1/ NEW🕵️🧵: Good question from @wesstreeting but Im not so sure I understand the response from @mariacaulfield & perhaps more worryingly the response appears to me to be somewhat discrepant from previously published data by @DHSCgovuk

Pls share widely/RT

Pls share widely/RT

2/ This table is included in the response splits it into "age" and "early" retirement which the Minister describes as:

"Age retirements" are taken at or beyond 60 years old

"Voluntary early retirements" are taken before the age of 60 years old

"Age retirements" are taken at or beyond 60 years old

"Voluntary early retirements" are taken before the age of 60 years old

3/ But this data also appears in the @DHSCgovuk to DDRB for example here for GPs starting at page 125 of

assets.publishing.service.gov.uk/government/upl…

assets.publishing.service.gov.uk/government/upl…

5/ So lets look at the response from the Minister in more detail as its confusing to separate "age" from "early" retirements

6/ If I have done my maths correctly, that would put average age of retirement for GPs at 59.2 and for hospital doctors at 60.7 - and that doesn't feel right to me (assuming I have calculated it correctly of course!)

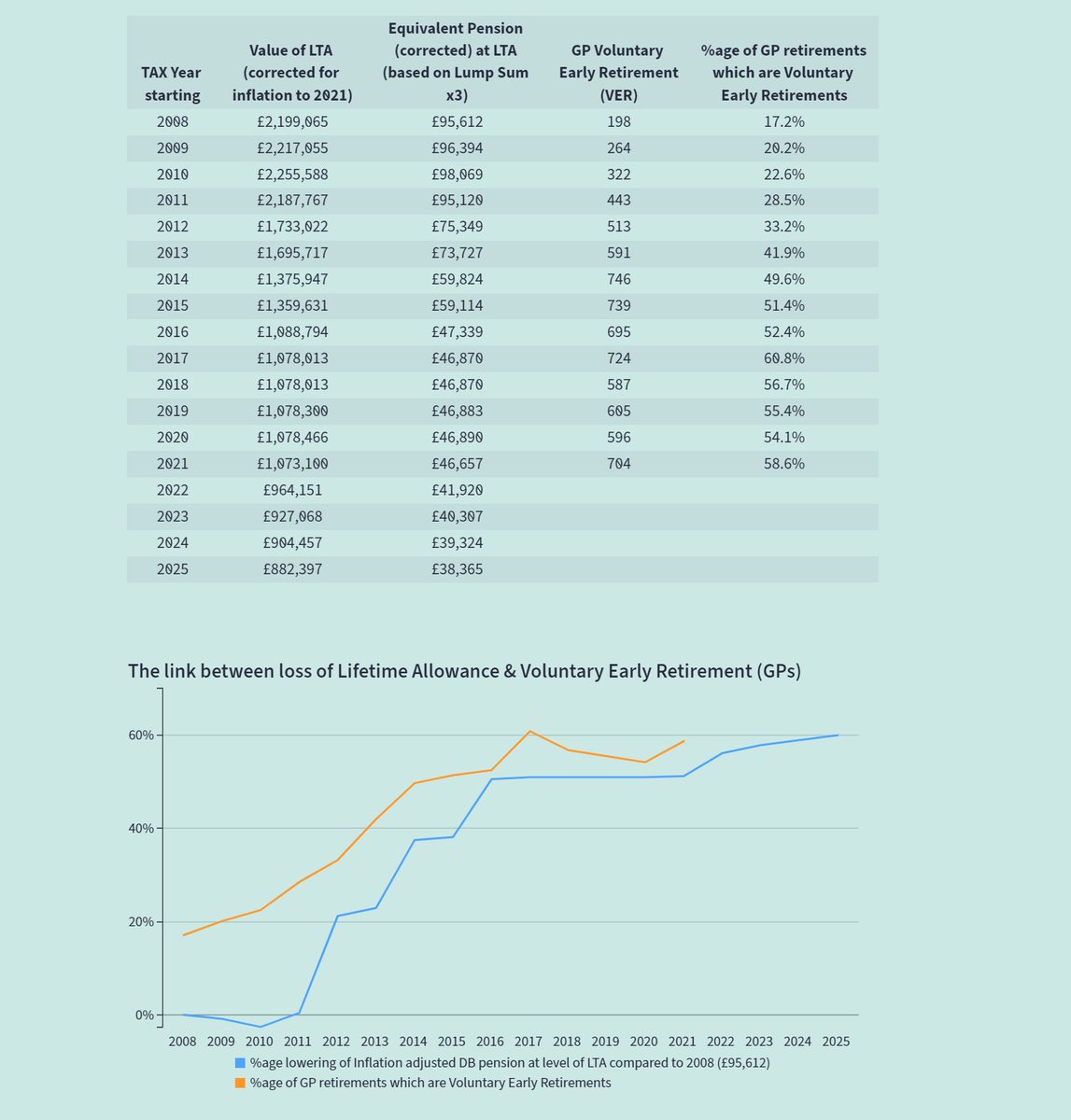

7/ But now lets cross check against evidence submitted to DDRB. At first I thought the difference in hospital doctors could be hospital doctors vs consultants, but I suspect not as the GP figures are also WAY out

8/ There are some caveats in the table about being different previously published data but I think the data in the DDRB report fits more with my perception of what is really happening, and dont recognise the figures given by the minister to be correct IMHO

9/ It would be useful for @wesstreeting @FeryalClark to get clarity on which version is correct, as this is a really important question. In getting clarity I would ask @wesstreeting to go back to 2008, here is why

10/ We are in the midst of a @Conservatives leadership campaign. We heard last night for a third time from @trussliz that she will sort this mess out stating "weve got a lot of doctors leaving the profession early because of the perverse way the pensions work"

11/ But experience tells us that sometimes promises made in leadership campaigns dont always come true, do they @BorisJohnson ?

12/ Why is this important, well its important because whilst @RishiSunak in his leadership campaign was keen to tell us about the changes to the taper, he may have omitted what he did to the lifetime allowance in the March 2021 budget.

13/ And why is that so important - well with inflation likely to hit 11.3% this September, this is what is happening to the LTA in real terms

14/ And how is this relevant to this thread about early retirement numbers? And the answer to that is an extremely close correlation between the slashing of the value of the LTA (blue line) nd the rates of early retirement (orange line). Its a *potent* driver to early retirement

15/ So whilst ministers say VER rates are flat as they did recently to @feryalclark that was before when LTA was indexed to inflation (i.e. flat) this years MASSIVE cut to the LTA - what will happen to the orange line? (assuming of course the data you get is correct as above).

16/ A further note of caution if retirements are average for GPs at 59.2 and for hospital doctors at 60.7 (which I highly doubt).... stay a day beyond 60 & this is what you do to you hard earned and paid for 1995 pension. You just burn it. We need #LateRetirementFactors

17/ Make sure you #KnowYourNumbers

1️⃣bma.org.uk/doesntpaytostay

🆓Peri-retirement🛠️(hos👨⚕️) #DoesntPayToStay

Understand now if you are paying to stay on - most consultants age 59/60 will lose >£100k by delaying retirement by a single year

1️⃣bma.org.uk/doesntpaytostay

🆓Peri-retirement🛠️(hos👨⚕️) #DoesntPayToStay

Understand now if you are paying to stay on - most consultants age 59/60 will lose >£100k by delaying retirement by a single year

18/ And also make sure you understand how you will be punished by AA in 22/23

2️⃣bma.org.uk/pay-and-contra…

🆓AA🛠️(GP) 22/23 #CPIdisconnect

2️⃣bma.org.uk/pay-and-contra…

🆓AA🛠️(GP) 22/23 #CPIdisconnect

19/ Please will somebody sensibe in government listen and fix this before its too late to recover waiting lists

Pls share / RT @TheBMA

Pls share / RT @TheBMA

• • •

Missing some Tweet in this thread? You can try to

force a refresh