1/ As one of the leading experts on pension taxation in NHS I've personally reached out to @trussliz @RishiSunak with my thoughts on this existential threat to the NHS & solutions

If you want #TalkToTony I'd be happy to explain this complex issue.

Read 👇& RT if you agree

If you want #TalkToTony I'd be happy to explain this complex issue.

Read 👇& RT if you agree

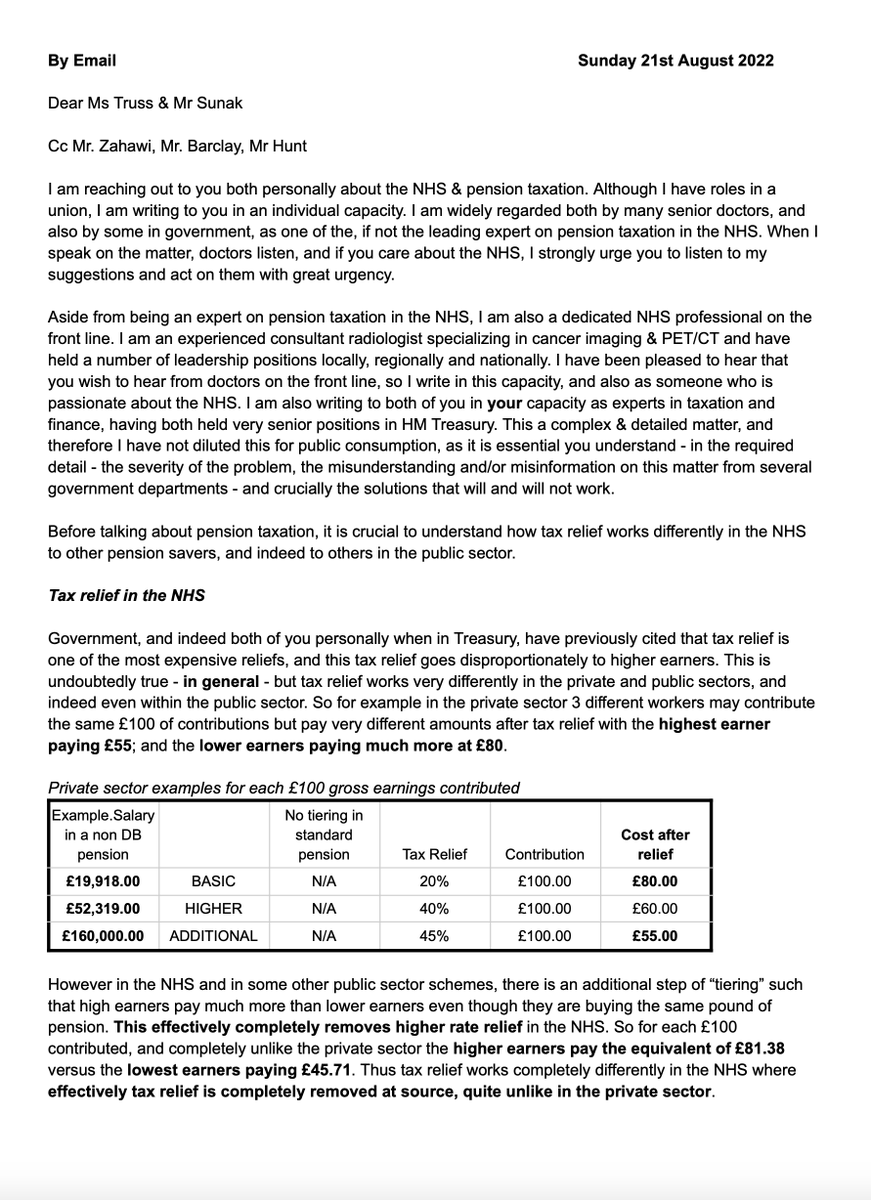

2/ I start by explaining in detail how about tax relief in the NHS is *not* the same as the private sector, nor is it the same as other public sector schemes

3/ Much of the general problem has been explained many times, including in the recent excellent @CommonsHealth report that correctly concluded that "It is a NATIONAL SCANDAL that senior doctors are being forced to reduce their working contribution"

4/ But even in the short time since the evidence for that report was collected, things are now moving exponentially with rapidly rising inflation causing issues with #CPIdisconnect #NegativePIAs & the very urgent need to #FixTheFinanceAct as raised recently by @DrDanPoulter

5/ Whilst issues with the Annual Allowance are central to the NHS pension crisis, rapidly rising inflation is now also destroying the Lifetime Allowance at unpredented rates. Ultimately we need a long term solution like offered to the judiciary #taxunregistered

6/ There are solutions. But government need to listen to people that understand this highly complex issue. Time is running out to fix this. Your urgent intervention is required before patient safety is further compromised by these absurdly unfair and ill conceived taxes.

Pls RT

Pls RT

7/ Read the letter in full below (with some minor corrections / typos)

docs.google.com/document/d/e/2…

docs.google.com/document/d/e/2…

• • •

Missing some Tweet in this thread? You can try to

force a refresh