Is “tokengated commerce” a Web3 use case?

The pitch sounds great: Enabling merchants to block their potential customers from buying anything unless they own the right NFT.

But before we get too excited, let’s check if it's a logically-valid use case or a #HollowAbstraction.

The pitch sounds great: Enabling merchants to block their potential customers from buying anything unless they own the right NFT.

But before we get too excited, let’s check if it's a logically-valid use case or a #HollowAbstraction.

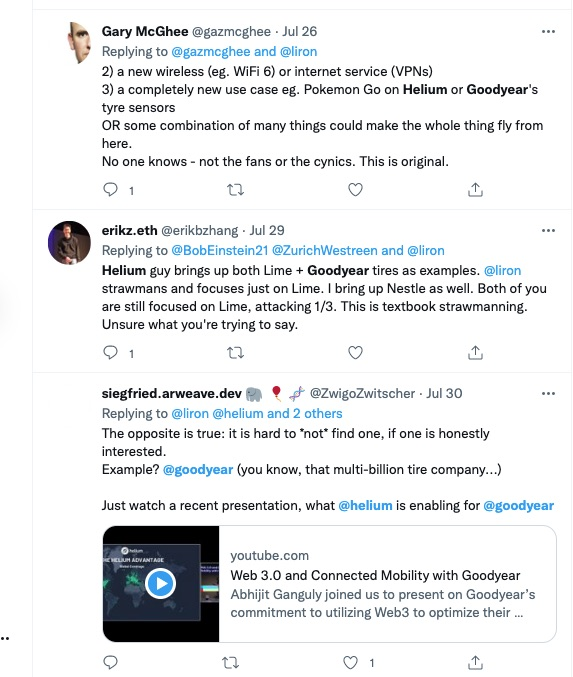

This is a big moment for Web3 devotees.

Tokengated commerce brings the theoretical possibility of NFTs into physical reality, promising to upend the way we engage in commercial transactions.

Shopify’s @Alex_Danco is confident this is something that merchants need.

Tokengated commerce brings the theoretical possibility of NFTs into physical reality, promising to upend the way we engage in commercial transactions.

Shopify’s @Alex_Danco is confident this is something that merchants need.

According to Alex, a great merchant doesn't just let you buy something and pay and leave.

They go on a journey with you and overcome a challenge with you.

They go on a journey with you and overcome a challenge with you.

Here’s Alex’s 7,000-word writeup for @PackyM’s Not Boring newsletter. It’s full of exciting abstractions:

“Crypto is fundamentally a different behavior”

“Forget about what you can do… it's about who you can be”

“It’s good to be a non-fungible buyer”

notboring.co/p/tokengated-c…

“Crypto is fundamentally a different behavior”

“Forget about what you can do… it's about who you can be”

“It’s good to be a non-fungible buyer”

notboring.co/p/tokengated-c…

Alex’s vision of our exciting tokengated-commerce future is pretty compelling:

You’re at a party that requires a membership card to attend.

You feel unmistakable joy that a machine recognizes you by your membership card.

Because your membership card is on the blockchain.

You’re at a party that requires a membership card to attend.

You feel unmistakable joy that a machine recognizes you by your membership card.

Because your membership card is on the blockchain.

Packy depicts tokengated commerce as a MetaMask-headed Trojan horse preparing to invade the online commerce space with social-context soldiers.

I wonder, is this smart-looking visual standing for actual use cases, or is it covering for yet another Web3 #HollowAbstraction?

I wonder, is this smart-looking visual standing for actual use cases, or is it covering for yet another Web3 #HollowAbstraction?

Let’s turn away from Alex’s soaring abstract rhetoric, and instead examine his specific use case.

Namely: Increasing a band’s t-shirt sales revenue by preventing anyone from buying unless they’re fans of that band and/or another band.

I clipped this from

Namely: Increasing a band’s t-shirt sales revenue by preventing anyone from buying unless they’re fans of that band and/or another band.

I clipped this from

Shopify launched tokengating features on Jun 22.

We know the animated video looks "lit", but what do we know about the traction with merchants and end users?

How many bands are using it? How much additional t-shirt sales revenue are they making?

We know the animated video looks "lit", but what do we know about the traction with merchants and end users?

How many bands are using it? How much additional t-shirt sales revenue are they making?

There are a total of six merchants in the Gated Merch section of Shopify’s mobile app.

All of these merchants are NFT projects.

No bands selling t-shirts.

No empirical validation that tokengated commerce can make non-crypto merchants care about crypto.

All of these merchants are NFT projects.

No bands selling t-shirts.

No empirical validation that tokengated commerce can make non-crypto merchants care about crypto.

.@InvsbleFriends is the only merchant featured by Shopify with currently available tokengated products.

Their NFT-holders get 20% off their t-shirts.

They're using blockchain tech to do the equivalent of sending a discount link to their customer mailing list.

Their NFT-holders get 20% off their t-shirts.

They're using blockchain tech to do the equivalent of sending a discount link to their customer mailing list.

I also noticed the Gated Merch flow in the Shop app is buggy.

Maybe the Shopify Crypto team isn't prioritizing maintenance work on an experimental feature that doesn’t seem to be getting much usage.

Maybe the Shopify Crypto team isn't prioritizing maintenance work on an experimental feature that doesn’t seem to be getting much usage.

Alright, we made an empirical observation that Shopify’s tokengated commerce is having a lukewarm start. Not much interest from bands, or any non-crypto merchants.

IMO, this outcome was inevitable as a matter of pure logic.

Folks just didn't think critically about use cases.

IMO, this outcome was inevitable as a matter of pure logic.

Folks just didn't think critically about use cases.

Alex’s use case was supposed to be allowing his band, The Fundamentals, to offer their merch to a different band’s fans.

How is that use case accomplished today, without blockchain?

The answer is: it's rarely attempted. Bands don’t see much value in this type of "collab".

How is that use case accomplished today, without blockchain?

The answer is: it's rarely attempted. Bands don’t see much value in this type of "collab".

If we insist for the use-case example to be *realistic*, that's when cracks appear in the abstract pitch.

So let’s keep adding realistic details.

Let’s say The Fundamentals is doing a collab on tokengated commerce with The Mighty Mighty Bosstones, a more popular ska band.

So let’s keep adding realistic details.

Let’s say The Fundamentals is doing a collab on tokengated commerce with The Mighty Mighty Bosstones, a more popular ska band.

Let’s say a Bosstones fan named Marty buys a $100 NFT that lets him attend a show, and another $100 NFT to drag his wife along.

Afterwards, Marty lists his wife’s NFT on OpenSea for $5, since she has no interest in holding it.

Now Alex’s example is showing its cracks…

Afterwards, Marty lists his wife’s NFT on OpenSea for $5, since she has no interest in holding it.

Now Alex’s example is showing its cracks…

Say Biff, who isn’t a fan of either band, nevertheless wants to buy a Fundamentals t-shirt. Tokengating ought to block him, right?

But Biff can buy a $5 Bosstones NFT and then buy Fundamentals merch.

If Bosstones NFTs are common, Biff could pay just $0.01 to access gated merch.

But Biff can buy a $5 Bosstones NFT and then buy Fundamentals merch.

If Bosstones NFTs are common, Biff could pay just $0.01 to access gated merch.

The only merchants that remotely make sense are crypto clubs like BAYC which limit group membership via rare NFTs. Demand for group membership theoretically maintains a high NFT floor price.

This explains why the only merchants using Shopify Gated Merch are NFT communities.

This explains why the only merchants using Shopify Gated Merch are NFT communities.

Also, we don’t need a blockchain to tell The Fundamentals who Bosstones fans are. Existing Web2 technology can easily implement that kind of data integration.

An OAuth API integration could securely pull membership info. So could a simple CSV dump with encrypted member emails.

An OAuth API integration could securely pull membership info. So could a simple CSV dump with encrypted member emails.

Alas, people will never stop thinking they've discovered a Web3 use case. Their abstractions feel rich with beautiful potential, until they’re tried and inevitably fail.

Only those who focus on specific use cases are able to recognize when a pitch is a #HollowAbstraction mirage.

Only those who focus on specific use cases are able to recognize when a pitch is a #HollowAbstraction mirage.

• • •

Missing some Tweet in this thread? You can try to

force a refresh