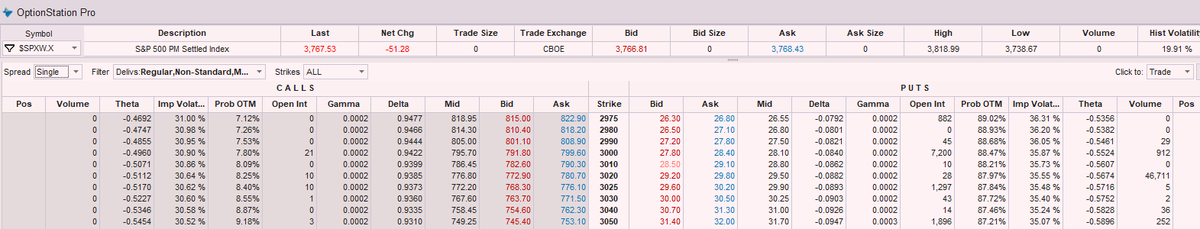

Today is the #JPMorgan July roll. Here is the current structure:

2/x This matters to you and I because there will be a structure change of some magnitude appearing in the SPX PM-settled complex at the end of October. While this is some distance away in time, as we navigate those strikes, we may feel the pressure.

3/ x Best guestimate of the new strikes are as follows:

.

Short 3260P

Long 3870P

Short 4325C

.

This will be for no-cost.

.

Each contract will provide approximately $60,000 of downside protection, and we expect at least 13,000 contracts to be opened for October.

.

Short 3260P

Long 3870P

Short 4325C

.

This will be for no-cost.

.

Each contract will provide approximately $60,000 of downside protection, and we expect at least 13,000 contracts to be opened for October.

5/x .

Here is the delta profile of their new hedge: remember -- this is from JPM's perspective. The Dealer's perspective flips it above the 0-axis (the dealers are on the other side of the trade).

Here is the delta profile of their new hedge: remember -- this is from JPM's perspective. The Dealer's perspective flips it above the 0-axis (the dealers are on the other side of the trade).

6/x This means that for prices below 3870 the dealer will be approaching limit +1 from below, getting longer, so will short as we drop within the market, causing us to move downward.

7/x Here is the gamma profile. Note that gamma exposure for dealers decreases as we drop in price below SPX = 4118 and increases in exposure above this level. Dealers are loathe to sit on high gamma-change areas, as the movement in delta adjustments is significant ...

9/x The actual strikes will be slightly different due to market movement today but this is an educated estimate.

.

JPM normally places this trade around 3 pm ET.

.

JPM normally places this trade around 3 pm ET.

10/x Note that the delta level is indicated to be around 53 into the trade. If 13,000 contracts are placed, we're looking at a notional offset of 13,000 * 0.53 * $4072 * 100 = $2.8B in required adjustment....

11/x This may have a significant movement on dealer flows, depending on positioning, and while this is a smaller hedge, it appears instantly and is a good example of what we call a "dislocation" in the market. This must be absorbed by the market.

12/x Historically, JPM has done a relatively poor job of neutralizing the dislocation, but the details matter. There may be opportunity in this depending on the adjustment methodology.

.

JPM normally approaches this problem in one of two ways:

.

JPM normally approaches this problem in one of two ways:

13/x 1) if any of their roll strikes (the ones expiring today) have any intrinsic value (e.g. deltas are limiting towards -1 or +1, depending on the instrument), JPM often will sell / buy to close the delta-equivalent of those expiring contracts.

14/x They do this at the same time they perform the roll, so the net to the dealers is flat -- AT THE TIME OF THE ROLL.

2) JPM also will buy a deep-in-the-money call, delta = 1, for today's expiry, and the number of contracts will be equivalent to the roll delta. ...

2) JPM also will buy a deep-in-the-money call, delta = 1, for today's expiry, and the number of contracts will be equivalent to the roll delta. ...

15/x What this does is zero the impact of the dislocation to the dealers, again making the roll transparent.

.

The issue here is 2-fold:

.

a) both method 1 and method 2 above terminate today, a Friday.

b) Dealers are still left with the dislocation delta at 4:01 pm ET.

.

The issue here is 2-fold:

.

a) both method 1 and method 2 above terminate today, a Friday.

b) Dealers are still left with the dislocation delta at 4:01 pm ET.

16/16 This dislocation delta and carry time is significant in that we may see some adjustments on Sunday, once the futures market opens.

.

We'll see.

.

We'll see.

• • •

Missing some Tweet in this thread? You can try to

force a refresh