#RUSHIL Mcap - 1054 Crores

PE - 18

Rushil Decor Ltd is primarily engaged in manufacturing and sale of

▶️Laminate Sheets,

▶️Medium Density Fibre Board

▶️Prelaminated Medium Density

▶️Fibre Board boards,

▶️Polyvinyl Chloride (PVC) Board

▶️Particle Board.

PE - 18

Rushil Decor Ltd is primarily engaged in manufacturing and sale of

▶️Laminate Sheets,

▶️Medium Density Fibre Board

▶️Prelaminated Medium Density

▶️Fibre Board boards,

▶️Polyvinyl Chloride (PVC) Board

▶️Particle Board.

Huge opportunity in Laminates

💢Industry Size - 6000+ CR

40% organized sector

60% unorganised sector

Consumption of Indian panel products has grown at CAGR of 15-20% for organised segment

Increasing consumerism and urbanization are key growth drivers

💢Industry Size - 6000+ CR

40% organized sector

60% unorganised sector

Consumption of Indian panel products has grown at CAGR of 15-20% for organised segment

Increasing consumerism and urbanization are key growth drivers

💢MDF Board Segment (50% of revenues)

400+ Distributors

2 Consignment stockists

4,000+ Dealers

8 Branches (including 5 Flooring)

70+ OEMs

1 unit at Karnataka and 1 unit at Andhra Pradesh

✅Capacity- 33 lacs CBM per annum

Utilisation- Q1FY23 ~80%

400+ Distributors

2 Consignment stockists

4,000+ Dealers

8 Branches (including 5 Flooring)

70+ OEMs

1 unit at Karnataka and 1 unit at Andhra Pradesh

✅Capacity- 33 lacs CBM per annum

Utilisation- Q1FY23 ~80%

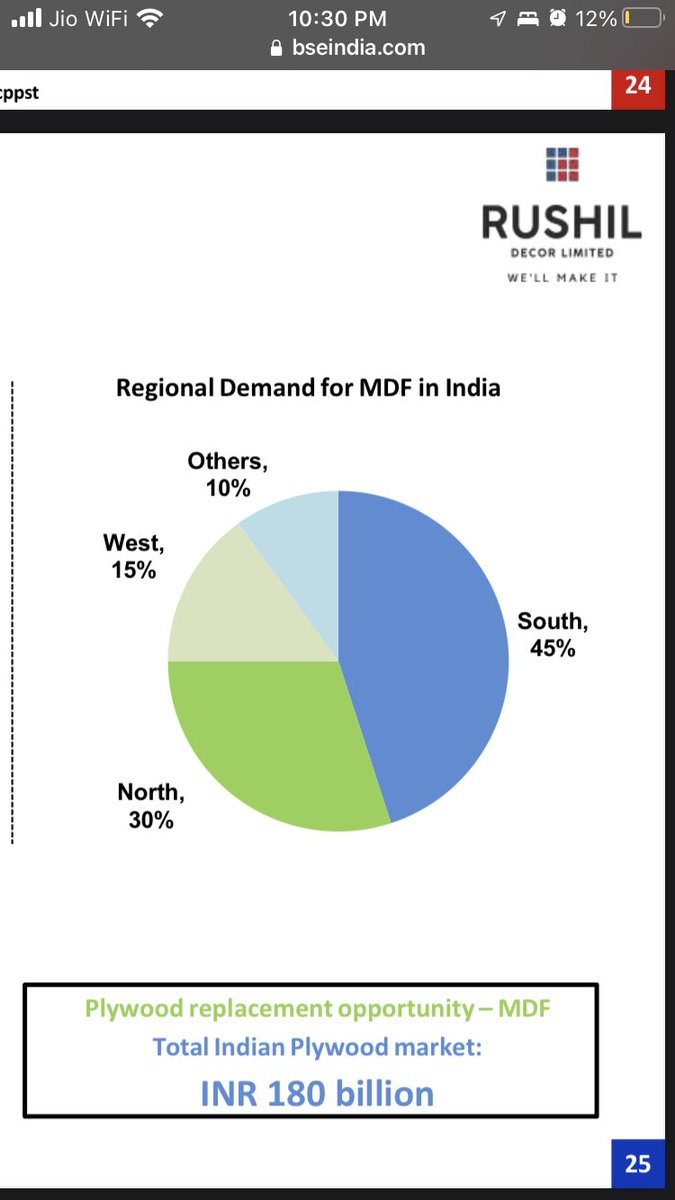

Huge opportunity in MDF too

💢Industry size - 5500 Cr

CAGR of 15% - 20% presently

Significant advantages over plywood spurring popularity

💢Industry size - 5500 Cr

CAGR of 15% - 20% presently

Significant advantages over plywood spurring popularity

💢Laminates Segment (48% of Revenue)

80+ Distributors

7 Consignment stockists

1 Depots

8 Branches

1600 Dealers

3 units at Gandhinagar, Gujarat

✅Capacity-34.92 lakh sheets per annum

Utilisation - Q1FY23 - 83%

80+ Distributors

7 Consignment stockists

1 Depots

8 Branches

1600 Dealers

3 units at Gandhinagar, Gujarat

✅Capacity-34.92 lakh sheets per annum

Utilisation - Q1FY23 - 83%

💢PVC Boards Segment (2% of revenues)

The company entered into the production of PVC boards through its facility which started operations in 2018.

The company entered into the production of PVC boards through its facility which started operations in 2018.

💢Board approved fund raising of upto Rs. 200 crores

Valuation looks reasonable imo.

From here on one can expect rerating.

-Invested and biased

Opinions welcomed.

From here on one can expect rerating.

-Invested and biased

Opinions welcomed.

@varinder_bansal @connectgurmeet @Finstor85 @sidd1307 @AI_Feb21 @drprashantmish6 @PrasadWakchaure @VVVStockAnalyst @suru27

@AdeptMarket

@AdeptMarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh