One on One Educational Services released their IPO prospectus yesterday. Here's a #SOTRSummary:

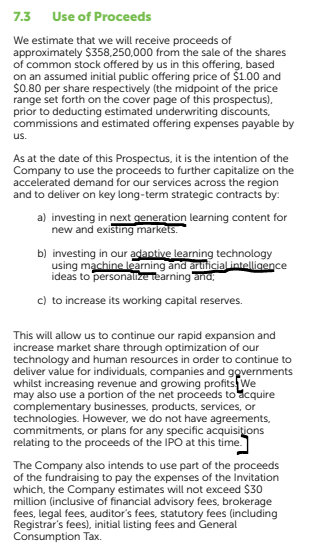

-looking to raise 358M

-Opens August 12, Closes August 19

-Each share will cost 1.00 outside of the conversion shares for 0.80

-looking to raise 358M

-Opens August 12, Closes August 19

-Each share will cost 1.00 outside of the conversion shares for 0.80

Different investors will have access to different pools of shares.

There is also a special pool of shares reserved for just teachers and trainers. 👏👏

The only pool to get a discount on the share price is the convertible loan holders who buy at 0.80 (more on this later).

There is also a special pool of shares reserved for just teachers and trainers. 👏👏

The only pool to get a discount on the share price is the convertible loan holders who buy at 0.80 (more on this later).

One on One started in 2013 with just 2 people. they now have a fully remote team of 70 people. More details on the businesses' timeline below:

The business provided the overview below Of note here is mention of their Classroom-in-a-Box, which, as described, should be game-changing, especially in reaching any student in any community anywhere. Looking forward to hearing more.

The company went further to detail the products that it offers. We note that OneX is slated to launch in Q3, however as @ricardodallen mentioned at #SOTR tonight, the product offerings are skewed towards business customers.

We note as well that in Sept 2021, the company acquired 100% of Spark Online, founded by @BrittSinghWill. The article stated the company's intention to extend its offerings to individuals (OneX).

jamaicaobserver.com/career-educati…

jamaicaobserver.com/career-educati…

Whew. Break time. While you're here, please subscribe to our social media channels (we will be engaging @ricardodallen and his team more over the next few weeks).

linktr.ee/stocksontheroc…

linktr.ee/stocksontheroc…

This is the shareholding of the company pre-IPO. Note that Ricardo still owns a majority of the company (28%).

Pos-IPO, Ricardo's holdings will be 23%. A smaller part of a bigger pie.

Pos-IPO, Ricardo's holdings will be 23%. A smaller part of a bigger pie.

Quick Fact (courtesy of @JCKNIGHT2 ):

-contingent on a successful raise, One on One will be the 100th company currently listed on the market.

One, One Hundred? Seems planned to us. lol

-contingent on a successful raise, One on One will be the 100th company currently listed on the market.

One, One Hundred? Seems planned to us. lol

We found it interesting that the company has key man insurance of US$1M. This identifies that Ricardo (most likely) is key to operations and this helps to mitigate that risk in an unfortunate scenario. Good that this is in place.

The board is led by Mr. Bernard, who also leads the JC board 😎. It is broad and has experts in the orange economy, capital markets, and education. It is mentored by Mr Douglas Orane himself.

Lots to say but please check the prospectus for more details on the management team.

Lots to say but please check the prospectus for more details on the management team.

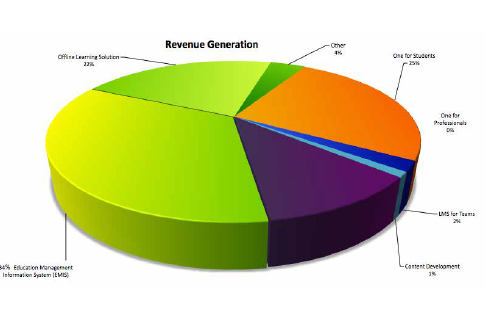

The company also provided details of its business model. Note that they expect to make almost US$1M from the OneX and One for professionals products alone for 2023.

They stated that the growth prospects for this is "very high".

They stated that the growth prospects for this is "very high".

Subscribe to our YouTube channel here: youtube.com/channel/UCtqZV…

A key note here is that the company will not be earning development fees from current deals, mostly service fees going forward.

What % of this EMIS income does this development fee account for and what will replace it in 2023?

What % of this EMIS income does this development fee account for and what will replace it in 2023?

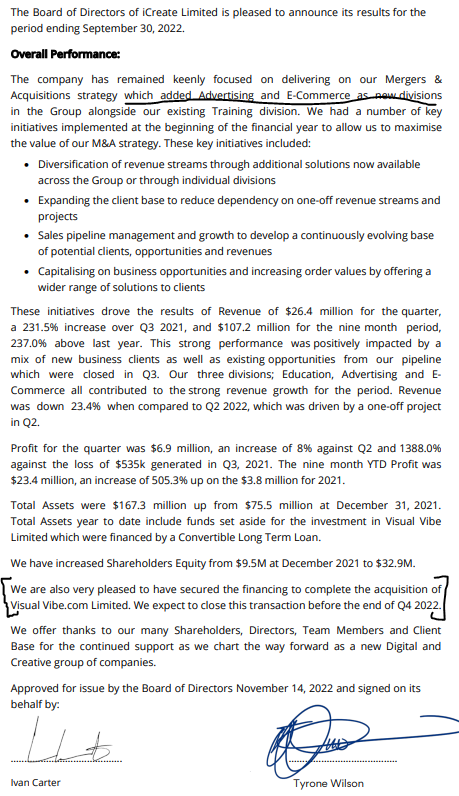

High level:

-269M in sales, ⬆️92%

-69M in profits before taxes (PBT), ⬆️19%

-net losses made in 2 of the last 5 years

-327M in assets with 100M in equity, soon to be 400M+

-positive operating cash

-269M in sales, ⬆️92%

-69M in profits before taxes (PBT), ⬆️19%

-net losses made in 2 of the last 5 years

-327M in assets with 100M in equity, soon to be 400M+

-positive operating cash

-84% gross margin with a 26% profit before tax margin

-67% return on equity which is very high

-21% return on assets, also high, and good.

Much more detail was provided in the prospectus. Please read it.

-67% return on equity which is very high

-21% return on assets, also high, and good.

Much more detail was provided in the prospectus. Please read it.

Join our telegram group at this link: t.me/sotrcommunity

The company provided year-to-date financials as well. As at May 2022:

-Revenue ⬆️24%

-PBT ⬆️230%

Using the full amount of shares post-listing and the trailing PBT of 103M and the listing price of 1, the listing PE is 18.5x and 18.1x when the projected 2022 PBT is used.

-Revenue ⬆️24%

-PBT ⬆️230%

Using the full amount of shares post-listing and the trailing PBT of 103M and the listing price of 1, the listing PE is 18.5x and 18.1x when the projected 2022 PBT is used.

At this point, I think we can see what the ticker for the company will be, but let's do a poll. What do you think the One on One ticker should be?

Let's continue. Su done man. Hold on.

The company also provided projected earnings for the next 3 years. Please see below. More details and the assumptions supporting this are in the prospectus.

The company also provided projected earnings for the next 3 years. Please see below. More details and the assumptions supporting this are in the prospectus.

See a list of the company's material contracts. It would've been good to see the value of each contract as well.

We have highlighted those contracts that are slated to expire in 2022.

We have highlighted those contracts that are slated to expire in 2022.

Remember, all forms of investments come with some form of risk, please see a list of such risks for this IPO listed below. Please read.

After discussing whether this is a good investment for you with your licensed financial advisor, please see details on the application process below.

Remember. Treat the open date as the close date if you do intend to invest.

Remember. Treat the open date as the close date if you do intend to invest.

Thanks for staying with us.

please share this thread with anyone that wants to get more information on this new IPO.

Bless 🙏🏾

please share this thread with anyone that wants to get more information on this new IPO.

Bless 🙏🏾

• • •

Missing some Tweet in this thread? You can try to

force a refresh