A THREAD ON SHORT VOLATILITY STRATEGIES:

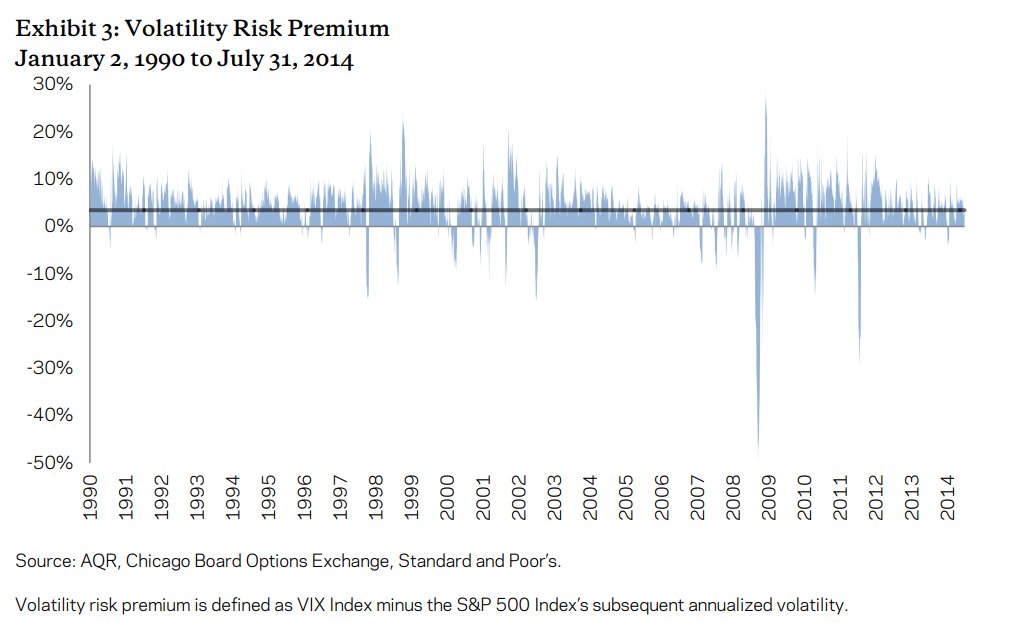

1) Short volatility strategies becomes an important part of institutional portfolios in recent years. They benefit from the "Volatility Risk Premium (VRP)", which is simply "Implied Volatility > Subsequent Realized Volatility".

1) Short volatility strategies becomes an important part of institutional portfolios in recent years. They benefit from the "Volatility Risk Premium (VRP)", which is simply "Implied Volatility > Subsequent Realized Volatility".

2) A very easy access to ideas related to VRP can be found in this excellent paper: naaim.org/wp-content/upl…

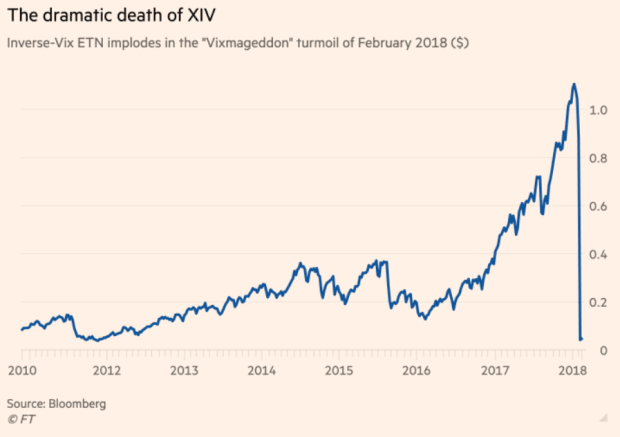

3) Short vol strategies may have high CAGR and sharpe but also have extreme negative skewness. This means that most of the time you earn significant returns, while you also have risk of rare blowups. See inverse VIX ETF blowup in "volmageddon" in 2018

4) Why short volatility strategies earn a significant return? Because investors are risk averse and thus they are willing to pay a premium for buying insurance against market drawdowns. Short vol strategy means that you are selling that insurance and thus earn a premium

5) Selling insurance earns a long term positive risk premia as explained here: aqr.com/Insights/Resea…

6) Two basic strategies for short volatility are a) Sell put and call options and delta hedge your spot exposure : cboe.com/us/indices/das…

b) Short VIX futures :cboe.com/us/indices/das…

b) Short VIX futures :cboe.com/us/indices/das…

7) The CBEO indices above shows positive performance of short vol strats in recent years. You can also find excellent info about the expected return of these strategies from Antti Ilmanen's book

8) But can we assume that this will continue in the future as well? This is a trillion dollar question

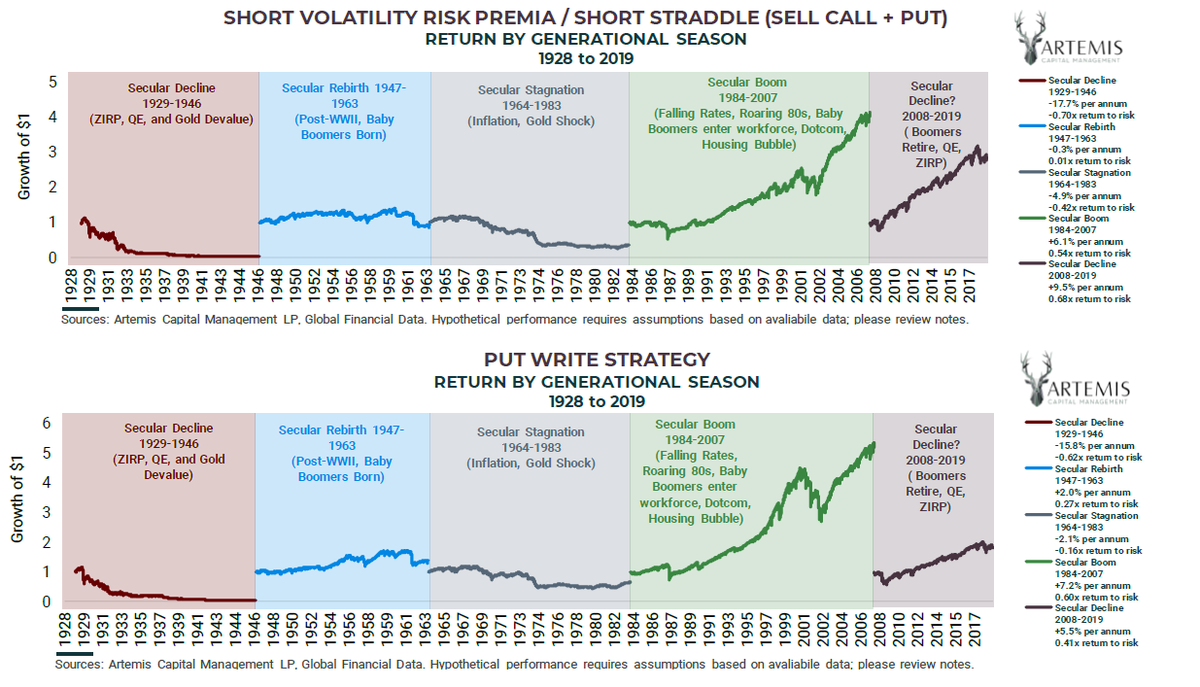

9) Artemis capital has an excellent paper on long term performance of various asset classes and systematic strategies: macrovoices.com/guest-content/…

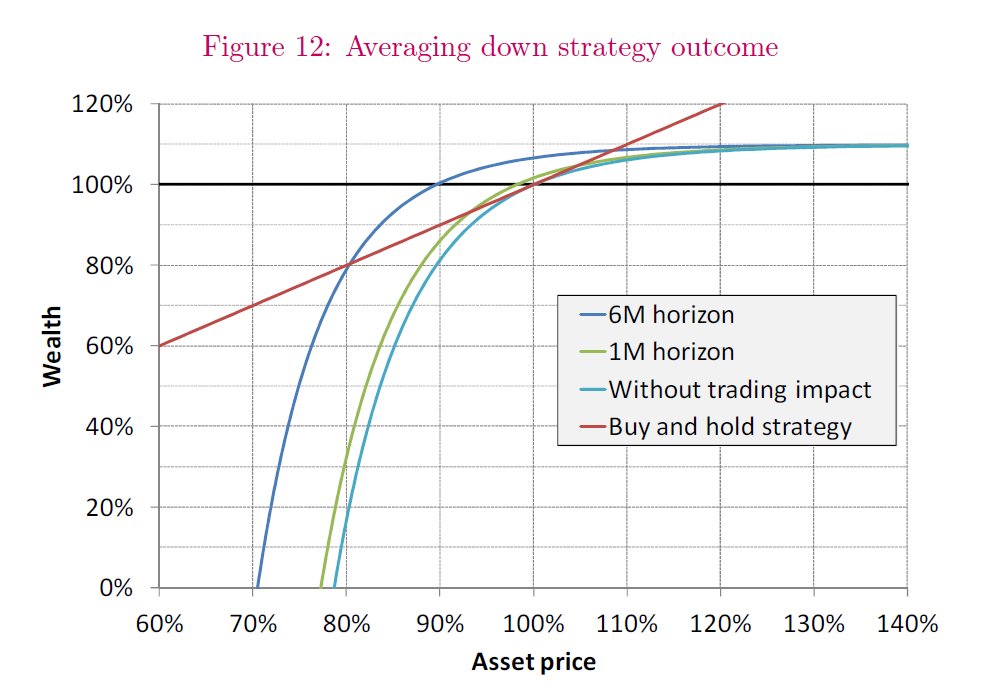

10) They also show that a "Buy the dip (BDFD)" strategy is closely related to short volatility. BDFD is a very popular investing mantra especially during FED fuelled QE era.

11) Indeed BDFD strategies has a payoff structure very close to short puts as shown in this technical paper: papers.ssrn.com/sol3/papers.cf…

12) In their paper, Artemis Capital replicate volatility surface using a model based approximation and with the help of this they can backtest short vol strategies for the last 100+ years. The performance of short vol strats seem to be highly macro regime dependent:

13) So the trillion dollar question is as follows: Will short volatility strategies: a) Continue to generate positive excess returns in the following decade since investor behavior against insurance buying cannot change immediately

14) b) Stop working since we will experience a macro environment (e.g. stagflation with hawkish FED) which will be very different from the one we experienced recently (e.g. FED stimulus through QEs which favors BDFD)

15) What are your thoughts on this important question? We can also ask experts about their views: @CliffordAsness @choffstein @GestaltU @Ksidiii @jam_croissant @ArturSepp @SinclairEuan

• • •

Missing some Tweet in this thread? You can try to

force a refresh