Tokenomics 101 Aave

@AaveAave

Aave is a borrowing and lending protocol. Loans are overcollateralized and depositors are paid interest.

The AAVE token is mainly used for governance, safety and liquidity incentives.

Here is how it works 🧵

@AaveAave

Aave is a borrowing and lending protocol. Loans are overcollateralized and depositors are paid interest.

The AAVE token is mainly used for governance, safety and liquidity incentives.

Here is how it works 🧵

Depositors can pool capital and receive interest.

Borrowers can take a loan, paying interest. As there is no KYC or credit rating checks, borrowers have to overcollateralize their loan i.e. post more collateral than the loan they take.

Borrowers can take a loan, paying interest. As there is no KYC or credit rating checks, borrowers have to overcollateralize their loan i.e. post more collateral than the loan they take.

The core feature are pools that hold deposited funds, determine interest rates and ensure a loans collateral stays above its liquidation level.

Revenue comes from borrowing & lending spreads and flash loans and go to the treasury.

Revenue comes from borrowing & lending spreads and flash loans and go to the treasury.

The treasury is governed by AAVE token holders. Who also decide over risk parameters and token issuance from the ecosystem reserve fund.

The reserve fund was created to incentivise usage of the safety module and liquidity providers.

The reserve fund was created to incentivise usage of the safety module and liquidity providers.

AAVE can also be staked. The safety module pays stakers of AAVE more AAVE and is meant to protect the Aave system in oracle failures events, smart contract and liquidiation risks.

AAVE has a supply of 16m with a circulating supply of 13.9m and the remaining 2.1m in the ecosystem reserve.

No tokens are locked and where allocated as shown.

Generally the token is quite well distributed with the largest individual address holding just 1.6% of tokens.

No tokens are locked and where allocated as shown.

Generally the token is quite well distributed with the largest individual address holding just 1.6% of tokens.

Aave leads the lending market by TVL and has grown to > 100k users dune.com/rchen8/defi-us…

The main demand driver for AAVE is the governance control over the treasury, which collects revenue from the borrowing and lending market.

None of these revenues are distributed to holders, but governance rights over an increasing treasury is not a weak demand driver.

None of these revenues are distributed to holders, but governance rights over an increasing treasury is not a weak demand driver.

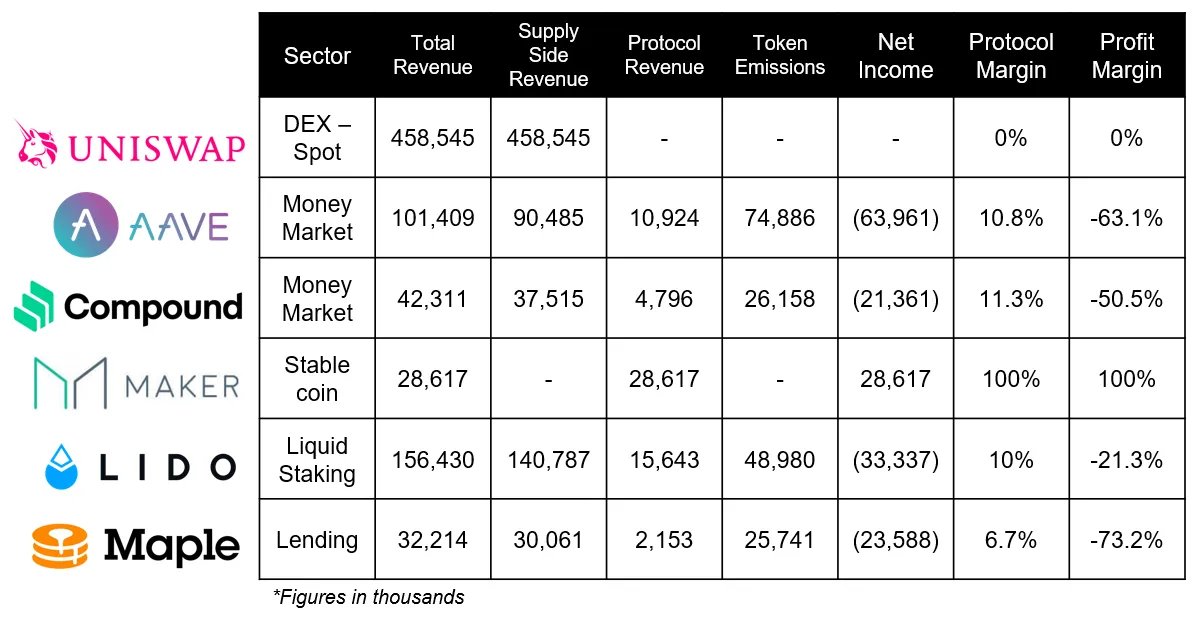

However, due to token emissions to liquidity incentives and safety module, Aave is not profitable according to this great analysis by @BanklessHQ newsletter.banklesshq.com/p/which-defi-p…

You can read the full detailed breakdown here: tokenomicsdao.substack.com/p/tokenomics-1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh