1/20 $AMZN 2Q'22 Update

Amazon may be the first and the last ~$1.5 Tn market cap company to report negative Trailing Twelve Months (TTM) FCF (-$23.5 Bn to be exact).

Amazon may be the first and the last ~$1.5 Tn market cap company to report negative Trailing Twelve Months (TTM) FCF (-$23.5 Bn to be exact).

2/20 It is quite incredible how Amazon management gained credibility and earned trust to ride through two of the most secular growth markets for multiple decades: e-commerce and cloud. Competitors must envy Amazon for its lack of burden of posting profits!

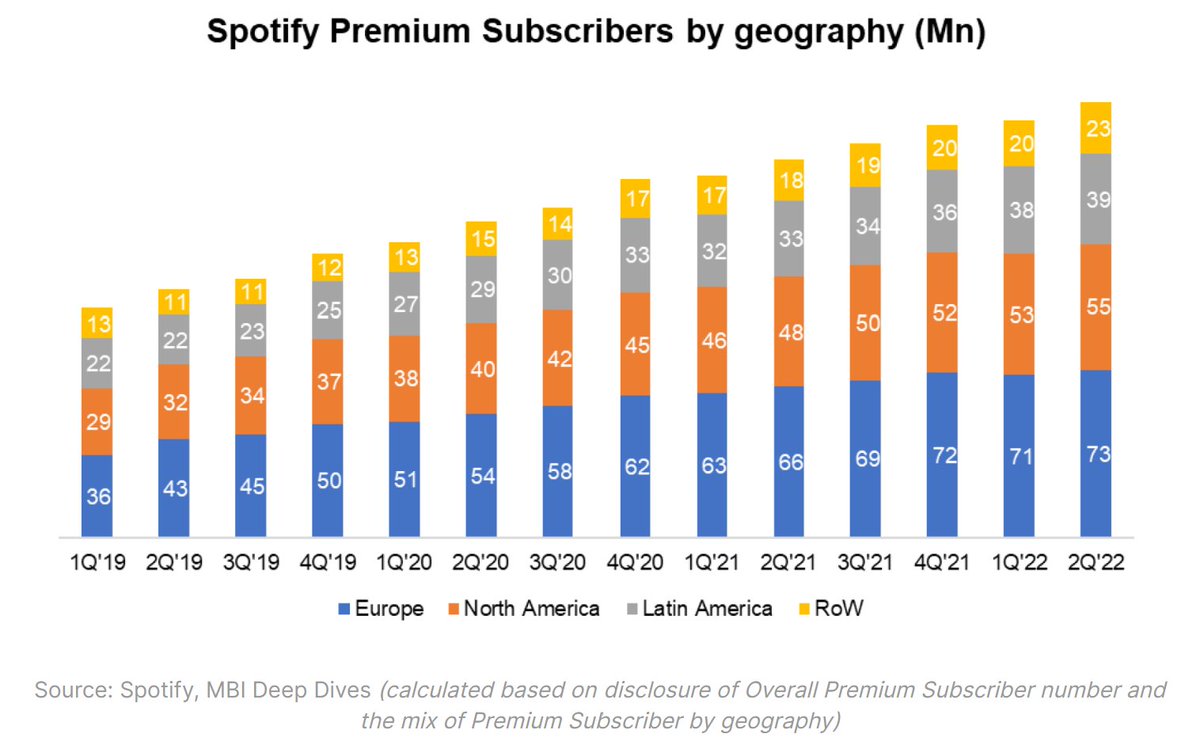

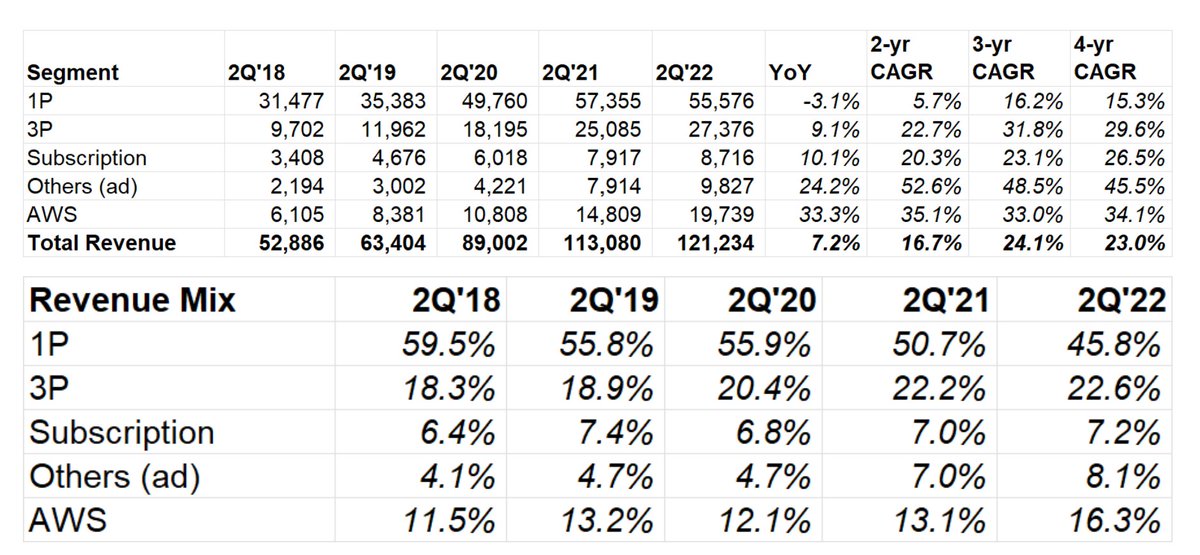

3/20 For the second consecutive quarters, 1P posted negative growth. Revenue mix continues to lean to services as 1P declined from ~60% in 2018 to ~45% in 2022.

AWS maintains >30% growth momentum even in this scale.

~320 bps FX headwind, so revenue growth was +10% FX neutral

AWS maintains >30% growth momentum even in this scale.

