Exactly 1 year ago, I bought my Bored Ape and started this Twitter account.

Since then, I've:

- grown from 0 => 20K followers

- advised multiple web3 projects

- started my own web3 projects

Here are my 16 biggest learnings from year 1. 🧵👇

Since then, I've:

- grown from 0 => 20K followers

- advised multiple web3 projects

- started my own web3 projects

Here are my 16 biggest learnings from year 1. 🧵👇

1/20

This 🧵 is for anyone who believes in a web3 future and wants to dive deeper into the space. I cover:

1. Growing a Twitter following

2. Advising a web3 project

3. Creating your own web3 project

4. Trading JPEGs

5. Keeping your sanity

This 🧵 is for anyone who believes in a web3 future and wants to dive deeper into the space. I cover:

1. Growing a Twitter following

2. Advising a web3 project

3. Creating your own web3 project

4. Trading JPEGs

5. Keeping your sanity

2/20

1. GROWING A TWITTER FOLLOWING

Lesson #1: Starting from 0 followers? Buy a NFT with a strong community — your asset is more than just a $$$ investment.

Buying a BAYC helped grow my follower count via #apefollowape which is why I still follow new BAYC accounts today.

1. GROWING A TWITTER FOLLOWING

Lesson #1: Starting from 0 followers? Buy a NFT with a strong community — your asset is more than just a $$$ investment.

Buying a BAYC helped grow my follower count via #apefollowape which is why I still follow new BAYC accounts today.

3/20

Lesson #2: Define your content type + why it'll be valuable.

Just like any good Product Market Fit (PMF) and Founder Market Fit (FMF), Twitter accounts act similarly to startups.

Your content needs to be repeatable and consistent while driving value to your community.

Lesson #2: Define your content type + why it'll be valuable.

Just like any good Product Market Fit (PMF) and Founder Market Fit (FMF), Twitter accounts act similarly to startups.

Your content needs to be repeatable and consistent while driving value to your community.

4/20

Lesson #3: Content is king. Follower count is secondary.

Twitter will often change up their algorithm but the one constant is that good content will surface to the top.

Follower count is really only correlated to the # of people who recognize your username and brand.

Lesson #3: Content is king. Follower count is secondary.

Twitter will often change up their algorithm but the one constant is that good content will surface to the top.

Follower count is really only correlated to the # of people who recognize your username and brand.

5/20

Lesson #4: Build a relationship with your community.

Just like startups, do things that don't scale. This past week, I've DM'ed with 50+ founders and lined up 10+ hrs of calls to give feedback to their product/idea.

Take time to help those who took time to reply to you.

Lesson #4: Build a relationship with your community.

Just like startups, do things that don't scale. This past week, I've DM'ed with 50+ founders and lined up 10+ hrs of calls to give feedback to their product/idea.

Take time to help those who took time to reply to you.

6/20

Lesson #5: Twitter 🧵 and memes are the best forms of content for engagement.

Content should either be educational (🧵) or entertaining (💩 posting). Both have high virality potential on Twitter.

Interested in writing Twitter 🧵? Check out my 🧵👇

Lesson #5: Twitter 🧵 and memes are the best forms of content for engagement.

Content should either be educational (🧵) or entertaining (💩 posting). Both have high virality potential on Twitter.

Interested in writing Twitter 🧵? Check out my 🧵👇

https://twitter.com/azfnft/status/1546995077188296706

7/20

2. ADVISING A WEB3 PROJECT

Lesson #6: There are two ways to find a project to advise:

1. Grow a big enough following with valuable content where projects will reach out to you.

2. Target a specific project and identify ways to provide value (like writing content for them)

2. ADVISING A WEB3 PROJECT

Lesson #6: There are two ways to find a project to advise:

1. Grow a big enough following with valuable content where projects will reach out to you.

2. Target a specific project and identify ways to provide value (like writing content for them)

8/20

Lesson #7: Do a trial run before jumping on as an advisor.

Trial runs help determine fit and align expectations.

Project founders understand more clearly the value you provide, which can increase compensation. You can also evaluate if you believe in the project/team.

Lesson #7: Do a trial run before jumping on as an advisor.

Trial runs help determine fit and align expectations.

Project founders understand more clearly the value you provide, which can increase compensation. You can also evaluate if you believe in the project/team.

9/20

Lesson #8: Be extremely picky about projects you advise.

Your time and energy is limited.

Advising for a project is your bet that with your expertise and network, this project can become a major success.

Ideally, the team are also A+ players who you can learn from too.

Lesson #8: Be extremely picky about projects you advise.

Your time and energy is limited.

Advising for a project is your bet that with your expertise and network, this project can become a major success.

Ideally, the team are also A+ players who you can learn from too.

10/20

3. CREATING YOUR OWN WEB3 PROJECT

Lesson #9: Some ideas are too fickle.

Many web3 ideas solve micro problems based on a rapidly changing meta. Like building on quicksand.

Lesson #10: Find prospective customers first.

Save time by getting feedback before you build.

3. CREATING YOUR OWN WEB3 PROJECT

Lesson #9: Some ideas are too fickle.

Many web3 ideas solve micro problems based on a rapidly changing meta. Like building on quicksand.

Lesson #10: Find prospective customers first.

Save time by getting feedback before you build.

11/20

Lesson #11: Good tech is not enough.

Personal example: My friends and I created a better version of Rarity Tools in Oct 2021. It was faster and had a much sleeker UX/UI. But when I showed projects our demo, they still chose to pay 2ETH for RarityTools.

Why? 👇

Lesson #11: Good tech is not enough.

Personal example: My friends and I created a better version of Rarity Tools in Oct 2021. It was faster and had a much sleeker UX/UI. But when I showed projects our demo, they still chose to pay 2ETH for RarityTools.

Why? 👇

12/20

Rarity Tools at the time was seen as the defacto rarity score the entire community rallied behind.

Plus, founders saw 2ETH as a marketing cost to getting in front of the thousands of people who used Rarity Tools on a day to day basis.

Rarity Tools at the time was seen as the defacto rarity score the entire community rallied behind.

Plus, founders saw 2ETH as a marketing cost to getting in front of the thousands of people who used Rarity Tools on a day to day basis.

13/20

4. TRADING JPEGS

I'm prefacing this section with the fact I'm not a NFT day trader. I hold what I like and rarely do flips.

Lesson #12: Don't take Twitter shills at face value. Read the whitepaper and make your own judgement.

There are a few benefits from this 👇

4. TRADING JPEGS

I'm prefacing this section with the fact I'm not a NFT day trader. I hold what I like and rarely do flips.

Lesson #12: Don't take Twitter shills at face value. Read the whitepaper and make your own judgement.

There are a few benefits from this 👇

14/20

1. You learn about new ways NFT utility is being built.

2. You figure out which Twitter accounts are providing real alpha.

3. You develop your own thesis for trading NFTs.

4. Reading stops you from FOMO behavior.

5. If you do buy, you'll hold with stronger conviction.

1. You learn about new ways NFT utility is being built.

2. You figure out which Twitter accounts are providing real alpha.

3. You develop your own thesis for trading NFTs.

4. Reading stops you from FOMO behavior.

5. If you do buy, you'll hold with stronger conviction.

15/20

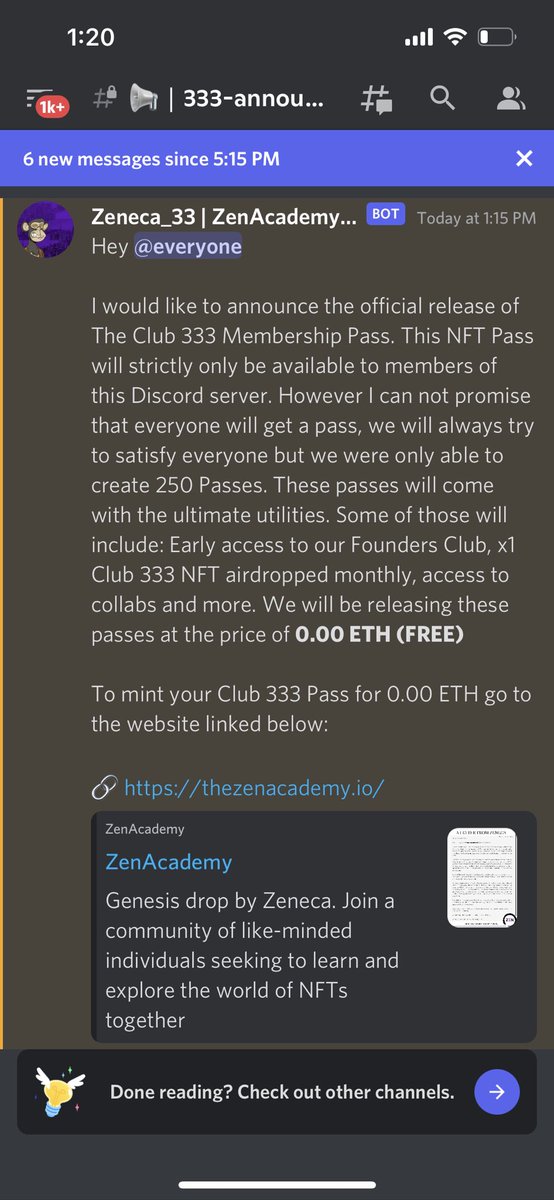

Lesson #13: Buy with utility in mind.

If this token could not be resold, would you be ok with the provided utility?

Ex. I buy passes into strong communities (PROOF, 333Club, Midnight Labs, etc). The community + strong leader makes me certain I can get non-$ value.

Lesson #13: Buy with utility in mind.

If this token could not be resold, would you be ok with the provided utility?

Ex. I buy passes into strong communities (PROOF, 333Club, Midnight Labs, etc). The community + strong leader makes me certain I can get non-$ value.

16/20

5. KEEPING YOUR SANITY

With so much happening in web3, it can feel almost required to be on Twitter/Discord all the time.

Lesson #14: Allocate time to invest in your health.

As GaryVee eloquently put it, "If you're dead, you're out of business."

5. KEEPING YOUR SANITY

With so much happening in web3, it can feel almost required to be on Twitter/Discord all the time.

Lesson #14: Allocate time to invest in your health.

As GaryVee eloquently put it, "If you're dead, you're out of business."

17/20

Lesson #15: Only put money in you can lose, emotionally.

You may be able to survive financially and still pay rent/mortgage/food, but if an even larger crash happens, can you handle it emotionally?

Would you be ok with not selling NFTs for a new car/watch/house?

Lesson #15: Only put money in you can lose, emotionally.

You may be able to survive financially and still pay rent/mortgage/food, but if an even larger crash happens, can you handle it emotionally?

Would you be ok with not selling NFTs for a new car/watch/house?

18/20

Lesson #16: Recognize what your goals are in this space and focus on what you can control.

No one knows what the market will do tomorrow. But you have the accountability and freedom to work on what you want. Go do that and not worry about the rest.

Lesson #16: Recognize what your goals are in this space and focus on what you can control.

No one knows what the market will do tomorrow. But you have the accountability and freedom to work on what you want. Go do that and not worry about the rest.

19/20

SUMMARY

By participating in this web3 community via Twitter, I've been able to level up my writing skills and meet some awesome people.

These lessons were only possible b/c of actions I took and the failures I encountered.

I'm looking forward to year 2 with y'all! 🚀

SUMMARY

By participating in this web3 community via Twitter, I've been able to level up my writing skills and meet some awesome people.

These lessons were only possible b/c of actions I took and the failures I encountered.

I'm looking forward to year 2 with y'all! 🚀

20/20

How long have you been in the web3 Twitter space? What are important lessons you've learned during your time here? Some favorite memories?

Love engaging with everyone 👇

How long have you been in the web3 Twitter space? What are important lessons you've learned during your time here? Some favorite memories?

Love engaging with everyone 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh