💊🔬🩸

Medtech and biotechnology benefit from key secular growth trends.

📈📊💵

An aging population, new innovative therapies and increasing testing requirements, some businesses with be able to grow profits for a long time.

This thread will focus on a few beneficiaries

🧵

👇👇

Medtech and biotechnology benefit from key secular growth trends.

📈📊💵

An aging population, new innovative therapies and increasing testing requirements, some businesses with be able to grow profits for a long time.

This thread will focus on a few beneficiaries

🧵

👇👇

$MEDI Medistim 🇳🇴

📊Sales CAGR: 10%

📈EBIT Margin: 25%

💰ROIC: 28%

Medistim provides medical imaging technology for heart surgeries. It benefits from a strong market position and its solutions are growing in popularity in the US.

📊Sales CAGR: 10%

📈EBIT Margin: 25%

💰ROIC: 28%

Medistim provides medical imaging technology for heart surgeries. It benefits from a strong market position and its solutions are growing in popularity in the US.

$ATRC AtriCure 🇺🇸

📊Sales CAGR: 12%

📈EBIT Margin: Negative

💰ROIC: -

AtriCure provides medical devices for Atrial Fibrilation Treatment. By expanding its product range and capturing larger market share, AtriCure's 75% Gross margins should translate into profits soon.

📊Sales CAGR: 12%

📈EBIT Margin: Negative

💰ROIC: -

AtriCure provides medical devices for Atrial Fibrilation Treatment. By expanding its product range and capturing larger market share, AtriCure's 75% Gross margins should translate into profits soon.

$RGEN Repligen 🇺🇸

📊Sales CAGR: 45%

📈EBIT Margin: 29%

💰ROIC: 5-7%

Repligen provides multiple products for bioprocessing. Through acquisitions, it has built a broad product range that should see demand rise as drug production capacity is set to expand.

📊Sales CAGR: 45%

📈EBIT Margin: 29%

💰ROIC: 5-7%

Repligen provides multiple products for bioprocessing. Through acquisitions, it has built a broad product range that should see demand rise as drug production capacity is set to expand.

$CTKB Cytek Biosciences 🇺🇸

📊 3Y Sales CAGR: 30%

📈EBIT Margin: 7%

💰ROIC: 3%

Cytek provides cell analysis tools to the Life Sciences industry. Its acquisition of a reagent business could lead it to translate this growth into profits.

📊 3Y Sales CAGR: 30%

📈EBIT Margin: 7%

💰ROIC: 3%

Cytek provides cell analysis tools to the Life Sciences industry. Its acquisition of a reagent business could lead it to translate this growth into profits.

$CLPT ClearPoint Neuro🇺🇸

📊Sales CAGR: 23%

📈EBIT Margin: Negative

💰ROIC: -

CLPT's technology platform is used by drug manufacturers to deliver drugs to the brain. Many treatments use CLPT as a delivery platform in trials and will be used commercially as some get FDA approval.

📊Sales CAGR: 23%

📈EBIT Margin: Negative

💰ROIC: -

CLPT's technology platform is used by drug manufacturers to deliver drugs to the brain. Many treatments use CLPT as a delivery platform in trials and will be used commercially as some get FDA approval.

$AZT ArcticZymes🇳🇴

📊Sales CAGR: 12%

📈EBIT Margin: 45%

💰ROIC: 25%

AZT's enzymes are used in Diagnostics, Biomanufacturing. You can find a full write-up about the company here:

partnershipinvesting.substack.com/p/arcticzymes-…

📊Sales CAGR: 12%

📈EBIT Margin: 45%

💰ROIC: 25%

AZT's enzymes are used in Diagnostics, Biomanufacturing. You can find a full write-up about the company here:

partnershipinvesting.substack.com/p/arcticzymes-…

$CRAD.B C-Rad 🇸🇪

📊Sales CAGR: 26%

📈EBIT Margin: 12%

💰ROIC: 11%

C-Rad provides equipment to the healthcare industry that makes radiation therapy safer and more effective. The company aims to expand its services revenue and grow its installed base of customers.

📊Sales CAGR: 26%

📈EBIT Margin: 12%

💰ROIC: 11%

C-Rad provides equipment to the healthcare industry that makes radiation therapy safer and more effective. The company aims to expand its services revenue and grow its installed base of customers.

$CGS.AX Cogstate 🇦🇺

📊Sales CAGR: 10%

📈EBIT Margin: 23%

💰ROIC: ~35%

Cogstate's neuroscience software technology is the industry standards. Drug manufacturers rely on their software to measure cognitive performance in Alzheimer drug trials.

📊Sales CAGR: 10%

📈EBIT Margin: 23%

💰ROIC: ~35%

Cogstate's neuroscience software technology is the industry standards. Drug manufacturers rely on their software to measure cognitive performance in Alzheimer drug trials.

$CEVI Cellavision 🇸🇪

📊Sales CAGR: 16%

📈EBIT Margin: 29%

💰ROIC: 20%

CEVI's tools are the standard in laboratories around the world and improve the blood analysis workflow. Here is a full write-up on CEVI:

partnershipinvesting.substack.com/p/cellavision-…

📊Sales CAGR: 16%

📈EBIT Margin: 29%

💰ROIC: 20%

CEVI's tools are the standard in laboratories around the world and improve the blood analysis workflow. Here is a full write-up on CEVI:

partnershipinvesting.substack.com/p/cellavision-…

$MASI Masimo 🇺🇸

📊Sales CAGR: 12%

📈EBIT Margin: ~18%

💰ROIC: 18%

Masimo's patient monitoring technology is widely regarded as top-tier by many healthcare professionals. This has led to contstant revenue and EBIT growth as the company releases more products.

📊Sales CAGR: 12%

📈EBIT Margin: ~18%

💰ROIC: 18%

Masimo's patient monitoring technology is widely regarded as top-tier by many healthcare professionals. This has led to contstant revenue and EBIT growth as the company releases more products.

$ERF.PA Eurofins Scientific 🇫🇷

📊Sales CAGR: 23%

📈EBIT Margin: ~17%

💰ROIC: ~15%

Eurofins has one of the most expansive lab testing networks in the world. The company has grown this network through acquisitions to be able to offer clients global coverage in all service lines.

📊Sales CAGR: 23%

📈EBIT Margin: ~17%

💰ROIC: ~15%

Eurofins has one of the most expansive lab testing networks in the world. The company has grown this network through acquisitions to be able to offer clients global coverage in all service lines.

$REG1V Revenio 🇫🇮

📊Sales CAGR: 29%

📈EBIT Margin: 30%

💰ROIC: ~25%

Revenio's devices provide diagnostics for the eye (ophtamlic diagnostics). Revenio is a market leader and it iCare brand is responsible for tremendous growth in the business.

📊Sales CAGR: 29%

📈EBIT Margin: 30%

💰ROIC: ~25%

Revenio's devices provide diagnostics for the eye (ophtamlic diagnostics). Revenio is a market leader and it iCare brand is responsible for tremendous growth in the business.

$BIO Bio-Rad 🇺🇸

📊Sales CAGR: 7%

📈EBIT Margin: 19%

💰ROIC: ~15%

Bio-Rad is one of the global leaders in life sciences research and clinical diagnostics. Bio-Rad offers a wide range of products for almost every type of life sciences activity you could think of.

📊Sales CAGR: 7%

📈EBIT Margin: 19%

💰ROIC: ~15%

Bio-Rad is one of the global leaders in life sciences research and clinical diagnostics. Bio-Rad offers a wide range of products for almost every type of life sciences activity you could think of.

$DIM Sartorius Stedim Biotech 🇫🇷

📊Sales CAGR: 24%

📈EBIT Margin: 31%

💰ROIC: 20%

DIM provides tools to the biopharmaceutical industry. It main areas of activity are cell cultivation, fermentation, filtration, purification, and fluid management.