~320 bps FX headwind, so revenue growth was +10% FX neutral

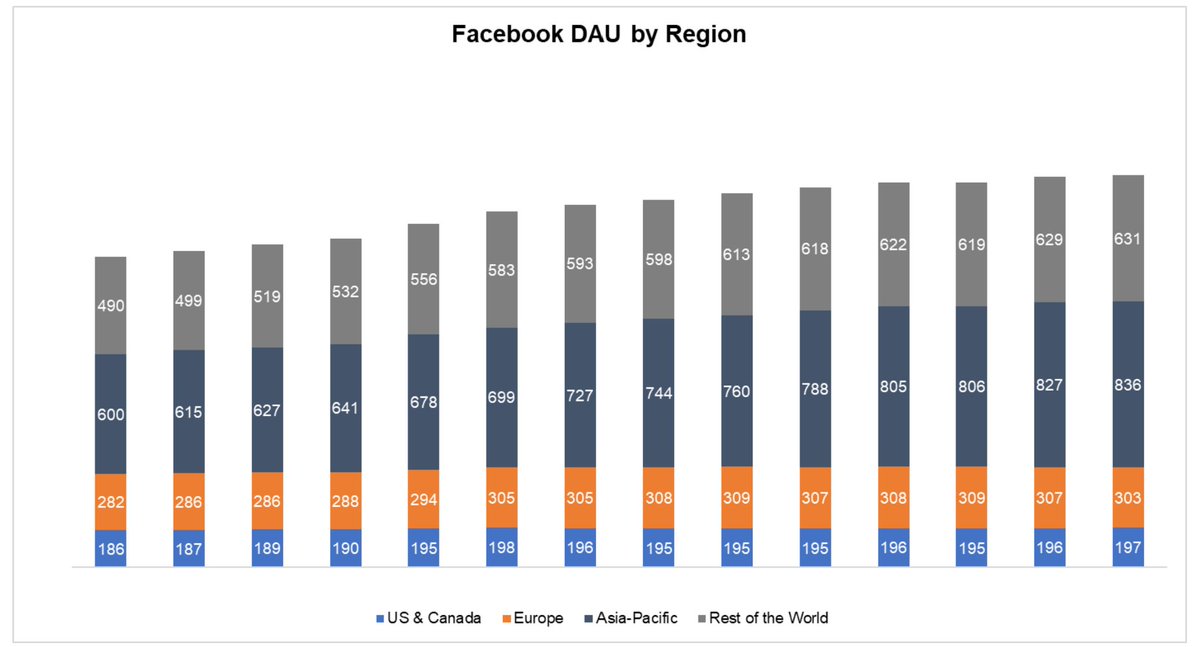

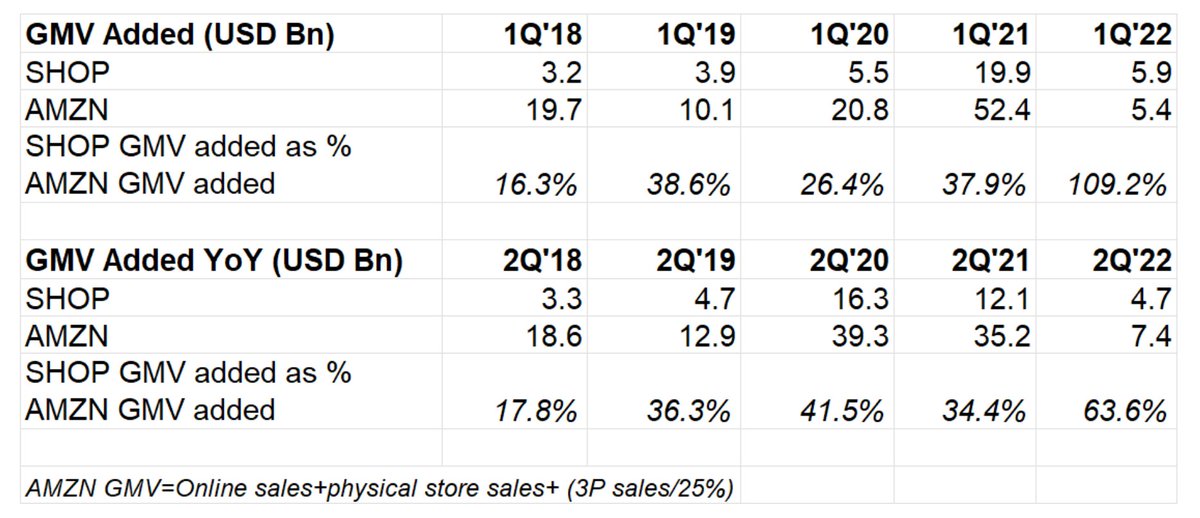

4/20 One metric I like to keep track in e-commerce is Amazon vs Shopify GMV. Shopify again seems impressive in the context of overall reality in e-commerce this year.

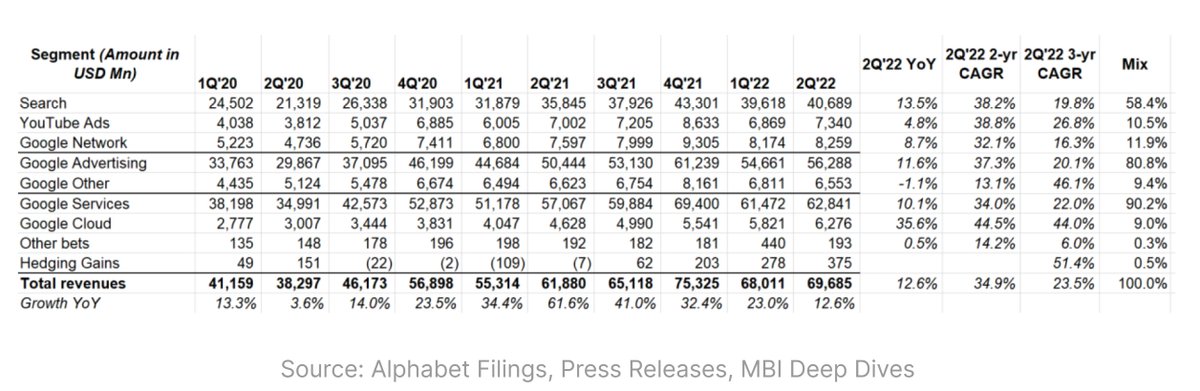

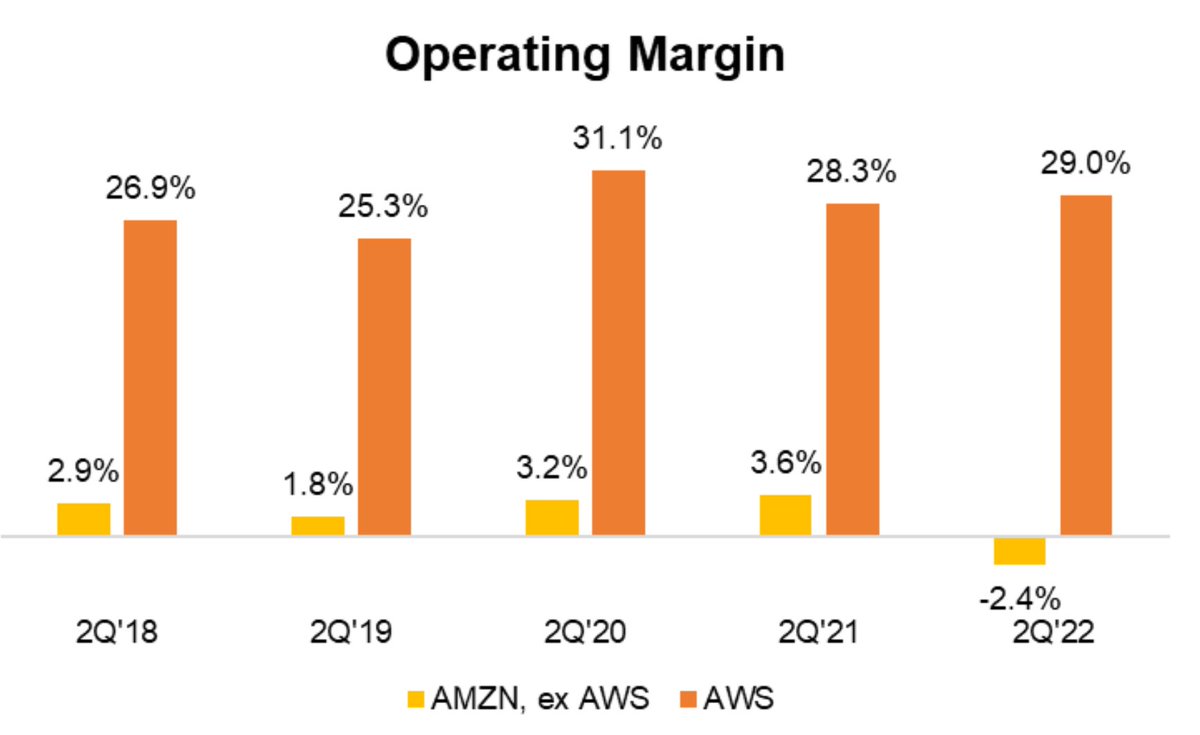

5/20 Operating Margin

For the fourth consecutive quarter, Amazon, ex AWS posted negative operating margin.

