The first countertrend rally in The Bear always take us to a max stupid point. It becomes an echo of the prior top.

Cloudbear calls this the All Clear Echo. 🧵

Spoiler - This is why you are seeing HKD happen 18mths after GME/Spac madness.

1/15

Cloudbear calls this the All Clear Echo. 🧵

Spoiler - This is why you are seeing HKD happen 18mths after GME/Spac madness.

1/15

In 2008, after Bear Stearns, we bounced into May and came within a few % of the highs. At that lower high, the relief was palpable, and I remember PMs telling me that BSC was the sacrificial lamb because they hadn’t played ball back in 1998 and didn’t bail out LTCM…

2/

2/

…with the other banks so the Fed punished them and let them fail - “not in the Club.” With BSC shot, the system was cleansed and the market could move on. I had that conversation at least five different times, and still recall with whom I spoke on it 14 years later!

3/

3/

Four months later the system fell apart, everyone was reading Irving Fisher, and people were talking about a new Great Depression.

4/

4/

Let’s go back farther to 2000. Most on here weren’t around then, but we all see the Nasdaq retail blowoff parabola in March 2000. What people don’t remember, because they weren’t there, is that while the Naz collapsed, Dow & SPX chopped wood for another 6mths to Sept00…

5/

5/

…AND YET many mania stocks went on ANOTHER incredible run just to kill the pros who didn’t take the summer off like Druck, and shorts got run TF over in 3Q00. I will give you an example but there were countless stocks like this in my fuking life back then:

6/

6/

Juniper Networks - JNPR. Ipo’d June 1999 at $5. Peaked at $125 in March 2000. By May it was at $60. Game over right? Wrong. Fuking WRONG. By October it was at $200. GOOD NIGHT SHORTS.

6mths later it was $25. A year later, right after 9/11, it was below $10… -95% in 1yr.

7/

6mths later it was $25. A year later, right after 9/11, it was below $10… -95% in 1yr.

7/

If you traded JNPR perfectly back then I call you a liar. Full stop. This stock to this day, 22 years later, still defines for me what I call the All Clear Echo and what constitutes MAX STUPID.

8/

8/

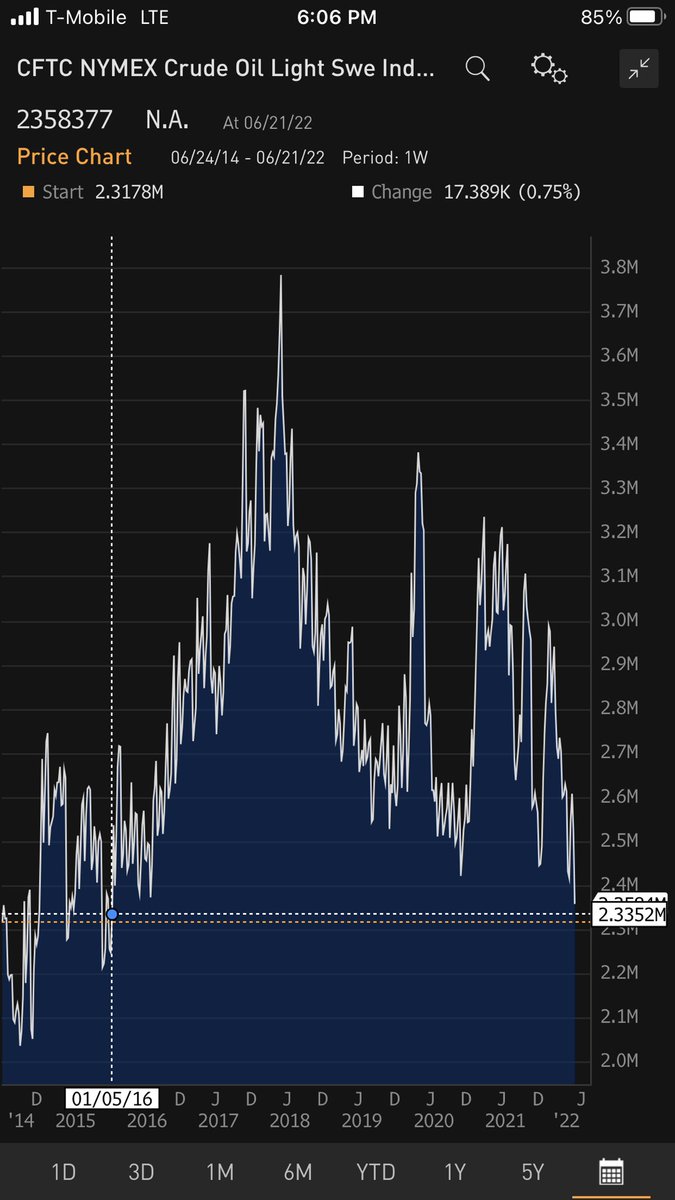

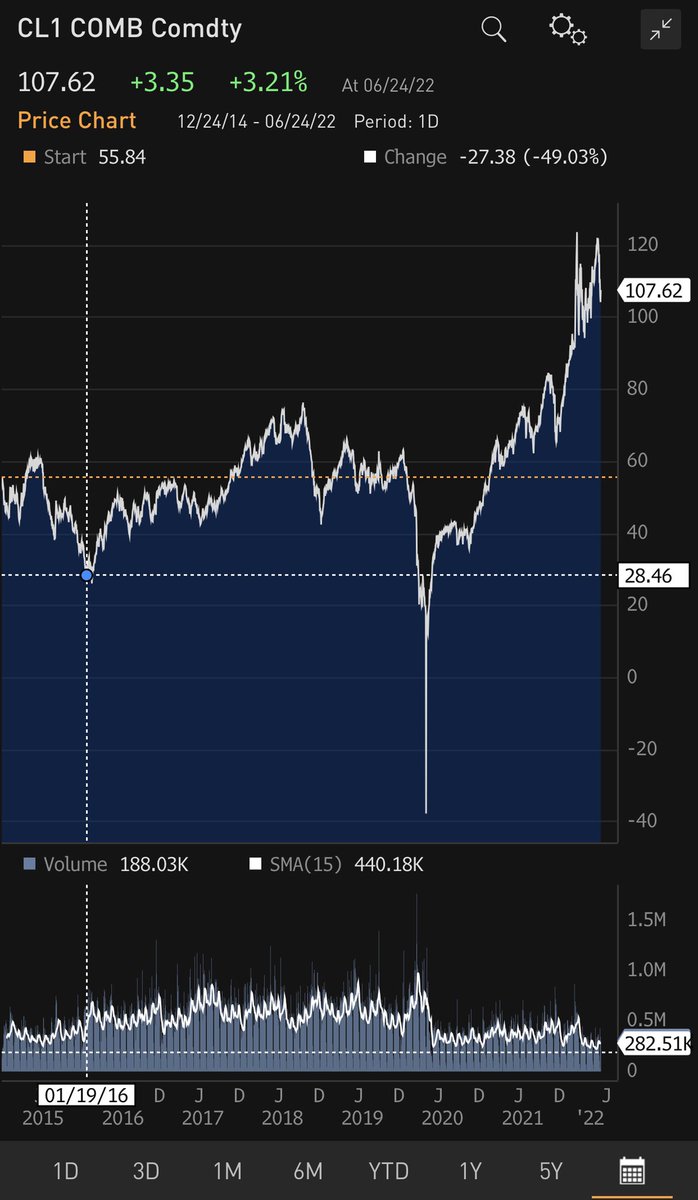

Back to today. Everything comes down to positioning. Too many managers are down YTD in an illiquid period for this market to suddenly buckle (without something truly horrendous hitting it).

9/

9/

I tend to think we need to go max stupid to complete the All Clear Echo. We almost *have* to go Max Stupid, because of the degree of recent years of excess, from centimillion dollar painting auctions to trillions thrown away in pure ponzi “bits in the sky.”

10/

10/

https://twitter.com/PauloMacro/status/1554993737918545928

I mean, an echo of the biggest bubble in modern history itself needs to be fuking EPIC right? Am I wrong? Stands to reason no?

11/

11/

So what are the sorts of things we could see to achieve Max Stupid? I will throw this question out to you. I want to hear back here, but I am not looking for wild predictions for wildness’ sake. Like JNPR in 2000, it needs to TIE BACK to the bubble, something the mob gets…

12/

12/

…in their teeth one last time, that leaves seasoned pros shaking their heads for a few weeks or months like Cartman here:

13/

13/

My own thoughts? Three years ago after abandoning TSLAQ, I said the madness would have to go see the headline “Elon is the world’s richest man.”

An Echo of that insanity would be TSLA becoming - even briefly - the world’s most valuable company.

Never happen right?

14/

An Echo of that insanity would be TSLA becoming - even briefly - the world’s most valuable company.

Never happen right?

14/

The future history books are literally screaming at us to go “see” this headline. A fraudulent histrionic narcissist became the world’s richest man, will run the world’s biggest ponzi - why not?

Think of what came before leading up to this.

Beware Max Stupid.

/FIN

Think of what came before leading up to this.

Beware Max Stupid.

/FIN

Ps - I will give you guys a 1999-2002 chart of Juniper so you know what I am talking about. This not only happened, it happened to more names than I can remember.

BEWARE MAX STUPID guys, I am telling you the odds are higher than you think that we go full stupid in a few corners

BEWARE MAX STUPID guys, I am telling you the odds are higher than you think that we go full stupid in a few corners

• • •

Missing some Tweet in this thread? You can try to

force a refresh