1/30 BREAKING 🧵 New @CommonsHealth report 👇

"Its a NATIONAL SCANDAL that senior doctors are being forced to reduce their working contribution to the NHS or to leave it entirely because of NHS pension arrangements"

Highlights & my analysis. Pls read to end & share/RT👇.

"Its a NATIONAL SCANDAL that senior doctors are being forced to reduce their working contribution to the NHS or to leave it entirely because of NHS pension arrangements"

Highlights & my analysis. Pls read to end & share/RT👇.

2/30 A huge thanks to @Jeremy_Hunt @drlukeevans @rosie4westlancs & colleagues at @CommonsHealth for this really important report released today. Some vital recognition of problems relating to punitive pension tax & recommendations re pensions. Please read all carefully to end.

3/30 First & foremost is recognition that

1) Its a "national scandal" doctors forced to reduce hours or leave it because of NHS pension taxation

2) Crucially, the problem persists *despite* changing the taper rate of the annual allowance.

1) Its a "national scandal" doctors forced to reduce hours or leave it because of NHS pension taxation

2) Crucially, the problem persists *despite* changing the taper rate of the annual allowance.

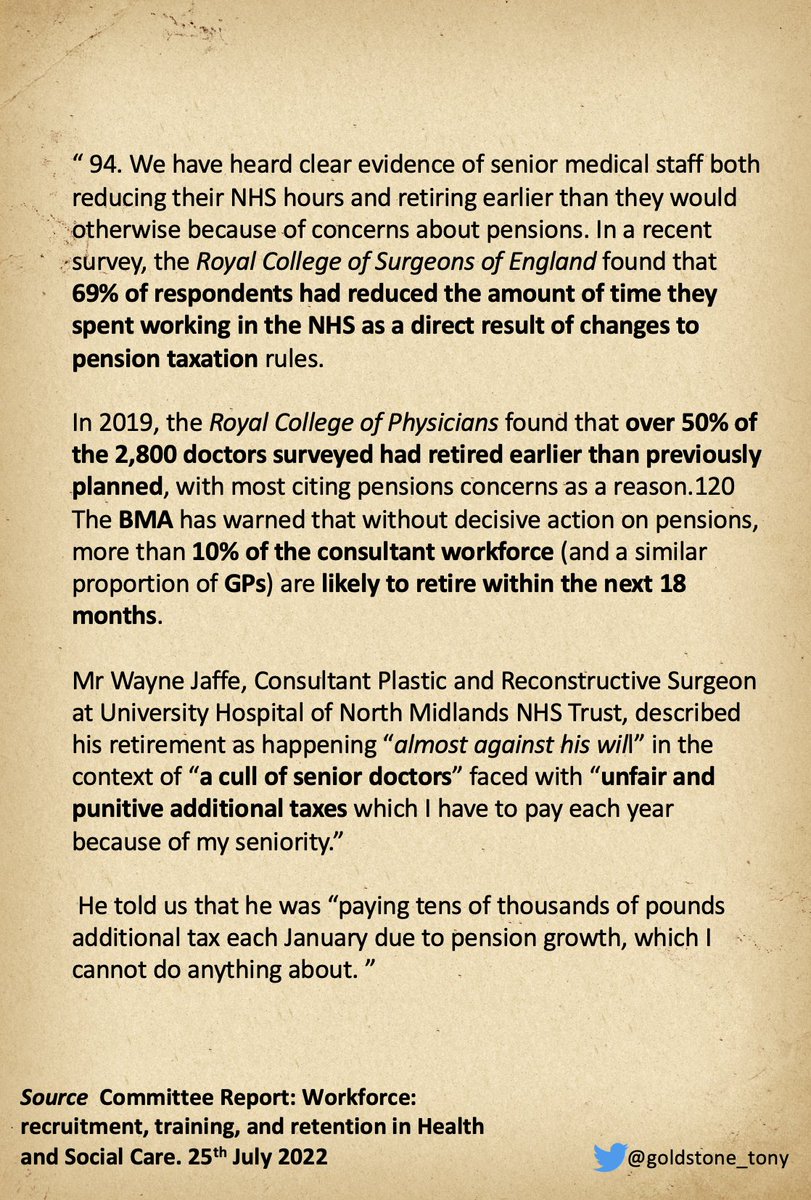

4/30 On pensions @commonshealth saw evidence from @RCSnews @RCPhysicians & @TheBMA showing a very large proportion of doctors retired earlier than planned due to punitive pension taxation. Committee heard powerful testimony from @Clinicalred

5/30 @bma_pensions Vish Sharma explained how doctors can be financially worse off by working longer (i.e. not retiring as it #DoesntPayToStay)

See bma.org.uk/doesntpaytostay for more details - typical consultant aged 59 or 60 over £100k worse off by delaying retirement by 1 year

See bma.org.uk/doesntpaytostay for more details - typical consultant aged 59 or 60 over £100k worse off by delaying retirement by 1 year

6/30 Next Danny Mortimer from @NHSEmployers claimed "the case for reform of the NHS pension scheme ... to give employees much more control over what they pay in, is very clear".

@bma_pensions *strongly* disagree with this. Let me explain why.

@bma_pensions *strongly* disagree with this. Let me explain why.

7/30 Firstly we have been here before. The initial reaction to flexibility (in the form of "50:50") was so bad that government had to withdraw their own consultation on this

8/30 This consultation was re-run again with more flexibility - so called "decile flexibility". This was again rejected by both people responding and also by government who agreed "that tax reform would be the simplest way of solving the issue"

gov.uk/government/con…

gov.uk/government/con…

9/30 We of course know that tax reform came in March 2020 (changing the taper threshold which was broadly welcomed, although making it even worse for the highest earners). But then further tax reform in March 21 (freezing the LTA) made things even worse for retention.

10/30 But crucially we know "taper tweak" has not solved the problem (@thebma warned government at the time it was not enough). Additionally "flexibility" add further enormous complexity to something that is already hideously complex- complexity per se is a problem in itself.

11/30 Importantly flexibility will do nothing for the particularly serious inflation related issues that have raised their head SINCE committee took evidence.

See bma.org.uk/pay-and-contra… for more info (this serious issue affects GPs & consultants)

See bma.org.uk/pay-and-contra… for more info (this serious issue affects GPs & consultants)

12/30 As pointed out at the last consultation - flexibility is simply a pay cut without associated recycling of unused employer costs. Its the wrong solution, at the wrong time. I guarantee it won't work & won't solve the retention crisis.

13/30 Next the committee heard from the SOS and the often quoted figure that 96% of GPs and 98% of consultants not affected. We are pleased the committee saw that the taper tweak has NOT solved the issue as the taper was never the extent of the problem.

14/30 The committee also discussed the issue of "abatement". This affects a lot of nurses and a small number of consultants (with MHO status) - @TheBMA agree entirely that this needs to be permanently extended.

15/30 The committee heard evidence from then SOS Sajid Javid that taper changes were made for everyone “for equality reasons".

I explain in detail why this argument does not stack up in the thread below as tax relief is removed in the NHS 👇

I explain in detail why this argument does not stack up in the thread below as tax relief is removed in the NHS 👇

https://twitter.com/goldstone_tony/status/1538128900051591169?s=20&t=NbCm2F6P8csLxMDXu6W5aA

16/30 But it also doesn't stack up as explained by Vish Sharma from @bma_pensions as exceptions have been made for judges. Furthermore a tax unregistered scheme is fundamentally fair to taxpayers & doctors, and could save @hmtreasury money too. Read more about it here

17/30 Noting the national scandal forcing early retirement / reducing hours, and that taper tweak has "not gone far enough", they stated "urgent action is needed to reform NHS pensions and prevent the haemorrhage of senior staff"

18/30 Crucially they state "Government MUST act swiftly to reform the NHS pension scheme to prevent senior staff from reducing their hours and retiring early from the NHS."

19/30 The @CommonsHealth said government should continue abatement

20/30 .@CommonsHealth said @NHSEngland should to create a national NHS “retire and return” policy and *vitally* "the Government should *INSTRUCT* NHS England to require NHS Trusts to follow pension recycling ♻️ guidance... to help with impact of the pension problem.

21/30 We also note a similar call earlier this week from DDRB who said they "would expect national NHS leadership to take charge" of "recycling♻️of unused employer contributions". @TheBMA have been asking for >3years for government to mandate recycling of the full employers cont.

22/30 We note also @sajidjavid said "make it clear that it is something that we, at the centre, are happy with.... we want to make sure that they understand that they have these flexibilities, and where that is happening, it is certainly helping."

23/30 Recycling ♻️ is a fair option for those forced out of the scheme by punitive pension taxation. It's time to end this postcode lottery and mandate this not only the UK, but in all 4 nations. Different solutions needed to prevent opt outs in low paid.

https://twitter.com/goldstone_tony/status/1529357095879036934?s=20&t=CMbutAeu5D-0JV0bPi4RpA

24/30 Whilst @bma_pensions incredibly grateful to @commonshealth for their report & conclusions, 3 other issues have arisen largely after evidence has been given to the committee - turning this workforce crisis into a workforce *emergency*.

25/30 1️⃣

Rapidly rising CPI means Finance Act isnt operating as intended & no longer measuring growth ABOVE inflation. As per 👇 this will cause v. serious issues in 22/23 unless S235/S234 fixed. See detail in briefing docs below

Rapidly rising CPI means Finance Act isnt operating as intended & no longer measuring growth ABOVE inflation. As per 👇 this will cause v. serious issues in 22/23 unless S235/S234 fixed. See detail in briefing docs below

https://twitter.com/goldstone_tony/status/1543984107109203968?s=20&t=CMbutAeu5D-0JV0bPi4RpA

26/30 2️⃣ Against a back drop of soaring inflation, DDRB thought fit to award doctors with 1%, 2% or 3-4.5% pay uplift, or rather the biggest pay & pension cut in 2 decades. This has serious implications as many consultants better of retiring vs delaying.

https://twitter.com/goldstone_tony/status/1549700813114773506?s=20&t=h4LFK2_7vwWOdnhSABoBCA

27/30 3️⃣ Contrary to prior assurances that the LTA issue would be fixed, the toxic combination of freezing it & high inflation is a potent driver to retirement. There's a *very* close correlation between dropping LTA value and early retirement. LTA is now dropping like a stone.

28/30 We @TheBMA are incredibly grateful to @DrDanPoulter for raising these 3 new issues in parliament a couple of weeks ago. Following this there will be roundtable with @hmtreasury after the recess in September - more details to follow.

https://twitter.com/goldstone_tony/status/1548735054943330307?s=20&t=NbCm2F6P8csLxMDXu6W5aA

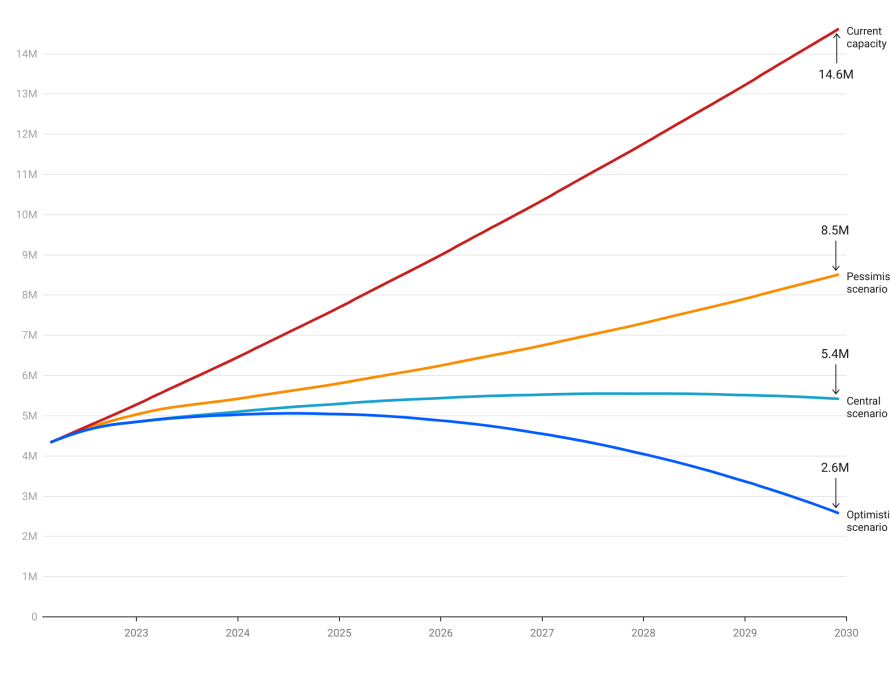

29/30 Whilst a complex issue & a "national scandal" there is a serious risk of unprecedented loss of the senior medical workforce, a loss from which the NHS may never recover.

Complex however, does not mean impossible. @bma_pensions solutions below, in addition to mandated ♻️

Complex however, does not mean impossible. @bma_pensions solutions below, in addition to mandated ♻️

30/30 Time is running out to fix this crisis. Grateful those contending leadership are now least talking about NHS. But *please* be very clear, waiting list going nowhere unless & until punitive pension taxation is fixed. Policy decides this 👇

Pls RT

Pls RT

https://twitter.com/goldstone_tony/status/1550737640760254464?s=20&t=c62lJa7hoyOu8RJ2abRrSA

• • •

Missing some Tweet in this thread? You can try to

force a refresh