📊Sales CAGR: 24%

📈EBIT Margin: 31%

💰ROIC: 20%

DIM provides tools to the biopharmaceutical industry. It main areas of activity are cell cultivation, fermentation, filtration, purification, and fluid management.

$SLP Simulations Plus 🇺🇸

📊Sales CAGR: 14%

📈EBIT Margin: 24%

💰ROIC: 10-12%

SLP's software is the leading modeling and simulation for pharmaceutical and biotech companies. The software helps scientists reduce research and development costs and increase the speed of research.

📊Sales CAGR: 14%

📈EBIT Margin: 24%

💰ROIC: 10-12%

SLP's software is the leading modeling and simulation for pharmaceutical and biotech companies. The software helps scientists reduce research and development costs and increase the speed of research.

$BIM bioMérieux 🇫🇷

📊Sales CAGR: 9%

📈EBIT Margin: ~15%

💰ROIC: 15%

bioMérieux is a leader in in-vitro diagnostics. The company provides testing equipment, tools and diagnostics for all kinds of pathologies.

📊Sales CAGR: 9%

📈EBIT Margin: ~15%

💰ROIC: 15%

bioMérieux is a leader in in-vitro diagnostics. The company provides testing equipment, tools and diagnostics for all kinds of pathologies.

$NXU NEXUS 🇩🇪

📊Sales CAGR: 12%

📈EBIT Margin: 12%

💰ROIC: 20%

NEXUS provides software for hospitals, psychiatric clinics, rehabilitation and diagnostic centres. Through acquisitions, it aims to gain footing in new markets and add new product capabilities.

📊Sales CAGR: 12%

📈EBIT Margin: 12%

💰ROIC: 20%

NEXUS provides software for hospitals, psychiatric clinics, rehabilitation and diagnostic centres. Through acquisitions, it aims to gain footing in new markets and add new product capabilities.

$BLFS BioLife Solutions🇺🇸

📊Sales CAGR: 61%

📈EBIT Margin: Negative

💰ROIC: -

BLFS provides tools to the life sciences market, more specifically the cell- and gene therapy market. Its products help the materials stay usable/healthy during manufacturing, storage and distribution

📊Sales CAGR: 61%

📈EBIT Margin: Negative

💰ROIC: -

BLFS provides tools to the life sciences market, more specifically the cell- and gene therapy market. Its products help the materials stay usable/healthy during manufacturing, storage and distribution

$IDXX IDEXX Laboratories🇺🇸

📊Sales CAGR: 10%

📈EBIT Margin: 29%

💰ROIC: 50%

IDEXX is the leading provider of diagnostics for animals and water quality. Labs, veterinarians and owners of livestock use IDEXX's instruments and software to test animal health and water quality

📊Sales CAGR: 10%

📈EBIT Margin: 29%

💰ROIC: 50%

IDEXX is the leading provider of diagnostics for animals and water quality. Labs, veterinarians and owners of livestock use IDEXX's instruments and software to test animal health and water quality

$BONEX Bonesupport 🇸🇪

📊Sales CAGR: 15%

📈EBIT Margin: -

💰ROIC: -

BONEX provides synthetic bone grafting for complex fractures. With its most advanced product recently cleared by the FDA, BONEX expects to see substantial revenue growth and margin expansion from this launch

📊Sales CAGR: 15%

📈EBIT Margin: -

💰ROIC: -

BONEX provides synthetic bone grafting for complex fractures. With its most advanced product recently cleared by the FDA, BONEX expects to see substantial revenue growth and margin expansion from this launch

$SECT.B Sectra 🇸🇪

📊Sales CAGR: 11%

📈EBIT Margin: 18%

💰ROIC: 30%

Sectra provides medical imaging software to the healthcare industry. It also has a cybersecurity segment that provides critical infrastructure with the security they need.

