As Forest take on Spurs, a lot of people are asking how they can afford to recruit so many players over the course of the summer, so here's a possible explanation #NFFC

Under PL profitability & sustainability (P&S) rules a club can lose up to £15m over 3 years, plus a further £30m for each season in the PL and £8m for each season in the EFL that is injected in the form of equity shares, so for Forest it is £15m + £30m + 2x£8m = £61m

In addition expenditure on infrastructure, women's teams, academy, promotion costs, & community are excluded from the calculations. Forest were only allowed to lose £39m over three years in the Championship & initially things looked tricky...

...however, 2020 and 2021 were impacted by Covid, so direct costs (loss of matchday revenue, testing, extra travel and accommodation due to social distancing etc) were allowed, I've conservatively estimated these at £10m. Reduces the P&S loss to £44m

Clubs also allowed to combine 2020 & 2021, & take average of losses for those years as a single assessment. Therefore now assessed over 2018, 2019 & combined 2020 & 21. All the above combined results in Forest's P&S loss of £30m up to 2021 so potentially some carry over into PL

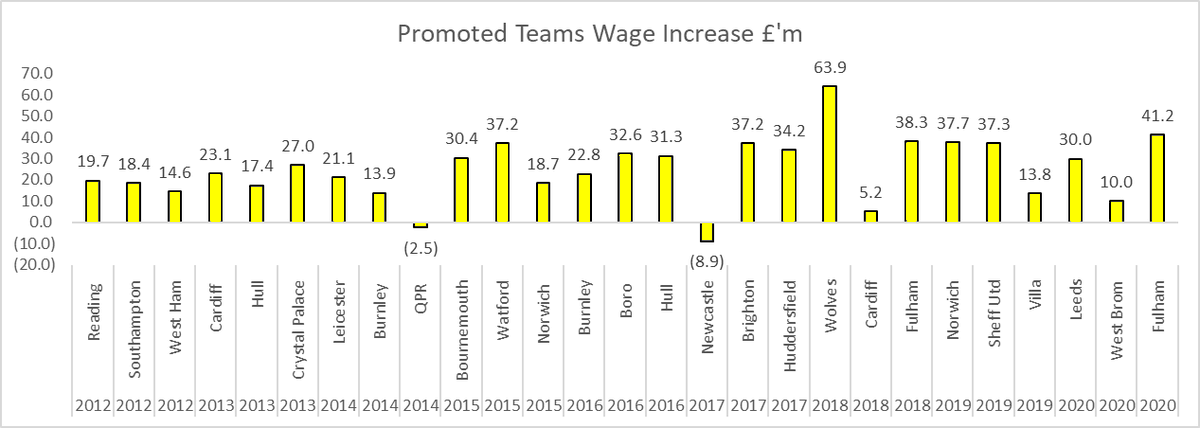

Compared to other clubs, Forest are the second highest spenders over the last decade following promotion, but Wolves, Villa, and Fulham all had bigger existing squads and lower wage bills when they went up.

If Forest have signed players on average of 4 years contracts, then their amortisation cost will be about £32 million in 2022/23. Income for promoted clubs has increased on average by £93m and for clubs not in receipt of parachutes £117m. This allows Forest a lot of wages leeway

Wages do rise significantly following promotion, and also tend to by high in the year of promotion too as clubs pay out big bonuses (excluded from P&S)

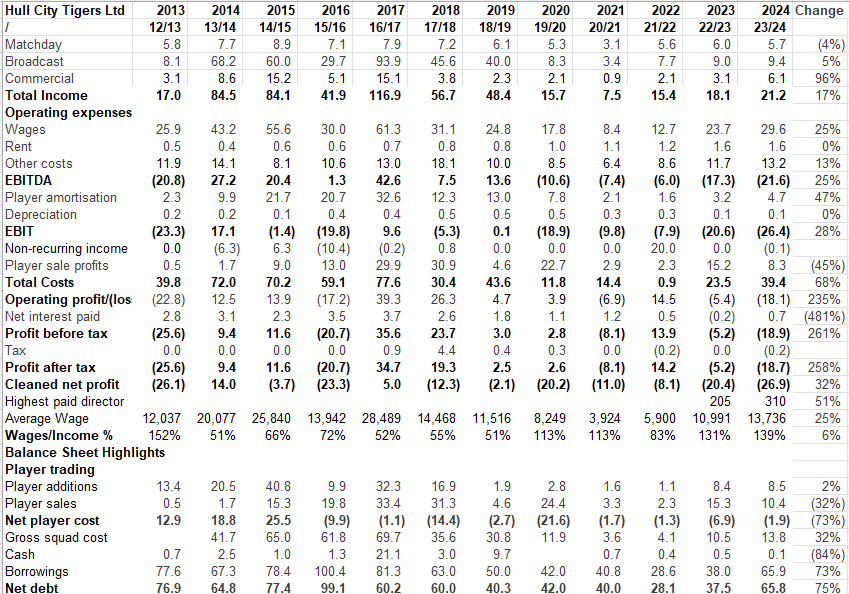

Forest wages have doubled over the last decade, and have exceeded income every year during that period.

Forest wage bill competitive by Championship standards, but not excessively so. Note the 2021 figures cover 13 months not 12, and figures for Derby from 2018, when Mel Morris could last be bothered to publish accounts.

Forest could therefore in theory take themselves to a wage bill in the region of £110m (average of 'Other 14' was £120m) and increase amortisation by £32m and still remain within the P&S loss limit of £61m

• • •

Missing some Tweet in this thread? You can try to

force a refresh