6 months ago I shared my thesis about the incoming "GMX Wars" to celebrate the 10 billy mark

Now at $50B the thesis is turning into reality

GMX has appreciated 50% in ETH terms since then

Maybe fading.exe is not the best strategy now anon?

🧵🧵🧵

Now at $50B the thesis is turning into reality

GMX has appreciated 50% in ETH terms since then

Maybe fading.exe is not the best strategy now anon?

🧵🧵🧵

https://twitter.com/Mark2work/status/1482737497587261443

1. The bull case for any coin is pretty simple as the chad @Ninjascalp shows

Having more buying than selling = numba go up

Token needs to be more attractive for holding than the selling pressure it will face

Being attractive not always equals utility

Having more buying than selling = numba go up

Token needs to be more attractive for holding than the selling pressure it will face

Being attractive not always equals utility

https://twitter.com/Ninjascalp/status/1552331743289556994?s=20&t=1VJSQt02TGl_fY_cyjxGDQ

2. But in the case of $GMX we will make them equal to be fundamentally based

These were and still are the main levers for proving utility in GMX

They need to be profitable enough (directly or indirectly) to offset the extra supply hitting the market

These were and still are the main levers for proving utility in GMX

They need to be profitable enough (directly or indirectly) to offset the extra supply hitting the market

https://twitter.com/Mark2work/status/1482737531296927746?s=20&t=ecWDksKzwMv1Ul9hW1tbLg

3. All of these levers have increased their potential power bigly in these last months

When fee discounts are introduced I expect most of the projects building on top of GMX to grab a big stack to lower their operational costs and thus net a bigger profit

When fee discounts are introduced I expect most of the projects building on top of GMX to grab a big stack to lower their operational costs and thus net a bigger profit

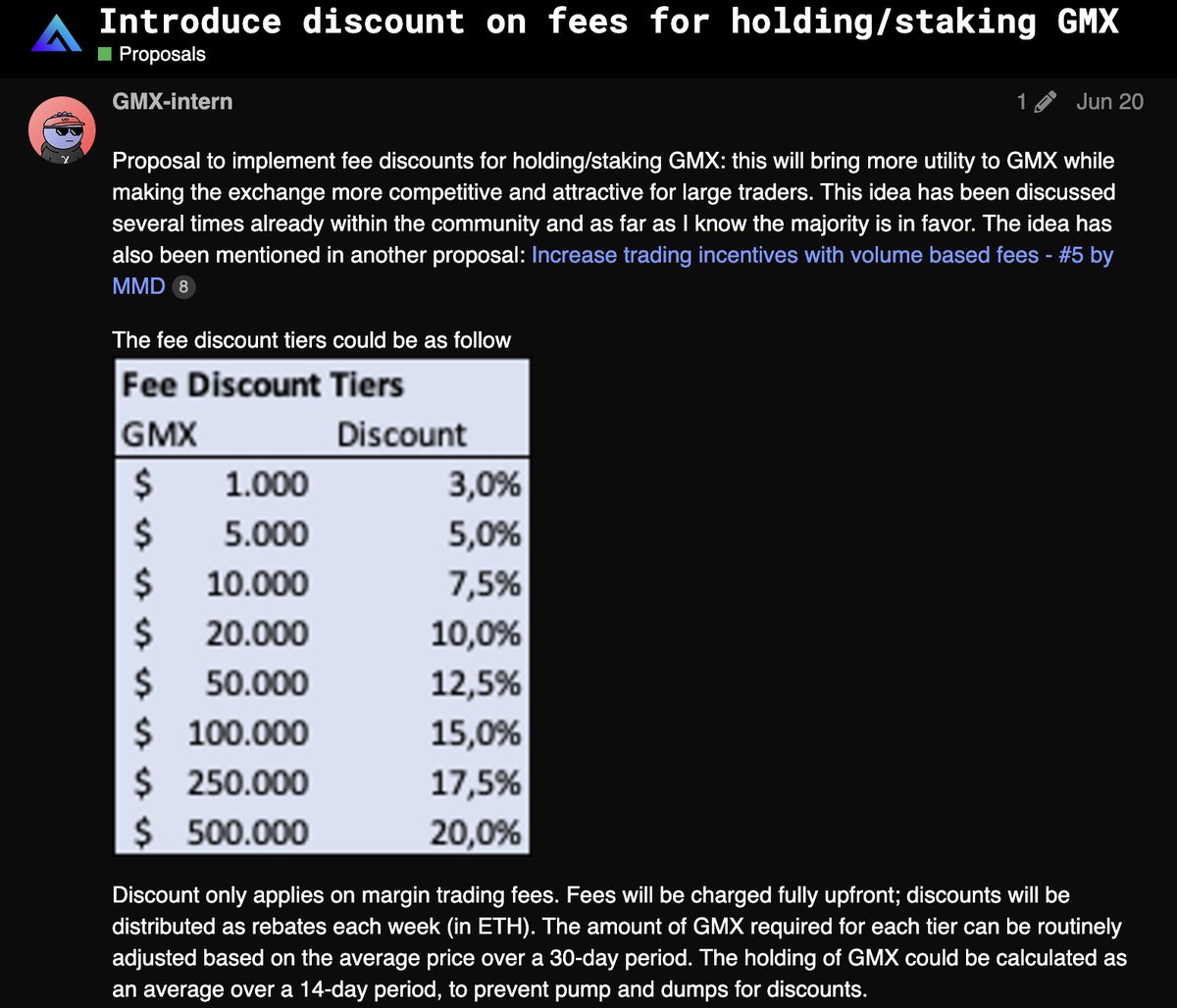

4. The proposal from @cryp_growth is still being discussed here

Using some rough math, we can see that having 10 people/projects aiming for the max 20% means a buying pressure of 5M$

Not much right?

Well, thats 15% of the circ supply not staked

gov.gmx.io/t/introduce-di…

Using some rough math, we can see that having 10 people/projects aiming for the max 20% means a buying pressure of 5M$

Not much right?

Well, thats 15% of the circ supply not staked

gov.gmx.io/t/introduce-di…

5. So its really big considering we have been extremely conservative (that demand could well be x5-x10)

Fundamentals & adoption of the protocol has improved a lot in this period

Big whales consistently trading with +10M$ so buying the demanded GMX would be +EV for them

Fundamentals & adoption of the protocol has improved a lot in this period

Big whales consistently trading with +10M$ so buying the demanded GMX would be +EV for them

6. Protocol adoption has been even bigger and at least 10 protocols are using GMX as base layer to increase their functionality

@dopex_io @PremiaFinance @UmamiFinance @STFX_IO @rage_trade are just some of the examples

I expect this trend to continue further in the next months

@dopex_io @PremiaFinance @UmamiFinance @STFX_IO @rage_trade are just some of the examples

I expect this trend to continue further in the next months

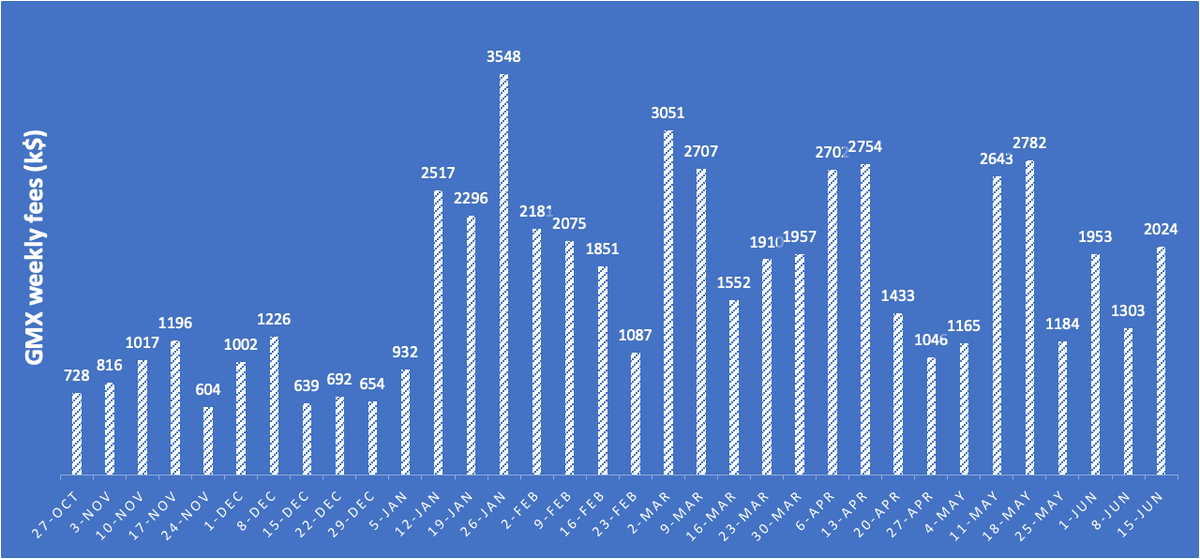

7. Second lever is the fee distribution among stakers

It has consistently keep growing in ETH terms even with the market turmoil

Most likely it will grow faster with synthetics deployment (1-2 months)