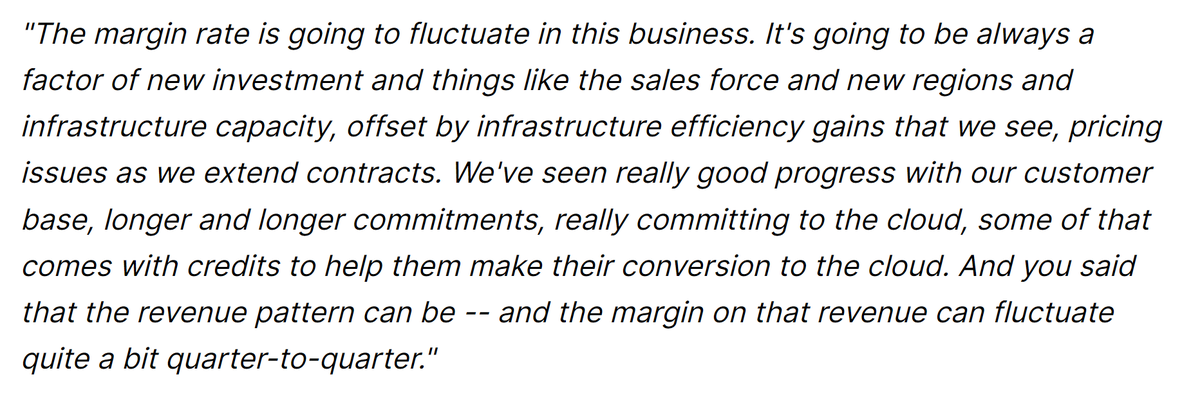

AWS margins fell from 35% in 1Q'22 to 29% in 2Q'22. Why? (see image)

For the fourth consecutive quarter, Amazon, ex AWS posted negative operating margin.

AWS margins fell from 35% in 1Q'22 to 29% in 2Q'22. Why? (see image)

6/20 AWS backlog was +65% YoY in 2Q'22 (vs 68% YoY in 1Q'22).

Weighted avg remaining life of long-term commitments in 2Q'22 was 3.9 years (vs 3.8 years in 1Q'22)

AWS run-rate is $79 Bn and still growing like weed.

Weighted avg remaining life of long-term commitments in 2Q'22 was 3.9 years (vs 3.8 years in 1Q'22)

AWS run-rate is $79 Bn and still growing like weed.

7/20 When AWS had $4.6 Bn revenue in 2014, Bezos wrote in his letter, "I believe AWS is market-size unconstrained."

I remember that sentence every quarter I look at AWS numbers!

I remember that sentence every quarter I look at AWS numbers!

8/20 Retail

"we're not seeing some of the pressures that other people are seeing right now. Our macroeconomic issues are principally on inflation, and we've been pretty transparent on that."

"we're not seeing some of the pressures that other people are seeing right now. Our macroeconomic issues are principally on inflation, and we've been pretty transparent on that."

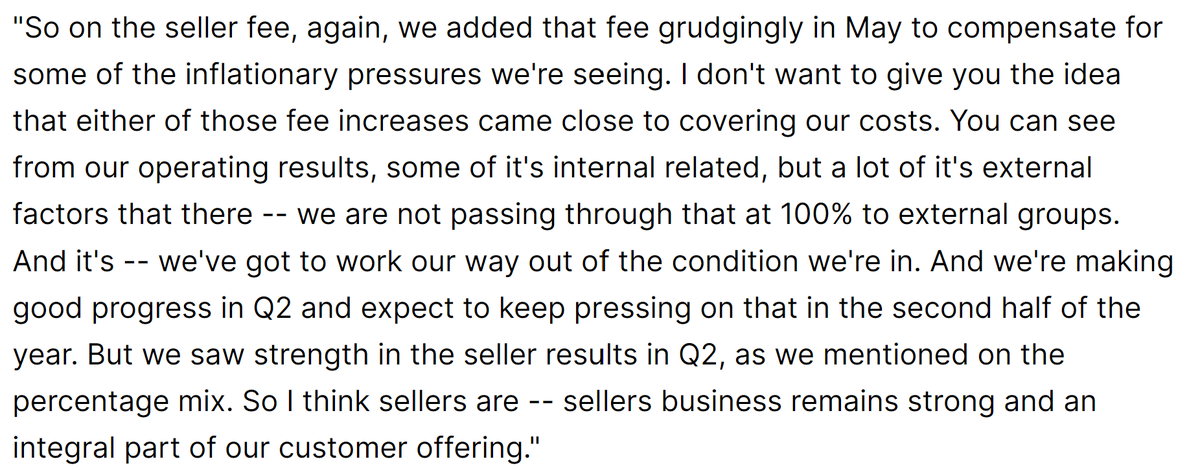

9/20 3P

"Third-party sellers represented 57% of all units sold on Amazon in Q2, the highest percentage ever."

"So on the seller fee, again, we added that fee grudgingly in May to compensate for some of the inflationary pressures we're seeing."

"Third-party sellers represented 57% of all units sold on Amazon in Q2, the highest percentage ever."

"So on the seller fee, again, we added that fee grudgingly in May to compensate for some of the inflationary pressures we're seeing."

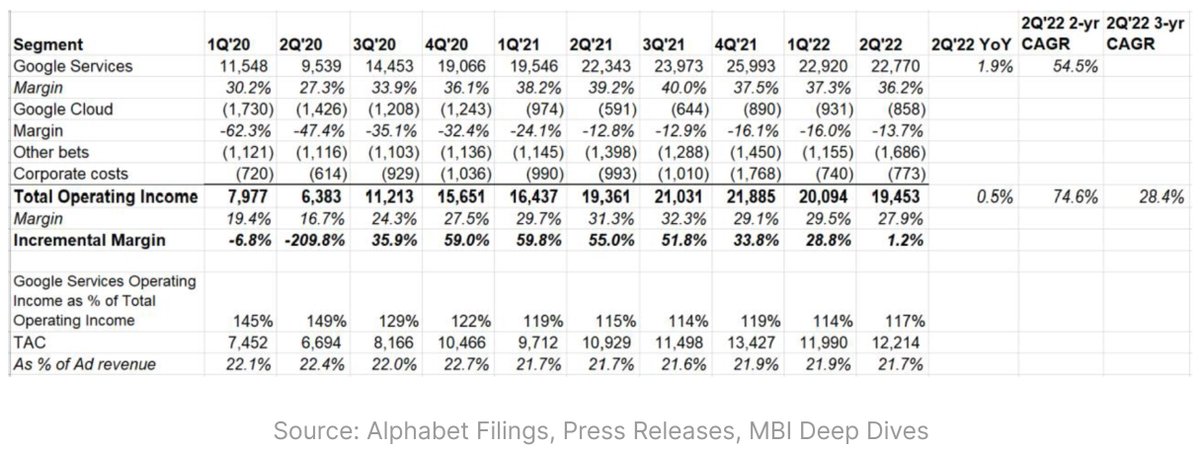

10/20 Advertising

Unlike David Wehner who blamed macroeconomy for soft advertising, Amazon sounds pretty optimistic on ads (Image I)

This sounds intriguing but not smart enough to know whether this is material (Image II)

Unlike David Wehner who blamed macroeconomy for soft advertising, Amazon sounds pretty optimistic on ads (Image I)

This sounds intriguing but not smart enough to know whether this is material (Image II)

11/20 International markets

"..In our established international locations, U.K., Germany, Japan, over time, we've continued to improve the profitability"

"..In our established international locations, U.K., Germany, Japan, over time, we've continued to improve the profitability"

12/20 "In our emerging locations, there's a healthy amount of investment we've done to drive expansion, and we expect to continue to do that given the strong competition across many of these markets."

13/20 Prime

"Prime member membership and retention is still strong. I think that change has been above our expectations positively."

"Prime member membership and retention is still strong. I think that change has been above our expectations positively."

14/20 Expenses

Inflationary costs, fulfillment network productivity and fixed cost deleverage added $4 Bn incremental cost in 2Q'22 (as expected) vs $6 Bn in 1Q'22.

Inflationary costs, fulfillment network productivity and fixed cost deleverage added $4 Bn incremental cost in 2Q'22 (as expected) vs $6 Bn in 1Q'22.

15/20 Capex

In 2021, Amazon spent $60 Bn in capex. 2022 capex will be slightly higher, but the composition of capex will change to more investment in technology infrastructure (50% in '22 vs 40% in '21).

In 2021, Amazon spent $60 Bn in capex. 2022 capex will be slightly higher, but the composition of capex will change to more investment in technology infrastructure (50% in '22 vs 40% in '21).

16/20 Alexa

“Amazon now has over 1 million registered developers, brands, and device makers building with Alexa.”

Also, drone delivery is expected by the end of this year in selected areas

“Amazon now has over 1 million registered developers, brands, and device makers building with Alexa.”

Also, drone delivery is expected by the end of this year in selected areas

17/20 Guidance

3Q'22 topline guidance $125-130 Bn, +13-17%. Pretty impressive guide, but please note Prime Day was in 2Q last year but was in 3Q this year, so slightly easier comp in 3Q'22

3Q'22 topline guidance $125-130 Bn, +13-17%. Pretty impressive guide, but please note Prime Day was in 2Q last year but was in 3Q this year, so slightly easier comp in 3Q'22

18/20 Expects to see $1.5 Bn sequential cost improvement in fulfillment which will be offset by more investment in AWS and Prime content

Operating income guidance for 3Q'22 is $0-3.5 Bn (vs $4.9 Bn in 3Q'21)

Operating income guidance for 3Q'22 is $0-3.5 Bn (vs $4.9 Bn in 3Q'21)

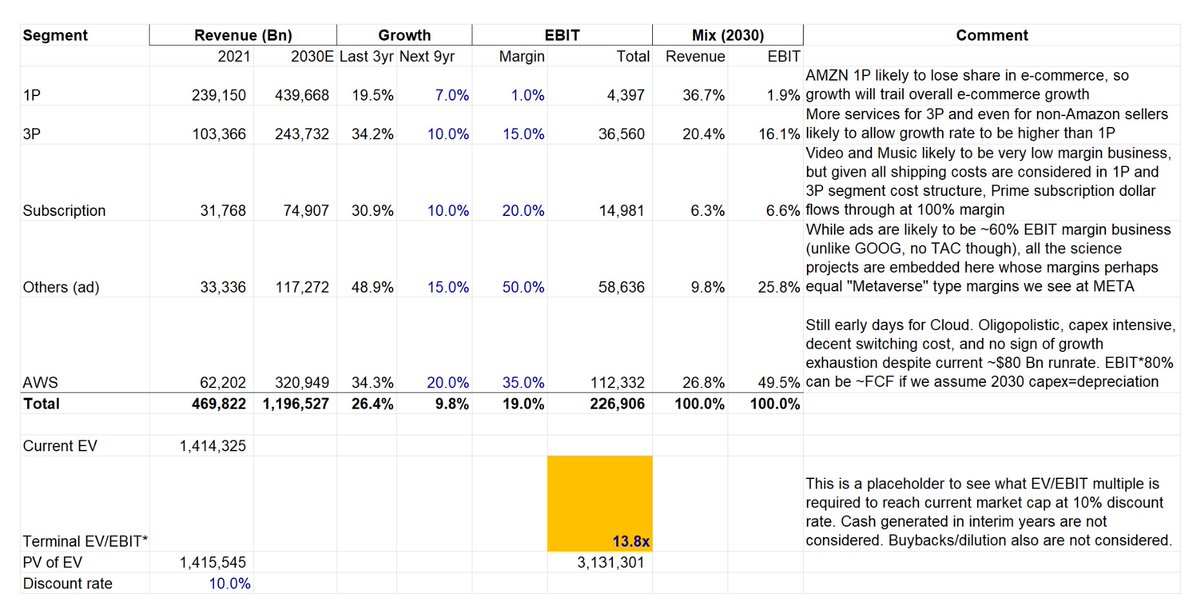

19/20 Valuation

I do this back-of-the-envelope exercise every quarter to see what's embedded. If Amazon can post this EBIT, terminal EBIT multiple required to generate ~10% IRR is <14x (excluding impact from intermittent cash).

I do this back-of-the-envelope exercise every quarter to see what's embedded. If Amazon can post this EBIT, terminal EBIT multiple required to generate ~10% IRR is <14x (excluding impact from intermittent cash).

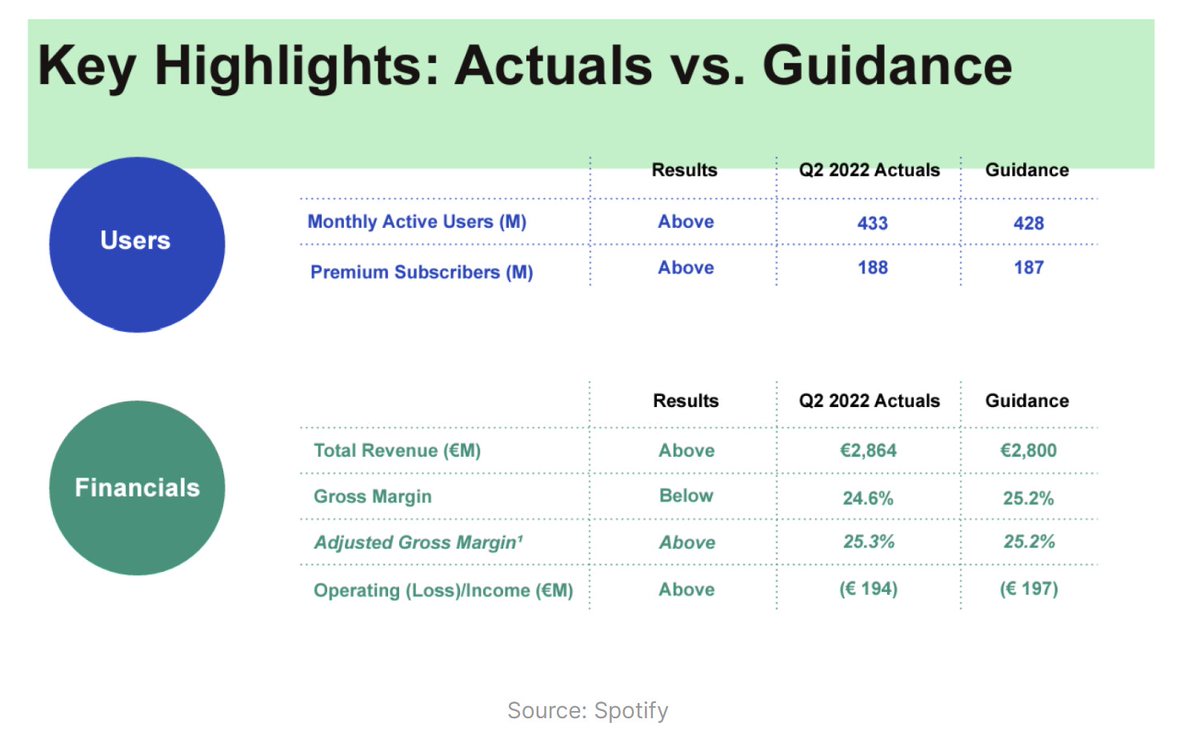

20/20 For context, $META, despite terminal value concerns, currently trade at ~14-15x NTM EV/EBIT.

I will cover $SQ next week! Sign up for here: mbi-deepdives.com

I will cover $SQ next week! Sign up for here: mbi-deepdives.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh