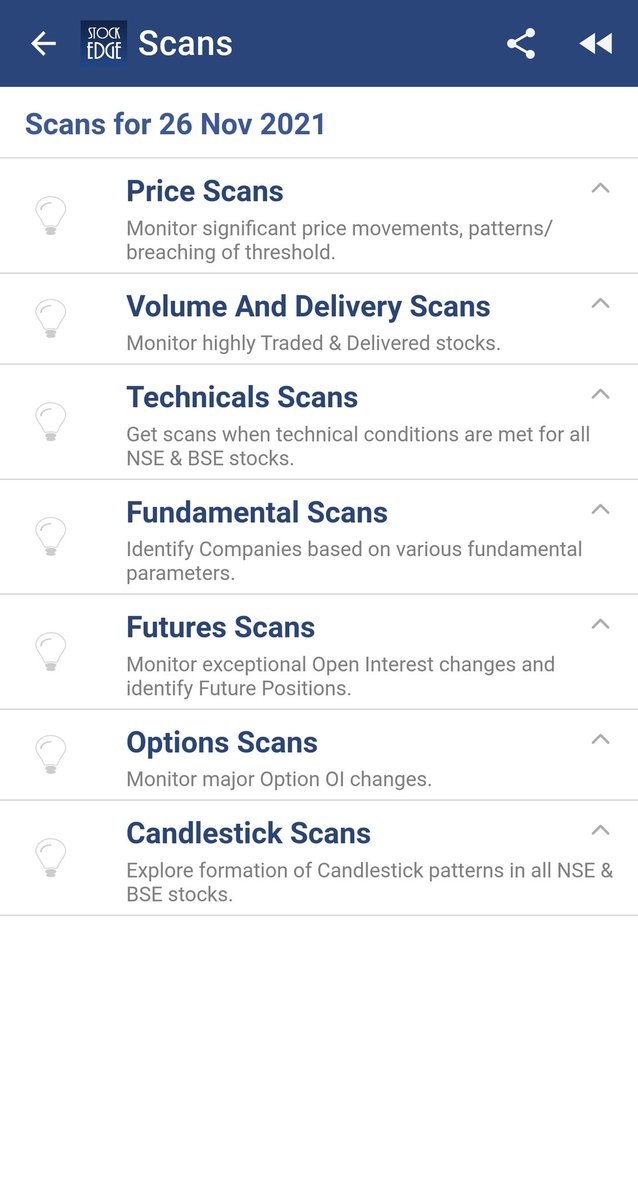

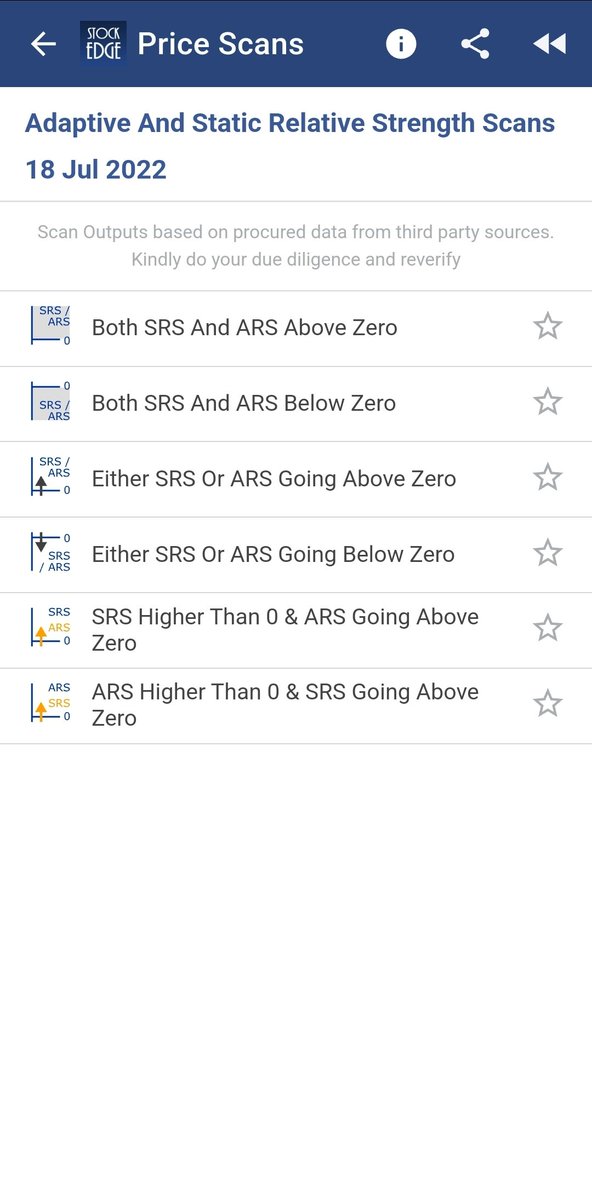

Then, I met my RS brother @premalparekh around 2018 in Ahmedabad.He is also an RS practitioner for many years.He explained me his concept of Adaptive RS and Static RS. I loved it and we instantly created a scan in @mystockedge

He runs an amazing #RSRwarrior community.

5/n

He runs an amazing #RSRwarrior community.

5/n

However, I want simpler solution for my life. One of my core philosophy in @mystockedge

We did lot of testing and found that my theory of 3 month outperformance works well for my style of trading. Hence we created RS55. 55 is almost 3 month live market and Fibonacci number.

6/n

We did lot of testing and found that my theory of 3 month outperformance works well for my style of trading. Hence we created RS55. 55 is almost 3 month live market and Fibonacci number.

6/n

Indicators are like priests who will help you to reach the God, The Price.

Finally a sound entry and exit strategy will make us money.

I combined RS55, RSI and moving averages to find momentum and strength and trade the price based on price action.

7/n

Finally a sound entry and exit strategy will make us money.

I combined RS55, RSI and moving averages to find momentum and strength and trade the price based on price action.

7/n

My full model and technique is Freely shared in my #Learn2Trade series with 50 videos.

youtube.com/playlist?list=…

If you have not experience the learnings, you should do to become a multi asset trader.

8/n

youtube.com/playlist?list=…

If you have not experience the learnings, you should do to become a multi asset trader.

8/n

My life learnings as a trader and founder of one of the largest prop trading firms in India.

1. No model is permanent

2. Learning is perpetual

3. Finally one should know when to trade and when not to trade

9/n

1. No model is permanent

2. Learning is perpetual

3. Finally one should know when to trade and when not to trade

9/n

Finally, If you find my workings effective and would like to become part of my community where I share my research and learnings on real time basis, join stockedgeclub.com

I have personally curated team of 20+ analyst who are guiding 9000+ members on real time basis.

N/n

I have personally curated team of 20+ analyst who are guiding 9000+ members on real time basis.

N/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh