1/

Get a cup of coffee.

In this thread, I'll walk you through one of the greatest qualities a business can have: a LONG RE-INVESTMENT RUNWAY.

If a business can plow its profits back into itself, to grow at a good clip for a long time, it can make its owners fabulously wealthy.

Get a cup of coffee.

In this thread, I'll walk you through one of the greatest qualities a business can have: a LONG RE-INVESTMENT RUNWAY.

If a business can plow its profits back into itself, to grow at a good clip for a long time, it can make its owners fabulously wealthy.

2/

Imagine that Alice wants to start a chain of laundromats.

She does some research.

She figures out some good locations around town for these laundromats: strip malls with high traffic, close to large apartment complexes that don't provide in-unit washers/dryers, etc.

Imagine that Alice wants to start a chain of laundromats.

She does some research.

She figures out some good locations around town for these laundromats: strip malls with high traffic, close to large apartment complexes that don't provide in-unit washers/dryers, etc.

3/

Say a commercial washer/dryer costs $10K.

Alice buys 100 of these -- putting in $10K * 100 = $1M of her own money to start her laundromat business.

So, right at the outset, Alice has a CASH OUTFLOW of $1M.

That's her "upfront capital".

Say a commercial washer/dryer costs $10K.

Alice buys 100 of these -- putting in $10K * 100 = $1M of her own money to start her laundromat business.

So, right at the outset, Alice has a CASH OUTFLOW of $1M.

That's her "upfront capital".

4/

And having PUT IN this $1M of upfront capital, Alice is hoping to TAKE OUT more than $1M from her laundromat operations over time.

These operations are pretty simple:

Customers pay in cash. That's "Revenue" for Alice. And cash coming IN the door.

And having PUT IN this $1M of upfront capital, Alice is hoping to TAKE OUT more than $1M from her laundromat operations over time.

These operations are pretty simple:

Customers pay in cash. That's "Revenue" for Alice. And cash coming IN the door.

5/

At the same time, cash also goes OUT the door -- via "operating" and "capital" expenses.

Operating expenses: Rent, electricity, water, staff salaries, taxes, etc.

Capital expenses: Repairing and replacing washer/dryer units that break from time to time.

At the same time, cash also goes OUT the door -- via "operating" and "capital" expenses.

Operating expenses: Rent, electricity, water, staff salaries, taxes, etc.

Capital expenses: Repairing and replacing washer/dryer units that break from time to time.

6/

After covering BOTH operating and capital expenses, let's say Alice is able to TAKE OUT $150K per year from her laundromat chain.

That is, Alice's business gives her a $150K DIVIDEND at the end of each year.

After covering BOTH operating and capital expenses, let's say Alice is able to TAKE OUT $150K per year from her laundromat chain.

That is, Alice's business gives her a $150K DIVIDEND at the end of each year.

7/

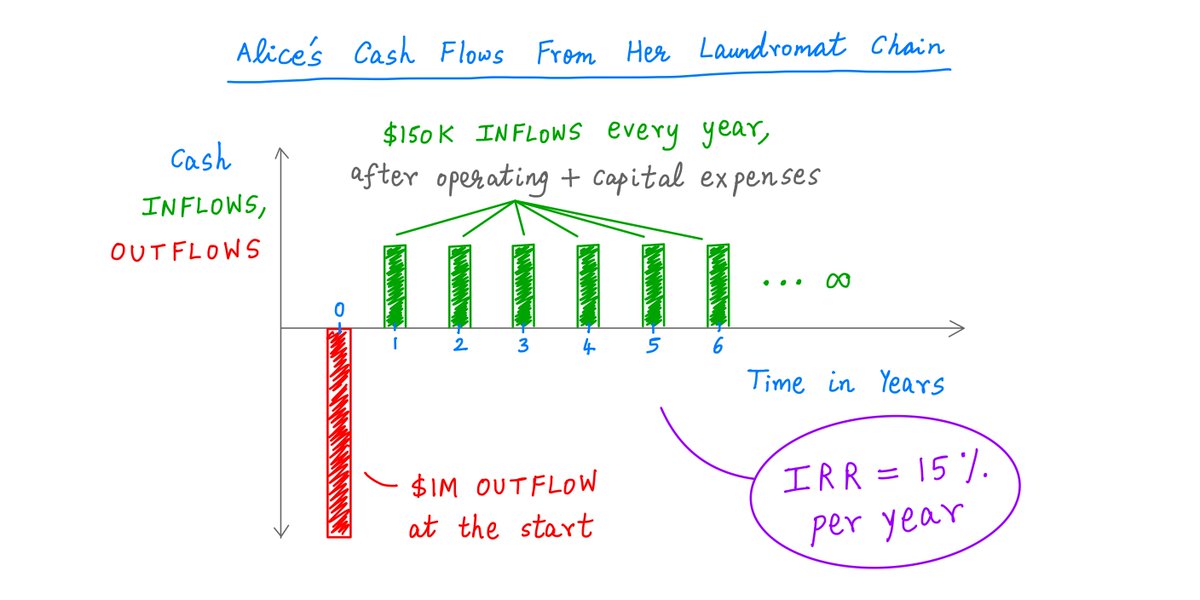

So, Alice's "cash flows" look like this:

- A $1M cash OUTFLOW at the start,

- And then a $150K cash INFLOW every year after that.

That's a nice 15% per year return (IRR, or Internal Rate of Return) for Alice on her $1M investment.

So, Alice's "cash flows" look like this:

- A $1M cash OUTFLOW at the start,

- And then a $150K cash INFLOW every year after that.

That's a nice 15% per year return (IRR, or Internal Rate of Return) for Alice on her $1M investment.

8/

Fast forward 5 years.

Alice's laundromats are still throwing off $150K in dividends every year for Alice.

And there's still $1M worth of capital -- assets in the form of washer/dryer units -- in the business.

But now Alice wants to sell her laundromats and retire.

Fast forward 5 years.

Alice's laundromats are still throwing off $150K in dividends every year for Alice.

And there's still $1M worth of capital -- assets in the form of washer/dryer units -- in the business.

But now Alice wants to sell her laundromats and retire.

9/

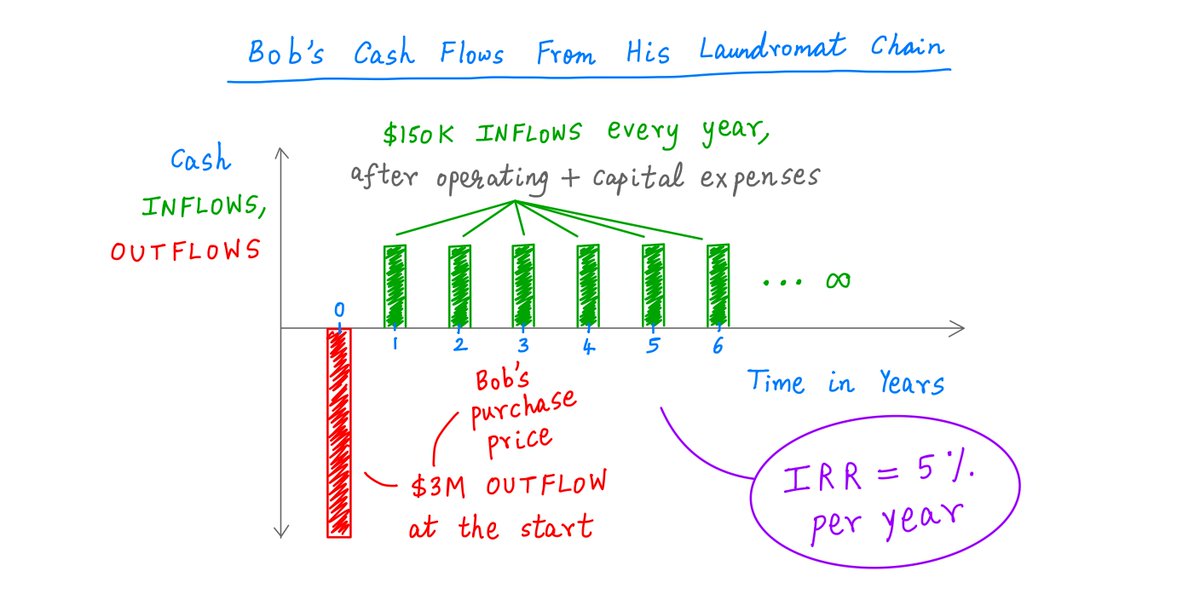

Let's say Bob buys Alice's laundromats for $3M.

As we said, the business has $1M of assets. AND it earns 15% ($150K) per year on these assets.

Bob figures he's paying about 3x book value (P/B), or 20x earnings (P/E) for the business.

Not bad for a 15% earner, right?

Let's say Bob buys Alice's laundromats for $3M.

As we said, the business has $1M of assets. AND it earns 15% ($150K) per year on these assets.

Bob figures he's paying about 3x book value (P/B), or 20x earnings (P/E) for the business.

Not bad for a 15% earner, right?

10/

Here's the thing though:

Bob won't make anywhere near a 15% return on HIS investment.

Why? Because Bob paid 3 times book, he only gets to take home one-third of 15%, or 5% per year.

Here's the thing though:

Bob won't make anywhere near a 15% return on HIS investment.

Why? Because Bob paid 3 times book, he only gets to take home one-third of 15%, or 5% per year.

11/

This is the SAME business Alice used to own.

With the SAME assets, cash flows, earnings, and dividends.

But whereas the business earned 15% for Alice, it earns ONLY 5% for Bob.

Because Alice only PUT IN $1M to build the business.

Whereas Bob PUT IN $3M to acquire it.

This is the SAME business Alice used to own.

With the SAME assets, cash flows, earnings, and dividends.

But whereas the business earned 15% for Alice, it earns ONLY 5% for Bob.

Because Alice only PUT IN $1M to build the business.

Whereas Bob PUT IN $3M to acquire it.

12/

This is a key point:

Purchase Price makes a BIG difference.

The business doesn't earn more just because Bob paid a fancy price for it.

It pays out the SAME $150K dividend every year. And that's only 5% of Bob's $3M purchase price.

So, Bob only gets a 5% IRR.

This is a key point:

Purchase Price makes a BIG difference.

The business doesn't earn more just because Bob paid a fancy price for it.

It pays out the SAME $150K dividend every year. And that's only 5% of Bob's $3M purchase price.

So, Bob only gets a 5% IRR.

13/

This is true whether we buy entire businesses or small pieces of them (ie, stocks).

IF a business doesn't grow,

And it dividends out its profits every year,

And we buy and hold it forever,

Our IRR will be equal to our dividend yield,

Inversely related to our purchase price.

This is true whether we buy entire businesses or small pieces of them (ie, stocks).

IF a business doesn't grow,

And it dividends out its profits every year,

And we buy and hold it forever,

Our IRR will be equal to our dividend yield,

Inversely related to our purchase price.

14/

So, a *business* may earn 15% on *its* capital.

But the *owner* of said business may only earn 5% on *their* purchase price.

But there's ONE way Bob can overcome this:

FOREGO dividends for a while; RE-INVEST that money back into the business to GROW it.

So, a *business* may earn 15% on *its* capital.

But the *owner* of said business may only earn 5% on *their* purchase price.

But there's ONE way Bob can overcome this:

FOREGO dividends for a while; RE-INVEST that money back into the business to GROW it.

15/

Here's the idea:

Suppose Bob doesn't need his $150K dividend each year.

So, instead of taking OUT this $150K each year, Bob leaves this money IN the business.

And he USES this money to EXPAND the business -- by buying MORE washer/dryer units, opening MORE locations, etc.

Here's the idea:

Suppose Bob doesn't need his $150K dividend each year.

So, instead of taking OUT this $150K each year, Bob leaves this money IN the business.

And he USES this money to EXPAND the business -- by buying MORE washer/dryer units, opening MORE locations, etc.

16/

Let's say these *additional* investments by Bob have the SAME economics as Alice's original $1M investment.

That is, the business earns 15% per year on ALL capital in it -- Alice's original $1M as well as Bob's subsequent "contributions" (via foregone dividends).

Let's say these *additional* investments by Bob have the SAME economics as Alice's original $1M investment.

That is, the business earns 15% per year on ALL capital in it -- Alice's original $1M as well as Bob's subsequent "contributions" (via foregone dividends).

17/

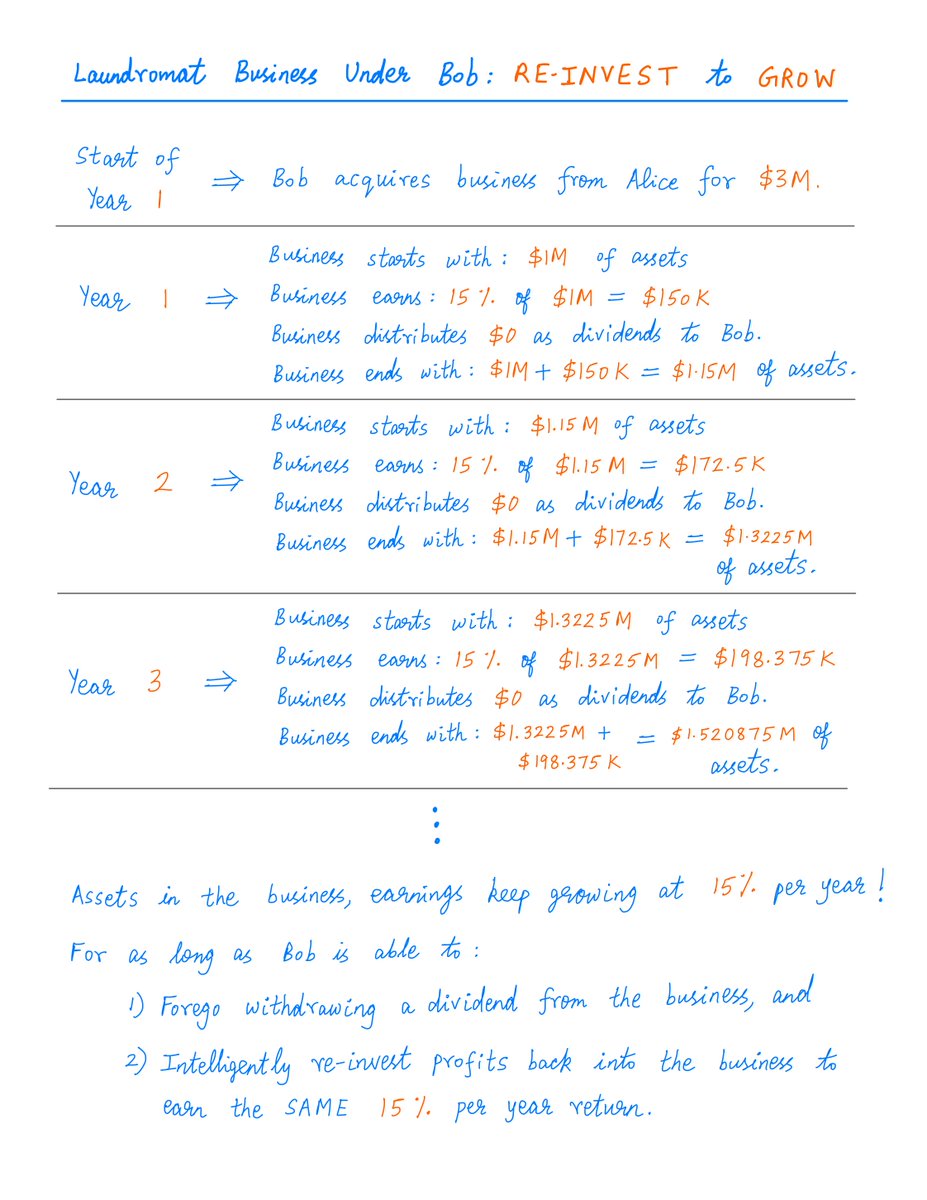

Let's work out Bob's cash flows in this case.

We know that when Bob first takes over from Alice, he pays her $3M for the business.

That's a $3M cash OUTFLOW for Bob at the start.

Then, in Year 1, the business earns $150K.

But Bob doesn't take ANY of this $150K OUT.

Let's work out Bob's cash flows in this case.

We know that when Bob first takes over from Alice, he pays her $3M for the business.

That's a $3M cash OUTFLOW for Bob at the start.

Then, in Year 1, the business earns $150K.

But Bob doesn't take ANY of this $150K OUT.

18/

Instead, Bob RE-INVESTS this $150K back into the business.

This *adds* $150K to the $1M of capital already in the business -- leaving it with $1M + $150K = $1.15M of capital.

In Year 2, the business can then earn 15% on this $1.15M = $172.5K -- 15% UP from Year 1's $150K.

Instead, Bob RE-INVESTS this $150K back into the business.

This *adds* $150K to the $1M of capital already in the business -- leaving it with $1M + $150K = $1.15M of capital.

In Year 2, the business can then earn 15% on this $1.15M = $172.5K -- 15% UP from Year 1's $150K.

19/

This ~15% GROWTH in earnings can continue for as long as Bob is:

a) Willing to forego dividends, AND

b) Able to intelligently RE-INVEST the "foregone dividend" money to GROW the business -- earning the SAME 15% on ALL new capital he's pouring into the business.

Like so:

This ~15% GROWTH in earnings can continue for as long as Bob is:

a) Willing to forego dividends, AND

b) Able to intelligently RE-INVEST the "foregone dividend" money to GROW the business -- earning the SAME 15% on ALL new capital he's pouring into the business.

Like so:

20/

Of course, Bob won't be able to continue making these high return investments forever.

For example, there's probably a limit to how many washer/dryer units Bob can install at one location. Once this limit is crossed, new units will just lie idle -- and NOT earn their keep.

Of course, Bob won't be able to continue making these high return investments forever.

For example, there's probably a limit to how many washer/dryer units Bob can install at one location. Once this limit is crossed, new units will just lie idle -- and NOT earn their keep.

21/

Also, Bob can't keep opening new laundromats forever. Sooner or later, he'll saturate the market in his town.

So, EVENTUALLY, Bob won't be able to RE-INVEST profits to GROW at 15%/year.

When that happens, Bob will be FORCED to take a dividend -- whether he needs it or not.

Also, Bob can't keep opening new laundromats forever. Sooner or later, he'll saturate the market in his town.

So, EVENTUALLY, Bob won't be able to RE-INVEST profits to GROW at 15%/year.

When that happens, Bob will be FORCED to take a dividend -- whether he needs it or not.

22/

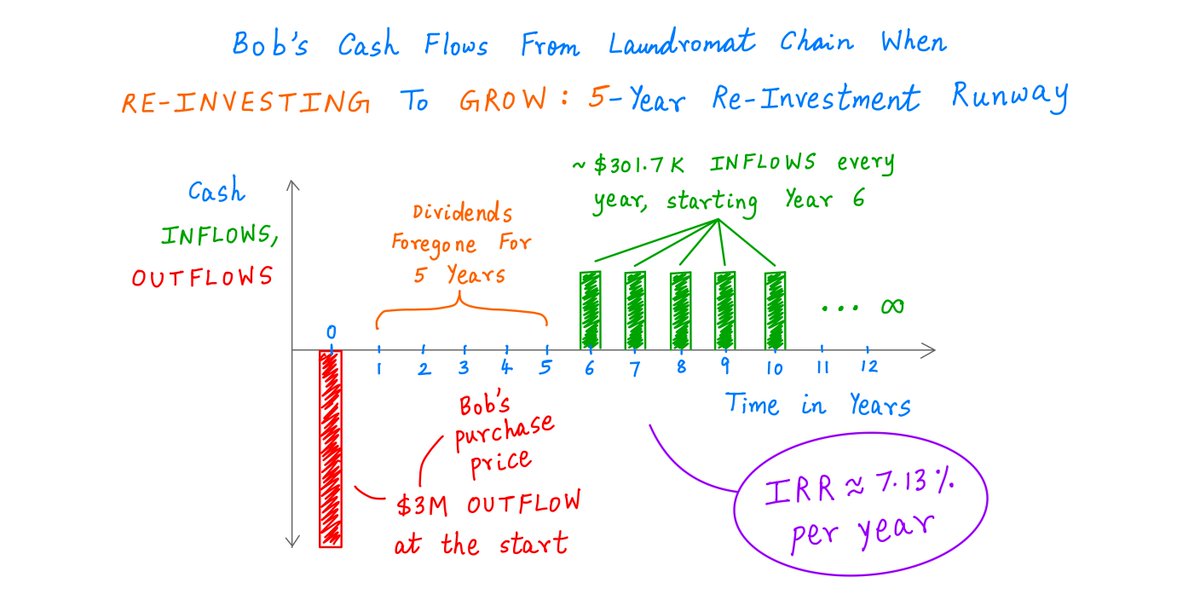

Let's say Bob has a 5-year "Re-investment Runway".

That is, Bob foregoes dividends for 5 years.

And in each of these 5 years, Bob GROWS profits 15% -- by intelligently re-investing his foregone dividend money back into his laundromats.

Let's say Bob has a 5-year "Re-investment Runway".

That is, Bob foregoes dividends for 5 years.

And in each of these 5 years, Bob GROWS profits 15% -- by intelligently re-investing his foregone dividend money back into his laundromats.

23/

After 5 years of such 15% GROWTH, the business will be earning $150K * (1.15^5) = ~$301.7K per year.

And starting Year 6, Bob will be FORCED to take OUT this ~$301.7K per year as a dividend -- because his "Re-investment Runway" has ended.

After 5 years of such 15% GROWTH, the business will be earning $150K * (1.15^5) = ~$301.7K per year.

And starting Year 6, Bob will be FORCED to take OUT this ~$301.7K per year as a dividend -- because his "Re-investment Runway" has ended.

