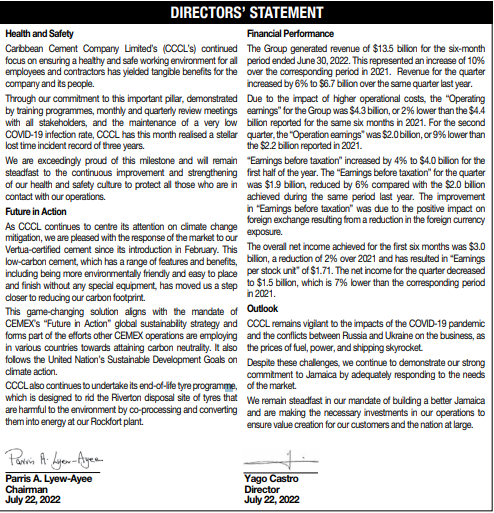

Caribbean Cement Company Limited, $CCC.ja, recently released its Q2 earnings. Here's a #SOTRSummary:

-Revenues ⬆️5.7%

- Operating Earnings 🔻8.6%

-Net Income 🔻7.2%

The reduction in income was due to an increase in overall expenses.

-Revenues ⬆️5.7%

- Operating Earnings 🔻8.6%

-Net Income 🔻7.2%

The reduction in income was due to an increase in overall expenses.

Lower net profits were driven largely by an increase in the cost of raw materials, fuel, and electricity. This increase is due to gas prices being much higher for this quarter than they were for the same quarter last year. Same for the hard inputs for cement.

Note the royalty and service fees that have started to accrue. This likely consist mostly of the well-discussed fee that is now being charged by CEMEX.

CCC's balance sheet continues to grow well and remains strong. Liabilities are falling while assets are growing alongside its retained income.

Debt to Equity is now below 10% as most of its liabilities are from payables and deferred taxes.

Debt to Equity is now below 10% as most of its liabilities are from payables and deferred taxes.

At a price of 63.02, the stock is now trading at a

PE of 12.5x.

$CCC.ja has traded down from a high 118+ late last year, a 47% drop.

PE of 12.5x.

$CCC.ja has traded down from a high 118+ late last year, a 47% drop.

• • •

Missing some Tweet in this thread? You can try to

force a refresh