Coinbase says they don’t list any securities, end of story.

Except Braintrust's token, BTRST, is a security.

And BTRST is listed on Coinbase.

Why Coinbase is gaslighting about securities 🧵

Except Braintrust's token, BTRST, is a security.

And BTRST is listed on Coinbase.

Why Coinbase is gaslighting about securities 🧵

The Howey Test defines what it means to buy a security:

“An investment of money for a reasonable expectation of profits to be derived from the efforts of others.”

In the non-crypto world, it's established that every company's stock is a security.

“An investment of money for a reasonable expectation of profits to be derived from the efforts of others.”

In the non-crypto world, it's established that every company's stock is a security.

Things are fuzzier for crypto investors.

According to the SEC, there’s at least one crypto asset that’s not a security: Bitcoin.

In 2019, then chair Jay Clayton said BTC isn't a security because it could hypothetically substitute for a sovereign currency like USD or Euro.

According to the SEC, there’s at least one crypto asset that’s not a security: Bitcoin.

In 2019, then chair Jay Clayton said BTC isn't a security because it could hypothetically substitute for a sovereign currency like USD or Euro.

For crypto investors, what determines if something is a security?

The Howey Test again.

The SEC doesn’t change their test just because a decentralized ledger is involved.

Here’s the SEC’s framework for analyzing digital asset purchases: sec.gov/corpfin/framew…

The Howey Test again.

The SEC doesn’t change their test just because a decentralized ledger is involved.

Here’s the SEC’s framework for analyzing digital asset purchases: sec.gov/corpfin/framew…

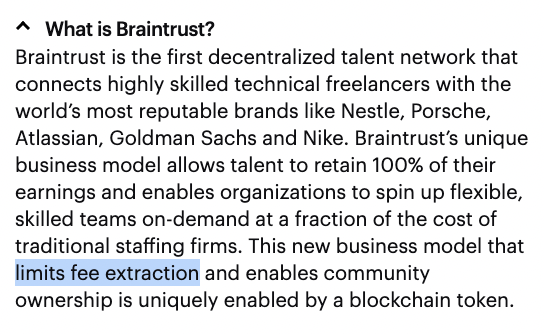

This brings us to Braintrust, a job placement marketplace that raised $123M by selling $BTRST tokens to investors.

If you don’t already know what Braintrust is and what kinds of Web3 #HollowAbstractions they gaslight about, see my previous thread:

If you don’t already know what Braintrust is and what kinds of Web3 #HollowAbstractions they gaslight about, see my previous thread:

https://twitter.com/liron/status/1561166817669722112

Braintrust’s profits increase the value of the $BTRST token via a mechanism that’s structurally identical to a stock buyback.

Companies who hire freelancers on Braintrust pay a 10% fee in fiat, which gets converted into $BTRST at market price, which raises the price of $BTRST.

Companies who hire freelancers on Braintrust pay a 10% fee in fiat, which gets converted into $BTRST at market price, which raises the price of $BTRST.

The auto-purchase of $BTRST is documented here: snapshot.org/#/usebraintrus…

In their own words: “Demand [and tokenholder’s profit] for BTRST will be programmatically linked to the Gross Services Volume of the network.”

It's like how stock buybacks return value to equity holders.

In their own words: “Demand [and tokenholder’s profit] for BTRST will be programmatically linked to the Gross Services Volume of the network.”

It's like how stock buybacks return value to equity holders.

It’s glaringly obvious that $BTRST meets the Howey Test definition of a security.

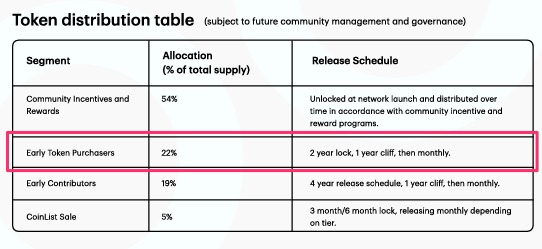

When Coatue and Tiger bought $100M of $BTRST in Dec 2021, they did so with an expectation of profit, and awareness of a specific mechanism by which to obtain that profit.

usebraintrust.com/blog/-100m-btr…

When Coatue and Tiger bought $100M of $BTRST in Dec 2021, they did so with an expectation of profit, and awareness of a specific mechanism by which to obtain that profit.

usebraintrust.com/blog/-100m-btr…

That’s why CEO @adamjacksonsf is talking about Braintrust investors not buying equity in a corporation.

His investors have purchased $BTRST tokens; nothing else.

Could it be any more clear that a token is a security when equity investors are buying it instead of buying equity?

His investors have purchased $BTRST tokens; nothing else.

Could it be any more clear that a token is a security when equity investors are buying it instead of buying equity?

Last month, Coinbase announced that they don’t list securities.

They say their rigorous review process keeps securities off their platform.

Psst, @coinbase… I think I spotted a security that slipped past your rigorous reviewers.

blog.coinbase.com/coinbase-does-…

They say their rigorous review process keeps securities off their platform.

Psst, @coinbase… I think I spotted a security that slipped past your rigorous reviewers.

blog.coinbase.com/coinbase-does-…

Coinbase knows what kind of business they’re in. In a June 2018 blog post, they explicitly said they were on track to listing securities.

blog.coinbase.com/our-path-to-li…

blog.coinbase.com/our-path-to-li…

So why, all of a sudden, won't Coinbase call a security a security?

It's because they’re a platform for VCs to take advantage of retail investors.

Look at Braintrust. A subsidized staffing agency that will probably never be a self-sustaining business… but VCs love it. Why?

It's because they’re a platform for VCs to take advantage of retail investors.

Look at Braintrust. A subsidized staffing agency that will probably never be a self-sustaining business… but VCs love it. Why?

Because at $2 per BTRST, Braintrust’s early VCs who bought in at $0.33 are set to walk away with a 600% return.

Meanwhile, the majority of retail investors who bought $BTRST through Coinbase have lost money.

Meanwhile, the majority of retail investors who bought $BTRST through Coinbase have lost money.

Without securities regulation holding them back, VCs don't mind investing in shitcoins.

Worst case, they can pump in more funding and let the next buyer be their exit liquidity.

Sure, the pumps always lead to crashes, but everyone thinks they'll time their exit and be fine.

Worst case, they can pump in more funding and let the next buyer be their exit liquidity.

Sure, the pumps always lead to crashes, but everyone thinks they'll time their exit and be fine.

Retail investors take high-risk bets on tokens like $BTRST without any clue whether there's a profitable business behind the exciting price graph.

Claims by a project like Braintrust go unchecked. People take the word of VCs who have a financial interest in their compliance.

Claims by a project like Braintrust go unchecked. People take the word of VCs who have a financial interest in their compliance.

Securities regulation requires disclosures to protect investors from losing their life savings in ultra-high-risk securities that market themselves as low-risk.

If you have a retirement account with stock and bond index funds, you're benefiting from well-regulated securities.

If you have a retirement account with stock and bond index funds, you're benefiting from well-regulated securities.

I believe SEC regulations should prevent Coinbase from running a casino where retail becomes early exit liquidity for VCs.

The first step is to stop gaslighting that equity on the blockchain isn't a security.

Take responsibility for what's going on. Call securities securities.

The first step is to stop gaslighting that equity on the blockchain isn't a security.

Take responsibility for what's going on. Call securities securities.

• • •

Missing some Tweet in this thread? You can try to

force a refresh