2/50 The tone of this earnings report was a bit different from what SpaceMob has become used to.

3/50 Not just because the stock hit a 52 week high in trading before the earnings report, and not just because we know with certainty that the launch of BlueWalker 3 is just a few weeks away, but because AST pre-announced financial results for the 2nd quarter on July 18th.

4/50 investors.ast-science.com/news-releases/…

This allowed AST to focus more on BlueWalker 3, and other non-financial business matters.

This allowed AST to focus more on BlueWalker 3, and other non-financial business matters.

5/50 For the sake of completeness, following are two slides from the earnings report detailing financial results:

6/50 As you can see, spending for R&D and Engineering services went up by a combined $1.4 million over the previous quarter. This is a result of increased head count as build for the first 5 BlueBird satellites has begun.

7/50 General and admin expenses increased by $900k as the company grows.

8/50 Following is a screen shot for the current quarter operating expenses, the previous quarter operating expenses, and operating expenses one year ago.

The only comment I have to add here is adding data for the quarter ended June '21 doesn't make much sense to me.

The only comment I have to add here is adding data for the quarter ended June '21 doesn't make much sense to me.

9/50 The company went public (and received funds from the SPAC process in April '21), so the quarter ended June '21 is an unusual period in the life of the company.

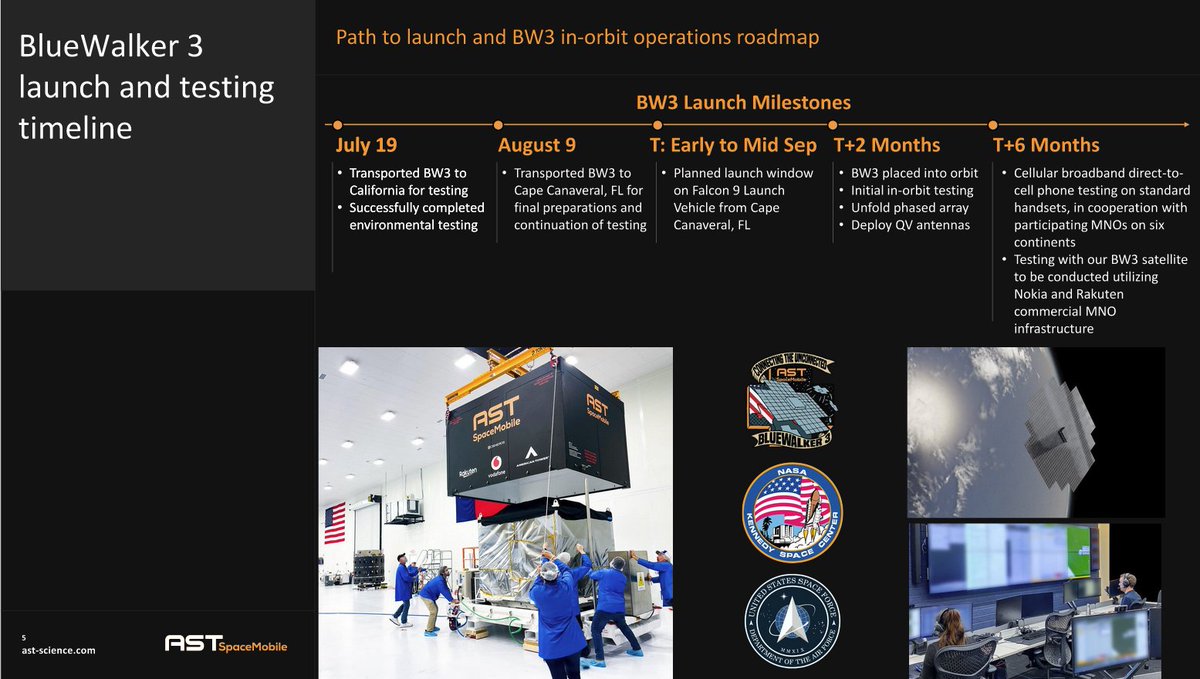

10/50 With financials out of the way, let's get on to the part of the earnings report that AST investors have been waiting for a long time for - the upcoming launch of BlueWalker3.

11/50 No delays - it's still scheduled for the beginning to middle of September. Though it hasn't been formally announced, the likely launch window is between September 7th and September 15th.

12/50 In addition to confirmation of the Summer '22 launch schedule being met, we were given an overview of what will happen during the testing process of BlueWalker 3.

I was personally glad to see this outline.

I was personally glad to see this outline.

13/50 It confirms independent research I have been doing on the testing process, and I will be giving a much more detailed overview of the testing process in an upcoming thread.

14/50 There has been some confusion in interpreting the screen shot above. So here is a magic decoder ring for you.

T refers to the launch date

When times are added to T, it is total time from the launch date.

T refers to the launch date

When times are added to T, it is total time from the launch date.

15/50 Therefore:

T + 2 months = Within 2 months of the launch date

T + 6 months = Within 6 months of the launch date

Though most people are interested in the launch itself, the most interesting period to me is the T + 2 months time frame.

T + 2 months = Within 2 months of the launch date

T + 6 months = Within 6 months of the launch date

Though most people are interested in the launch itself, the most interesting period to me is the T + 2 months time frame.

16/50 First, someone asked me just the other day why AST is going to wait for one to two weeks after BW3 has been launched to unfurl the device. The answer is relatively simple.

Launch is going to expose BW3 to enormous pressures.

Launch is going to expose BW3 to enormous pressures.

17/50 Though BW3 has been through "Shock and Vibration" testing before it ever left Midland, it makes sense to ensure that all critical components have survived the launch intact.

18/50 There is redundancy built into every critical system of the satellite, and if some of the electronics needed to either unfurl the satellite, or handle other aspects of command and control were damaged during launch, you want to know early so that alternate methods to

19/50 control the satellite can be used.

The next step - unfolding the phased array - also known as "unfurling" - will be the part of the testing process that I am most interested in.

The next step - unfolding the phased array - also known as "unfurling" - will be the part of the testing process that I am most interested in.

20/50 I have stated before that I view this as being the highest risk area of the testing process of BlueWalker 3.

That's not to say that I think that failure to deploy the phased array is likely.

That's not to say that I think that failure to deploy the phased array is likely.

21/50 If I didn't think that BW3 would unfold correctly, I would have any money invested in the company.

22/50 I have read CatSE's work on Reddit on the unfurling mechanism ( reddit.com/r/ASTSpaceMobi… ), and I have also read the patent application that AST has on the mechanism and went as far as researching prior art sited in the AST patent.

23/50 But still the same, I am looking forward to the unfurling process being completed.

The reason for that is simple.

The reason for that is simple.

24/50 Between the AltioStar software that AST has been using since gaining an investment from Rakuten and the Nokia NetAct network management software, combined with custom software that AST has been working on and with since the BW1/BW2 tests, I view the testing of the overall…

25/50 …system as being highly likely to succeed.

The next thing from the earnings call worth mentioning were a couple of surprises.

First, AST has already begun working on assembly of the first 5 BlueBird satellites.

The next thing from the earnings call worth mentioning were a couple of surprises.

First, AST has already begun working on assembly of the first 5 BlueBird satellites.

26/50 Second, rather than the original design that called for BlueBirds to be approximately 20m x 18m, the first 5 BlueBirds will be roughly the same size as BlueWalker 3.

I am not sure what the reason behind this change in plans was.

I am not sure what the reason behind this change in plans was.

27/50 If anyone from AST would like to help inform SpaceMob on the motivation for the changes, my DMs are open.

But a couple of thoughts do come to mind.

We know from past earnings calls that the initial BlueBird satellites will be using FPGAs instead of ASICs.

But a couple of thoughts do come to mind.

We know from past earnings calls that the initial BlueBird satellites will be using FPGAs instead of ASICs.

28/50 While the fact that FPGAs are programmable after deployment and ASICs aren't provide some advantages early in the life of this program, FPGAs are also more power hungry than ASICs.

29/50 One of the side effects of using FPGAs translates to the solar system - it has to feed more power hungry chips, and that increases total systems cost.

The smaller satellite size *MIGHT* be a way to help contain some of the costs for the initial batch of BlueBirds.

The smaller satellite size *MIGHT* be a way to help contain some of the costs for the initial batch of BlueBirds.

30/50 But there are other cost factors that have to be considered.

The new launch plan for the initial 5 BlueBird satellites calls for all 5 satellites to be launched at once. Originally BlueBird 1 and BlueBird 2 were planned as separate launches.

The new launch plan for the initial 5 BlueBird satellites calls for all 5 satellites to be launched at once. Originally BlueBird 1 and BlueBird 2 were planned as separate launches.