At least a x2 is feasible in the short term

It has consistently keep growing in ETH terms even with the market turmoil

Most likely it will grow faster with synthetics deployment (1-2 months)

At least a x2 is feasible in the short term

https://twitter.com/Mark2work/status/1538905293031149571?s=20&t=m0hOW32ifd-SoKs7EDZ4sg

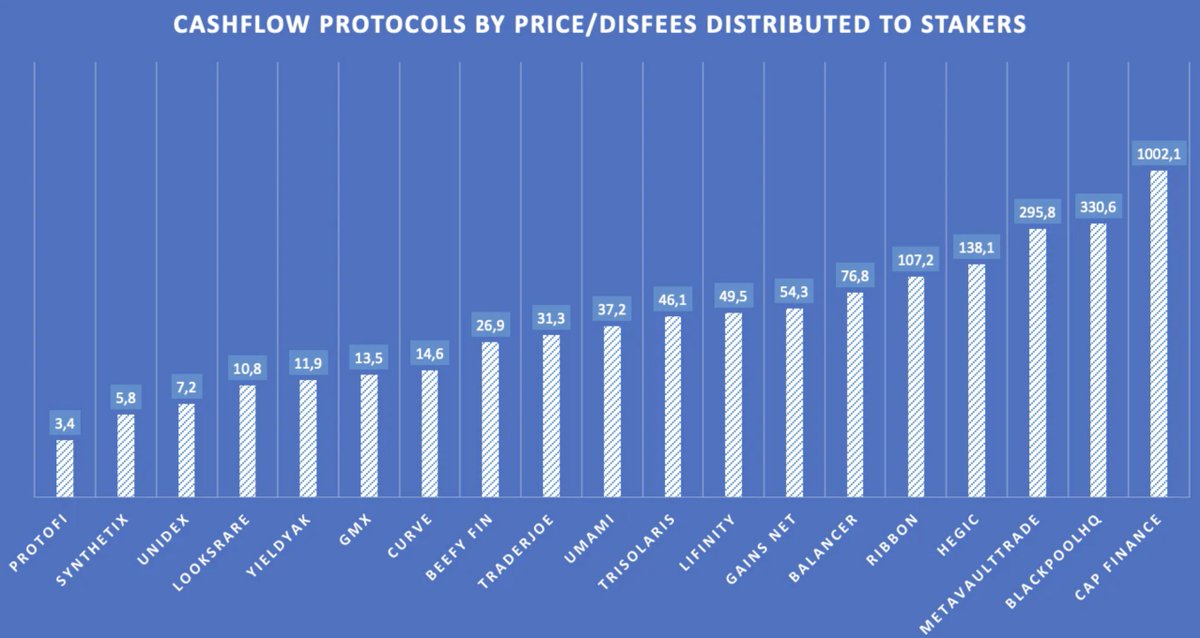

8. Players will probably submit to the #realyield narrative and seek yields within one of the protocols with a lower P/E ratio

mirror.xyz/0x6D2BcfEFb7CF…

mirror.xyz/0x6D2BcfEFb7CF…

9. DAO voting power is the last lever

GLP model imposed some restrictions to include new trading pairs

Synthetics deployment will make it way easier and allow to potentially list up to 48 crypto/forex pairs both in Arbitrum & Avalanche

data.chain.link/arbitrum/mainn…

GLP model imposed some restrictions to include new trading pairs

Synthetics deployment will make it way easier and allow to potentially list up to 48 crypto/forex pairs both in Arbitrum & Avalanche

data.chain.link/arbitrum/mainn…

10. This is something submitted to voting

Some projects might be directly impacted by which pairs are running and thus might want to have a big voting power to influence including them

@STFX_IO or @rage_trade to be able to offer more pairs to their traders for example

Some projects might be directly impacted by which pairs are running and thus might want to have a big voting power to influence including them

@STFX_IO or @rage_trade to be able to offer more pairs to their traders for example

11. Looks like everything is pretty bullish on the demand side right?

What about the offer?

Its even more bullish, check this to grasp the full picture

What about the offer?

Its even more bullish, check this to grasp the full picture

https://twitter.com/Mark2work/status/1482737554151587841?s=20&t=GgZ8j12zYOLvA--6tmwq2A

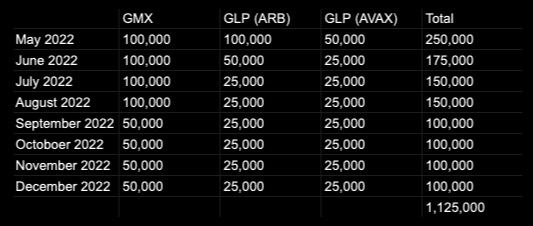

12. Long story short, only 550k esGMX will hit the market with current liquidity mining program

This means that there is only a 5,4% of the supply yet to hit the market due to LM

I expect some more to bootstrap liquidity in ZkSync on launch, but nothing too big

This means that there is only a 5,4% of the supply yet to hit the market due to LM

I expect some more to bootstrap liquidity in ZkSync on launch, but nothing too big

13. Currently the numbers look like this:

GMX + esGMX circ supply = 10,1M

GMX + esGMX total supply = 13,25M

Difference is 3,15M tokens

2M sit on the treasury and most likely will not ever hit the market

1M tokens dedicated to marketing are being gradually released

GMX + esGMX circ supply = 10,1M

GMX + esGMX total supply = 13,25M

Difference is 3,15M tokens

2M sit on the treasury and most likely will not ever hit the market

1M tokens dedicated to marketing are being gradually released

14. The conservative scenario is that 1,15M tokens will be released in the long run (treasury will likely not be needed)

1,15/10,1 = 11,3% tokens still to be released

This is extremely low and its not even accounting for the fact that most of these tokens are esGMX

1,15/10,1 = 11,3% tokens still to be released

This is extremely low and its not even accounting for the fact that most of these tokens are esGMX

15. That is right

22% of the total 10,1M are esGMX and not sellable

66% of the esGMX are currently staked and probably will not be vested anytime soon (esGMX tokens are not liquid)

1,15M esGMX to hit the market in the long run

Still talking about selling pressure anon?

22% of the total 10,1M are esGMX and not sellable

66% of the esGMX are currently staked and probably will not be vested anytime soon (esGMX tokens are not liquid)

1,15M esGMX to hit the market in the long run

Still talking about selling pressure anon?

16. All of this explains why GMX has been one of the best performing assets last months

Market is reacting to the fact that there are very few tokens left

Powerful real yield bearing tokens

Fade at your own discretion :)

Market is reacting to the fact that there are very few tokens left

Powerful real yield bearing tokens

Fade at your own discretion :)

https://twitter.com/0xroborosCap/status/1552517671916171268?s=20&t=JfneI4EKmV8LA4KQc24T4A

17. Final remarks

-NFA/DYOR

-Avoid FOMO

-Thanks for reading

-Ask in the GMX official group if you have any questions

t.me/GMX_IO

-NFA/DYOR

-Avoid FOMO

-Thanks for reading

-Ask in the GMX official group if you have any questions

t.me/GMX_IO

18. Few chads that deliver sound info about $GMX

- @crypto_condom

- @cryp_growth

- @rektdiomedes

- @tanoeth

- @APP0D14L

- @Riley_gmi

- @DeFiSurfer808

- @TheDeFinvestor

- @crypto_condom

- @cryp_growth

- @rektdiomedes

- @tanoeth

- @APP0D14L

- @Riley_gmi

- @DeFiSurfer808

- @TheDeFinvestor

19. Start of the thread :)

https://twitter.com/Mark2work/status/1552989638259785728?s=20&t=8i-AUQMnzho52tMMP4QyHQ

20.

Feel free to use my referral code if you want to operate with a 10% discount on fees

gmx.io/#/?ref=Gmxtrad…

Feel free to use my referral code if you want to operate with a 10% discount on fees

gmx.io/#/?ref=Gmxtrad…

• • •

Missing some Tweet in this thread? You can try to

force a refresh