🗒️Today's Twitter Space Agenda:

1. History of the PSLF Program

2. PSLF Program Qualifications

3. Breakdown of the PSLF Help Tool

4. What you need to fill out a PSLF Form

5. How to handle Employer Certification

6. How to Submit a PSLF Form and Next Steps in the process

7. FAQs

1. History of the PSLF Program

2. PSLF Program Qualifications

3. Breakdown of the PSLF Help Tool

4. What you need to fill out a PSLF Form

5. How to handle Employer Certification

6. How to Submit a PSLF Form and Next Steps in the process

7. FAQs

From 2007 to now, we're covering the history of Public Service Loan Forgiveness (PSLF) and improvements made to the program. We just surpassed $10 billion in Public Service Loan Forgiveness (PSLF) for more than 175,000 public servants.

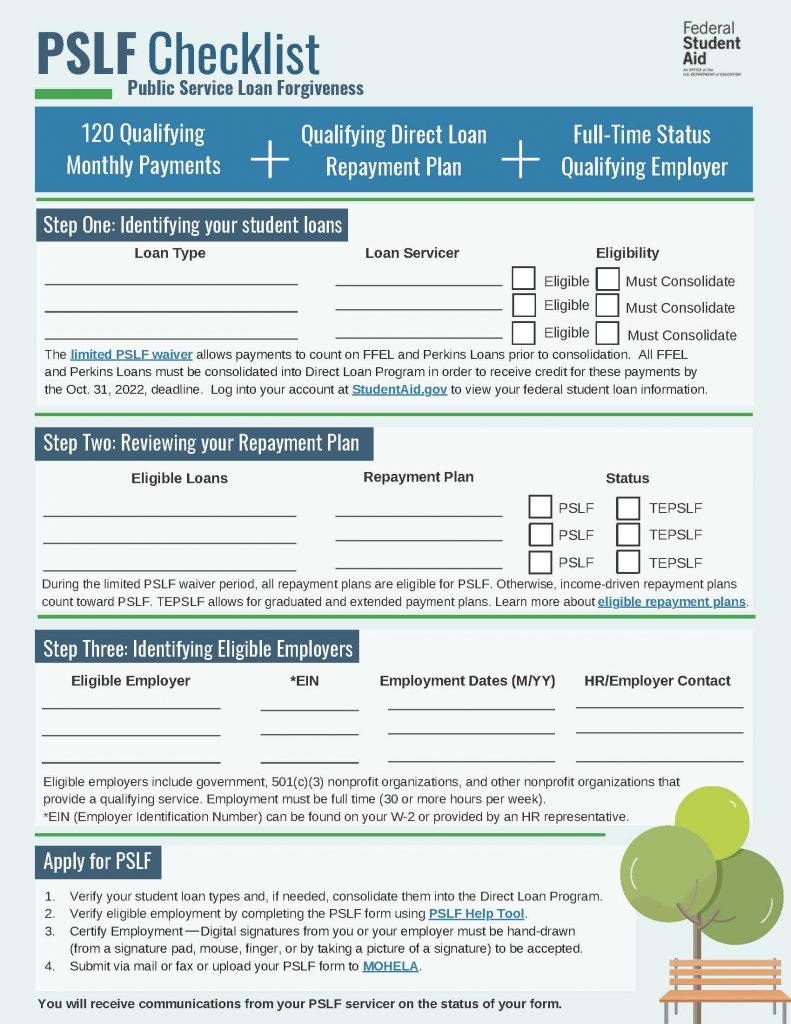

Before you plan on receiving Public Service Loan Forgiveness (PSLF), check all the requirements carefully to make sure you’re eligible under each category:

☑️employer,

☑️qualifying payments (120 needed)

☑️repayment plan, and

☑️ loan type.

☑️employer,

☑️qualifying payments (120 needed)

☑️repayment plan, and

☑️ loan type.

You must work full-time, or at least 30 hours a week, for a qualifying employer to be eligible for PSLF. Your job title does not impact eligibility. Use the employer search tool to see if your employer qualifies: studentaid.gov/pslf/employer-…

#PSLF only works if you have a remaining loan balance after 120 qualifying payments. Ultimately, the amount forgiven depends on your income, family size, and loan balance.

Estimate you forgiveness in the PSLF program with the loan simulator StudentAid.gov/loan-simulator

Estimate you forgiveness in the PSLF program with the loan simulator StudentAid.gov/loan-simulator

Your #PSLF payments don’t have to be consecutive. If there’s a period when you’re working for a nonqualifying employer or you leave work to go back to school, you won’t lose credit for the qualifying payments you made in the past.

Federal Family Education Loan (FFEL) Program loans and Federal Perkins Loans don’t qualify for PSLF unless they are consolidated into a Direct Loan. Here's how you can check what type of loan you have online:

Private Educational loans are not eligible for #PSLF. Unlike those loans other federal loans, private loans cannot be consolidated into the Direct Loan program to become eligible.

Repayment plan, qualifying payments, and loan type requirements have limited time flexibility thanks to the PSLF Waiver. These flexibilities end on Oct. 31 so make sure you take advantage of this opportunity. Learn more: studentaid.gov/articles/take-…

Your PSLF payments don’t have to be consecutive. If there’s a period when you’re working for a nonqualifying employer or you leave work to go back to school, you won’t lose credit for the qualifying payments you made in the past.

In some instances, prior servicers have reported grace periods that are unreasonably long. Forbearance periods of 12 consecutive months or greater, or 36 cumulative months or greater will count under the waiver. Account adjustments to include these periods will begin this fall.

Under the PSLF limited waiver (ends Oct. 31), payments will count as time in repayment:

🎖️Time spent in specific military-related deferments

📅 Time spent in any deferment, except in-school deferment, prior to 2013

🧾 Time in an Economic Hardship Deferment

🎖️Time spent in specific military-related deferments

📅 Time spent in any deferment, except in-school deferment, prior to 2013

🧾 Time in an Economic Hardship Deferment

If you have FFEL or Perkins loans, consolidate your loans into the Direct Loan program before submitting a PSLF form. A borrower must submit a consolidation app by Oct. 31, to benefit from the limited PSLF waiver.

Some Things to Know Before Consolidating: studentaid.gov/articles/5-thi…

Some Things to Know Before Consolidating: studentaid.gov/articles/5-thi…

After you confirm that consolidation makes sense for you, you can apply to consolidate online here: studentaid.gov/app/launchCons…

This article provides tips on how to use the PSLF help tool so that you’re in and out with minimal hassle. Specifically, there are helpful examples for how to use the employer database: studentaid.gov/articles/becom…

To use the PSLF Help Tool, you need to log in.

If you have an issue logging in, check out the video below to troubleshoot:

If you have an issue logging in, check out the video below to troubleshoot:

Our in-person team is still taking PSLF on Twitter Spaces right now. Reply with your questions we'll try to address them soon! We cannot answer any questions about your personal application status or about the possibility of any general loan forgiveness.

Now, onto how you certify employment and apply for PSLF. You can use the PSLF Help Tool to autofill your PSLF form. This online tool will help you answer questions on the form and provides info about whether your employer is eligible for PSLF. Get started: studentaid.gov/pslf

Once logged in there are 5 sections to the PSLF form.

1. Employment History

2. Loan Tips

3. Application Details

4. Personal Information

5. Review & Save

After you complete all five sections, it will generate a PDF of the PSLF form.

1. Employment History

2. Loan Tips

3. Application Details

4. Personal Information

5. Review & Save

After you complete all five sections, it will generate a PDF of the PSLF form.

As a reminder, you must verify your employer’s eligibility using the PSLF Employer Search. This search function is found on the resource section of the PSLF landing page on StudentAid.gov/publicservice.

To use this employer look-up, you will need your organization’s EIN, so have your W2 handy. You will also need start and end dates for each employer.

You're not done yet! Borrowers need to get their PSLF form certified with the signature of the employer's HR representative. Make sure the signatures on your PSLF form follow one of the approved signature formats.

More info: studentaid.gov/manage-loans/f…

More info: studentaid.gov/manage-loans/f…

One common #PSLF application mistake? Missing information. This includes fields that are left blank like the Employer Identification Number (EIN). It is critical your PSLF form has your employer’s EIN, so again, have your W2 nearby. Do not leave this blank.

Now that your PSLF form is signed and completed, you can send it in for review in one of the three ways below:

FedLoan Servicing will continue to serve PSLF borrowers until all borrowers are transferred to @MOHELA: studentaid.gov/announcements-…

Regardless of your current loan servicer, all new PSLF forms should be submitted to MOHELA.

Regardless of your current loan servicer, all new PSLF forms should be submitted to MOHELA.

After your #PSLF form is processed, @MOHELA will notify you of the total number of qualifying payments you’ve made, and how many payments you must still make before you can qualify for #PSLF.

If you are already a @MOHELA customer, you can upload your PSLF form online which allows you to confirm that your application was delivered.

If you think there is a mistake related to your payment count, we ask you to be patient. ED and MOHELA are updating payment counts in the next few months. MOHELA will contact you when your payment count has been updated.

We're covering common questions to wrap up today's conversation. Listen live now.

Resources:

⏰⏰ PSLF Limited Waiver FAQ: studentaid.gov/announcements-…

Resources:

⏰⏰ PSLF Limited Waiver FAQ: studentaid.gov/announcements-…

Once you have refinanced your Federal Student loans with a private lender, those loans become private commercial loans that are not eligible for the #PSLF program.

As long as you meet the qualifying payment criteria, prepayments will count for up to 12 months or the next time you’re due to recertify your IDR plan, whichever is sooner. Plan your prepayments carefully!

Wondering how the COVID-19 payment pause impacts your PSLF count? Learn more in #1 and #2 here: studentaid.gov/articles/6-thi…

Once the waiver ends on October 31, 2022, you can’t receive a benefit under both the Teacher Loan Forgiveness Program and #PSLF for the same period of teaching service.

Amounts forgiven under the Public Service Loan Forgiveness (PSLF) Program are not considered income by the Internal Revenue Service. Therefore, you will not have to pay federal income tax on the amount of your Direct Loans that is forgiven.

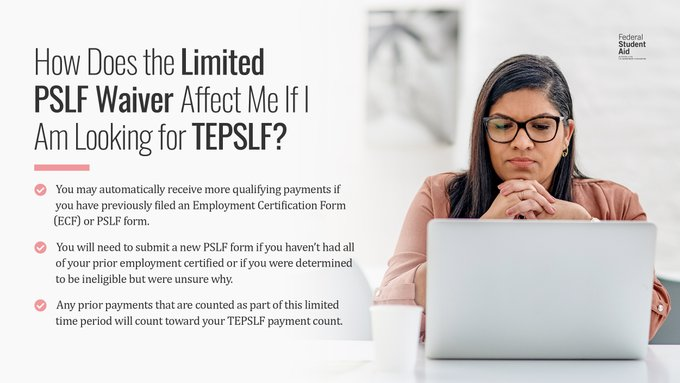

If you’re pursuing Temporary Expanded Public Service Loan Forgiveness (TEPSLF), the limited Public Service Loan Forgiveness (PSLF) waiver might affect you.

Learn how: go.usa.gov/xuZE2

Learn how: go.usa.gov/xuZE2

Reminder: After you make your 120th qualifying payment, you’ll need to submit the PSLF form one last time to receive loan forgiveness. You will not automatically receive PSLF after you’ve made 120 qualifying monthly payments, so it’s important you take this step!

Payments identified under the limited #PSLF waiver become part of your ongoing payment count. They do not expire or disappear simply because the limited PSLF waiver period ends and this helps you get closer to forgiveness!

If you generate a form with a qualifying employer using the PSLF Help Tool, your form will be processed more quickly than if you don’t use the Help Tool.

Thanks for joining us for today's Twitter Space on Public Service Loan Forgiveness (PSLF) and limited-time waiver.

Special thanks to our wonderful moderator Tanika!

Big shoutout to our insightful PSLF experts Travis, Eric, and Christine. twitter.com/i/spaces/1OyKA…

Special thanks to our wonderful moderator Tanika!

Big shoutout to our insightful PSLF experts Travis, Eric, and Christine. twitter.com/i/spaces/1OyKA…

• • •

Missing some Tweet in this thread? You can try to

force a refresh