#SCHAND

Let's talk about the latest entrant into my portfolio.

Reset for Growth

Please consider retweeting if you find it useful :D

🧵🧵🧵⤵️

Let's talk about the latest entrant into my portfolio.

Reset for Growth

Please consider retweeting if you find it useful :D

🧵🧵🧵⤵️

Outline

0. Who is S CHAND Group?

1. Business segments

2. New Education policy

3. Turn-around in working capital

4. Balance sheet and debt

5. FY23 Focus

6. Valuation

0. Who is S CHAND Group?

1. Business segments

2. New Education policy

3. Turn-around in working capital

4. Balance sheet and debt

5. FY23 Focus

6. Valuation

Who is S CHAND Group?

S Chand & Company is principally engaged in publishing educational books with products ranging from

📒School books,

📒Higher academic books,

📒Competition and reference books,

📒Technical and professional books, and

📒Children's books.

S Chand & Company is principally engaged in publishing educational books with products ranging from

📒School books,

📒Higher academic books,

📒Competition and reference books,

📒Technical and professional books, and

📒Children's books.

The company provides its products and services in printed as well as digital forms.

Brand Verticals

A) K12

B) Higher Education

C) Early Learning

Digital Offerings

A) Learnflix app : It has been downloaded over 80,000 times and has over 18,000 paying subscribers.

B) Mylestone: Approximately 400 schools have signed up at the end of FY20

A) K12

B) Higher Education

C) Early Learning

Digital Offerings

A) Learnflix app : It has been downloaded over 80,000 times and has over 18,000 paying subscribers.

B) Mylestone: Approximately 400 schools have signed up at the end of FY20

C) Educate 360: New app

D)Test Coach – Has been downloaded over 10,000 times for competitive exam preparation.

E) MyStudygear App – Blended learning app with books and over 1 million users currently.

F) Chhaya Learning App –Learning with books with over 500,000 users

D)Test Coach – Has been downloaded over 10,000 times for competitive exam preparation.

E) MyStudygear App – Blended learning app with books and over 1 million users currently.

F) Chhaya Learning App –Learning with books with over 500,000 users

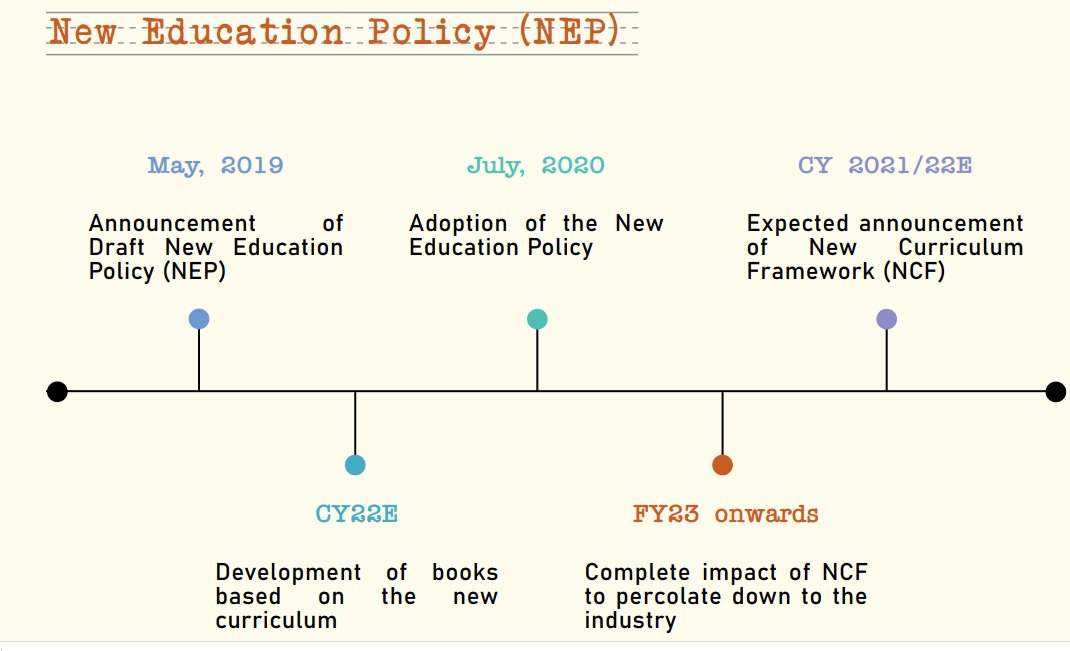

The New Education Policy (NEP) was formally adopted by the Union Government in July, 2020.

Expect release of the New National Curriculum Framework (NCF) after taking inputs from all stakeholders during CY2022E.

Expect release of the New National Curriculum Framework (NCF) after taking inputs from all stakeholders during CY2022E.

Strong runway of growth for at least 2-3 years.

Since the New Curriculum is being developed after a gap of 15 years, it would eliminate sale of second-hand books.

Since the New Curriculum is being developed after a gap of 15 years, it would eliminate sale of second-hand books.

Lessons from 2005 NEP/NCF roll out. During the 2005 NCF announcement, the new syllabus was rolled out over a period of 3 years with 5 grades moving to the new syllabus in Year 1, another 5 grades

moving to new syllabus in year 2 and 2 grades moving to new syllabus in

year 3.

moving to new syllabus in year 2 and 2 grades moving to new syllabus in

year 3.

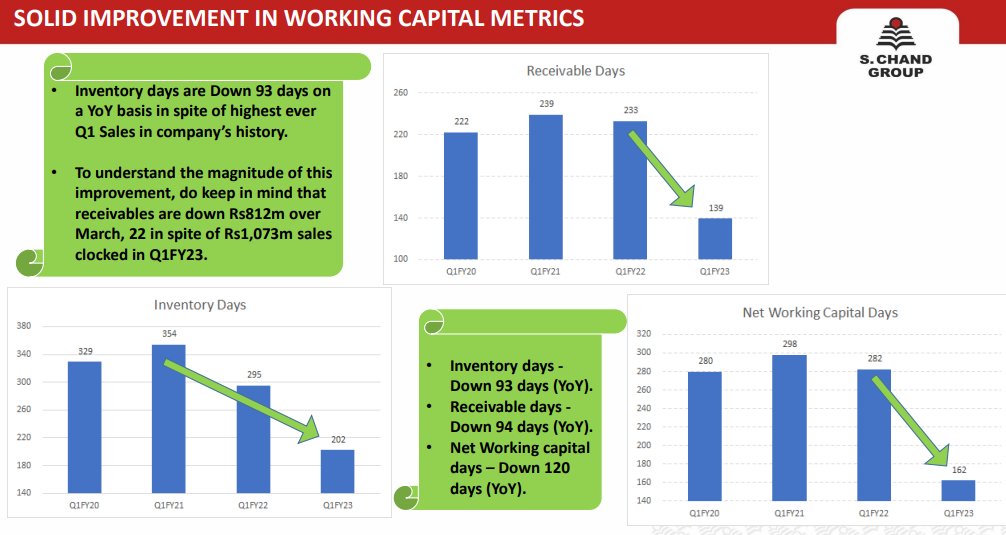

Company firmly on the way to achieve target of

becoming net debt zero by Q4FY23.

Company moving to a structurally lower inventory

levels.

becoming net debt zero by Q4FY23.

Company moving to a structurally lower inventory

levels.

Top Focus in FY 23

🟢 Expect 25% + revenue growth

🟢 Implementation of 15% + price hike.

🟢 Net Debt free by Q4 FY 23

🟢 Expect 25% + revenue growth

🟢 Implementation of 15% + price hike.

🟢 Net Debt free by Q4 FY 23

Valuation.

Since the New Curriculum is being developed after a gap of 15 years, would lead to strong growth for at least 2-3 years.

Invested and biased.

Since the New Curriculum is being developed after a gap of 15 years, would lead to strong growth for at least 2-3 years.

Invested and biased.

@tushar9590 @tusharbohra @AnyBodyCanFly @Atulsingh_asan @LearningEleven @Finstor85 @dadalife369 @connectgurmeet @itsTarH @VVVStockAnalyst @InvestmentBook1

• • •

Missing some Tweet in this thread? You can try to

force a refresh