#Strategy

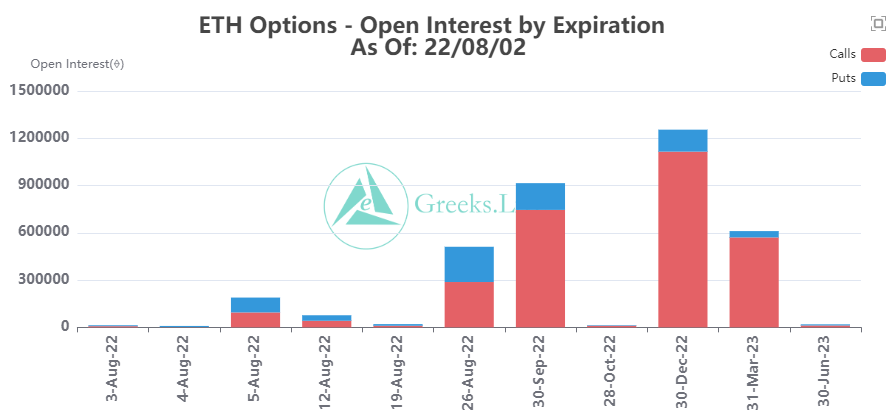

ETH is likely to turn POS in late September, most likely creating a fork. Currently, ETH futures are not discounted to a high degree. Once the fork is made, the forward futures will be discounted more. Deribit futures will only track the most popular coin.

ETH is likely to turn POS in late September, most likely creating a fork. Currently, ETH futures are not discounted to a high degree. Once the fork is made, the forward futures will be discounted more. Deribit futures will only track the most popular coin.

Strategy 1: Swap all USDC for ETH spot, then short the September future. Past experience has shown that the price of ETH futures will drop, and by hedging the futures you can gain the forked coin without loss and the further discount caused by the fork.

Strategy 2: Deribit supports the pm. For the traders with a risk appetite, you can carry out cross-period arbitrage by going long August future and short September future. If there is a consensus expectation that September will fork, the discount will be cashed out early.

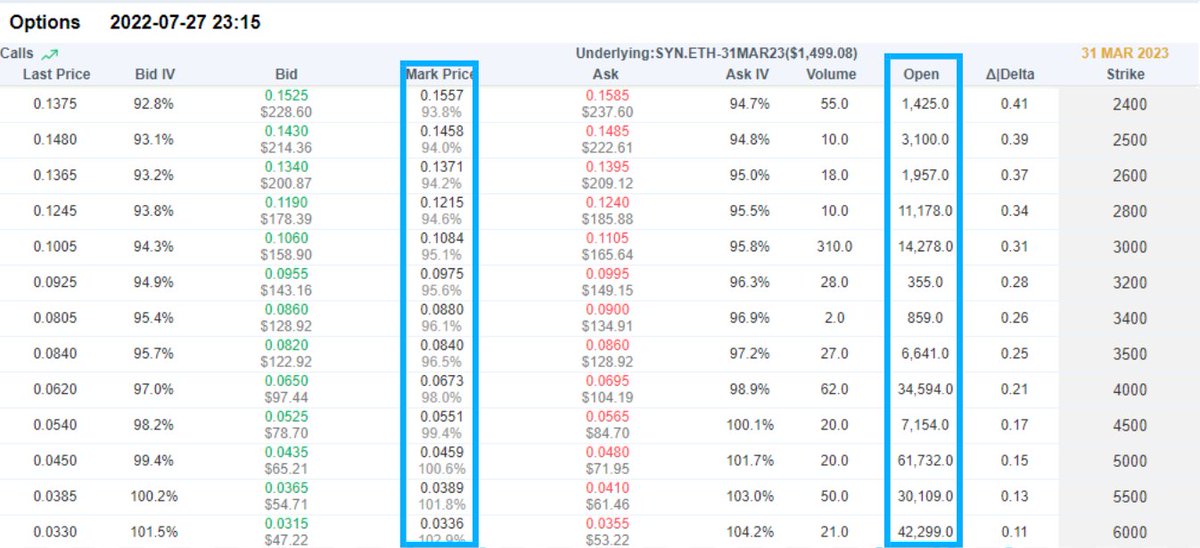

Strategy 3: For options, you can sell recent OTM around 5% PUT, and buy September OTM at 20% PUT.

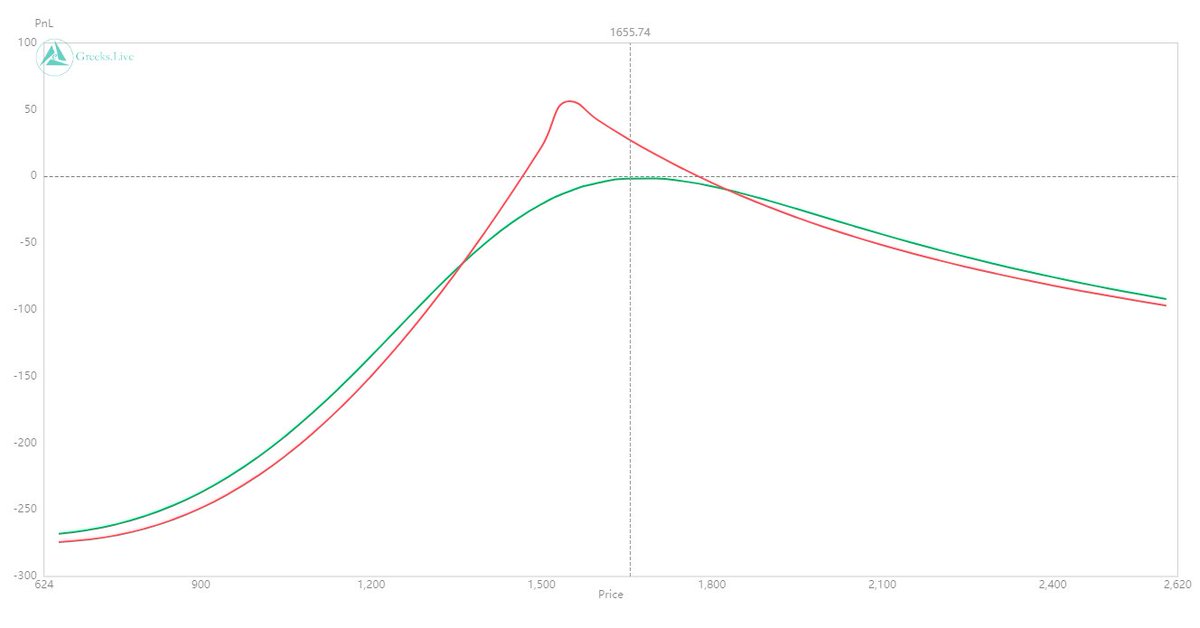

You can simulate the return curve with PV.(link——greeks.live/web/pv.html?cu…)

You can simulate the return curve with PV.(link——greeks.live/web/pv.html?cu…)

The first strategy is more certain, and the return depends mainly on the value of the forked coin.

The second strategy has more leverage.

The third strategy is the most flexible, you can adjust the position according to your needs, for example, choose to overbuy Sep OTM options.

The second strategy has more leverage.

The third strategy is the most flexible, you can adjust the position according to your needs, for example, choose to overbuy Sep OTM options.

• • •

Missing some Tweet in this thread? You can try to

force a refresh