24/

Here are Bob's cash flows in this "5-year Re-investment Runway" situation. His IRR works out to ~7.13%.

Thus, by foregoing dividends for 5 years and intelligently re-investing that money back into the business, Bob is able to boost his IRR from 5% to ~7.13% per year.

Here are Bob's cash flows in this "5-year Re-investment Runway" situation. His IRR works out to ~7.13%.

Thus, by foregoing dividends for 5 years and intelligently re-investing that money back into the business, Bob is able to boost his IRR from 5% to ~7.13% per year.

25/

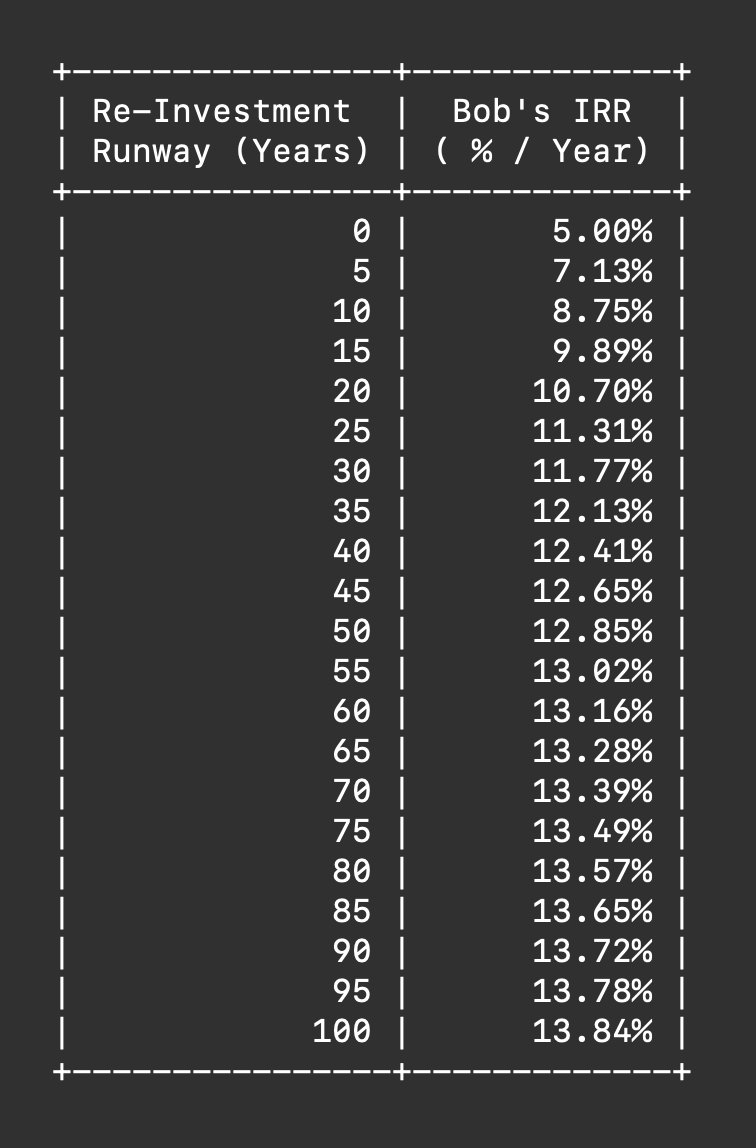

Moreover, Bob's IRR keeps improving as his runway gets longer.

As the runway goes to *infinity*, Bob's IRR converges to 15% -- the business's return on capital.

Thus, a LONG runway can allow Bob to earn a very satisfactory return -- in spite of paying ~3x book.

Moreover, Bob's IRR keeps improving as his runway gets longer.

As the runway goes to *infinity*, Bob's IRR converges to 15% -- the business's return on capital.

Thus, a LONG runway can allow Bob to earn a very satisfactory return -- in spite of paying ~3x book.

26/

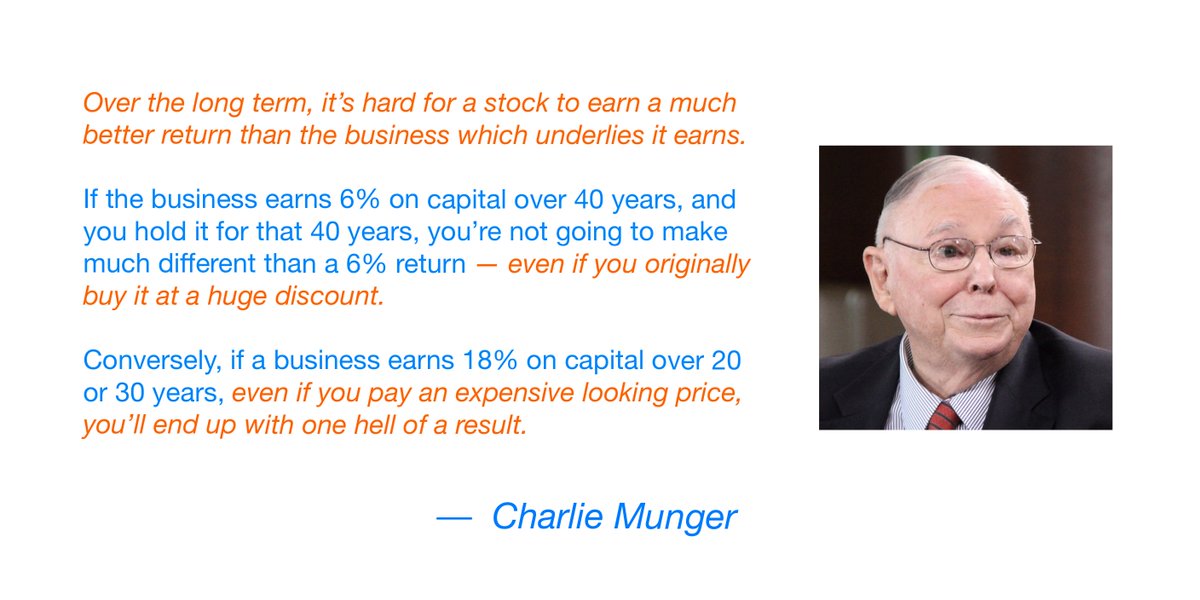

So, the key takeaway is:

If we buy a high quality business with a LONG runway to RE-INVEST profits at attractive rates of return, we are likely to do well in the long run -- EVEN if we pay a somewhat high price to acquire the business.

As Charlie Munger put it:

So, the key takeaway is:

If we buy a high quality business with a LONG runway to RE-INVEST profits at attractive rates of return, we are likely to do well in the long run -- EVEN if we pay a somewhat high price to acquire the business.

As Charlie Munger put it:

27/

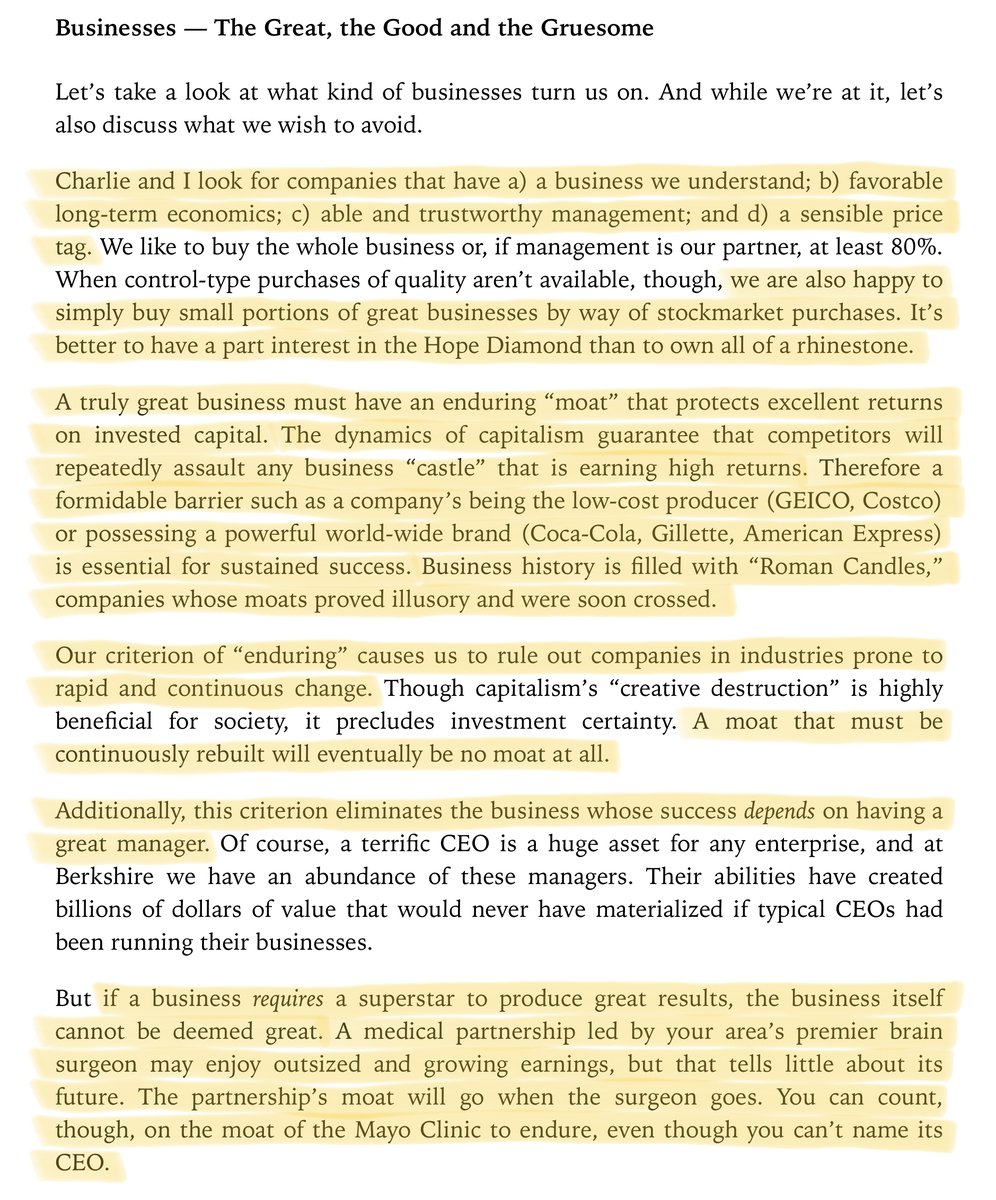

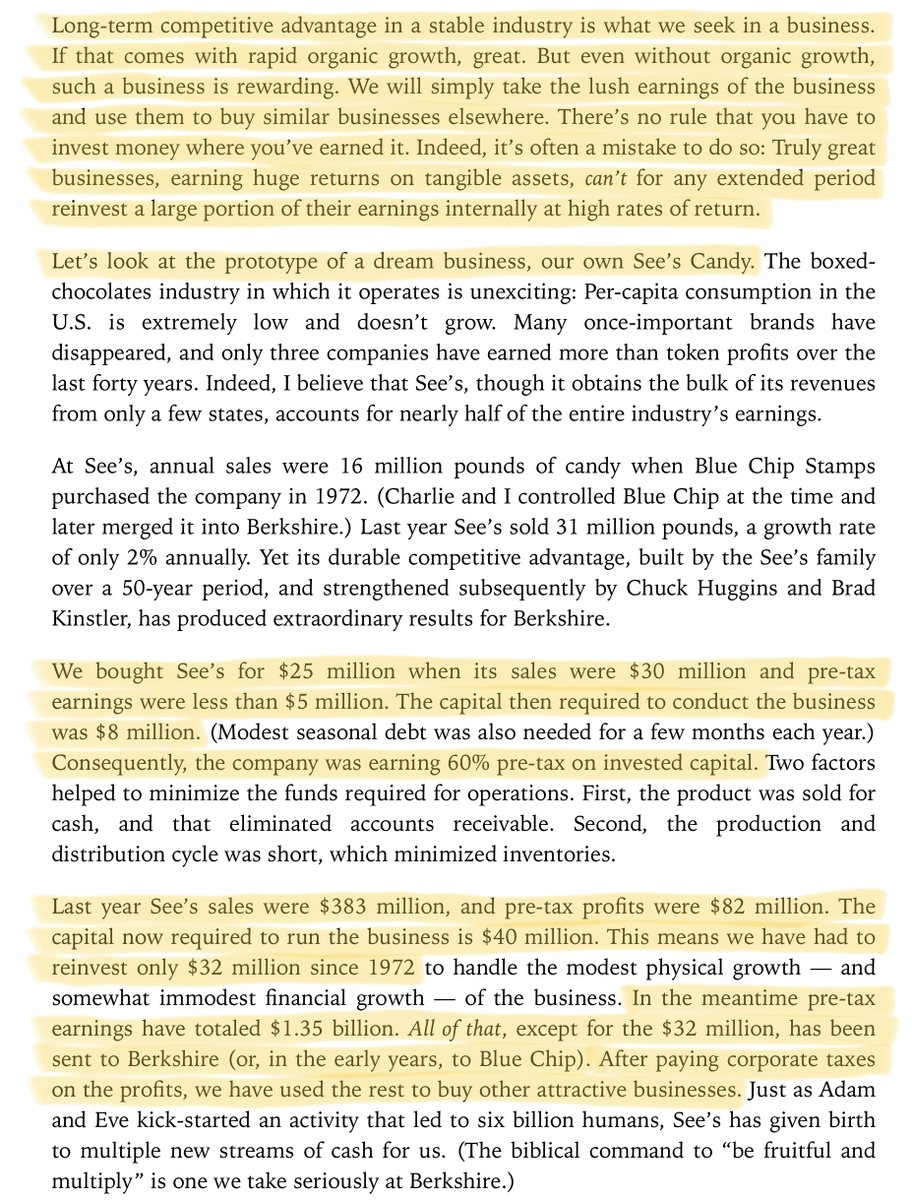

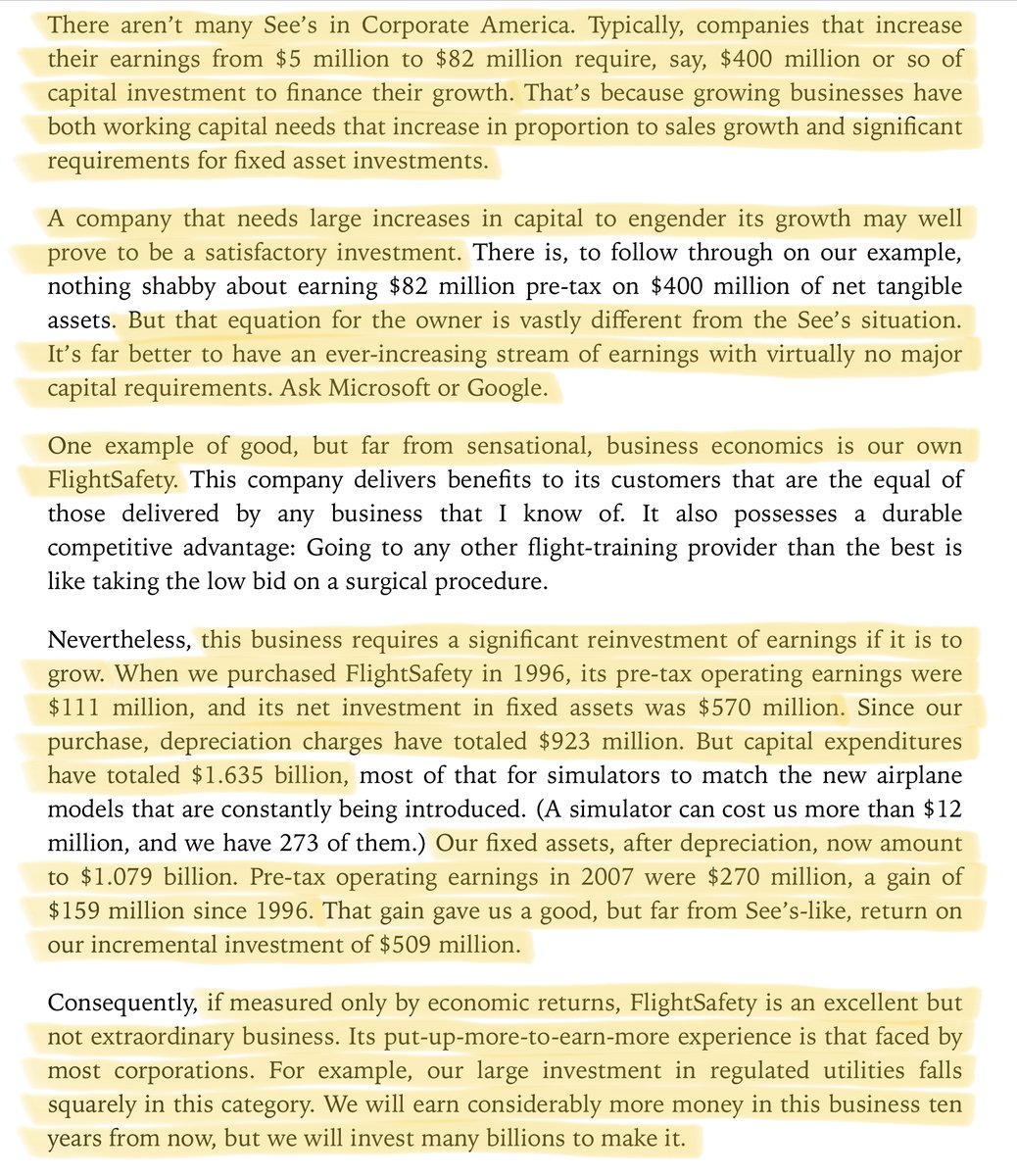

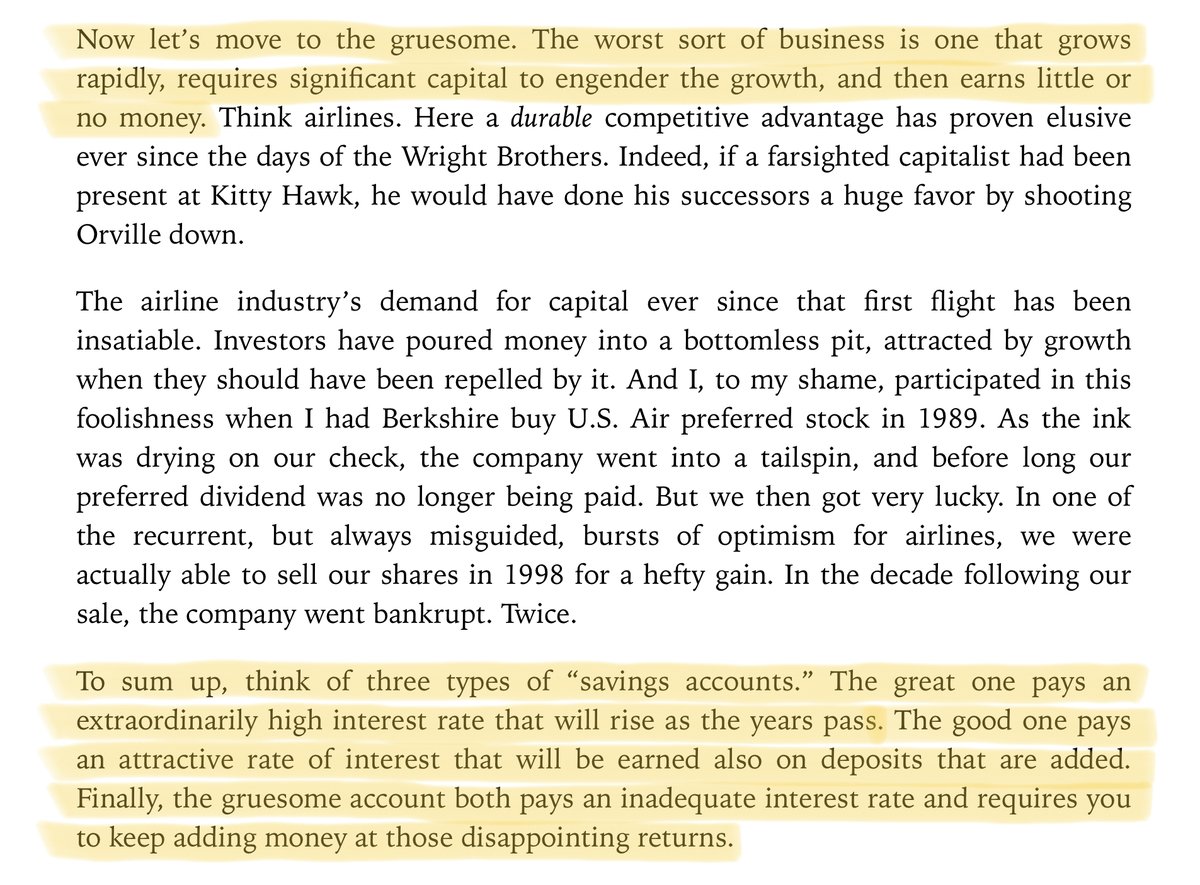

To understand the power of a long Re-investment Runway, I also recommend reading this wonderful section from Buffett's 2007 letter:

"Businesses: The Great, The Good, And The Gruesome"

To understand the power of a long Re-investment Runway, I also recommend reading this wonderful section from Buffett's 2007 letter:

"Businesses: The Great, The Good, And The Gruesome"

28/

If you're still with me, thank you very much!

To learn more about the economic characteristics that make a business wonderful, please consider joining this course I'm teaching with Ali Ladha (@AliTheCFO):

maven.com/good-business-…

Have a great weekend!

/End

If you're still with me, thank you very much!

To learn more about the economic characteristics that make a business wonderful, please consider joining this course I'm teaching with Ali Ladha (@AliTheCFO):

maven.com/good-business-…

Have a great weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh