My twitter feed is filled with trading logic—volume, liquidity, Fed policy, short positions, commitment of traders, sentiment indicators, Bollinger Bands, Garage Bands,...The bear will be done when the stocks are cheap on an absolute (historical) scale. Nikkei 2.0 is coming.

BTW-They call the '29 crash the Babson Break after Roger Babson who called it...continuously...for about five years. That stopped clock was finally right, and we got the Great Depression.

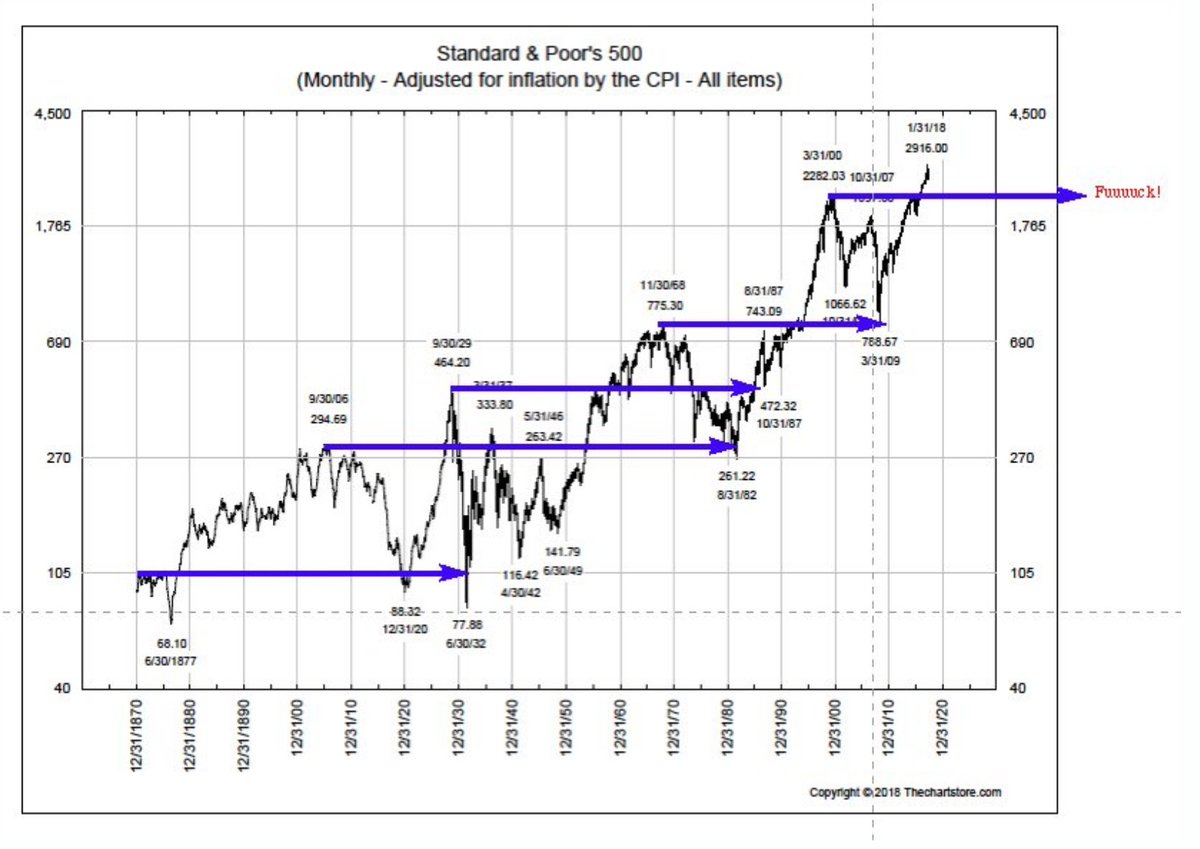

The markets weren't even slightly cheap in 3/20. They were below fair value for about 2 weeks in '08-'09. They were dirt cheap in '81 after 15-year inflation-adjusted ravaging of –75%. Bullard says they are more credible than Volcker. He is an idiot. They all are.

The Nikkei always recovers they said. Buy the dips they said. Japan will dominate the global economy they said. Just buy and hold they said. It was correct for over 4 decades, and then...

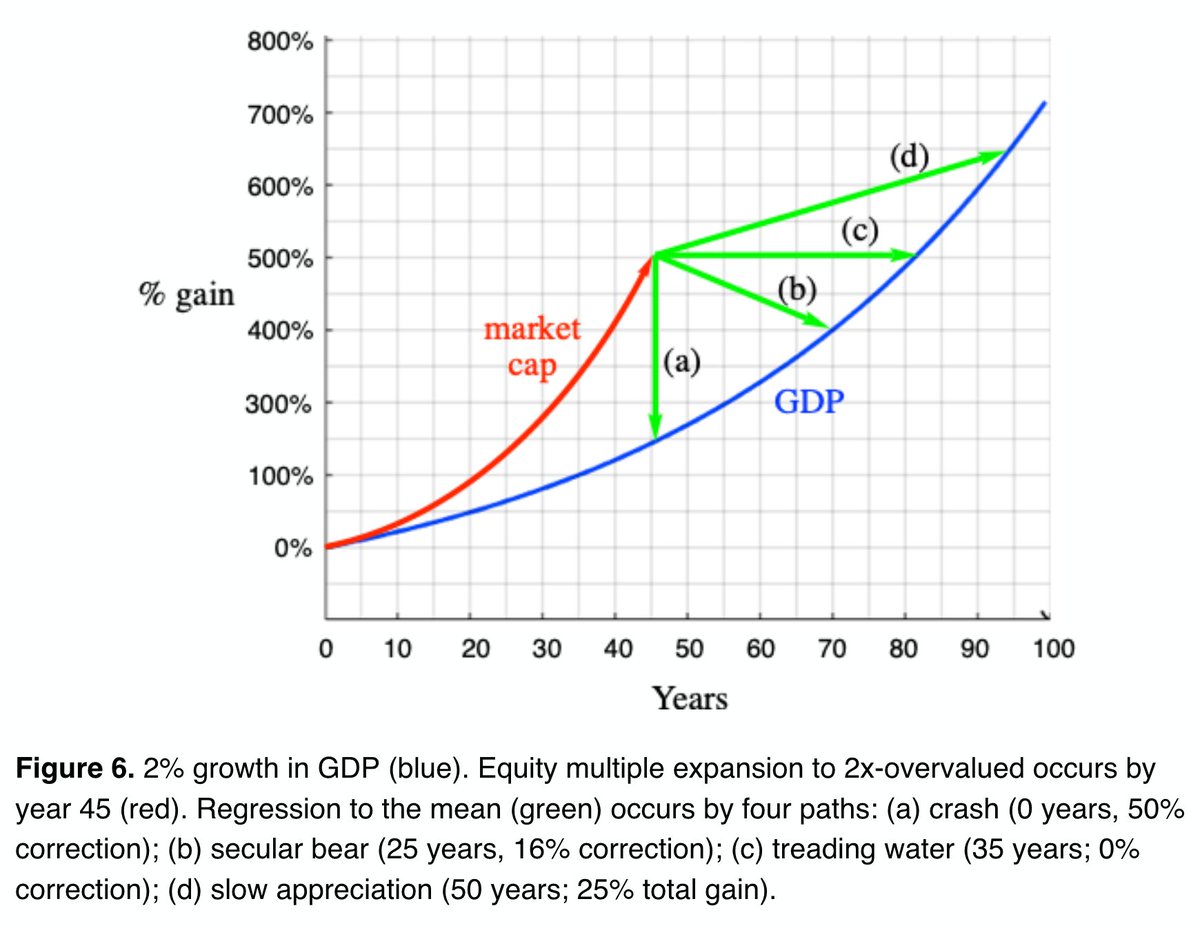

It is Ponzi finance. I have us comfortably 2x overvalued by 25 metrics. Here are four paths back to fair value (let alone below it). I'm rooting for (a). The Fed is trying to achieve (d).

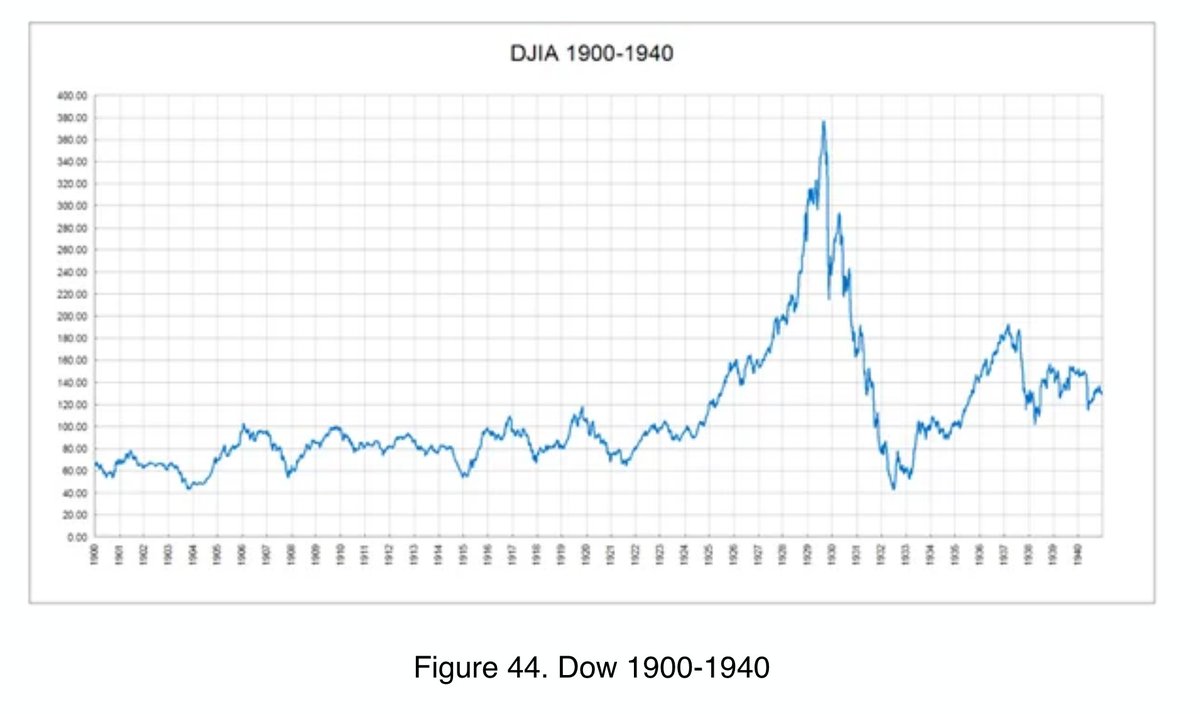

This is what a sharp equity correction looks like. Notice how for decades it was nearly all dividends. By the end, the boom-bust cycle is clear as can be...

And one of my favorites (made using ChemDraw). Those arrows represent the time that the inflation-adjusted market wobbled around but went precisely nowhere. They are 45-75 years long...

I know y'all have your telltale indicators, but as @RampCapitalLLC said to @StockCats (or vice versa and paraphrased), "We all use the same ones."

• • •

Missing some Tweet in this thread? You can try to

force a refresh