31/50 Launching 5 satellites at once on a Falcon 9 will lower launch costs. And by having smaller satellites, it is possible to launch all 5 satellites on a Falcon 9 rocket. (Not to be confused with the Falcon 9 Heavy)

32/50 Of course, for ultimate launch cost containment, we need to wait a while longer for SpaceX to put the StarShip into service.

It was also announced that AST intends to begin offering some kind of intermittent commercial service towards the end of 2023 or beginning of 2024.

It was also announced that AST intends to begin offering some kind of intermittent commercial service towards the end of 2023 or beginning of 2024.

33/50 I would love to hear more details about this from the company.

Intuitively an intermittent service doesn't seem very desirable to me. But then again, I live in the United States and am used to being in an area with continuous coverage.

Intuitively an intermittent service doesn't seem very desirable to me. But then again, I live in the United States and am used to being in an area with continuous coverage.

34/50 I am going to close this thread with discussion on an Investor Question that was submitted by me. If my name and the Arizona flag in my profile picture didn't make it obvious already, I am "Steve from Arizona" from the last 3 earnings call.

36/50 I had more detail in my original question that was edited for brevity on their end.

At the end of Q2, AST had $202 million in cash.

The private placement of stock through B. Riley can bring in up to an additional $75 million in cash when exercised.

At the end of Q2, AST had $202 million in cash.

The private placement of stock through B. Riley can bring in up to an additional $75 million in cash when exercised.

37/50 The sale of NanoAvionics will bring in $28 million in cash this quarter.

Put it all together, and AST has about $305 million in cash to work with.

As mentioned during the call, there is a new estimate on the cost for building BlueBirds.

Put it all together, and AST has about $305 million in cash to work with.

As mentioned during the call, there is a new estimate on the cost for building BlueBirds.

38/50 The price tag has gone up by 14% and is now $16 million per satellite. (Interestingly,when quoting the cost for the entire constellation, the range $300 million to $340 million was used - the higher end would come to $17 million per satellite.)

39/50 In any event, there is a shortage of cash needed to fully deploy phase I of SpaceMobile.

This is the point where people starting running around in circles screaming "Dilution! Dilution!".

But that isn't necessarily the case.

This is the point where people starting running around in circles screaming "Dilution! Dilution!".

But that isn't necessarily the case.

40/50 First of all, I want to direct everyone's attention to the last sentence in the answer to the question that I submitted.

41/50 AST is securing a credit facility for the purchase of equipment for the buildout of the second facility in Midland.

Let me phrase that using a different set of words.

Let me phrase that using a different set of words.

42/50 If you look at the balance sheet of AST, you will find that they have a little under $5 million in long term debt. This debt came as a result of the purchase of the second manufacturing facility in Midland.

43/50 That's not much debt for a company their size and with the assets that they have.

People are willing to lend them money to buy specialized manufacturing equipment needed to automate the build and testing of satellites.

People are willing to lend them money to buy specialized manufacturing equipment needed to automate the build and testing of satellites.

44/50 There are ways other than issuing stock to fund the gap between cash on hand and what is needed to complete the build and deployment of phase I.

One very attractive way of getting an additional $202.4 million dollars in funding is the calling of warrants.

One very attractive way of getting an additional $202.4 million dollars in funding is the calling of warrants.

45/50 Though converting warrants to common shares is technically dilution, this is something that has been known about since the time the original DA between NPA and AST was announced in December 2020.

There are 17.6 million warrants outstanding.

There are 17.6 million warrants outstanding.

46/50 When the stock price closes over $18 for 20 of 30 consecutive trading days, those warrants will become "callable", and AST will convert each warrant for a share in common stock in exchange for the warrant and $11.50 in cash.

47/50 A few weeks ago when the stock price was in the $6 range, thinking about warrants being called wasn't realistic.

48/50 But with the stock on a tear and a closing price of $13.34 today, it is possible that a good pre-launch ramp will get the stock price to the point where warrants become callable.

Of course getting the stock price past $18 is half the battle.

Of course getting the stock price past $18 is half the battle.

49/50 In order to maintain price momentum and keep the stock price high enough for 20 of 30 consecutive trading days, I believe that AST will need to provide regular feedback during the testing process of BW3.

50/50 Even though some of the test results will be technical and difficult for a lot of people to understand, SpaceMob has some very talented members and we are always happy to help make things understandable among our peers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh