The key to successful DeFi:

Real Yield.

Knowing where the yield comes from will help you find the hidden gems in DeFi.

Here’s the step-by-step guide if you don’t know where to start:

Real Yield.

Knowing where the yield comes from will help you find the hidden gems in DeFi.

Here’s the step-by-step guide if you don’t know where to start:

Most DeFi users know nothing about where their yield is coming from.

“If you don’t know where the yield comes from, then you are the yield”.

This is not how DeFi should work.

“If you don’t know where the yield comes from, then you are the yield”.

This is not how DeFi should work.

The history of Yield Farming goes back to June 2020.

The 2017-era ICOs led to rounds with large token distributions to private investors.

Retail investors felt the true pain of being used for exit liquidity.

Liquidity mining (LM) was an attempt to even the playing field.

The 2017-era ICOs led to rounds with large token distributions to private investors.

Retail investors felt the true pain of being used for exit liquidity.

Liquidity mining (LM) was an attempt to even the playing field.

The public felt they could at least have an equal chance of owning a protocol's native token.

Compound, Curve, and Uniswap launched their LM programs.

This drew in even more users for participation.

And a number of those users ended up staying and using the protocol.

Compound, Curve, and Uniswap launched their LM programs.

This drew in even more users for participation.

And a number of those users ended up staying and using the protocol.

The more liquidity a protocol has -- the more volume and attention it attracts from users.

Increased participation from users leads to:

1. Higher value token emissions

2. A rise in the price of the native token

And this led to a flywheel that has since dominated DeFi.

Increased participation from users leads to:

1. Higher value token emissions

2. A rise in the price of the native token

And this led to a flywheel that has since dominated DeFi.

Innovation was rewarded fairly but as with any free market there's always the opportunity to profit.

Mercenary capital flooded in.

They had no loyalty to any protocol and instead pursued the opportunities that were most profitable at that time.

Some examples:

Mercenary capital flooded in.

They had no loyalty to any protocol and instead pursued the opportunities that were most profitable at that time.

Some examples:

Think back to DeFi Summer.

We had protocols like $OHM and $TIME that had all the attention and hype.

It was a competition for DeFi protocols - "Who can quickly incentivize the most users?"

And for users - "Where can we get the greatest rewards from?"

We had protocols like $OHM and $TIME that had all the attention and hype.

It was a competition for DeFi protocols - "Who can quickly incentivize the most users?"

And for users - "Where can we get the greatest rewards from?"

But there was no long term liquidity incentives and the tokenomics were poorly designed.

Liquidity flowed in and out and only a small handful of people actually took profits.

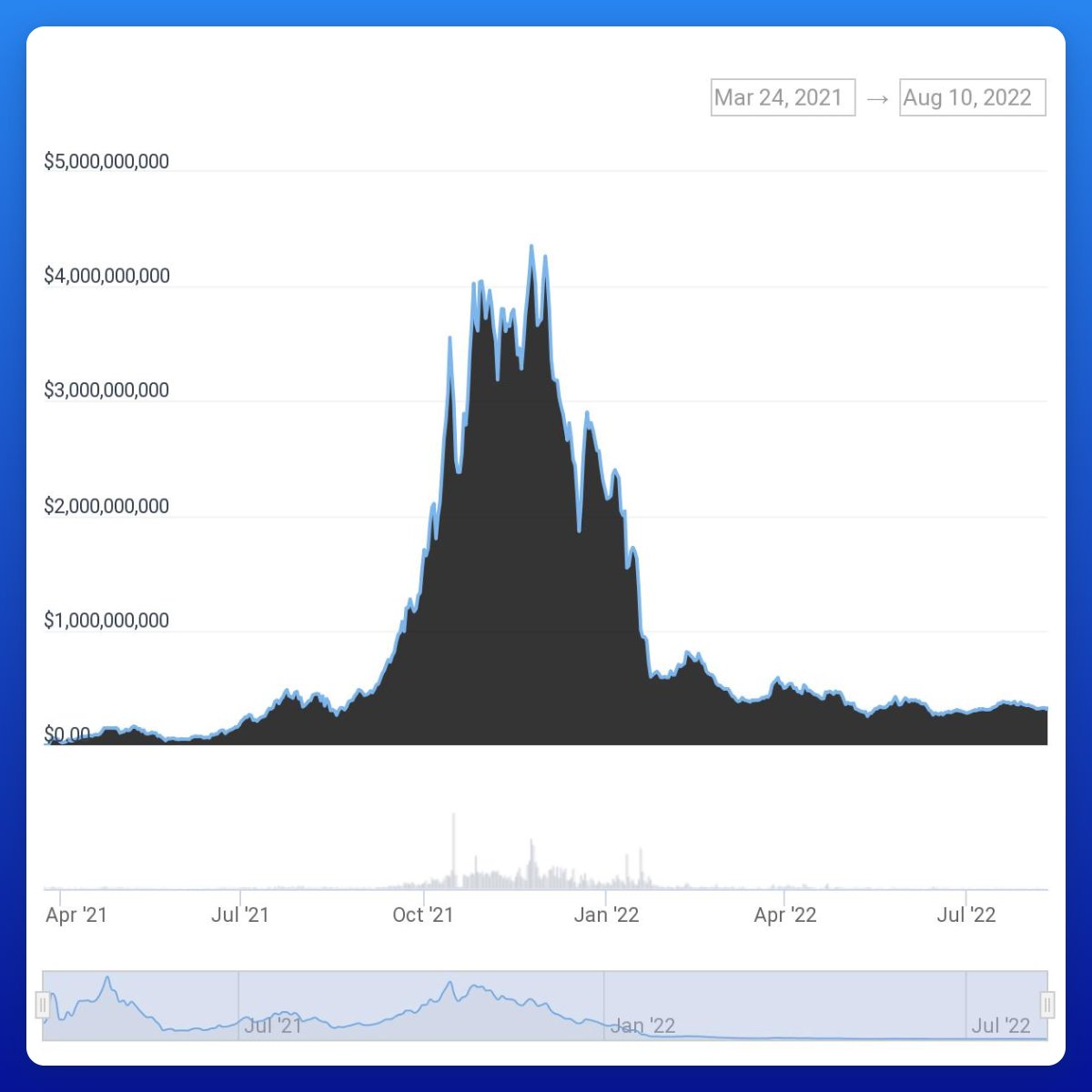

But we didn't learn from our mistakes, so we saw a lot more charts like $OHM:

Liquidity flowed in and out and only a small handful of people actually took profits.

But we didn't learn from our mistakes, so we saw a lot more charts like $OHM:

We got burned again with $LUNA and $UST.

This time was even worse than the last.

It should've been obvious that the 20% yields from Anchor Protocol weren't sustainable in the long run.

This time was even worse than the last.

It should've been obvious that the 20% yields from Anchor Protocol weren't sustainable in the long run.

So the spotlight of DeFi has come to "Real Yield" protocols.

The protocols who derive their yield from real revenue rather than token emissions - like dividend stocks.

The more money the protocol earns, the higher the token rewards for holders.

The protocols who derive their yield from real revenue rather than token emissions - like dividend stocks.

The more money the protocol earns, the higher the token rewards for holders.

Learn something from the thread? You can help me out by:

1. Giving me a follow: @sabocrypto

2. Giving the thread a RT, first tweet is linked below.

1. Giving me a follow: @sabocrypto

2. Giving the thread a RT, first tweet is linked below.

https://twitter.com/sabocrypto/status/1557395592812195840?s=20&t=oheEWo_9c3gKuZRrE7zcKw

If you enjoyed the thread and want to learn more about real yield opportunities, you should check out my newsletter, linked below:

This thread is adapted from a published article with @TheHeathen22.

We go into more depth on $UMAMI, $MPL & $GMX.

sabocrypto.substack.com/p/the-harsh-re…

This thread is adapted from a published article with @TheHeathen22.

We go into more depth on $UMAMI, $MPL & $GMX.

sabocrypto.substack.com/p/the-harsh-re…

• • •

Missing some Tweet in this thread? You can try to

force a refresh