📊Sales CAGR: 11%

📈EBIT Margin: 18%

💰ROIC: 30%

Sectra provides medical imaging software to the healthcare industry. It also has a cybersecurity segment that provides critical infrastructure with the security they need.

$STMN.SW Straumann 🇨🇭

📊Sales CAGR: 17%

📈EBIT Margin: 25%

💰ROIC: 20%

Straumann is a market leader in dental health. It provides dentists with implants, prosthetics and instruments and consumables.

📊Sales CAGR: 17%

📈EBIT Margin: 25%

💰ROIC: 20%

Straumann is a market leader in dental health. It provides dentists with implants, prosthetics and instruments and consumables.

@Invesquotes @InvestmentTalkk @LaBulll @zimp_a @Logos_LP @bluff_capital @PythiaR @WTCM3 @chriswmayer @MT_Capital1 @borrowed_ideas @ElliotTurn @pommelhorse9 @IntrinsicInv @YHamiltonBlog @RyanReeves_

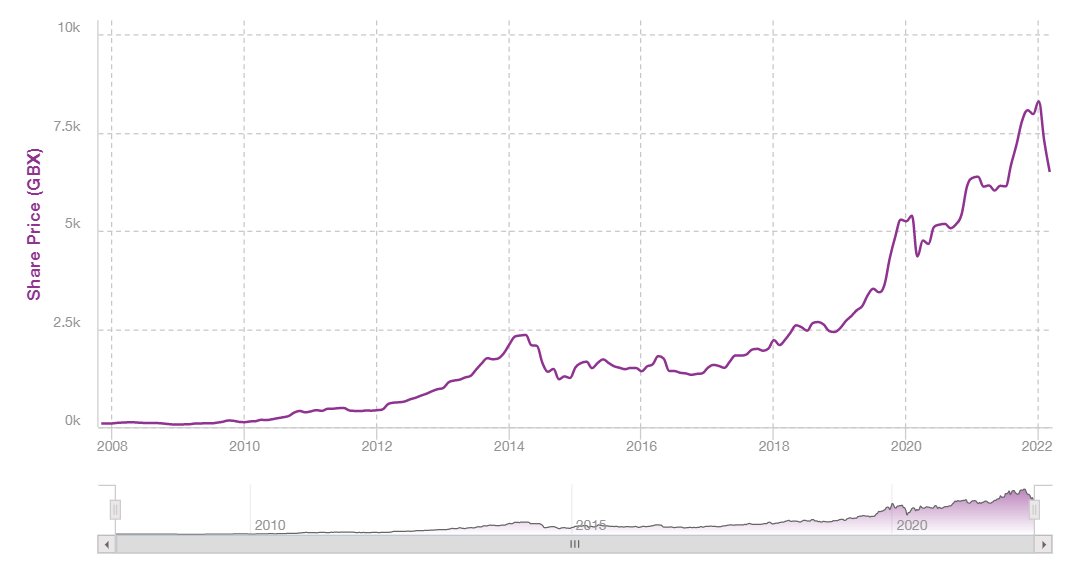

ChemoMetec

📊Sales CAGR: 27%

📈EBIT Margin: ~45%

💰ROIC: 35%

CHEMM's cell counting equipment is considered the most advanced and accurate in the cell-based therapies market. Find out what makes CHEMM one of the best performing stocks in Europe here:

partnershipinvesting.substack.com/p/chemometec-b…

📊Sales CAGR: 27%

📈EBIT Margin: ~45%

💰ROIC: 35%

CHEMM's cell counting equipment is considered the most advanced and accurate in the cell-based therapies market. Find out what makes CHEMM one of the best performing stocks in Europe here:

partnershipinvesting.substack.com/p/chemometec-b…

I regularly write about companies in the Medtech space and look around the world for the highest quality companies I can find. To receive regular write-ups, join 1000+ investors and subscribe to Global Quality Investing:

partnershipinvesting.substack.com

partnershipinvesting.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh