I can't stand to not speak up about this @feiprotocol situation. Please read this 🧵 for one of the most egregious "DAO/DeFi" situations I've ever seen. There's CeFi drama stuff, but this is a new low for DeFi.

Some background on what's going on: In late 2021 Fei Protocol (the stablecoin) did a merger with Rari Capital DAO (developers of the Fuse money market). The merger passed overwhelmingly & $RGT tokens became $TRIBE tokens effectively sealing the deal. tally.xyz/governance/eip…

In late April 2022, the Fei-Fuse money market was drained due to a reentrancy bug. Many early adapters of Fuse lost millions. @fraxfinance a huge FEI/Fuse backer+lender+user lost ~$13m. @OlympusDAO lost ~$9m. The total hack resulted in nearly $80m lost.

The FEI/TRIBE DAO had 100s of millions USD in excess PCV at this time & held a governance vote where TRIBE holders voted overwhelmingly to reimburse all victims of the hack. They were applauded for this exemplary & ethical move. I sang their graces. snapshot.org/#/fei.eth/prop…

Then weeks went by...🦗..no repayment. Then in May/June 2022, the crypto markets took their infamous downturn. Then FEI emerges with an insane proposal: "Let's do the repayment vote over again, the last one didn't count." The egregiousness of this is wild & absolutely ridiculous.

Of course, as you might expect, to no one's surprise the vote does not pass this time...the repayment of victims is off the table now.

@cobie had a good thread explaining it below. The gist of it is clear: FEI didn't want to repay victims because their stablecoin peg & treasury value was dangerously low. While passions were high, their supporters (including us at FRAX) were patient.

https://twitter.com/cobie/status/1537220039522545664

I even personally posted in the thread where they renegged on repayment, and I promised that any repayment to FRAX would permanently go to providing FEI-FRAX liquidity to bolster their peg. They'd be repaying FRAX AND STRENGTHENING THEIR PEG. Silence. Not even 1 reply.

I tried multiple times to reach out to @joey__santoro since June. No response. FRAX was on of their earliest supporters. I've met them all in real life. Nothing now. Not even a post mortem discussion/call with us after renegging on governance vote+repayment to all victims.

To his credit @JackLongarzo did speak to me in detail but when I asked for a meeting to discuss with him+Joey...silence...

Then today...the FEI team comes out that they're winding everything down. So what about the repayment of victims now that there's an orderly shutdown?

Then today...the FEI team comes out that they're winding everything down. So what about the repayment of victims now that there's an orderly shutdown?

FEI has more than enough PCV to redeem every stablecoin at peg, repay every cent to victims, & STILL have ~$65m in value for $TRIBE holders to redeem & profit. But what are they doing instead? Giving FRAX, Olympus etc cents on the dollar leaving victims with 95% hack losses.

Take a look at this, curtesy of @dcfgod. If FEI repaid every hack victim, redeemed all FEI at peg, then distributed the remaining treasury pro rata to TRIBE holders, TRIBE would be worth $.16 with 10s of millions USD value given back to holders. A graceful & perfect sunsetting.

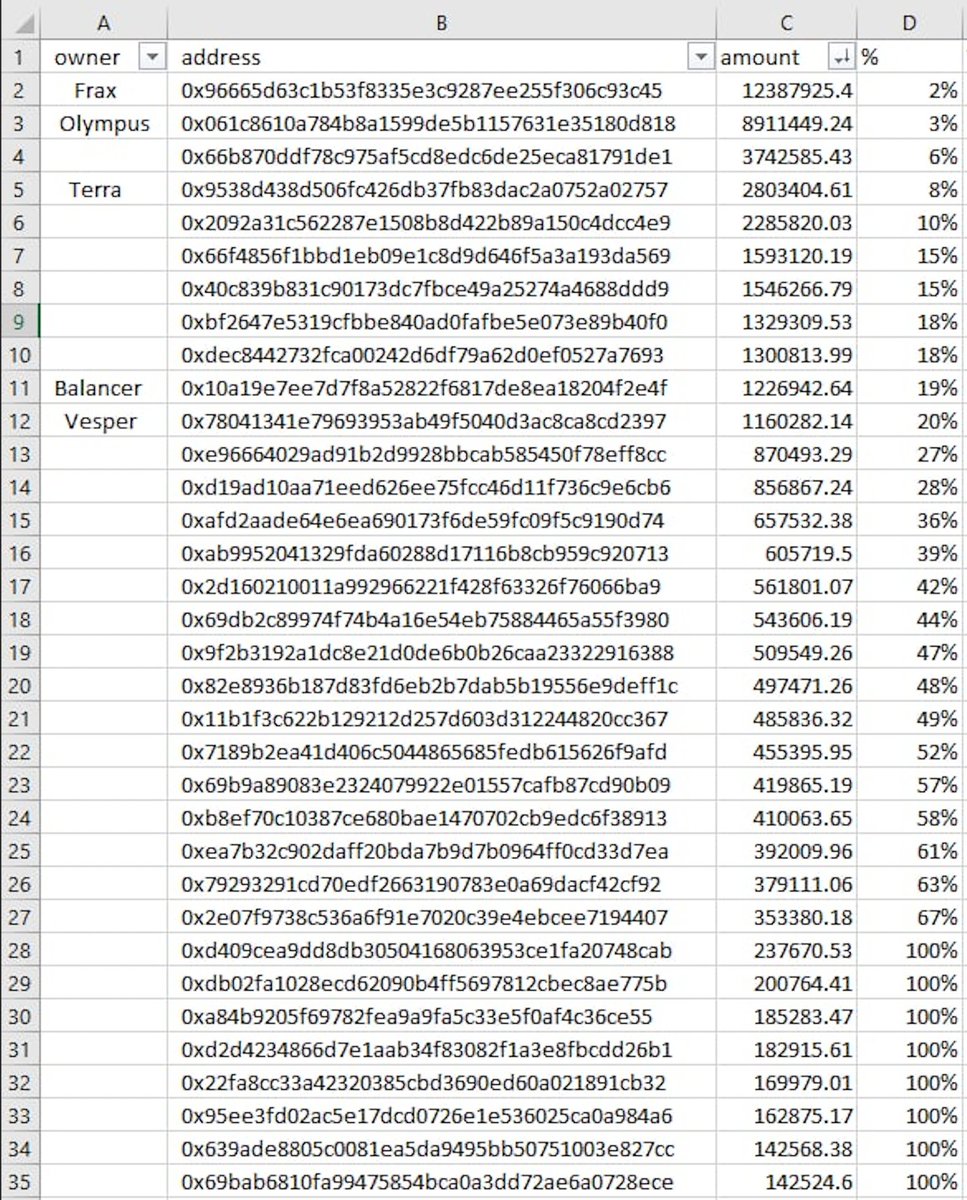

Instead of the above, they're planning to do this 👇 They're preposing repaying FRAX 2% of $12.3m lost. 3% of @OlympusDAO's $8.9m lost. And just 19% & 27% of @BalancerLabs @VesperFi losses respectively etc. Why? How does this make any sense other than fraud?

An honorable, ethical, & respectable shutdown of a DAO is literally perfectly here. The money is there. The full repayment, the perfect peg redemption, & moral precedent is possible. I truly don't understand how it's possible to look at this, then decide "Na let's take the rest."

This post in the Tribe forums resonates greatly. It straight up calls them out for simply wanting to keep more money for themselves at the expense of their early backers+friends solely because they probably think they can get away with it (they won't).

tribe.fei.money/t/tip-121-prop…

tribe.fei.money/t/tip-121-prop…

This is truly one of the most mind boggling situations I've seen. Outright fraud, blackhat hacks, scams/rugs are obvious. Difficult situations are also obviously difficult. This....I don't understand what this is other than WTF. This is a public VC backed, tier 1 project..

Their investors include @hiFramework @a16z @nascentxyz among others. I've personally done nothing but try in good faith for many months to resolve this and in the end this is what FRAX gets for being one of their earliest backers and supporters. No good deed goes unpunished.

Is it really worth the FEI/Rari team doing this to their bright careers in crypto for a couple million more dollars? There's still time to take feedback & fix mistakes so everyone can move on in peace & give respect+credit to FEI/Rari for doing the right thing in the very end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh