Most of us probably use Nansen, Dune, DefiLlama and Parsec quite frequently.

Today I want to share 10 research tools that are not that well known but I find particularly useful.

See below 👇🧵

Today I want to share 10 research tools that are not that well known but I find particularly useful.

See below 👇🧵

1/10: EtherDrop Bot

Built by @0xCheck and similar to Nansen alerts, this bot allows you to set notifications on your Telegram for any movements in a specific wallet, pool or NFT collection for free.

Full guide: 0xcheck.medium.com/etherdrops-bot…

Built by @0xCheck and similar to Nansen alerts, this bot allows you to set notifications on your Telegram for any movements in a specific wallet, pool or NFT collection for free.

Full guide: 0xcheck.medium.com/etherdrops-bot…

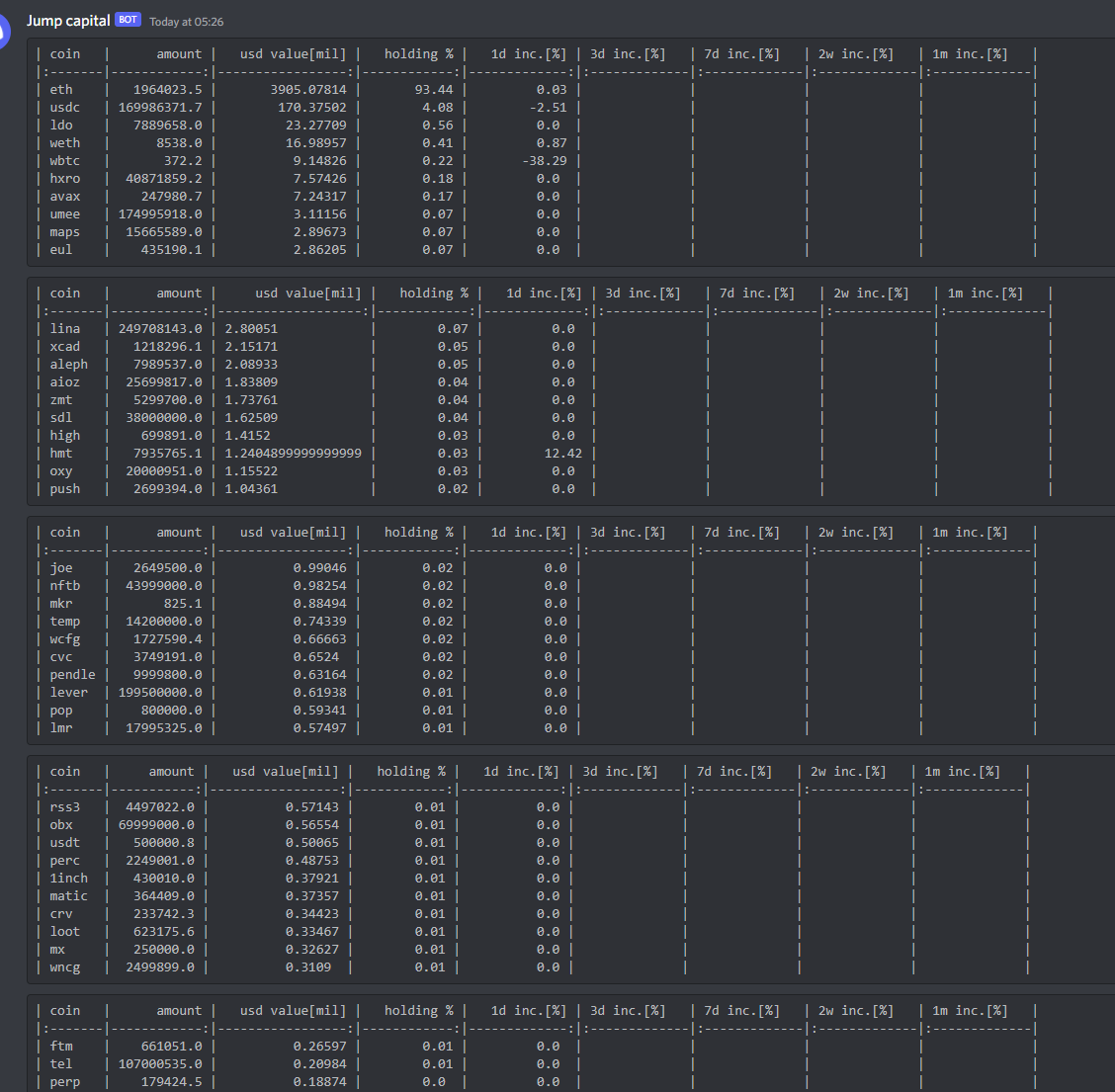

2/10: Wallet Tracker Discord

Created by @slurpxbt, this Discord tracks over 500 wallets including funds, exchanges, protocol treasuries, founders and CT accounts.

More info here:

Created by @slurpxbt, this Discord tracks over 500 wallets including funds, exchanges, protocol treasuries, founders and CT accounts.

More info here:

https://twitter.com/slurpxbt/status/1552324850047483904?s=20&t=sPhbM45CtvMATQ9MyV7w7A

3/10: Track Governance Proposals

@tallyxyz is a great platform to keep up to date with any governance proposals across different EVM chains. It's also a great tool for setting up a DAO.

@tallyxyz is a great platform to keep up to date with any governance proposals across different EVM chains. It's also a great tool for setting up a DAO.

4/10: Apophenia's Blog Scrapper

Another bot built by a fellow intern from @InternDAO. This bot sends you a Telegram message every time a project uploads a new article to their medium/blog. Many projects update their blog before tweeting about it.

Another bot built by a fellow intern from @InternDAO. This bot sends you a Telegram message every time a project uploads a new article to their medium/blog. Many projects update their blog before tweeting about it.

5/10: Token Unlock Dashboard

@Token_Unlocks is my favourite tool to track token unlocks. Their Dashboard is super intuitive and when you select a project it provides a lot of details about its tokenomics.

@Token_Unlocks is my favourite tool to track token unlocks. Their Dashboard is super intuitive and when you select a project it provides a lot of details about its tokenomics.

6/10: OpenBB Terminal

@openbb_finance is an investment research app that allows users to access a lot of Bloomberg's features for free in a Python-based environment.

More details here:

@openbb_finance is an investment research app that allows users to access a lot of Bloomberg's features for free in a Python-based environment.

More details here:

https://twitter.com/pyquantnews/status/1549911563821260801?s=20&t=Zu7r2DzDpyqCH3G-uTkfgQ

7/10: MEV and On-chain analysis

@Eigenphi is one of my favourite tools for MEV. Track sandwich attacks, flashloans and identify malicious tokens in their website.

@Eigenphi is one of my favourite tools for MEV. Track sandwich attacks, flashloans and identify malicious tokens in their website.

8/10: Deep Dive into MEV

zeromev.org categorises MEV by how harmful it is for users. It differentiates toxic frontruning vs other types of MEV. It can be visualised by wallet or by block.

Here's a walkthrough video covering the basics:

zeromev.org categorises MEV by how harmful it is for users. It differentiates toxic frontruning vs other types of MEV. It can be visualised by wallet or by block.

Here's a walkthrough video covering the basics:

9/10: Identify yield opportunities

@0xCoindix monitors over 10,000 vaults across 27 chains and allows you to filter by protocol, chain, type of yield or TVL.

See below an example of yield opportunities on stablecoins in vaults with >$1m TVL sorted by APY.

@0xCoindix monitors over 10,000 vaults across 27 chains and allows you to filter by protocol, chain, type of yield or TVL.

See below an example of yield opportunities on stablecoins in vaults with >$1m TVL sorted by APY.

10/10: Track Derivatives data

@laevitas1 is a data analytics platform. Probably my favourite app for tracking derivatives and funding rates in crypto.

Their dashboards have a lot of interesting data so I'd recommend checking them out.

@laevitas1 is a data analytics platform. Probably my favourite app for tracking derivatives and funding rates in crypto.

Their dashboards have a lot of interesting data so I'd recommend checking them out.

Remember to always DYOR. Let me know if there are any other tools you like to use, and feel free to share the first tweet if you found this thread helpful.

https://twitter.com/sgallardo_9/status/1559505675151183872?s=20&t=NplFT2tfJV6c28v17W6T2Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh